Cocoa CFD Technical Playbook | Downside Targets in Focus😎 Cocoa Crash Caper: Thief-Style Swing/Day Trade Setup 🍫📉

Asset: Cocoa Commodities CFD

Market Strategy: Wealth Thief Map (Swing/Day Trade)

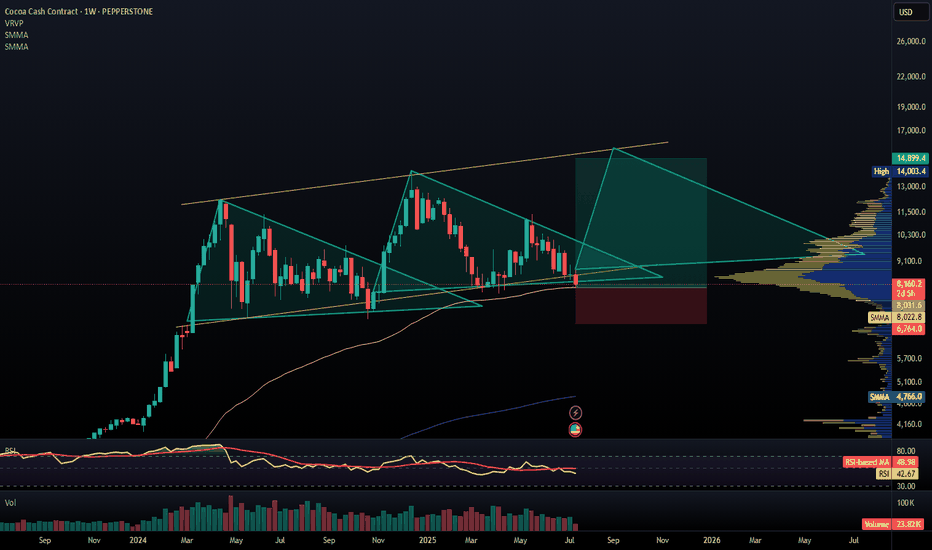

Outlook: Bearish 🐻 — Sellers smashed through the Triangular Moving Average (TMA 1786), confirming the downtrend! 🚨

📜 The Grand Heist Plan

🎯 Entry: Deploy the Thief Layering Strategy with multiple sell limit orders to snatch profits like a pro!

Suggested layers:

💰 8000

💰 7800

💰 7600

💰 7500

Pro Tip: Feel free to add more layers based on your risk appetite — stack those orders like a master thief!

🕵️♂️ Alternatively, enter at any price level if you’re feeling bold!

🛑 Stop Loss: Set at 8200. Dear Thief OG’s 👑, this is my suggested SL, but it’s your heist — adjust it to your risk tolerance!

🎯 Target: Aim for 6800, where strong support, oversold conditions, and a potential trap await! 🕳️ Escape with your profits before the market pulls a fast one!

Note: This is my TP suggestion — take profits at your own discretion, you sly foxes! 🦊

🧠 Why This Setup?

The Cocoa market is screaming bearish vibes after sellers bulldozed the 1786 TMA . 📉 The trend is confirmed, and the momentum is on our side. With the Thief Layering Strategy, we’re setting up multiple sell limit orders to capitalize on this downward spiral while managing risk like seasoned bandits. 💸

🔗 Related Pairs to Watch ($ Correlated Assets)

Keep an eye on these correlated markets for extra clues:

Coffee ( PEPPERSTONE:COFFEE ): Often moves in tandem with Cocoa due to shared agricultural market dynamics. Watch for similar bearish signals! ☕

Sugar ( PEPPERSTONE:SUGAR ): Another soft commodity that can reflect broader agricultural trends. Check for parallel price action. 🍬

USD Index ( TVC:DXY ): A stronger USD can pressure commodity prices, including Cocoa. Monitor for correlation with Cocoa’s decline. 💵

Key Correlation Point: Cocoa prices often weaken when the USD strengthens, as commodities are priced in USD. A rising TVC:DXY could amplify this bearish setup, so keep tabs on it! 📊

⚠️ Disclaimer

This Thief-Style Trading Strategy is just for fun and educational purposes! Trading is risky, and you’re the master of your own heist. Always do your own research and manage your risk responsibly. No financial advice here — just a playful setup to spark your trading creativity! 😜

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#TradingView #Cocoa #ThiefStrategy #SwingTrading #DayTrading #Bearish #Commodities #TechnicalAnalysis

Trade ideas

Cocoa as a highly sensitive treeI have observed a recurring pattern of over-optimistic reporting in cocoa-related news. Especially when comparing farmers’ and professionals’ views with actual outcomes, there is a grate difference. Cocoa cultivation is highly sensitive to weather fluctuations, and climate change is making these risks increasingly severe. Extremes in both directions (drought - heavy rainfall) raise disease and quality risks and make bean drying more difficult.

