19 January Deliveries. Worse Than the Pandemic.In my first post on Friday, I argued the "record backlog + Boeing weakness = buy" narrative is structurally broken. Engine constraints, margin compression on legacy-priced orders, and aircraft being scrapped at age six for parts.

Zero engagement. Fair enough. Maybe the thesis felt speculative. So h

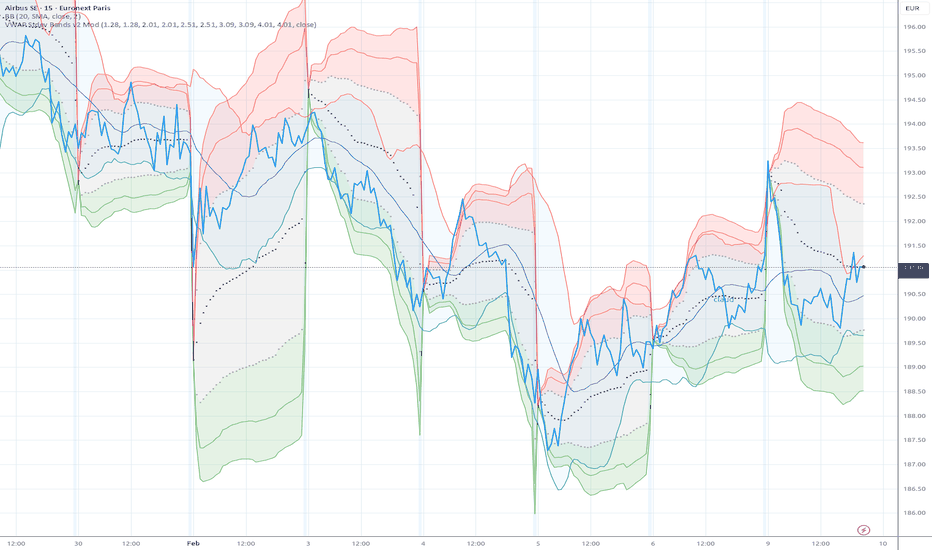

Airbus SE

No trades

Key facts today

Airbus (AIR) stock fell from €221 to €190 ahead of its financial results announcement. The company secured an order for 8 A350-1000s and reported €47.4 billion in revenue.

Safran's CEO stated that CFM will focus on meeting its engine supply commitments to Airbus, amid ongoing tensions with Pratt & Whitney affecting Airbus's production goals.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.76 USD

4.58 B USD

74.89 B USD

About Airbus SE

Sector

Industry

CEO

Guillaume Faury

Website

Headquarters

Leiden

Founded

1998

IPO date

Jul 10, 2000

Identifiers

3

ISIN US0092791005

Airbus SE is a holding and management company, which engages in the design, manufacture, and marketing of aerospace products, services, and solutions. It operates through the following segments: Airbus, Airbus Helicopters, and Airbus Defense and Space. The Airbus segment involves the development, manufacture, marketing, and sale of commercial jet passenger aircraft, regional turboprop, and components, conversion and related services. The Airbus Helicopters segment includes the provision of civil and military helicopters and related services. The Airbus Defense and Space segment focuses on connected intelligence, military air, and space systems. The company was founded on December 29, 1998 and is headquartered in Leiden, Netherland.

Related stocks

AIRBUS - Beyond the Backlog: What the Consensus Is Missing𝗖𝘂𝗿𝗿𝗲𝗻𝘁 𝗣𝗿𝗶𝗰𝗲: €189 | 𝗖𝗼𝗻𝘀𝗲𝗻𝘀𝘂𝘀 𝗧𝗮𝗿𝗴𝗲𝘁: €230 | 𝗠𝗼𝗿𝗻𝗶𝗻𝗴𝘀𝘁𝗮𝗿 𝗙𝗩: €165

𝗞𝗲𝘆 𝗗𝗮𝘁𝗲: February 19, 2026 — FY 2025 Earnings Release

𝗧𝗛𝗘𝗦𝗜𝗦: 𝗧𝗛𝗘 "𝗥𝗘𝗖𝗢𝗥𝗗 𝗕𝗔𝗖𝗞𝗟𝗢𝗚 + 𝗕𝗢𝗘𝗜𝗡𝗚 𝗪𝗘𝗔𝗞𝗡𝗘𝗦𝗦 = 𝗕𝗨𝗬" 𝗡𝗔𝗥𝗥𝗔𝗧𝗜𝗩𝗘 𝗜𝗦 𝗦𝗧𝗥𝗨𝗖𝗧𝗨𝗥𝗔𝗟𝗟𝗬 𝗕𝗥𝗢𝗞𝗘𝗡.

