What Synopsys' Chart Says Following Nvidia's $2B Stock PurchaseSynopsys NASDAQ:SNPS has risen some 20% over the past roughly two weeks in part on word that Nvidia NASDAQ:NVDA has invested $2 billion in the chip-engineering-solutions firm. Let's see what Synopsis' chart and fundamentals show in the deal's wake and ahead of SNPS's earnings report due out next week.

Synopsis' Fundamental Analysis

The news broke Monday that AI chip giant Nvidia had bought $2 billion of SNPS common stock at a $414.79 average price (vs. the $463.74 the shares closed at Thursday).

The two firms also announced a strategic partnership that will integrate Nvidia's strength in computing infrastructure with Synopsys' semiconductor-engineering and circuit-manufacturing capabilities. This partnership isn't exclusive, but both sides have an obvious financial interest in making it work.

Meanwhile, Synopsys plans to report fiscal Q4 results after the closing bell next Wednesday, with the Street looking for $2.88 in adjusted earnings per share on $2.24 billion of revenue.

While a top-line print like that would be good for almost 37% in year-over-year growth, the bottom-line number wouldn't really compare all that well with the $3.40 in adjusted EPS that Synopsys reported for the same period last year.

In fact, 16 of the 18 sell-side analysts that I know of who cover SNPS have lowered their earnings estimates for the quarter since the period began. (Two analysts have left their earnings estimates unchanged.)

And while SNPS rose on the Nvidia news, the stock is still down nearly 30% from a $651.73 all-time intraday high that it hit on July 30.

Much of that decline came on Sept. 10, when SNPS fell nearly 36% in a single session after reporting poorly received Q3 earnings.

Synopsys' Technical Analysis

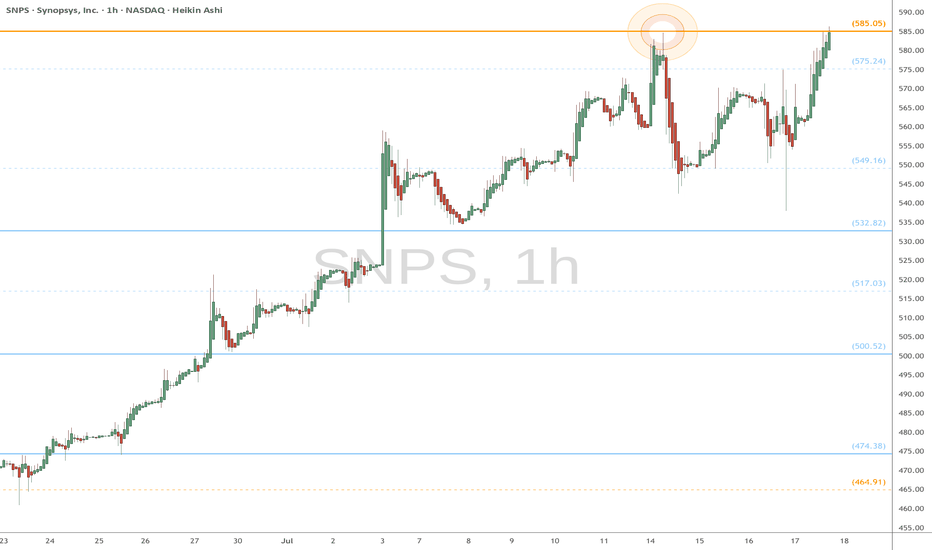

Has Nvidia's purchase helped put in a floor on Synopsys' stock price? Let's look at SNPS's chart going back some five months and running through Monday afternoon:

This chart appears to show a rapidly improving technical picture for the stock, even though readers will see Synopsis' 35.8% one-day drop in early September, marked as "Bottom 1" above.

SNPS partially recovered over the next month, but eventually retested that early September low as the chart's right (marked "Bottom 2" above). This created a double-bottom pattern of bullish reversal, as denoted by the green jagged line and green shaded area.

