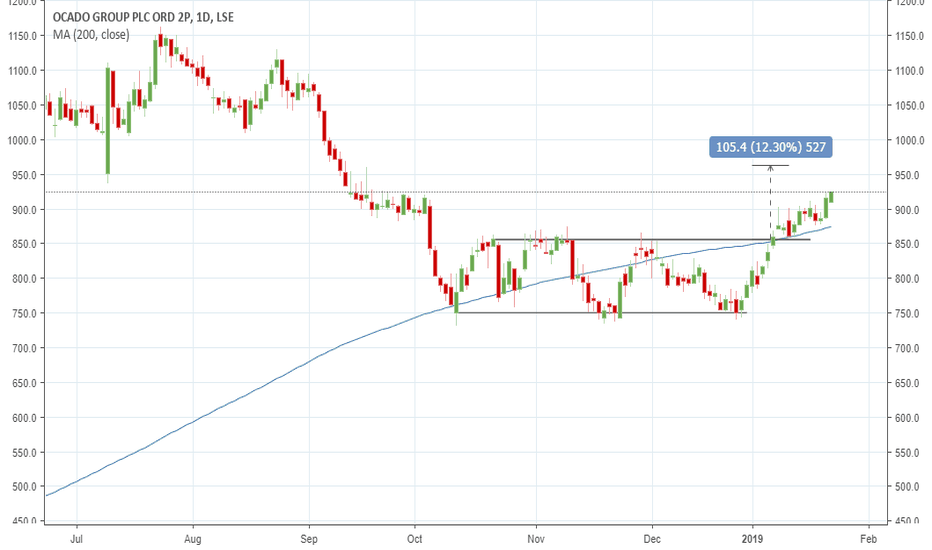

OCDO | Bull vs Bear casesOcado has been experiencing a strong pullback on the negative patent litigation news, with what seems like a classic bearish head and shoulders pattern.

The question here is whether the reversal has run out of steam as we try to break out of the multi month downtrend.

Bullish scenario: further lockdowns and festive season online spending act as tailwinds to push the stock past the downtrend, up towards local highs.

Bearish scenario: if the downtrend holds, we can see further downside back to our previous consolidation range. This range should act as strong support.

I'm long OCDO and consider this to be a healthy pullback after strong YTD gains. I would consider adding to my position if support holds around 19.50.

Any thoughts?

Thanks again

(*This is not financial advice, for sake of discussion and illustrative purposes only*)

0OC trade ideas

Ocado - Looking ripe for buying.Technical

Ocado has had a dramatic rise in price over the past 18 months. The breakout level at 1163p has been retested and has so far been well supported. The shares have been in a consolidation phase for the past few weeks, but some signs are emerging that could put an end to the sideways price action. A move back to and above the previous highs is expected from here.

Fundamentals

The company continues to make strides into technology, which offers potential medium-term growth.

Numis reiterated thier 'Buy' rating on the 10th May 2019 with a price target of 1700p

Ocado has announced a string of deals and recently tied up a joint venture with Marks and Spencer.

Stop 1105p

Target 1500p

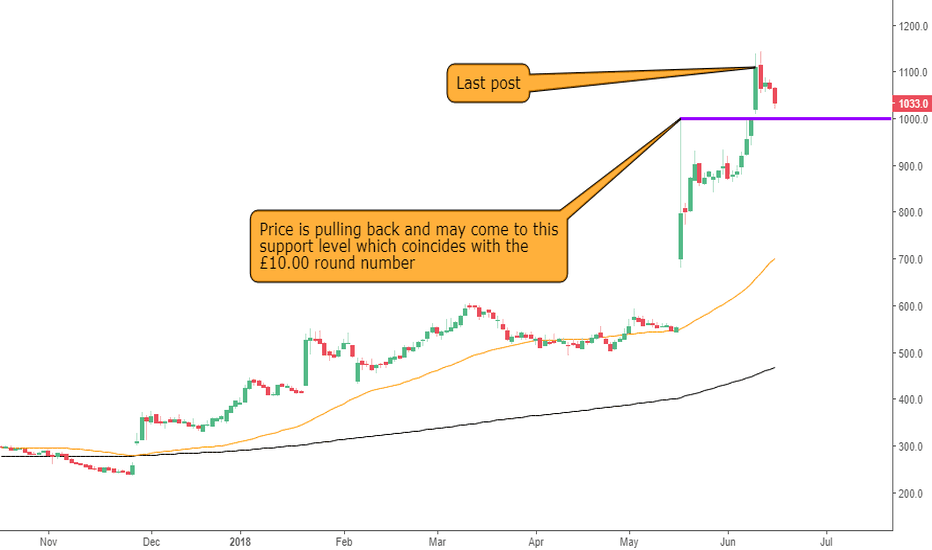

Ocado Bouncing Off SupportLast post: June 15th. See chart .

Review: Price was pulling back after being in a nice uptrend.

Update: Price is stuck inside the consolidation zone and currently at the support area.

Conclusion: We need to see a breakout of this consolidation zone before looking at any trading opportunities.

Any comments or questions, do not hesitate to leave them below. Give us the thumbs up if you share our sentiments!

Sublime Trading

Ocado Producing A PullbackLast post: June 11th. See chart .

Review: Price was trending up fast after breaking out of consolidation.

Update: Price is producing a pullback. There is a strong support level underneath which consists of the previous resistance turned support and the £10.00 round number.

Conclusion: If the support level holds then it may present a pullback opportunity, otherwise it may be best to wait for a breakout of the recent high.

Any comments or questions, do not hesitate to leave them below. Give us the thumbs up if you share our sentiments!

Sublime Trading

Ocado Moving Up Fast!This stock is featuring for the first time on our TradingView blogs.

Current setup: Price is experiencing a strong trend and does not look like slowing down.

Conclusion: As price has broken through a previous high on the daily timeframe it is looking good for a long opportunity.

Any comments or questions, do not hesitate to leave them below. Give us the thumbs up if you share our sentiments!

Sublime Trading

Ocado eyes end to price war, daily chart shows bullish symmetric"While the market remains very competitive, there are the first signs of a change in market pricing dynamics coming through," said chief executive Tim Steiner

Daily chart below shows a bullish symmetrical triangle breakout. Share prices has been riding along the support offered by the upper end of the triangle. Let us see if it spikes today...