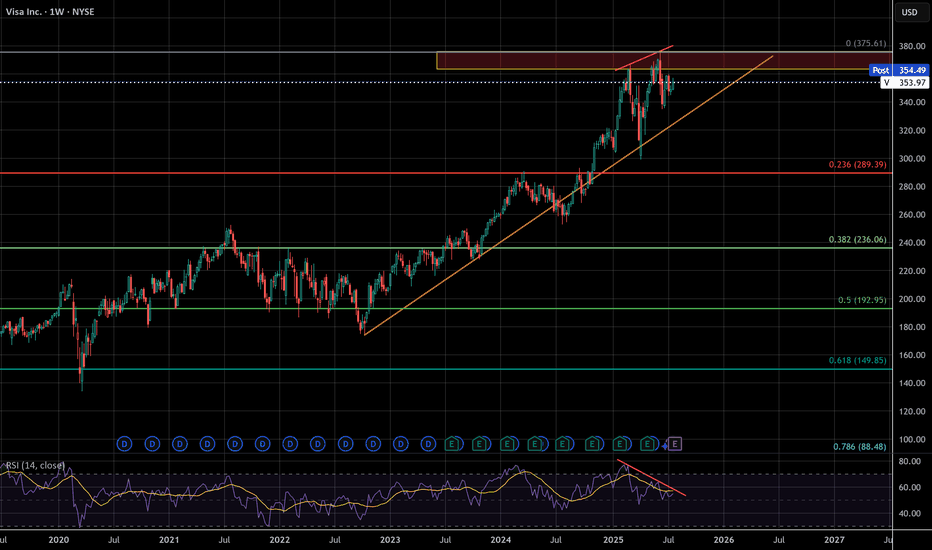

Visa Completing Corrective Structure Preparing for InflectionVisa is completing a corrective compression cycle into a multi-year trendline with Fib confluence and institutional support levels. This setup tilts the probability toward a bullish breakout and trend continuation. If visa holds this support area and breaks the descending wedge there is a possibility of reaching $375 and $400. Alternative breaking this support area may open the door to $320.

Disclaimer: Not financial or trading advice.

Trade ideas

VISA flashed a huge Sell SignalVisa Inc. (V) has been trading within a 7-year Channel Up and two weeks ago closed below its 1W MA50 (blue trend-line). Given that this took place after a June Higher High, we can claim that this break-out has confirmed the new Bear Cycle/ Leg of the pattern.

Observe the incredible symmetry of the 1W MACD, which on the current level (-0.0058), it was when the November 01 2021 and March 09 2020 breaks below the 1W MA50 occurred. They both eventually crashed to the bottom (Higher Lows trend-line) of the Channel Up.

As a result, we officially turn bearish on this stock and based on the previous Bearish Leg that broke below its 1W MA200 (orange trend-line) and hit the 0.5 Fibonacci retracement level before rebounding into the new Bullish Leg, we expect to see the price drop to $265.00 before forming a bottom. That would be a potential contact with the 1W MA300 (red trend-line) as well.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Visa May Be CrumblingVisa has been rangebound for months, but some traders may think it’s starting to head lower.

The first pattern on today’s chart is the consolidation period between late July and mid-November. At the beginning of the period, V’s 50-day simple moving average (SMA) was above its 100-day SMA. Both were above the 200-day SMA.

Things were just the opposite at the end, with the faster SMAs below the slower ones. That included a “death cross” of the 50-day SMA under the 200-day SMA, which may suggest the longer-term trend is getting bearish.

Second, the Wall Street Journal reported on June 13 that large retailers were exploring the use of stablecoins. V gapped lower on that news and has remained below it since.

Third, MACD is falling and the 8-day exponential moving average (EMA) is below the 21-day EMA. Those patterns may be consistent with a bearish short-term trend.

Next, V is trying to hold the August 7 low of $328.70. Traders may watch a potential break of that support line as a signal for steeper downside.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

$V Seismic shift is taking place.- $V & NYSE:MA will soon get toasted when their fees would compress which they charge for processing transaction.

- NYSE:XYZ has already started bitcoin based transaction which cost a seller no transaction fees. You might think this is contained but soon NYSE:TOST , NYSE:FI , NASDAQ:SHOP all the payment processor will start accepting Bitcoin as mode of payment and will offer lower transaction fees and initially zero transaction fees for mass adoption.

- Even if $V & NYSE:MA adopt to this trend their margins will get hurt and there would be pressure on transaction fees nonetheless.

Visa Inc. In the financial sector, Visa Inc., a leader in digital payments globally, is getting closer to a critical support area and appears to be headed for possible decline. since Visa's shares approach this pivotal level, investors and experts are keeping a careful eye on it, since it may signal a change in market mood. In the days ahead, a number of factors could affect Visa's trajectory, including: company-specific developments, regulatory changes, and economic conditions. It is recommended that traders use caution and be up to date on important market indications in order to properly manage any potential volatility. Stakeholders will be keenly monitoring Visa's actions as it gets closer to this critical service area in order to gain insights into the larger financial landscape.