This pattern indicates a $515 pivot, but SNPS has more-immediate levels to contend with at the moment.

First up would be Synopsys' 50-day Simple Moving Average, or "SMA," denoted by a blue line at $441 in the chart above. After that would be the stock's 200-day SMA (marked with a red line) at $489.

Synopsys recently crossed the 50-day SMA, and holding either of those lines would help create an environment more conducive to increased long-side participation among portfolio managers.

Other factors that bulls might find interesting would be the unfilled gap above, which would need the stock to tick to $602.50 or higher to fill. Stocks don't always fill in unfilled gaps in technical analysis, but they often do.

Looking at other technical measures, Synopsis' Relative Strength Index (or "RSI," marked with a gray line at the chart's top) is currently looking better than neutral.

Similarly, the stock's daily Moving Average Convergence Divergence indicator (or "MACD," denoted by black and gold lines and blue bars at the chart's bottom) is improving, although not yet bullishly postured.

The histogram of Synopsys' 9-day Exponential Moving Average (or "EMA," marked with blue bars) is now above the zero-bound. That's a short-term bullish signal.

Meanwhile, the 12-day EMA (the black line) has crossed above the 26-day EMA (the gold line). That's positive as well, although the one negative would be that both lines are still below zero.

An Options Option

As I write this, options markets are pricing in a roughly 5% move in response to next Wednesday's earnings.

Options traders who are bullish on Synopsys but unwilling to plunk down a ton of bread for the equity might try a simple bull-call spread. In that scenario, you buy one call while selling a second call with a higher strike price, but the same expiration date.

Here's an example using Synopsys' 50-day SMA as the first call's strike price:

-- Long one SNPS $440 call with a Dec. 12 expiration (i.e., after next week's earnings release). This cost about $27.55 at recent prices.

-- Short one SNPS Dec. 12 $460 call for about $17.10.

Net debit: $10.45.

The trader is risking a $10.45 theoretical maximum loss with the above spread to try to earn a maximum potential gain at expiration of $9.55 (the difference between the two strike prices minus the strategy's net debit above).

(Moomoo Technologies Inc. Markets Commentator Stephen "Sarge" Guilfoyle had no position in SNPS at the time of writing this column.)

This article discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. Specific security charts used are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. Moomoo and its affiliates make no representation or warranty as to the article's adequacy, completeness, accuracy or timeliness for any particular purpose of the above content. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Options trading is risky and not appropriate for everyone. Read the Options Disclosure Document ( j.moomoo.com ) before trading. Options are complex and you may quickly lose the entire investment. Supporting docs for any claims will be furnished upon request.

Options trading subject to eligibility requirements. Strategies available will depend on options level approved.

Maximum potential loss and profit for options are calculated based on the single leg or an entire multi-leg trade remaining intact until expiration with no option contracts being exercised or assigned. These figures do not account for a portion of a multi-leg strategy being changed or removed or the trader assuming a short or long position in the underlying stock at or before expiration. Therefore, it is possible to lose more than the theoretical max loss of a strategy.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

TradingView is an independent third party not affiliated with Moomoo Financial Inc., Moomoo Technologies Inc., or its affiliates. Moomoo Financial Inc. and its affiliates do not endorse, represent or warrant the completeness and accuracy of the data and information available on the TradingView platform and are not responsible for any services provided by the third-party platform.

Synopsys, Inc.

No trades

Trade ideas

Back at supportA leading company in semiconductor circuit design is undergoing a sharp correction following an earnings report that fell short of expectations.

The price has dropped again to touch the support level at $386 (blue trendline) that has held firm for nearly 4 years.

This could be a potential entry or accumulation opportunity, provided a stop is placed in case of a bearish breakdown below support.

SNPS (Synopsys, Inc.) — 2H TF | Long Setup

SNPS (Synopsys) experienced a parabolic run into $651 ATH, followed by a brutal selloff wiping out nearly $250 in value in a matter of days. This sharp capitulation was after the earnings shock and news impact. However the company fundamental and historical growth still very healthy!

