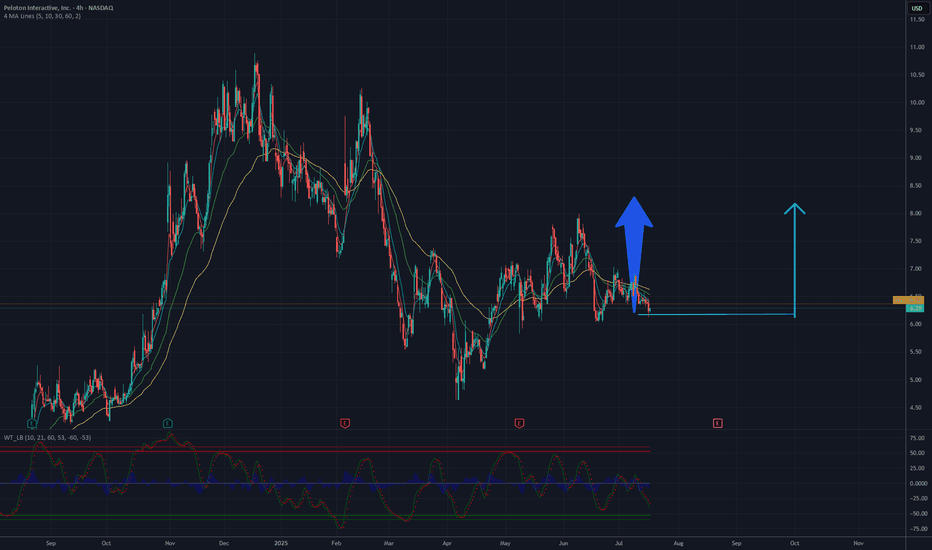

PTON Squeeze 2.0?Its Christmas Eve today, and Santa Powell is likely voting today to lower rates. By how much? Depends on the proportion of slurs / message in your favorite discord serve, but I'm leaning towards the standardized view of 0.25. If we get anything above, or below for that matter, expect to have your ha

Key facts today

Peloton's stock increased by 3.4% following the release of positive inflation data that met forecasts, contributing to market optimism regarding potential interest rate cuts from the Federal Reserve.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.262 EUR

−100.93 M EUR

2.11 B EUR

381.98 M

About Peloton Interactive, Inc.

Sector

Industry

CEO

Peter C. Stern

Website

Headquarters

New York

Founded

2012

ISIN

US70614W1009

FIGI

BBG01HQ1YXJ0

Peloton Interactive, Inc. provides an at-home fitness platform for live and on-demand indoor cycling classes. The firm pioneered connected, technology-enabled fitness, and the streaming of immersive, instructor-led boutique classes for its members. It operates through the Connected Fitness Products and Subscription segments. The Connected Fitness Products segment includes the sales of bikes, tread & related accessories. The Subscription segment refers to the monthly subscription and credits from live studio classes. The company was founded by John Foley, Graham Stanton, Thomas Cortese, Yony Feng, and Hisao Kushi in 2012 and is headquartered in New York, NY.

Related stocks

PTON: Structural Reversal in Progress?PTON's price action has triggered a quarterly MSB setup, indicating a probable bullish expansion. A trendline is also due for a retest, presenting an excellent low-risk opportunity for a discounted entry.

There is a key observation zone between $15 and $17, which may act as resistance. This level re

Peloton (PTON): Can Bulls Ride Toward $17?Peloton (PTON): Can Bulls Ride Toward $17?

Peloton is showing signs of life after months of consolidation. With price action breaking above the $8.00 resistance and forming a bullish pattern.

The breakout above $8.00 confirms bullish intent. A sustained close above $8.00 could attract swing trad

It's a time for Peloton Interactive, Inc. (PTON)-Target 8.20 $The chart analysis for Peloton Interactive, Inc. (PTON) suggests a potential rise with a target of 8.20 USD. The 4-hour chart indicates a recent downtrend from a peak around 10 USD, with the current price stabilizing near 6.30 USD. A key support level is observed around 6 USD, which could provide a

PTON is staging a potential long-term rebound. NASDAQ:PTON is looking very strong upside after it has broken out of the major downtrend line which started in Feb 2021 and the recent rebound was seen rebounding off strongly above 61.8% Fibonacci retracement level. NeXT, the stock is building up very aggressive uptrend channel with recent bullish

$PTON - LongNASDAQ:PTON in lower time frames is reversing. If momentum to upside continues, this would be a good trade for short-term.

