CORN trade ideas

CORN Setup: Is This The Bullish Breakout We've Been Waiting For?🌽 CORN CFD | Money Heist Plan 🎭 (Swing / Day Trade)

🔑 Trading Plan (Thief Style Strategy)

Entry (Breakout Trigger): 📈 406.00 — when candle breaks ATR resistance, bullish plan activates.

Layering Entries (Thief Method):

Buy Limit Layers: 400.0 | 402.0 | 405.0 | 407.0 | 410.0 (flexible — adjust/add more based on breakout confirmation).

Layering helps manage entries & average position smartly.

Stop Loss (Thief’s Safety Lock): @ 395.00 🛑 after breakout trigger.

⚠️ Adjust SL based on your own risk tolerance.

Target (Escape Point): 🎯 421.00

Resistance zone + overbought condition = “police barricade” (take profits before getting trapped).

🌍 Why This Plan? | Thief Technical + Macro/Fundamental Mix

📊 Technical Edge

ATR breakout level at 406.00 ⚡

Momentum build-up near resistance, potential squeeze if volume spikes.

Layered entries provide risk-managed exposure.

🌽 CORN Market Data (10 Sep 2025)

Daily Change: -1.05% 🔴

Monthly Performance: +3.13% 🟢

Yearly Performance: -1.90% 🔴

👥 Investor Sentiment

Retail: 45% Long 😊 | 55% Short 😟 (slightly bearish bias).

Institutions: Net short 91,487 contracts 🏦 (hedging against oversupply).

😨 Fear & Greed Index

Score: 51/100 (Neutral 😐)

Balance between fear (supply risks) vs greed (demand resilience).

📉 Fundamentals & Macro Score

Supply Side

Record US production: 16.7B bushels 🟢

Brazil’s harvest adds oversupply pressure 🔴

Crop diseases (Tar Spot & Southern Rust) hurting yields 🔴

Demand Side

Exports YTD: +46.8% 🌍

Ethanol production: 1.105M barrels/day ⛽ (+30k WoW) 🟢

Tariff risks (China/Mexico) could slow trade 🔴

Macro Score: 6/10 → Moderately Bullish

🎯 Market Outlook Summary

Bull Case (Long) ✅

Strong exports (+28.6% YTD)

Biofuel/ethanol demand supporting floor

Technical rebound chances

Bear Case (Short) ❌

Record harvests (US/Brazil/Ukraine) = oversupply

Institutions scaling up shorts

Global glut risks

📌 Outlook Bias: Bearish-to-Neutral 🐻⚖️

Short-term pressure from supply glut, but demand stabilizes downside.

📌 Key Takeaways for Traders

Breakout Watch: 406.00 🚨

Layered Entry: Manage risk via staggered buys.

Target Zone: 421.00 (book profits before trap).

Macro Mix: Demand solid but supply risks dominate.

Watch List: CAPITALCOM:CORN , CBOT:ZS1! (Soybeans), CBOT:ZW1! (Wheat), CBOT:ZC1! (Corn Futures)

🔗 Pairs to Watch (in USD)

AMEX:SOYB (Soybeans CFD): Moves in lockstep with CORN due to shared ag trends.

AMEX:WEAT (Wheat CFD): Grains often trend together—keep an eye out!

TVC:USOIL : Influences ethanol demand, impacting CORN indirectly.

TVC:DXY (US Dollar Index): A rising USD could pressure commodity prices.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#CORN #Commodities #SwingTrade #DayTrade #ThiefStrategy #MoneyHeistPlan #Futures #LayeringStrategy #BreakoutTrading #Agriculture #Ethanol #TradingCommunity

Corn could be reversing soon!Corn is at the moment almost close to its lowest prices in the year. Seasonality wise it starts to reverse from second week of August. COT report is also showing increase in net commercials week over week by over 25K.

It is at a weekly and daily demand zone at the moment, hence intending to go long.

What do you think?