Currently, price is bouncing around $409–412, just above the major demand zone at $368–385. On the upside, clear supply zones sit at $605–616 and $639–651, which will act as hurdles for any recovery rally.

Likely linked to earnings or lowered forward guidance (Synopsys is a leader in EDA software, highly sensitive to semiconductor cycle).

Broader tech weakness and yield-driven selloff could have amplified losses.

🔀 Trend & Structure:

Primary Trend: Bullish (macro still intact from 2022 lows, but in deep correction)

Short-Term: Bearish momentum

Setup: Bounce from demand with potential retracement toward supply zones

🟩 Key Supply/Demand Zones:

Demand Zone (Buy Area): $368 – $385

Supply Zones (Sell Areas):

$605 – $616

$639 – $651

🎯 Trade Setup (Swing Long Reversal Play):

Entry: $412–415 (current levels)

Stop Loss: $364 (below demand invalidation)

Take Profit 1: $605

Take Profit 2: $639

Risk/Reward: ~4.9R to TP1

Max Risk: 1–2% of capital only (high volatility stock)

🧭 Trade Management:

Move SL → BE once $490 is cleared

Scale partial at $550, hold runner to $605+

If $605 supply breaks, $639–651 retest possible

“Volatility is the price you pay for opportunity.”

⚠️ Disclaimer:

This is not financial advice. SNPS is in a high-risk post-earnings selloff setup. Only attempt this trade with tight risk management.

#SNPS #Synopsys #TechStocks #SupplyAndDemand #SwingTrade #ReversalSetup #RiskReward #TradingView

SNPS - LONG Swing Entry PlanNASDAQ:SNPS - LONG Swing Entry Plan

E1: $414.00 – $400.00

→ Open initial position targeting +8% from entry level.

E2: $339.00 – $329.00

→ If price dips further, average down with a second equal-sized entry.

→ New target becomes +8% from the average of Entry 1 and Entry 2.

AD: $257.00 – $247.00

→ If reached, enter with double the initial size to lower the overall cost basis.

→ Profit target remains +8% from the new average across all three entries.

Risk Management:

Stop Loss:

Risk is capped at 12% below the average entry price (calculated across all executed positions including the Edit Zone).

Position Sizing Approach:

Entry 1: 1x

Entry 2: 1x

Edit Zone: 2x

→ Total exposure: 4x

→ Weighted average determines final TP and SL calculations.

______________________________________

Legal Disclaimer

The information provided in this content is intended for educational and informational purposes only and does not constitute financial, investment, or legal advice or recommendations of any kind. The provider of this content assumes no legal or financial responsibility for any investment decisions made based on this information. Users are strongly advised to conduct their own due diligence and consult with licensed financial advisors before making any financial or investment decisions.

Sharia Compliance Disclaimer: The provider makes no guarantees that the stocks or financial instruments mentioned herein comply with Islamic (Sharia) principles. It is the user’s responsibility to verify Sharia compliance, and consultation with a qualified Sharia advisor is strongly recommended before making any investment decisions

Synopsys — a sharp sell-off, risky entry and clear opportunitySynopsys plunged roughly 30–34% on 10 September 2025, wiping out a large chunk of market value after quarterly results missed expectations and guidance was cut. That kind of move often feels like a “falling knife”: attractive on paper, dangerous in practice.

Price action and technical context

The stock has gapped lower and left a sizeable down-gap to fill. From a technical viewpoint the setup resembles a fast, impulsive sell-off inside a broader downtrend established since the spring; price is now testing levels that were former support in April 2025. Short-term momentum indicators show oversold readings, but volatility is elevated and trend-following measures still favour the downside until a reliable base is formed.

Key technical reference points to watch:

Gap zone/topside resistance: around the pre-drop range near the mid-$600s.

Immediate support / stop placement: just below the April 2025 lows (your stated stop).

Possible gap-fill target: if the market rotates back, reclaiming the gap by January 2026 implies roughly a ~55% upside from current depressed levels (as you noted).

