CVS Health (NYSE: $CVS) Delivers Strong Q4 ResultsCVS Health (NYSE: NYSE:CVS ) reported solid performance for the fourth quarter and full year of 2025 on February 10, 2026. The company showed revenue growth across its main business areas, but its stock dropped about 3% in early trading due to concerns over its insurance segment and a cautious outl

0.073 USD

1.52 B USD

345.05 B USD

About CVS Health Corporation

Sector

Industry

CEO

J. David Joyner

Website

Headquarters

Woonsocket

Founded

1963

IPO date

Oct 1, 1952

Identifiers

2

ISIN AR0107022060

CVS Health Corp. is a health solutions company, which engages in the provision of healthcare services. It operates through the following segments: Health Care Benefits, Health Services, Pharmacy and Consumer Wellness, and Corporate and Other. The Health Care Benefits segment operates as a health care benefits provider. The Health Services segment offers a full range of PBM solutions, delivers health care services in its medical clinics, virtually, and in the home. The Pharmacy & Consumer Wellness segment dispenses prescriptions in its retail pharmacies and through its infusion operations. The Corporate and Other Segment is involved in management and administrative expenses. The company was founded by Stanley P. Goldstein and Ralph Hoagland in 1963 and is headquartered in Woonsocket, RI.

Related stocks

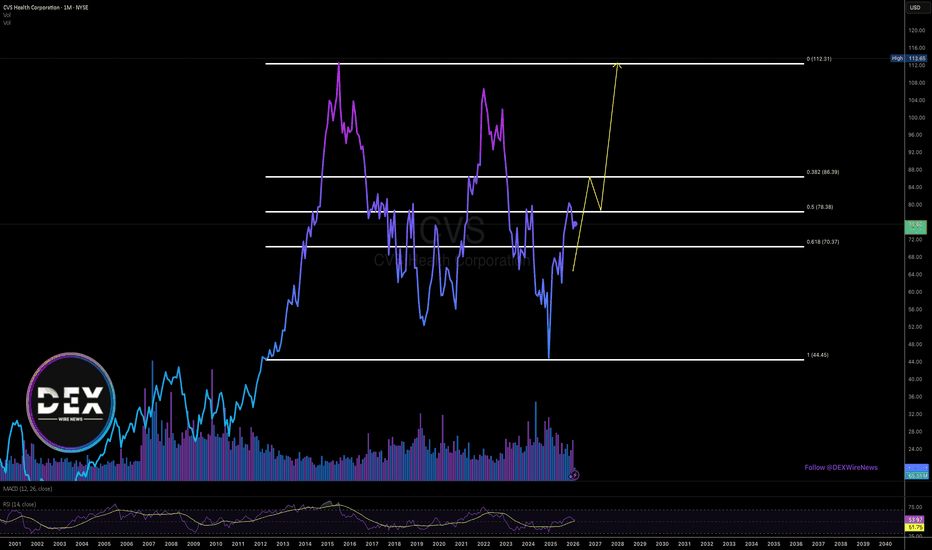

CVS IS LOOKING PROMISINGFrom a technical standpoint, CVS is starting to show some promising chart position. To confirm wave three of three, we need to see a clean weekly break above the control area between the 61.8% and 76.4% extensions. Then it should be off to the races. That said, the price is currently sitting at resi

CVS | Rally Mode In Progress Into 2026CVS Health Corp. is a health solutions company, which engages in the provision of healthcare services. It operates through the following segments: Health Care Benefits, Health Services, Pharmacy and Consumer Wellness, and Corporate and Other. The Health Care Benefits segment operates as a health car

CVS: Will The Snooze Continue?CVS Health has been hibernating all winter, but some traders may think its snooze is ending.

The first pattern on today’s chart is the bearish gap on October 30, one day after earnings beat estimates. The stock had rallied into the report, so the decline may have been a case of “selling the news.”

CVS - Control Confirmed, Upside UnlockedIn my last CVS video, we beautifully identified a 40% move which came to fruition quickly because we proved HTF taper (white) and buying (green) algorithms.

We have taken those profits where expected - not because we're bearish now but because we proved bullish algorithms and are now looking for co

Can Integration Save CVS or Sink It?CVS Health confronts a dangerous convergence of risks that threatens its vertically integrated business model. The company's Pharmacy Benefit Manager (PBM) subsidiary, Caremark, faces intensifying regulatory scrutiny as lawmakers target the opaque rebate structures and spread pricing mechanisms that

See all ideas

00963

CTBC Global High Dividend ETF Securities Investment Trust FundWeight

1.41%

Market value

514.86 K

USD

Explore more ETFs