According to my research, between June and September 2024, around 57% of the published articles predicted a strong cocoa harvest. As we now know, that did not happen. Crop estimates in 2024 were overly optimistic — and they still appear to be. The same pattern was evident in the 2024/2025 mid-crop: the actual Ivory Coast mid-crop came in at 400,000 MT, which was about 9% lower than the estimated 440,000 MT. Current news seem to repeat the same pattern in estimating a good corp.

Cocoa pod development takes 5–8 months, and the middle of 2025 was notably dry. Given how sensitive cocoa trees are to weather conditions, it’s surprising that estimates for the 2025/2026 crop remain so positive, even though the data and facts does not support such optimism.

Also reported that Cocoa arrivals to Ghana ports in the four weeks ending September 4 reached 50,440 MT compared to about 11,000 MT delivered in the same period in 2024. Is this because delivery to ports was delayed? Some wait for the right moment for their delivery. Still understanding the price increase for the farmers in Ivory Coast that took place in the beginning of October may lead for larger deliveries. This may be seen in the statistics in the beginning of November. Understanding that the earlier months deliveries in 2025 was lower, I would like to see a full year diagram with moving average to make assumptions.

Furthermore, despite aging of cocoa trees in West Africa, some forecasts still assume increased production. A cocoa tree takes 3–5 years to become productive. To boost production now, new trees should have been planted around 2022 — a time when prices had not yet risen, and few had incentives to expand planting.

Understanding the possible over optimism – whatever information sources are used - I would rely on facts and the amount of shopped bags instead of personal opinions.

The main question is that are there over optimism in the air or is the harvest going to be magnificent? I don’t know to be honest. Still, on my opinion, currently the cocoa related news seem to miss full perspective. Even if there have been heavy rains in some areas and fake fertilizers, there’s no discussion about plant deceases.

Chocolate LOVERS Hi All

just my quick technical view , one of my fav assets coco she can be brutal and moves fast . See charts which is straight forward we are at crucial price levels lines up with .618 fib and major trendlines so am expecting to reach ALT hights if we can get 9300 were all the VWAPS lead .

120% to ALT its very likely

COCOA: Meets Strong SupportCocoa has been decreasing strongly, with sellers driving the market lower in a clear bearish run. However, price has now reached a strong support zone, an area where buyers previously stepped in with conviction. This zone will be critical to watch: if sellers lose momentum here and buyers defend the level, it could trigger a bullish reaction and the start of a corrective leg upward.

If rejection confirms, that becomes your signal anticipating buyers to take control and push price back toward higher levels. I would anticipate price can climb around 9000.

Over optimism with Cocoa harvest?Cocoa pods usually take 5–7 months to mature. Over the past six months, conditions have been relatively dry, yet some cocoa-related news seems to overlook this factor and overlook the recent weeks rain. I’m closely watching how this will affect the upcoming harvest. In my view, current price levels don’t reflect the impact of these conditions and due to thet, giving a bullish signal.

2024/2025 Mid-harvest estimates were too optimistic, as an example in Ivory Coast +9% compared to the actual. The key question is whether this pattern of over-optimism is repeating.

US Cocoa (CC) – Swing Long from Higher Timeframe Demand Zone

I have initiated a Swing Long position in US Cocoa (CC) inside the 4H Demand Zone marked on the chart.

• On the Monthly and Weekly timeframes, price is sitting deep inside higher timeframe demand zones, i.e., the “cheap territory” where risk–reward becomes highly favorable.

• The arrival into our planned demand zone has been with weak price action, indicating that sellers are losing momentum. This further adds conviction that buyers could take control from here.

• If buyers manage to overpower sellers in this zone, the upside path of least resistance opens up. A 15–25% move higher looks very much on the cards given the clean structure above.

Trade Plan:

• Position: Swing Long

• Stop-loss: Daily candle close below the demand zone

• Target: Open upside with potential 15–25% rally

📌 This setup aligns with higher timeframe demand + weak arrival + favorable location = strong odds on the buy side.

Cocoa futures near a key technical resistance areaMARKETSCOM:COCOA futures have been trending lower, while trading within a falling channel pattern since around mid-May of this year. But we are near the upper bound of that channel. Let's see if it holds.

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Cocoa - Chocolate is DIPPING (literally)Hello Market Watchers 👀