Fundamentals and why this remains an opportunity

Despite the headline shock, Synopsys’s underlying business remains high-quality:

Market-leading positions in EDA tools and IP libraries.

Strong, recurring revenue mix (software subscriptions and maintenance).

Long secular tailwinds from AI, advanced node design and chiplet modularity.

Valuation has re-rated materially after the drop — the company is no longer priced at the frothy multiples of earlier in the cycle. Analysts have revised estimates downward but many still target stock levels clustered around $600, reflecting belief in recovery by late 2025 / early 2026.

Options flow and timing

There is notable open interest concentration in both calls and puts around the $600 strike with expiries in December 2025 and January 2026. That concentration suggests the market expects meaningful activity/interest around that level into the winter and gives a window where a gap-fill or relief rally could materialize before January expiries.

Risk management and trade plan

Trade type: speculative rebound / gap-fill play, not a buy-and-forget investment.

Target: gap-fill / recovery toward pre-drop levels by January 2026 — roughly +55% potential from current depressed price (per your scenario).

Stop: just below April 2025 lows (limits downside if the downtrend resumes).

Position sizing: small relative to portfolio — treat as a high-volatility, event-driven trade.

Alternatives: consider defined-risk option structures (e.g., debit spreads) to cap downside while retaining upside exposure to a gap fill.

Catalysts to monitor

Any updates to guidance or profitability from Synopsys management.

China demand/FX developments and IP licensing commentary.

Options positioning into December 2025 / January 2026 expiries.

Broader semiconductor capital spending and AI-related design win announcements.

Technical indicators to watch

200DMA and April lows (support/resistance anchors).

RSI(14) and MACD for bullish divergence and momentum confirmation.

Volume on any recovery day — strong volume on up days increases odds of a sustained bounce.

Bottom line

This is a high-risk, high-reward setup: a classic “ falling knife ” that can be dangerous if you’re early, but presents a credible opportunity because Synopsys’s fundamentals remain solid, valuation is more attractive, and market positioning (options interest near $600) favors a potential recovery window through January 2026. Use tight risk controls (stop under April lows) and consider defined-risk option plays if you prefer limited downside.

Wyckoff Stage #4 Markdown?- NASDAQ:SNPS crashed on September 10, 2025 but I'm not interested in buying it yet.

- Fundamentally it had a premium valuation which has gotten little compressed but I think it deserves to be punished more.

- Monthly chart looks ugly and NASDAQ:SNPS is likely in a Wyckoff Stage #4

- Fundamentally,

year | 2025 | 2026 | 2027 | 2028

EPS | 13.72 | 15.35 | 18.27 | 22.76

EPS% | 4.54% | 11.92% | 19.00% | 24.59%

EPS is fluctuating from 4% to 24% in 2028. Considering average eps % to be 15%. Fair forward p/e would be 15 but I am willing to pay 20 forward p/e as the base case.

Fair value:

year | 2025 | 2026 | 2027 | 2028

EPS | 13.72 | 15.35 | 18.27 | 22.76

Price | $274 | $307 | $365 | $455

Bull Case ( forward p/e of 30 )

year | 2025 | 2026 | 2027 | 2028

EPS | 13.72 | 15.35 | 18.27 | 22.76

Price | $411 | $460 | $548 | $682

Bear Case ( forward p/e of 15 )

year | 2025 | 2026 | 2027 | 2028

EPS | 13.72 | 15.35 | 18.27 | 22.76

Price | $205 | $230 | $274 | $341

Synopsys (SNPS): Ready to Rally Again After a Brief Pause

Strong Climb, Then a "Breather" : SNPS has been going up very strongly since April. The Pattern clearly displays bull flag continuation patterns, with price consolidating in downward-sloping channels before breaking out to the upside.

Current Pause Ending: After its big jump in July, the stock entered another one of these "pauses," moving gently downwards in a channel. It stayed above a key support area, which is a good sign. Now, it looks like it's breaking out of this pause, suggesting the climb is about to resume.

