Natural Gas Approaches Strong Psychological ZoneNatural Gas Approaches Strong Psychological Zone

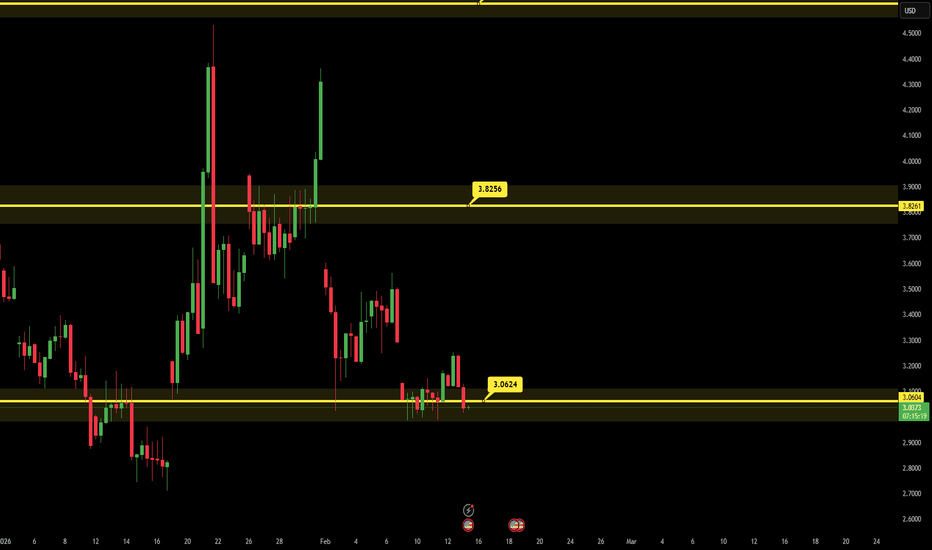

On the daily chart we can see that natural gas faced strong support near 2.73, where it was rejected several times over the past few years.

We can also observe a middle zone where the price reacted even closer to $3. There is a high possibility tha

About Natural Gas (Henry Hub)

Natural Gas (NGAS) is a fossil fuel formed from plants and animals buried underground and exposed to extreme heat and pressure. Natural gas is used domestically for cooking, as a power source, in agriculture, and in industrial manufacturing. Natural gas prices fluctuate constantly depending mainly on production issues, stockpiles, weather conditions, economic growth, crude oil prices, and more recently coal. Natural gas is commonly measured in MMBtu, with 1 MMBTu equaling 1 million BTU (British Thermal Units).

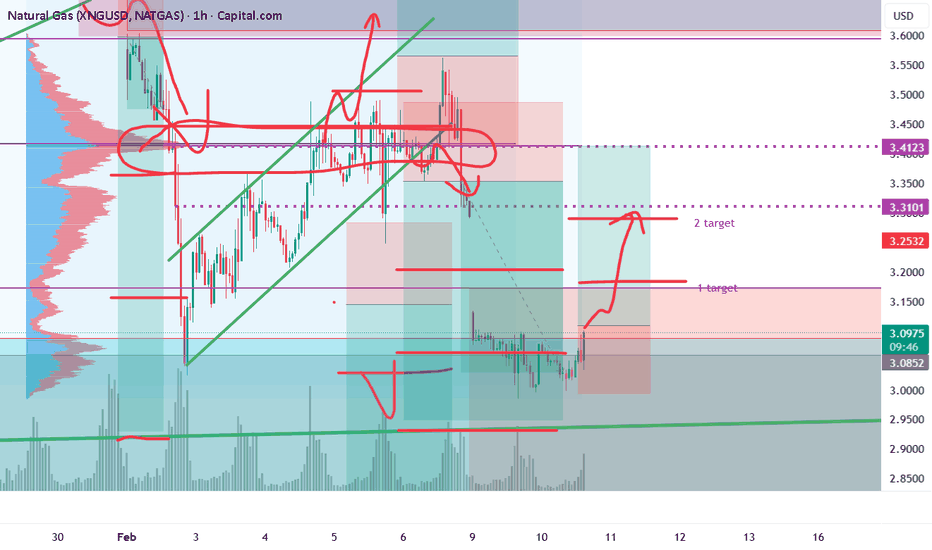

Natural Gas Holding On For Dear Life!Natural Gas is trying to defend the weekly high volume surge candle from the cold snap forecast.

This commodity looks very vulnerable if it gets another lower weekly candle close.

Right now the asset class is showing sell side pressure as we progress into building season.

I don't like the long

Bought Natural Gas futures $NG yesterday. Three reasons:Bought Natural Gas futures AMEX:NG yesterday in after-hours trading.

Three reasons: 👇

- A bear wedge is forming, and statistically these structures tend to break upward.

- Price is near the bottom of a broader range — and in ranges, the edge comes from buying low and selling high.

- Storage le

Why Natural Gas is a Coiled Spring

Accumulation zone within a narrow range after a 25% drop. In technical analysis, this often means that major players are "vacuuming up" the supply from panicked retail traders, forming a bottom.

Following a sharp decline in early February, a massive amount of short positions has accumulated in the

Fundamental Market Analysis for February 6, 2026 EURUSDEURUSD:

EUR/USD is hovering around 1.17900 on Friday, February 6, 2026, after the U.S. dollar strengthened notably. Investor caution has increased amid softer equities and higher uncertainty, which supports demand for the U.S. currency.

The Eurozone central bank kept rates unchanged and indicated

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.