* First Entry: $7, targeting the daily supply around ~$7.75

* Second Entry: ~$6, if price continues lower, with the same $7.75 targe if the first entry doesn't reach it.

PTON - 3 months HEAD & SHOULDERS══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

-

Long Trade Setup Breakdown for (PTON) 30 Mins📊

🔹 Asset: Peloton Interactive, Inc. (PTON)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Rising Wedge Breakout

🚀 Trade Plan (Long Position):

✅ Entry Zone: $10.14 (Breakout Confirmation)

✅ Stop-Loss (SL): $9.74 (Below Support)

🎯 Take Profit Targets (Long Trade):

📌 TP1: $10.64 (First Resistance)

📌 TP2: $1

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

PTON5385383

Peloton Interactive, Inc. 0.0% 15-FEB-2026Yield to maturity

—

Maturity date

Feb 15, 2026

PTON6093284

Peloton Interactive, Inc. 5.5% 01-DEC-2029Yield to maturity

—

Maturity date

Dec 1, 2029

See all 4PTON bonds

Curated watchlists where 4PTON is featured.

Frequently Asked Questions

The current price of 4PTON is 7.356 EUR — it has increased by 3.77% in the past 24 hours. Watch Peloton Interactive, Inc. Class A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EUROTLX exchange Peloton Interactive, Inc. Class A stocks are traded under the ticker 4PTON.

4PTON stock has risen by 3.27% compared to the previous week, the month change is a 10.83% rise, over the last year Peloton Interactive, Inc. Class A has showed a 72.60% increase.

We've gathered analysts' opinions on Peloton Interactive, Inc. Class A future price: according to them, 4PTON price has a max estimate of 17.17 EUR and a min estimate of 4.29 EUR. Watch 4PTON chart and read a more detailed Peloton Interactive, Inc. Class A stock forecast: see what analysts think of Peloton Interactive, Inc. Class A and suggest that you do with its stocks.

4PTON reached its all-time high on Dec 17, 2021 with the price of 37.410 EUR, and its all-time low was 2.645 EUR and was reached on Aug 14, 2024. View more price dynamics on 4PTON chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

4PTON stock is 3.63% volatile and has beta coefficient of 2.19. Track Peloton Interactive, Inc. Class A stock price on the chart and check out the list of the most volatile stocks — is Peloton Interactive, Inc. Class A there?

Today Peloton Interactive, Inc. Class A has the market capitalization of 2.94 B, it has increased by 5.54% over the last week.

Yes, you can track Peloton Interactive, Inc. Class A financials in yearly and quarterly reports right on TradingView.

Peloton Interactive, Inc. Class A is going to release the next earnings report on Oct 30, 2025. Keep track of upcoming events with our Earnings Calendar.

4PTON earnings for the last quarter are 0.04 EUR per share, whereas the estimation was −0.06 EUR resulting in a 173.23% surprise. The estimated earnings for the next quarter are 0.01 EUR per share. See more details about Peloton Interactive, Inc. Class A earnings.

Peloton Interactive, Inc. Class A revenue for the last quarter amounts to 515.20 M EUR, despite the estimated figure of 492.53 M EUR. In the next quarter, revenue is expected to reach 463.32 M EUR.

4PTON net income for the last quarter is 18.34 M EUR, while the quarter before that showed −44.09 M EUR of net income which accounts for 141.59% change. Track more Peloton Interactive, Inc. Class A financial stats to get the full picture.

No, 4PTON doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Sep 27, 2025, the company has 2.66 K employees. See our rating of the largest employees — is Peloton Interactive, Inc. Class A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Peloton Interactive, Inc. Class A EBITDA is 148.39 M EUR, and current EBITDA margin is 7.02%. See more stats in Peloton Interactive, Inc. Class A financial statements.

Like other stocks, 4PTON shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Peloton Interactive, Inc. Class A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Peloton Interactive, Inc. Class A technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Peloton Interactive, Inc. Class A stock shows the buy signal. See more of Peloton Interactive, Inc. Class A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.