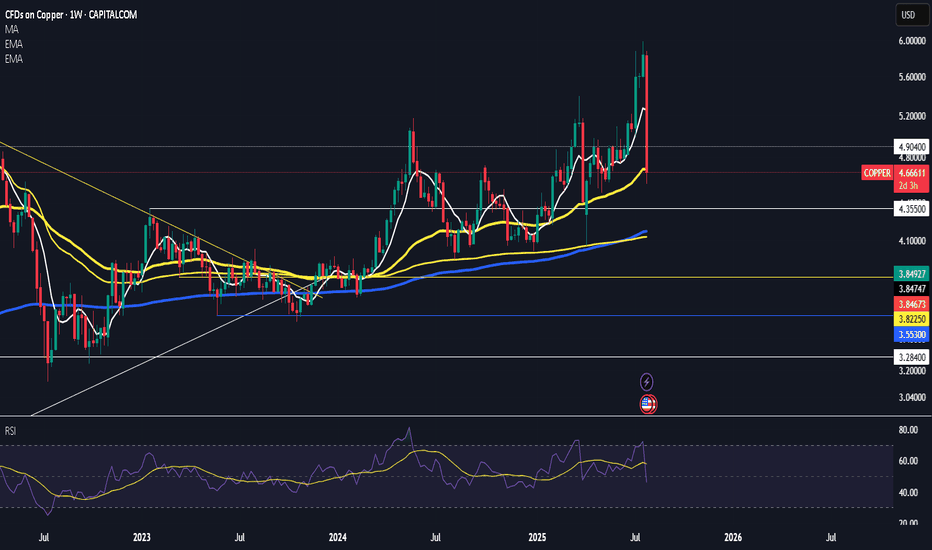

DOUBLE PATTERN:Cup and TriangleHello Traders,

All the eyes now on the next leg for the copper if Trump did not Finalize the Tariffs copper will go back to at least the bottom again 3.4 3.1 as every one kept loading up for the imports now the states is overloaded with loads of materials and minerals imagine what could happened if he didn't sign up this Tariffs on the mineral! they will be selling it for so cheap to cover the losses dramatically same like what happened with the oil its a commodity right !that's one scenario, the other one is every thing move as planned and the copper get back to the bottom of the triangle and shoot straight up so lets see what could happed I'm in short for now good luck, kindly support my idea if you like and make your decisions based on your research

Trade ideas

Copper | From Tariff Fireworks to Gravity’s Pull at $4.00/lbCopper’s July spike quickly reversed as tariff fears unwound—29 Jul saw risk-off positioning, followed by the 30–31 Jul announcement that duties would target copper products, not refined cathode. This erased the U.S. premium and drove an 18–20% drop.

Since then price has consolidated in a corrective channel that resembles a bear flag. With stochastics rolling over and momentum still pointing lower, the setup leans toward a continuation leg, with bias for a retest of the $4.00/lb zone.

UPDATE: Copper slow, steady and finally ready to rocketIt's been a laborious trade.

Just been moving sideways slowly.

But now the price is breaking above the 10,051 mark finally and the momentum is leaning towards further upside.

We still have 10,677 on the cards and will continue updating accordingly.

Also, you can draw a rectangle formation, for the price to break above.

Then it's a whole new chart pattern.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Copper vs Dollar | Institutional vs Retail Sentiment Analysis🔥 XCU/USD – Copper vs U.S Dollar | Thief Money-Making Plan (Swing/Scalping Trade)

🎯 Plan & Thief Entry Style

Bias: Bullish ✅ (Re-Accumulation Buy Setup)

Entry Style: Thief strategy = multiple limit order layers 🧩

Suggested Layers: (4.4600) 🟢 | (4.4700) 🟢 | (4.4800) 🟢 | (4.4900) 🟢 | (4.5000) 🟢

You can always increase limit layers depending on your own strategy.

Stop Loss (Thief SL): 4.4200 ⚠️

Ladies & Gentlemen (Thief OG’s) — always adjust SL to your own plan & risk appetite.

Target Zone: 4.6700 🎯

Resistance + overbought zone + possible trap → steal the money & escape! 🏃💰

📊 XCU/USD Market Snapshot (Copper vs U.S Dollar) – Sept 5, 2025

Real-Time Change: -0.8% 🔻

Retail Sentiment: 45% Long 😊 | 55% Short 😟

Institutional Sentiment: 60% Long 🚀 | 40% Short 🛑

➡️ Retail leaning bearish, while institutions show cautious optimism.

😨💰 Fear & Greed Index

Score: 48/100 (Neutral) ⚖️

Market mood balanced → no extreme fear/greed at the moment.