Six months ago, Airbus CEO Faury told the US Chamber of Commerce the supply chain had "c

𝗘𝘃𝗲𝗿𝘆 𝗠𝗼𝗿𝗻𝗶𝗻𝗴 𝗧𝗵𝗲𝘆 𝗠𝗮𝗿𝗸 𝗜𝘁 𝗨𝗽In Parts I and II, I built the fundamental case: 19 January deliveries (worst this decade, below pandemic levels), engine constraints through 2030 per P&W's own president, no supply agreement between Airbus and P&W for the foreseeable future, Singapore Airshow producing one order for four aircraft,

AIR moves below 200 Euro and the 20MA - a sign of more to come?We saw AIR down by 10% in early trading today. A mix of the recall note on 600 A320 airliners for the effect solar radiation has been found to have on the flight software, and a possible Ukraine Peace plan knocking all European defence stocks.

The former is quite some issue - but, by my superficial

Airbus SE Accelerates Production as Tension Grows with Suppliers

By Ion Jauregui – Analyst at ActivTrades

Airbus SE is once again at the center of industrial attention. The European manufacturer is standing firm on its ambitious plan to ramp up A320neo production to 75 aircraft per month by 2027, but pressure on the supply chain — particularly engine supplier

Airbus,Leonardo and Thales:Europe targets space- Project BromoAirbus, Leonardo and Thales: Europe targets space with Project Bromo

By Ion Jauregui – Analyst at ActivTrades

The planned agreement between Airbus (EPA: AIR), Leonardo (BIT: LDOF), and Thales (EPA: TCFP) to merge their satellite divisions under Project Bromo represents a far-reaching strategic m

Airbus Wave Analysis – 10 July 2025- Airbus broke resistance zone

- Likely to rise to resistance level 190.00

Airbus recently broke the resistance zone lying between the resistance level 175.00 (which started the earlier sharp downward correction in March, as can be seen from the Airbus chart below) and the resistance trendline of t

AIRBUS STOCK FORMING BEARISH TREND PATTERNAIRBUS STOCK FORMING BEARISH TREND PATTERN.

Price drop sharply after forming high 177.30 and created a lower low.

Market was trading in secondary trend from last few sessions.

After secondary trend, reversal candlestick pattern is been spotted.

Price is expected to remain bearish for upcoming sessio

Is Europe's Decline Grounding Airbus's Ascent?Europe's economic situation presents a complex picture of modest growth juxtaposed with significant challenges, creating uncertainty for major players like Airbus. In 2024, the European Union's GDP growth was projected to be below 1%, with only a slight acceleration anticipated for 2025. This sluggi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US9279AC4

Airbus SE 3.95% 10-APR-2047Yield to maturity

5.48%

Maturity date

Apr 10, 2047

USN0280EAS4

Airbus SE 3.95% 10-APR-2047Yield to maturity

5.33%

Maturity date

Apr 10, 2047

AIRC

Airbus SE 3.15% 10-APR-2027Yield to maturity

3.85%

Maturity date

Apr 10, 2027

XS218586805

Airbus SE 2.375% 09-JUN-2040Yield to maturity

3.80%

Maturity date

Jun 9, 2040

XS141058231

Airbus Finance B.V. 1.375% 13-MAY-2031Yield to maturity

2.87%

Maturity date

May 13, 2031

XS215279642

Airbus SE 2.375% 07-APR-2032Yield to maturity

2.85%

Maturity date

Apr 7, 2032

XS218586791

Airbus SE 1.625% 09-JUN-2030Yield to maturity

2.69%

Maturity date

Jun 9, 2030

EA8C

Airbus SE 2.125% 29-OCT-2029Yield to maturity

2.50%

Maturity date

Oct 29, 2029

XS215279626

Airbus SE 2.0% 07-APR-2028Yield to maturity

2.32%

Maturity date

Apr 7, 2028

XS218586783

Airbus SE 1.375% 09-JUN-2026Yield to maturity

2.23%

Maturity date

Jun 9, 2026

XS141058258

Airbus Finance B.V. 0.875% 13-MAY-2026Yield to maturity

2.21%

Maturity date

May 13, 2026

See all EADSY bonds