Visa breaking lower? Bearish

- several head and shoulder set ups potentially setting up,

- initial 6% down stretching to 15%

- Price moves lower to closed the gap

- If the gap is closed it suggests a H&S pattern present

If the H&S pattern triggers possible down side of 50% from here,

In covid 2020 times it fell 38%

In 2007/8 times it fell 50%

If VISA is disrupted by blockchain or crypto and we get a bear it could move its price back to the lows of 2008 which represent a 97% reduction in price

I guess if you are an employee of VISA with share options or dependant on them for your families money or pension. May be smart not to expose yourself and family to this level of risk.

If you are an executive working there pull your finger out and save your company please.

I am only reading the chart and I am pretty good at it. As of today I do not have a position here but will be looking to target a short position and will build it up and look to close it out in several years time.

$V$V – Market Review 💳📈

Our chart shows buyers are still willing to pay a premium for Visa demand remains strong, and price continues to respect higher support levels. That’s a signal of confidence.

However, I’m not seeing enough momentum yet for buyers to push above $360.

Why?

📌 Tariffs + tighter liquidity are making consumers think twice

📌 Even high-credit households are becoming selective

📌 Investors want clarity before pricing in further upside

But here’s the twist 👇

Holiday spending season + credit reliance = short-term boost potential

In a liquidity crunch, people swipe more not less.

So while upside may be limited without a catalyst, Visa still benefits from consumer adaptation:

💠 Less cash → More digital payments → Visa revenue stays strong

My view: Support remains solid. Breakout above $360 requires a macro greenlight — but the holiday cycle could provide that fuel.

Smart money stays patient. 🕵️♂️💼

#Visa #V #MarketAnalysis

VISA Stock AnalysisVisa Inc. is a leading global payments technology company. It doesn’t issue credit cards itself, nor does it extend credit to consumers; instead, it provides the infrastructure and network (VisaNet) that enables payments between consumers, merchants, financial institutions, and governments in over 200 countries and territories.

V - Can we see a new ATH?=======

Volume

=======

-Neutral

==========

Price Action

==========

- Price broke out of falling wedge

- Rounded bottom observed

- Triple bottom observed

=========

Oscillators

=========

- Ichimoku, price above cloud, green kumo expanding, base + conv + lagging piercing clouds upwards

- MACD bullish

- DMI slightly bullish

- StochRSI, slightly bullish

=========

Conclusion

=========

- short to long term swing, price may reverse at current level, to enter spot or wait for pullback.

Visa stock analysisVisa stock is showing signs of weakness as price approaches a possible death cross.

the uptrend line that has supported the advance for months. The structure suggests this trendline may be vulnerable to a break, which would mark a potential shift in momentum.

Based on the structure, I think Visa could head toward the 308 USD area, where the next meaningful support lies.

🎯 Conclusion: My view is bearish — with a potential death cross forming and the uptrend line at risk, I expect Visa to trend lower toward 308 USD.

VISA BACK TO 370 BY 2026 Why Visa (V) Could Hit $370 by 2026: Payments Powerhouse Bull Case Visa’s trading at ~$344 today (Sep 23, 2025), up 15% YTD on digital payments surge, but with EPS climbing 12%+ and global transaction volumes booming, $370 (8% upside) by EOY 2026 is a low-bar target for this steady climber. Here’s the roadmap:Revenue & Payments Growth: Q3 '25 cross-border volume +16% YoY, driving $39B TTM revenue (11% growth). Analysts project 9.4% YoY to $43B+ in FY26 on e-comm (25% of sales) and emerging markets expansion, per Simply Wall St—fueling $370 at 25x forward sales.

2 sources

EPS Acceleration: Consensus EPS hits $10.50 in FY26 (up 12% from $9.37 '25), trading at 28x forward P/E—below historical 32x avg. At norm multiple, that's $336 base; add 11.2% earnings growth for $370 pop, aligning with LiteFinance's $370–$380 range.

2 sources

Innovation Tailwinds: Visa Direct + fintech ties (e.g., Ample Earth climate collab) boost B2B volumes 20%+, hedging crypto/reg risks. Tokenization and AI fraud tech scale margins to 67%+, per management.

Analyst Consensus Backs It: 27–51 firms avg $380–$396 PT (Strong Buy, high $430), with StockScan eyeing $351 avg '26 (high $390). Lows at $305, but bulls dominate on 10%+ CAGR.

Visa: Corrective Upward MoveIn our primary scenario, we place Visa in the corrective upward move of blue wave (x). After the top, we expect the broader downward trend of turquoise wave 4 to take hold, which should push the stock into our turquoise Target Zone between $308.09 and $292.19. At that level, we anticipate a sustained reversal. From this low, a new upward impulse is likely: wave 5 should then have enough strength to lift price above the resistance levels at $375.51 and $394.49. However, an alternative scenario remains relevant: there is a 33% probability that the correction of wave alt.4 has already concluded. If so, the stock could immediately break above the resistance levels mentioned.

