RWSL.N0000 : CSE - Short Term OutlookPrevious Discussion

4X since initial discussion

Short Term Outlook

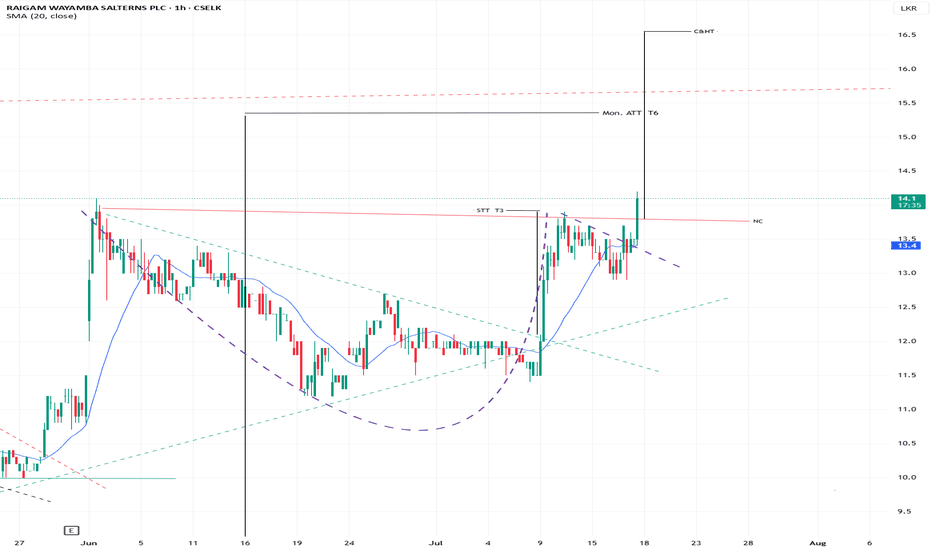

Technical Analysis (Chart Patterns)

* RWSL is nearing completion of a flag formation

* Flags are continuation patterns

* Breakout can occur any time as the pattern is matured now.

* Pattern target is LKR is LKR 33.50 - 34 +

Invalidation

* Breakdown below Trend Line 'B' invalidates the setup

* Traders should apply a comfortable stop-loss below TL B

Long Term Outlook

* To be discussed further. Let’s explore fundamentals, macro drivers next.

Trade ideas

MT/LT prospects for RWSL : RECORD SALT HARVEST to drive earningsPrevious Discussions

A. Short term TA outlook (8th Oct. 2025)

B. Longterm outlook (17th April 2024)

RWSL gave a 4X return since 17th April 2024 discussion.

Revisit of 2024 Bull Thesis

The original 2024 bull thesis was anchored on expectations of dry weather following several years of adverse conditions in Sri Lanka’s salt-producing regions. The assumption was that a bumper harvest would boost topline and gross profit (GP) margins for RWSL, the largest private salt producer in the country.

However, this thesis did not materialize. Sri Lanka experienced another unexpectedly wet year, leading to a complete inventory dry-out by March 2025—especially among state-owned salt companies.

Unexpected Upside: Import-Led EPS Surge

This scarcity created a strategic opening for RWSL, which became the preferred salt importer for the government.

Key drivers of performance:

• Salt prices surged due to scarcity and a newly imposed LKR 60.00 import levy.

• Despite lower GP margins on imported salt, higher prices and volumes drove a 5X EPS increase

• LKR 0.14 in Dec 2024

• LKR 0.79 in March 2025

• LKR 0.76 in June 2025

RWSL shares rallied 4X in response to this earnings momentum.

• As per June 2025 financials, RWSL’s imported salt inventory will last through September/October 2025.

• EPS is expected to remain in line with March and June 2025 levels for the Sep. 2025 quarter.

Weather Shift: Record Harvest in Puttalam

The dry weather anticipated in the original 2024 thesis has finally arrived. Salt producers expect the 2025 Maha season harvest in Puttalam to exceed 100,000 MT— the highest in five years.