I bring today an update on your favorite commodity (mine actually)... 🍫

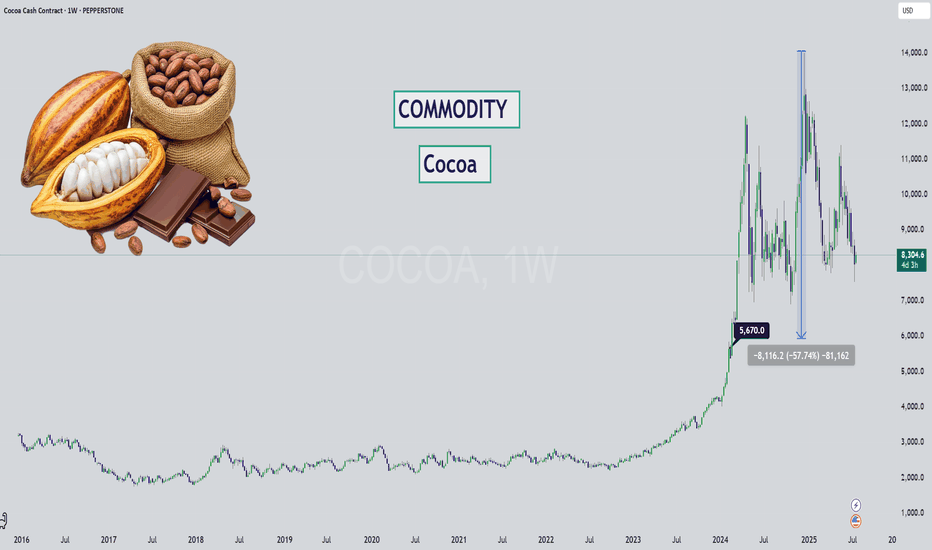

The weekly timeframe from a multi-year perspective is what's on the cover and one thing is clear - cocoa has never increased so much as it during May23' to Dec24'.

Sure inflation brought on by covid has a role to play. But even so, factoring in the amount of +509%? That is way out.

We could likely see this kind of stair step down movement on cocoa, since it has been following the logic of: " previous support = new resistance ".

Either way what this tells me is that cocoa has been running overly hot for too long... and it's time for a cooldown. Prices will likely never return to pre-covid levels, unless there is unfortunate weather or other supply chain issues.

Ultimately, a return back to the $5,600 zone would be a reasonable market correction for such a large increase.

Cocoa Bull Run over?There’s something brewing in the charts here, and it’s not a hot cup of cocoa. We had a clear rejection at the 0.382 Fibonacci and potentially the start of a C leg in a corrective pattern.

This is lower high after the bull flag breakout pattern. If we lose support here we could break the neckline and confirm the head and shoulders pattern, which is very bearish.

There’s a lot of moving parts to consider here. If you follow my trades you will know I already anticipated this as I am long a stock that behaves in an inverse manner to cocoa.

Not financial advice, do what’s best for you

Rob the Cocoa Market Before the Trend Escapes🏴☠️Cocoa Vault Breach: Sweet Profit Heist in Progress!🍫💰

(Thief Trader’s Swing/Day Plan – Only Bulls Allowed)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

We’ve cracked the code to the 🏉"COCOA"🏉 Commodities CFD market, and now it’s time to launch a high-stakes heist based on 🔥Thief Trading style technical + fundamental analysis🔥.

🎯 Mission Objective: Infiltrate the overbought zone, where traps are set, robbers are lurking, and the market’s about to turn. The plan? Ride the bullish wave, loot the Red Zone, and vanish with sweet profits. 🏆💸

🔓 Entry Point:

"The vault is wide open!"

Buy at will — loot that bullish treasure!

⏱️ Best tactic: Set buy limits on the 15M or 30M swing low/high zones. Set alerts and stay sharp.

🛑 Stop Loss:

SL = Nearest 4H Swing Low

🔐 Protect your stash. Use risk-adjusted SL based on trade size and number of entries.

🎯 Target:

11,300 or escape early if the pressure builds!

⚔️ Scalper’s Note:

Only steal on the long side.

💰 Big money = Go direct

💼 Small bags = Team up with swing traders

📉 Use trailing SLs to guard your gains.

🔥Cocoa Market is Bullish – Why?

☑️ Fundamentals

☑️ Macroeconomics

☑️ COT Report

☑️ Sentiment Signals

☑️ Intermarket Vibes

☑️ Seasonal Patterns

☑️ Trend Forecasts & Target Levels

👉 Dive into the data: 🔗🔗🔗

⚠️ Trading Alerts:

News releases = Danger zones!

❌ No new entries during news

✅ Trailing SL to protect ongoing raids

💥 Smash the Boost Button 💥

Support this Thief Plan and keep our crew winning daily.

💪 Rob with confidence. Win with consistency.

🎉 Thief Trading Style = Your daily cash machine.

💣Stay tuned for the next robbery blueprint!

— Your Friendly Market Criminal, 🐱👤

"COCOA" Commodities CFD Market Bullish Heist (Swing Trade Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the 🏉"COCOA"🏉 Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the Dangerous Red Zone Level. It's a Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA line breakout (9700) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 2H timeframe (8900) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 10700 (or) Escape Before the Target.

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸🏉"COCOA"🏉 Commodities CFD Market Heist (Swing Trade Plan) is currently experiencing a neutral trend there is high chance for bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Seasonal Factors, Positioning and future trend targets with Overall Score..... go ahead to check👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

This commodity called Cocoa is offering an excellent risk/rewardThe red dotted line shown is the weekly bearish trend line that has recently got a break out.

You can go to a smaller time frame, the 4H or 1H to find a better entry point. That may be a retracement that offers you a good opportunity to get in.

Now, commodity is much more volatile so don't be stingy with your SL , give it a wider margin else you will be disappointed when the game is over much faster than you anticipated.

Good luck!