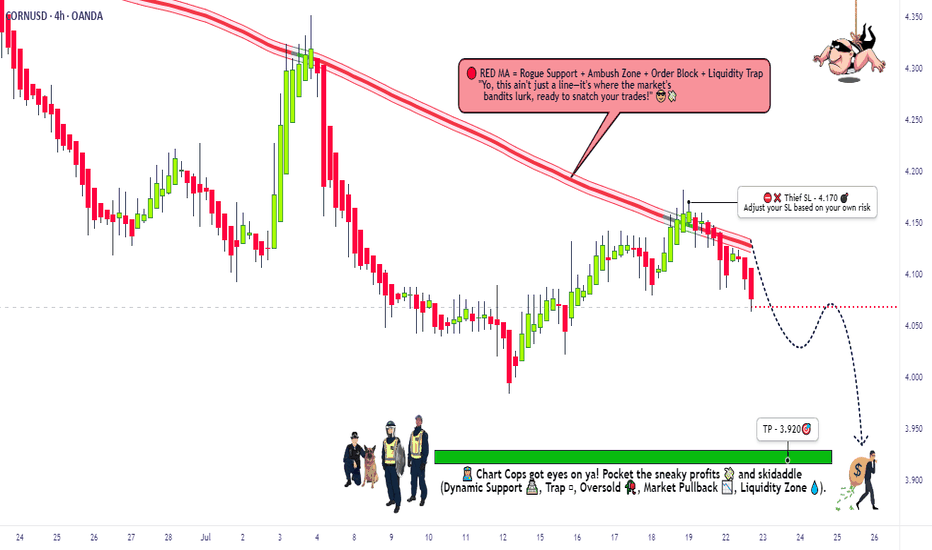

CORN Heist: Steal Short Profits Before Bulls React!🚨 CORN HEIST ALERT: Bearish Raid Ahead! 🚨 Swipe the Loot Before Cops Arrive! 🌽🔻

🌟 Attention, Market Bandits & Profit Pirates! 🌟

🔥 Thief Trading Intel Report 🔥

The 🌽 CORN CFD market is setting up for a bearish heist—time to short-swipe the loot before the bulls rally their defenses! Police barricade (resistance) is holding strong, but oversold conditions + consolidation hint at a trend reversal trap. High-risk, high-reward—just how we like it!

🎯 Heist Strategy (Swing/Day Trade)

Entry (Bearish Raid) 🏴☠️

"Vault’s unlocked! Swipe shorts at any price—OR set sell limits *near 15M/30M pullbacks for a cleaner steal!"*

Stop Loss (Escape Route) 🛑

Thief’s SL at nearest 4H swing high (4.170)—adjust based on your risk tolerance & lot size.

Pro Tip: Tighten SL if trading multiple orders!

Target (Profit Escape) 🎯

3.920 (or bail early if cops (bulls) show up!)

🌽 Market Snapshot: Why CORN is Ripe for a Raid

Neutral trend leaning bearish—consolidation breakout likely!

Key Drivers:

Macro pressure (USD strength, crop reports)

COT data hinting at big players positioning short

Seasonal trends favoring downside

Want full intel? 🔍 Check COT reports & intermarket analysis!

🚨 Trading Alerts (Avoid the Cops!)

News = Volatility Trap! 📰🚔

Avoid new trades during high-impact news.

Trailing stops to lock profits on running heists!

💥 Boost This Heist! 💥

"Like & boost this idea to fuel our next raid! More steals = more profits for the gang! 🏴☠️💰

Stay tuned—another heist drops soon! 🚀🤝

THE GREAT CORN GRAB! (Bearish CFD Heist)🌽 THE CORN HEIST: Bearish Raid Plan (Swing/Day Trade) 🚨💰

🌟 Attention, Market Robbers & Money Makers! 🌟

(Hola! Oi! Bonjour! Hallo! Marhaba!)

🔥 Based on the ruthless Thief Trading Style (TA + FA), we’re plotting a bearish heist on the CORN Commodities CFD Market! Time to short like a bandit and escape with profits before the bulls catch us! 🏴☠️💸

🎯 MASTER HEIST PLAN (BEARISH RAID)

Entry Point (Sell Limit / Market):

"The vault is open—swipe the bearish loot at any price!"