Next Stop 650: If the stock continues its upward momentum, my next target for the price is 650.

Risk Management: To limit potential losses, I would exit the trade if the price falls below 577. This level acts as safety net.

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

Inverse Head and Shoulders Already Completed Toward a New ATHThe price has completed the formation of an inverse head and shoulders pattern, with the final breakout occurring last week.

Volume confirms the validity of the pattern.

The distance from the head to the neckline projects a target toward a new all-time high (ATH).

As often happens after a breakout, a retest of the neckline may occur, which could present a good entry or accumulation opportunity

SNPS – Dangerous Correction Wave Nearing Completion?The wave structure marked in red often indicates a corrective move. While it appears impulsive at first glance, such formations typically end with a strong candle in the direction of the trend, followed by a full retracement.

This rally is likely not a new bullish impulse but a complex correction within a broader downtrend. Volume remains relatively muted compared to previous sell-offs, reinforcing the corrective nature of the current wave.

Due to the structure's unreliability and tendency to reverse sharply, this is a highly dangerous zone to enter a long. However, for experienced traders, a minimal long position with a trailing stop may be considered for a final push toward the resistance zone around $590.

A failure to break that zone with volume will likely lead to a rapid decline back to previous lows around $400 or even $360.

SNPS Trading Plan: Anticipating a Break Above SMA 150 at 535.73NASDAQ:SNPS

Currently, the price of SNPS is 520.70, which is slightly below the 150 SMA (527.81). The suggested entry point is 535.73, positioned above the SMA 150 to confirm a potential upward trend.

Entry Strategy:

Wait for the price to break above 535.73 to signal confirmation of strength and momentum.

Verify that the SMA 150 remains in an upward trend or shows signs of reversing upward.

Stop Loss:

Set the stop loss at 519.9, just below the SMA 150, to protect against significant downside.

Target:

Identify potential resistance levels above 535.73 to define profit-taking zones.

Alerts:

Place an alert on TradingView at 535.73 to get notified when the price breaks the entry point.

Note:

This plan also aims to identify a potential upward reversal in the trend of the SMA 150, ensuring the stock aligns with a strong bullish movement.

Stock Of The Day / 05.12.2024 / SNPS12.05.2024 / NASDAQ:SNPS

Fundamentals. Negative catalyst after earnings report and weak 2025 forecast.

Technical analysis.

Daily chart: nearest potential support level is 515.00 formed by the nearest break in the trend.

Premarket: Gap Down on moderate volume.

Trading session: The price forms a pronounced tightening to the level 532.00 against the initial downward movement, after a non-pullback decline from the opening of the session. We are considering a short deal in continuation of the initial movement.

Trading scenario: pullback along the trend (false tighten) to the level 532.00

Entry: 529.30 breakdown of the trend line of the tightening structure.

Stop: 532.27 above the held level 532.00

Exit: Close part of the position on 520.56 after an unsuccessful attempt to update lower low. Close the rest when exiting upward from the consolidation.

Risk Reward: 1/3

SNPS Breakout Potential to the UpsideNASDAQ:SNPS has been range-bound since 2023 and is finally showing technical patterns that reveal Dark Pool hidden accumulation, pro trader nudges, and the potential for HFTs to gap and run the stock upward.

This stock is setting up to challenge the all-time high. Often in the current Moderately Up-trending Market Condition, HFTs will gap the stock over the resistance level.

So keep the stock on a watchlist to look for pro trader nudges or resting-day candles that indicate the pros are attempting to trigger HFTs to gap the stock up. IF the HFTs gap the stock, then pro traders will take profits immediately, selling into the foray of retail traders chasing the gap. The goal is to enter before a potential gap. The stock may not gap. However, the pattern is indicative of more HFT activity.

Synopsys Inc. Growth Expectations Ahead of the Quarterly ResultKey arguments in support of the idea.

▪ Expectation of a robust quarterly report.

▪ Attractive entry price and favorable valuation levels based on key multiples.