📊 Fundamental Score – 6/10

Stable global copper demand ✅

Risks: US economic slowdown ❌ & weaker China industrial output ⚙️

Key Watch: industrial production data + trade policy shifts

🌍 Macro Score – 5.5/10

US Dollar strength 🦅

Global PMI data + US jobs report 🏭

Tariff talks & supply chain risks add uncertainty

🐂🐻 Overall Market Outlook

Neutral ➡️ Slightly Bullish ⚖️➡️🚀

Short-term pressure from USD strength 📉

Long-term supported by institutional buying & steady industrial demand 🏗️

Watch: US Nonfarm Payrolls + China economic updates 📡

🔎 Quick Take – Why This Thief Plan?

Copper is stable but under macro pressure.

Institutional flow is bullish compared to retail → signal of hidden strength.

Neutral sentiment = less volatility now, but data events may unlock momentum.

Swing/Scalp opportunities exist with layered buy entries → thief escape at 4.6700! 💰

📌 Related Pairs to Watch

OANDA:XAUUSD (Gold)

OANDA:XAGUSD (Silver)

PEPPERSTONE:USDX (Dollar Index)

$CLUSD (Crude Oil)

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#Copper #XCUUSD #Metals #Commodities #TradingView #SwingTrade #Scalping #Forex #ThiefStrategy #Layering #CommoditiesTrading #XAUUSD #XAGUSD #USDIndex #CrudeOil

Copper testing bullish trend lineWith copper prices easing over the last few days, it has now reached a key short-term support area in the shaded region. Here a bullish trend line meets prior support/resistance range. Can we see a bounce here today? Or are we inside a bear flag pattern? Either way, we will soon find out, and then one can trade copper accordingly. We prefer the long side give a positive long-term macro backdrop for copper.

Fawad Razaqzada, market analyst with FOREX.com

Copper on a possible breakout retest, resumption of a half-cycleCopper on a possible breakout retest, resumption of a half-cycle low.

28 days of what appears to be a weekly and daily cycle low. There could be significant gains until the end of October.

Entry: 9.984

Stop Loss (SL): 8.520

(The chart may look slightly different for you depending on the instrument you use.)

Slow and steady wins the race for Copper - yea right!In June I started a Target for Copper at 10,677.

THe result - nowhere slowly.

Now if one was holding this trade, it would have been costly.

Not only opportunity cost but also actual daily interest charges...

So why is Copper moving nowhere slowly?

🏭 Oversupply outweighs demand

📉 Tariff hype fizzled out

🌍 U.S. & global prices misaligned

🇨🇳 China demand cooling

⏳ Market in wait-and-see mode

The target is still on but it can take a while and you might need to read Vogue or something.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Copper establishing a baseFollowing the big drop in copper prices on the back of news at the end of July that Trump's tariff excludes refined metal, prices have started to stabilize near the lows, suggesting a potential recovery could be on the cards.

Copper prices dropped by the largest on July 30 after Trump excluded refined metal from his planned import tariff.

Dip-buyers are starting to step back in now, with prices now finding their footing around $4.40 area, which itself was a prior demand zone from early April.

Short-term resistance around $4.50 has provided a short-term ceiling but if that breaks then we could see a quick recovery towards the 200-day average first, ahead of potentially $5.00 in the coming weeks.

By Fawad Razaqzada, market analyst with FOREX.com

Copper Long Swing TradeCAPITALCOM:COPPER Long Swing trade, with my back testing of this strategy, Copper is bullish

This is good trade.

Don't overload your risk like Greedy gambler!!!

Be Disciplined Trader, what what you can afford.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

Copper Stabilizes: A Tactical Long OpportunityAfter pulling back from recent highs, copper is showing signs of stabilizing. In my view, this move is more likely a correction within a broader uptrend rather than the start of a deeper decline.

I remain optimistic about the commodity sector in the near term, and copper is no exception. From current levels, the odds favor a resumption of the uptrend over a continued drop.

On the monthly chart, the broader bullish trend remains intact as long as the price stays above the 4.00 level. There’s a possibility that copper may dip toward 4.20 before rebounding, but the current price zone already looks attractive for initiating long positions — we might not get a deeper pullback.

Friday’s candlestick adds confidence to the bullish case, and similar constructive setups are appearing across other industrial metals, such as silver, palladium, and platinum.

📝Trading Plan

🟢Entry: Current levels (~4.45)

🔴Stop: Below Thursday’s low — 4.35

🎯Target: 4.67 / 4.87 / 5.24

What a turnaround on copper futuresManipulation? Smells like it, but of course, this is just the market we are currently living in.

Let's dig in.

MARKETSCOM:COPPER

COMEX:HG1!