🔹 *For safer heists, set sell limits near pullbacks (15M/30M).*

Stop Loss (Escape Route):

📌 Thief SL at nearest swing high (1D timeframe) – 4.4000

📌 Adjust SL based on risk, lot size, & multiple orders.

Profit Target (Escape Before Cops Arrive):

🎯 4.1000 (or exit early if the trap snaps shut!)

🌽 MARKET TREND: NEUTRAL (BEARISH OPPORTUNITY!)

Consolidation zone = Thief’s playground!

Oversold? Maybe. But the real trap is where bullish robbers get slaughtered.

High risk = High reward—only for cold-blooded traders!

📡 FUNDAMENTAL INTEL (DON’T SKIP THIS!)

🔗 Get full reports (COT, Macro, Seasonals, Sentiment, Intermarket Analysis) in our bio0!

🚨 TRADING ALERT: NEWS = DANGER ZONE!

❌ Avoid new trades during news!

🔐 Use trailing stops to lock profits & escape alive!

💥 BOOST THIS HEIST! (HELP US ROB THE MARKET!)

🔥 Hit LIKE & FOLLOW to strengthen our robbery squad!

💸 More heists = More profits. Stay tuned for the next raid!

🐱👤 See you in the shadows, bandits! 🤑🚀

Shady CORN Scheme: Bullish Plot or Market Trap?🌟 Ultimate CORN Heist Strategy: Swing Trade Plan 🌟

Greetings, Wealth Chasers & Market Mavericks! 🤑💸

Ready to pull off a legendary heist in the 🌽 CORN Commodities CFD Market? Our Thief Trading Style blends sharp technicals and fundamentals to craft a high-octane plan for massive gains. Follow the strategy below, stick to the chart, and aim to cash out near the high-risk Red Resistance Zone—an electrified level where overbought conditions, consolidation, or trend reversals could spark traps from bearish bandits. Let’s lock in profits and treat ourselves to the spoils! 💪🎉

📈 Entry Plan: Launch the Heist! 🚀

Wait for a breakout above the Moving Average at 4.5800 to ignite your long entry—bullish riches are calling!

Option 1: Set Buy Stop Orders just above the MA for breakout confirmation.

Option 2: Place Buy Limit Orders on a pullback to the most recent swing low/high within a 15- or 30-minute timeframe.

📢 Pro Tip: Set an alert on your chart to catch the breakout in real-time! ⏰

🛑 Stop Loss: Protect Your Loot! 🔒

For Buy Stop Orders, place your Stop Loss after the breakout confirms to avoid premature exits.

Thief SL Recommendation: Set at the recent swing low on the 4H timeframe (4.4300) for day/swing trades.

Adjust SL based on your risk tolerance, lot size, and number of open orders—play it smart! ⚠️

Feeling rebellious? Set your SL wherever you dare, but don’t blame us if the market bites back! 😎🔥

🎯 Target: Grab the Gold! 🏴☠️

Aim for 4.8000—take partial profits or exit fully before hitting this level.

Scalpers: Stick to long-side scalps. Got deep pockets? Jump in now. Otherwise, join swing traders for the full heist.

Use a trailing Stop Loss to lock in gains and keep your money safe. 💰

🌽 CORN Market Outlook: Why This Heist Works 🌟

The CORN CFD market is currently neutral but shows strong bullish potential, driven by:

📰 Fundamentals: Check macroeconomic data, COT reports, geopolitical events, and news sentiment for a full picture.

📊 Intermarket & Seasonal Analysis: Aligns with favorable positioning and future trend targets.

⚠️ Trading Alert: News & Position Management 🚨

Avoid new trades during major news releases to dodge volatility spikes.

Use trailing Stop Loss orders to secure profits and protect open positions.

Stay updated via reliable sources like Investing.com for real-time news impacting CORN prices.