Earnings Implications

• Locally produced salt avoids the LKR 60.00 import levy and other import-related costs.

• With no public pressure to reduce retail prices, prices are expected to remain elevated.

• Once imported inventory is exhausted, RWSL’s GP margins will expand significantly, driving higher profitability and providing strong tailwinds for share price appreciation.

Strategic Opportunities

Note: The below strategic outlook is speculative and based solely on the author’s analysis. There is no known insider information or confirmation regarding PPP or acquisition discussions involving RWSL.

1. State Sector Privatization / PPP Opportunities

• Sri Lanka is moving toward liberalizing state enterprises, regardless of political party in power as happened in India post 1991.

• The government has already signaled interest in PPPs (e.g., Sevenagala Sugar Industries).

• State salt companies may follow suit.

RWSL’s strategic position:

• Largest private salt producer in the country

• Only domestic producer capable of PVD salt (high-grade industrial salt)

• Debt-free, with expected LKR 2 billion+ free cash by end of FY 2025

• Holds 10–15% market share, while state firms control about 75%

• Successful PPP participation could multiply RWSL’s scale significantly

2. Acquisition Target Potential

• RWSL is passively managed, with a self-described “risk-averse” approach.

• Historically, the company has not pursued aggressive expansion or meaningful

diversification.

• However, recent performance and assets make it attractive:

3X topline growth

Strong GP margins

Potential PPP opportunities

500+ acres of land, much of it near existing wind power infrastructure

• RWSL may come under the radar for a strategic acquisition by a more ambitious growth-oriented investor

Raigam Wayamba Saltetns RWSL.N0000-(CSE/Colombo Stock Exchange)Fundamentals

* Expected 12M EPS - LKR 1.20

* PE - 5.91 (@ LTP LKR 7.10)

* NAV - LKR 8.36

* Expecting NAV YE March 2024 - LKR 8.76

* PBV - 0.81

* Free Cash/Share (Including Fixed Deposits) - > LKR 3.00

Fundamental Investment Thesis Summary

* Sri Lanka had extremely high interest rates above 25% during 2022 & 2023

* Now fixed income rates had dropped below 10% and expecting fall below and remain lower

* No incentive for the company to continue with high free cash buffers

* Company is currently debt free. As borrowing rates are low, company can execute expansions on borrowings.

* Expecting distribution of free cash as enhanced dividends

Fundamental business outlook

* 2024 is expected to be a dry year (El Nino effects) for Sri Lanka. Dry conditions are very much conducive for salt production.

* Sri Lanka is coming out of an economic crisis. Consumption levels are expected to grow rapidly in 2024 (Growth of tourism/increased consumption from native population

Technical Analysis (Chart Patterns)

* With the breaking of LKR 7, RWSL is with a confirmed C&H Break Out. Target LKR 8.30, 18% upside.

* 52 W High LKR 9.30

RWSL.N0000Wait for pullback around 7.2 to 7.5

Disclaimer: The information and analysis provided in this publication are for educational purposes only and should not be construed as financial advice or recommendations to buy, sell, or hold any securities. The author and TradingView are not responsible for any investment decisions made based on the content presented herein. Always consult a financial professional before making any investment decisions.

RWSL.N - RAIGAM WAYAMBA SALTERNS PLCDisclaimer: This chart and analysis are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations. Do your own due diligence before trading or investing in any stock exchanges, Indices, Stocks, Forex, Crypto etc.

CSELK:RWSL.N0000

RWSL.N - RAIGAM WAYAMBA SALTERNS PLCDisclaimer: This chart and analysis are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations. Do your own due diligence before trading or investing in any stock exchanges, Indices, Stocks, Forex, Crypto etc.

CSELK:RWSL.N0000

RWSL, is still maintaining above the 30 MA on the weekly chart.

Currently it is in an uptrend with no any signs for reversal.