Aggressively bullish on $V with 360c exp on November 21# Visa Inc. (V) – Daily Chart Deep Dive

## 1. Price Structure & Trend Pattern

- The daily candles from April through mid-September trace a classic descending triangle: a series of lower highs feeding off the upper trendline, while horizontal support around 351.13 holds repeatedly.

- A descending triangle often signals distribution—supply overwhelming demand—but it can also form late in a broader uptrend as a bullish continuation pattern. Context is key: Visa’s multi-year uptrend remains intact above 280, so this consolidation could be a re-accumulation phase.

## 2. Volume Analysis

- Volume has steadily contracted as the triangle has narrowed, indicating lower conviction from both buyers and sellers—a hallmark of both continued consolidation or a Coiling Wyckoff re-accumulation.

- Look for a volume spike above the 20-day average on any breakout (up or down) to validate the move. A high-volume break below 351.13 would mark a Sign of Weakness (SOW), while a high-volume break above 359.73–370.61 would represent a Sign of Strength (SOS).

## 3. Momentum (MACD)

- The MACD lines are converging just below zero, and the histogram shows a slight bullish divergence: price making a marginally lower low near support while momentum holds flat or ticks higher.

- A bullish MACD cross here would reinforce a breakout scenario, especially if momentum turns positive and climbs above the zero-line.

## 4. Key Price Levels

| Price Level | Role |

|------------:|-----------------------------------|

| 370.61 | Upper trendline resistance |

| 359.73 | Near-term pivot resistance zone |

| 351.13 | Horizontal support (triangle base)|

| 337.12 | Secondary support zone |

## 5. Wyckoff Phase Mapping

- This structure most resembles a **Re-Accumulation**:

• **Preliminary Support (PS):** Multiple tests of 351.13 with waning volume.

• **Selling Climax (SC) & Automatic Rally (AR):** The swing from 337.12 up to ~370 formed the AR, then secondary tests near SC.

• **Secondary Test (ST):** Recent touches of support with lower volume.

• **Coiling:** The narrowing price range and lower volume prepare for a final breakout (Upthrust or Spring).

Visa Wave Analysis – 17 September 2025- Visa reversed from key support level 333.00

- Likely to rise to resistance level 351.20

Visa recently reversed down from the support area between the key support level 333.00 (which has been reversing the price from June), lower daily Bollinger Band and the 50% Fibonacci correction of the upward impulse 1 from April.

The upward reversal from this support area stopped the c-wave of the previous ABC correction ii from the end of August.

Given the strength of the support level 333.00, Visa can be expected to rise to the next resistance level 351.20 (top of wave i from the end of August).

VISA - The missing puzzle piece - Suffering from successI've seen a lot of negative sentiment online lately about the impending bubble, but even with social media, crude AI, and the US dollar being the peak of that negativity this whale has been dying slowly and few have taken notice.

VISA has begun to censor what can be bought, overcharge merchants, and short change banks on interchange fees. These are acts of desperation as growth reaches diminishing returns, the beginning decline of a massive company. Think about it, who isn't using visa already? They have to wait for new users to be born. There will only ever be more competition, competition that has superior speed, accuracy, efficiency, and cost.

VISA may not lead this crash, but it's days look to be numbered unless they make radical changes . According to google results, antitrust violations can carry 3 times the monetary penalty gained from illegal activity. I don't think this will happen, but it's a TON of leverage for a massive settlement. The cracks are just beginning, but this company is made of glass

Visa - Potential drop from descending triangleV - Potential Bear Swing

Timeframe - 1 weeks to 3 months

Volume

- Maintained volume

Price Action + Trend

- bullish trend broken

- Price broken out of downtrend line

Ichimoku

- Lagging, base and conversion line below kumo

- Kumo cloud thinning and red cloud forming

Patterns

- Descending triangle

Oscillators

- MACD - Turning into bearish MMT

- DMI - Bearish mmt picking up, DM + DM - showing divergence, DX turning up towards 20

Conclusion

- Low to mid risk

- high return

$V is oscillating in a nice range!Emerging Competitors and Niche Players

• UnionPay & JCB

While headquartered in Asia, these networks are expanding cross-border acceptance and carving out market share among Chinese and Japanese tourists globally.

• Fintech Disruptors

Companies like Stripe, Adyen, Square (Block), Affirm, and Klarna are eroding traditional card fees with direct-to-merchant billing, subscription billing, and flexible installments.

• Digital Wallets & Open Banking

Apple Pay, Google Pay, and bank-sponsored wallets leverage tokenization for contactless adoption, while PSD2-style Open Banking in Europe and evolving U.S. standards are shifting control of payment initiation away from card rails.