💥 Boost the Heist! 🚀

Support our Thief Trading Style by hitting the Boost Button to amplify our robbery squad’s strength! 💪 Together, we’ll swipe profits effortlessly every day. Stay tuned for the next heist plan—more riches await! 🤑🐱👤

Let’s make this CORN heist legendary! 🌽💸🎉

Corn Market Trends: Production in Argentina and Brazil (02.11)As the global corn market navigates supply constraints, the latest WASDE report highlights a downward revision in production forecasts for Argentina and Brazil, key players in global exports. Adverse weather conditions, including prolonged heat and dryness in Argentina and planting delays in Brazil, have led to lower yield expectations, tightening global supply chains.

Production Declines in Argentina and Brazil

Argentina's corn production is now projected at 50 million metric tons, down from 51 million, reflecting yield losses due to drought conditions in key growing regions. Brazil's output is also revised downward to 126 million metric tons, mainly due to slow second-crop planting progress in the Center-West region, which is critical for global supply.

Impact on Global Corn Trade

With reduced output from South America, global corn trade is seeing shifts. The WASDE report lowers projected corn exports from Brazil and Argentina, increasing reliance on alternative suppliers like the United States. However, U.S. exports are expected to face stiff competition from other global producers, including Ukraine and South Africa, despite ongoing geopolitical tensions.

U.S. Market and Price Dynamics

The U.S. corn market remains stable, with production estimates unchanged at 14.87 billion bushels. However, ending stocks are revised downward to 1.54 billion bushels, reflecting stronger demand. The season-average farm price for U.S. corn is raised to $4.35 per bushel, reflecting tighter global supplies and steady domestic consumption.

Key Market Implications

• Rising Global Prices: Lower South American output could support higher corn prices worldwide, benefiting U.S. exports.

• Shift in Import Demand: China, a major corn buyer, has reduced its import forecast, while Vietnam and Chile have increased theirs, signaling shifting trade patterns.

• Weather Risks Persist: Continued adverse weather could further impact production estimates, making upcoming forecasts critical for market direction.

Evolving weather conditions and policy changes could further impact global supply chains and price trends.

TOCOM:TGCN1! BMFBOVESPA:CORN11

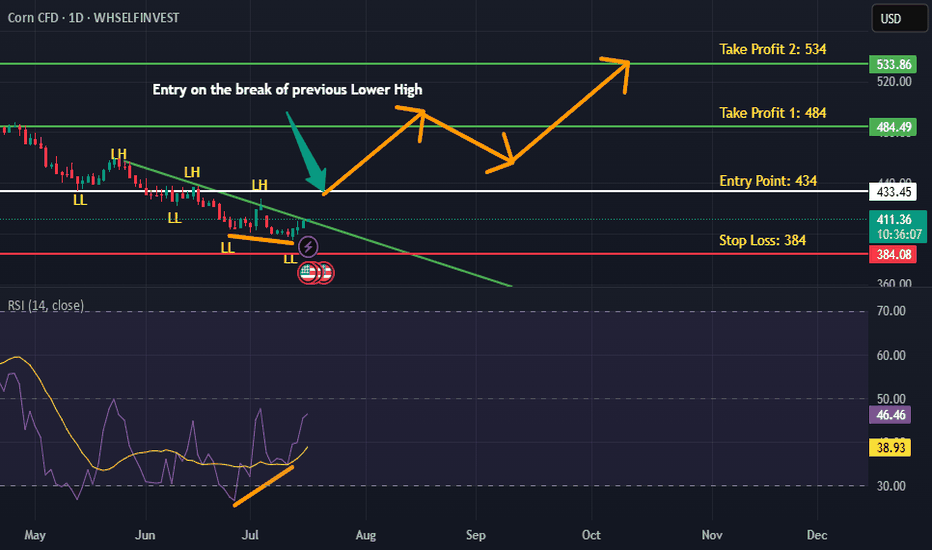

CORN is BullishCorn has not only broken the descending trendline but has also successfully breached previous lower high after the emergence of a bullish RSI divergence on weekly time frame. Entry can be taken at current price as according to Dow theory now price will start making higher highs and higher lows. Targets are mentioned on the chart.