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

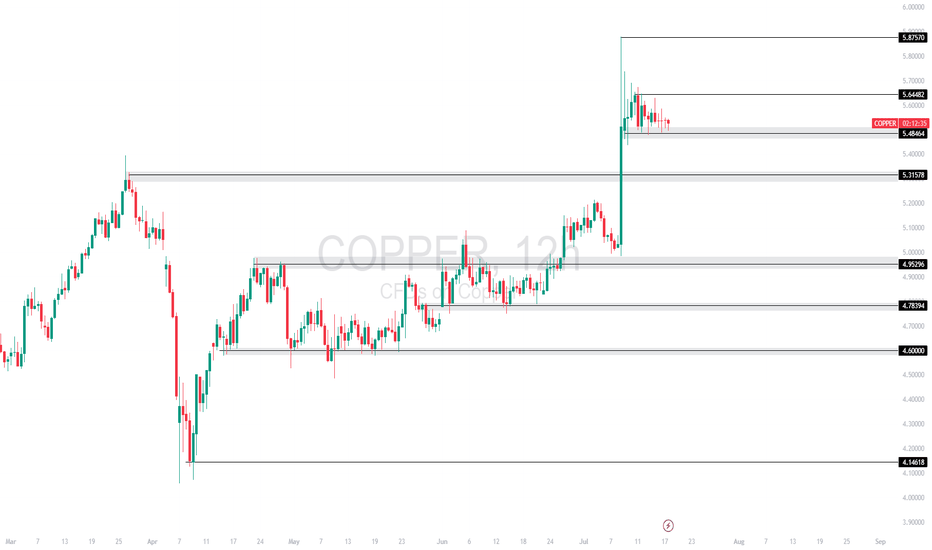

COPPER TECHNICAL ANALYSISCopper spiked into 5.8750 but is now consolidating just below short-term resistance at 5.6448, showing signs of a bullish continuation pattern. Price remains supported at the 5.4864 zone.

Currently trading at 5.4864, with

Support at: 5.4864 / 5.3157 / 4.9929 🔽

Resistance at: 5.6448 / 5.8750 🔼

🔎 Bias:

🔼 Bullish: Break above 5.6448 could push price toward 5.8750 and beyond.

🔽 Bearish: Loss of 5.4864 may trigger downside toward 5.3157.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

Copper Eyeing Key Reversal Point – Will It Break Above 4.68152 ?Copper is currently hovering near the 4.68152 🔼 resistance after rebounding from the 4.50280 🔽 support. Price is reacting to the 50-period SMA, which is slightly above current levels and may act as a dynamic resistance. The overall structure remains mixed with recent lower highs, but bulls have stepped in at key support.

Support at: 4.50280 🔽, 4.27241 🔽, 4.04129 🔽

Resistance at: 4.68152 🔼, 4.83230 🔼, 4.95323 🔼

Bias:

🔼 Bullish: A breakout and retest above 4.68152, and ideally a clean move above the 50 SMA, could signal bullish continuation toward 4.83230 and 4.95323.

🔽 Bearish: A strong rejection at 4.68152 or a drop below 4.50280 could send price back toward 4.27241.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

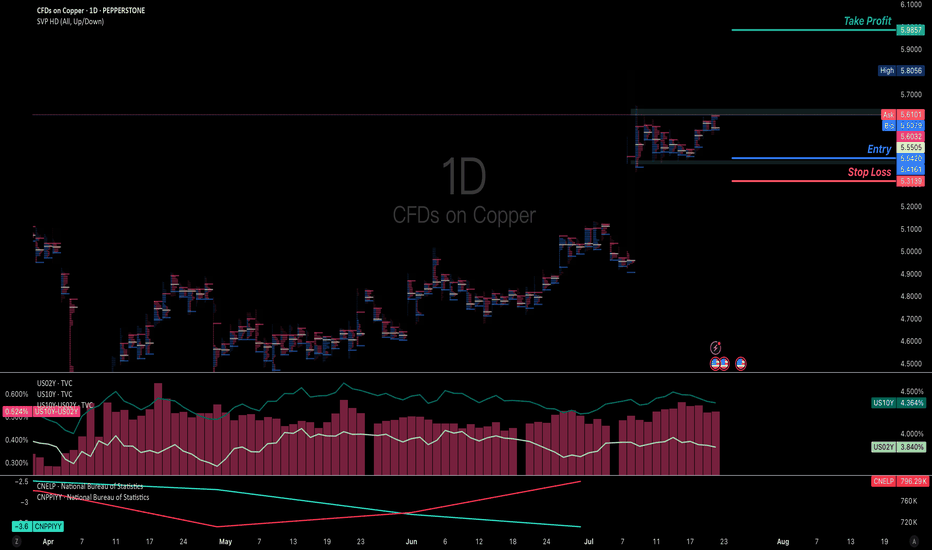

Long the copper for a potential breaking upWith the expectation of PPI bouncing back from the deep valley because China is launching a 1.3 Trillion infrastructure plan to build the largest hydro dam in the Yarlung Tsangpo Grand Canyon on the Qinghai-Tibet Plateau, the long term global demand of industrial copper is more bullish than last time.

In the aspect of currency, the bullish steepener yield curve of US T-bill is giving a continuous momentum to industrial commodities.

Imma entry in the bottom of the current consolidation and add position as the breaking in the next weeks