Investment Thesis

Synopsys, Inc. (SNPS) is the largest computer-aided design (CAD) company in the electronics design industry. Its flagship product, Design Compiler, is a widely recognized logic circuit synthesis tool. The Company offers a comprehensive range of additional products for the design of specialized integrated circuits, including solutions for logic synthesis, behavioral synthesis, element tracing, static timing analysis, formal verification, hardware description language (HDL) simulation (SystemC, SystemVerilog/Verilog, VHDL), and circuit simulation. Synopsys primarily serves customers in the semiconductor and electronics industries. The Company operates through two key segments: Design Automation, which accounts for approximately 69% of total revenue through the first nine months of fiscal year 2024, and Design Intellectual Property (IP), contributing 31%. Founded in 1986, Synopsys is headquartered in Sunnyvale, California.

Expectation of a robust quarterly report. We anticipate that the Company will report results for the current quarter that surpass consensus expectations. Demand for electronic design automation (EDA) solutions remains consistently strong, bolstered by Synopsys’ successful performance in the July quarter and a positive investor outlook for the ongoing period. The Company has reaffirmed its revenue growth guidance of 15% for FY2024 and expects improvements in operating margins. The strategic importance of EDA investments in executing customers' technology plans makes this sector relatively resilient to cuts in capital expenditures. Additionally, the adoption of new AI-based tools, such as ASO.AI and VSO.AI, is gaining momentum and contributing positively to Synopsys’ growth. Furthermore, The Company announced the acquisition of Ansys earlier this year, with the deal expected to close in the first half of 2025. This strategic move will enable Synopsys to provide a comprehensive solution for systematic chip design and integrated chip analysis, expanding its product line and enhancing its competitive position. Consequently, we foresee additional near-term upside for SNPS stock.

Attractive entry price and favorable valuation levels based on key multiples. The stock is currently trading at a discount relative to key multiples when compared to one of its main competitors and the industry average. For instance, Synopsys has an EV/EBITDA ratio of 29.5x for the next 12 months, which is favorable compared to Cadence Design Systems (CDNS) at 34.5x and the peer average of 31.3x. Additionally, the Company’s next 12-month P/E ratio stands at 38.4x, significantly lower than Cadence’s 44.7x and the industry average of 46.7x. This pricing presents an attractive entry point for investors and indicates strong upside potential for the stock.

The target price for the shares is $605, the rating is Buy. We recommend setting a stop loss at $425.

Synopsys Inc. (SNPS) - Waiting for an Entry PointSynopsys Inc. (SNPS) - Waiting for an Entry Point NASDAQ:SNPS

The stock is approaching a potential entry point around $559.31, above the trendline it tends to respect. The entry will be executed with stop loss management in place. It's important to monitor the developments and stay updated accordingly.

Strong technical buy signal for Synopsys (SNPS)Technical Analysis of Synopsys Inc. (ticker on Nasdaq: SNPS):

Synopsys (SNPS) shows strong development within both a long-term and short-term rising trend.

A new strong technical buy signal has now been triggered for Synopsys after breaking through a very important technical resistance level around USD 600.00.

There should now be significant technical support for the stock around the USD 600.00 level.

There has been a 'classic' test of the support level here now around USD 600.00, and now the share seems ready for further growth within both the short-term and long-term rising trend.

There is little technical resistance for further upside before around the USD 750.00 level, and up towards the upper trend line of the uptrend.

Based on the technical picture for the share, the potential is assessed to be around USD 750.00 in 1-3 months' time.

What could potentially change the currently very positive technical picture for the Synopsys share would be if the share were to have an established break below USD 590.00.

SNPS Cup N Handle Retracement TestHello everybody thank you for watching my video on this cup and handle setup the price had broken out over the resistance line on the 17th of June and started to retrace all the way up until today so we should see some respect of the support line for a possible entry. if that does not hold tomorrow and it goes lower I will cancel the trade idea and look elsewhere for opportunity.

Let me know if you need to know anything else!