Corn Market: Outlook Driven by Supply Trade, and Demand ShiftsThe global corn market in 2025 is undergoing notable transitions shaped by changing supply dynamics, evolving trade flows, and increasing demand across key sectors. The January 2025 WASDE report sheds light on the significant pressures and opportunities facing this essential commodity as production adjustments and geopolitical shifts come into play.

Corn production forecasts for the 2024/25 season reveal not so simple global picture. The U.S., the world’s largest corn producer, is grappling with significant yield losses due to ongoing drought conditions in the Corn Belt. Current projections estimate U.S. production at 14.5 billion bushels, marking a drop compared to prior seasons. Meanwhile, Brazil has emerged as a major player, capitalizing on favorable weather and expanding its planted acreage to achieve a record-high output of 132 million metric tons, securing its position as a leading exporter. However, production challenges in China, driven by high input costs and limited arable land, are expected to drive the nation’s continued reliance on imports.

Trade dynamics are shifting, with Brazil solidifying its role as a top corn exporter , leveraging competitive pricing and a streamlined export system. U.S. exports, on the other hand, are projected to decline to 49 million metric tons, reflecting challenges posed by strong competition and elevated domestic prices. China remains the leading importer, with anticipated purchases of over 24 million metric tons, largely driven by demand from its recovering swine sector and efforts to replenish depleted grain reserves. Elsewhere, nations in North Africa and the Middle East are maintaining strong import levels to address food security needs, particularly for animal feed applications.

Demand for corn remains robust but multifaceted in its drivers. Livestock feed continues to dominate global consumption, particularly in regions where meat production is rapidly expanding. Ethanol remains a cornerstone of U.S. domestic demand, as renewable energy mandates ensure a steady draw on supplies. Industrial uses of corn are also diversifying, with bio-based plastics and other applications gaining traction, adding a layer of complexity to the market’s demand profile.

Corn prices are expected to remain elevated through 2025, reflecting tight global supplies, ongoing trade uncertainties, and persistent weather challenges. The WASDE report projects U.S. corn prices to average $6.70 per bushel, up from the previous year’s average. Key drivers include adverse weather conditions in critical growing regions, particularly the prolonged droughts affecting the U.S., and the potential for La Niña disruptions in South America. A weaker U.S. dollar may offer some relief to American exporters, enhancing price competitiveness, though Brazil's strong presence in global trade poses a challenge.

For investors, the 2025 corn market presents a range of opportunities and risks. Elevated price volatility makes corn futures attractive for hedging and speculative strategies. Additionally, investments in agricultural innovation, such as drought-resistant seed technology and precision farming, offer long-term potential. Those seeking diversified exposure may consider agriculture-focused ETFs or equities tied to the corn supply chain, including logistics, equipment manufacturers, and fertilizer producers. As always we should stay sharp, the corn market in 2025 is shaped by a convergence of production pressures, evolving trade patterns, and robust global demand.

BMFBOVESPA:CCM1!

CBOT:ZC1!

Corn: Clear way downCorn market has had a somewhat of a shock revival over the past couple of weeks. The latest WASDE report provided a final jolt to the massive speculative positioning which we deem to be at an extreme around the 500 USD level.

We think the latest move has been an overkill and some of the positioning is bound to unwind as the speculators might have gotten ahead of themselves. Large stale short positions were the predominant drive of the move for the most part.

Therefore, all the latest long positions are at risk of being trapped.

Strategic short with stop around at the 555-560 USD level.

Targeting pre-WASDE levels.

crypto is crypto, but do you need to buy corn? - If the trend line breaks, this is the beginning of a bullish trend.

- a Formulated is Golden Cross Moving Average

- the reason for the rise in corn prices is the decrease in the EU corn harvest in 2024/25. This is the third consecutive year of poor harvest.

If you have anything to add, please write in the comments.

CORN CFD ANALYSIS IN DAILY TIME Corn Formulated MA Golden Cross And Also Breakout of Falling Wedge Pattern Show Bullish Reversal.

The reason for the rise in corn prices is the decrease in the EU corn harvest in 2024/25. This is the third consecutive year of poor harvest.

This is not a financial advice do you own research from execution of trade.

Taurian