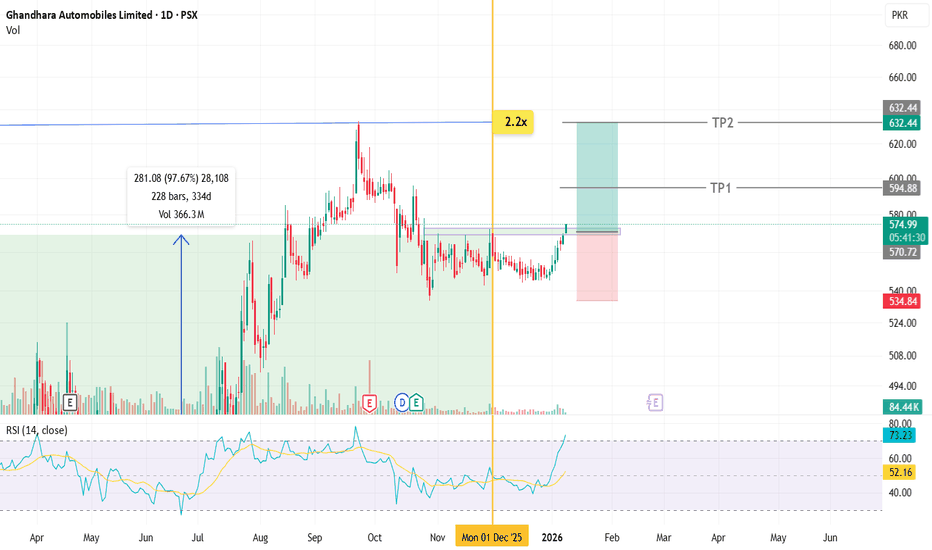

GAL – DTF Correction Completed? | Accumulation Above Key SupportHello Billioniares!!!

Ghandhara Automobiles Limited (PSX: GAL) is currently moving exactly according to the previous projections shared on GAL. After completing a classic Head & Shoulders distribution, price has entered a controlled corrective phase while respecting higher-timeframe structure.

🔍 Te

Ghandhara Automobiles Limited

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

90.64 PKR

4.10 B PKR

34.51 B PKR

15.76 M

About Ghandhara Automobiles Limited

Sector

CEO

Ahmad Kuli Khan Khattak

Website

Headquarters

Karachi

Founded

1981

IPO date

Sep 28, 1993

Identifiers

2

ISIN PK0059701018

Ghandhara Automobiles Ltd. operates as a holding company, which engages in the manufacture, import and sale of vehicles. It includes JAC trucks, Nissan, Dongfeng and Renault vehicles. The company was founded on August 8, 1981 and is headquartered in Karachi, Pakistan.

Related stocks

GAL on Triangular BreakoutGhandhara Automobiles Limited (GAL) is consolidating in a descending / symmetrical triangle near 530–535 after a correction. Bullish RSI divergence suggests selling pressure is easing. A break above 538 should open the door for a move higher, while strength above 562 may accelerate momentum.

Stop-lo

Rectangular Breakout GALGAL is forming a well-defined rectangle base in the 530–535 zone after a corrective phase. Bullish RSI divergence suggests seller exhaustion and a potential reversal. A breakout above the rectangle will be the first confirmation of strength; a sustained move above 562 should further accelerate upsid

GAL Technical Outlook📈 GAL (Ghandhara Automobiles Ltd) – Technical Observation | Bullish Structure

GAL is maintaining a higher highs and higher lows market structure, indicating a healthy uptrend. After a controlled pullback, price has reacted positively from the rising trendline support, suggesting buyers are still ac

GAL📈 BUY CALL – Ghandhara Automobiles (GAL)

Technical (Breakout Setup):

GAL has given a clean breakout above its key resistance, supported by rising volumes. Price is indicating strong bullish momentum and continuation potential.

Fundamental Strength (Model Factors):

GAL is among the strongest auto s

GAL – Trade Setup (4H)Entry:

Breakout confirmation above 560–565 zone

Targets

TP1: 571.98

TP2: 572.00

TP3: 632.56

Stop Loss

SL: 533.55

Technical Analysis:

1. Symmetrical triangle nearing breakout

2. Falling wedge already completed → bullish bias

3. RSI showing strength with bullish divergence

4. Volume expansion i

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of GAL is 528.21 PKR — it has increased by 2.11% in the past 24 hours. Watch Ghandhara Automobiles Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on PSX exchange Ghandhara Automobiles Limited stocks are traded under the ticker GAL.

GAL stock has risen by 0.19% compared to the previous week, the month change is a −4.33% fall, over the last year Ghandhara Automobiles Limited has showed a 11.93% increase.

We've gathered analysts' opinions on Ghandhara Automobiles Limited future price: according to them, GAL price has a max estimate of 780.00 PKR and a min estimate of 780.00 PKR. Watch GAL chart and read a more detailed Ghandhara Automobiles Limited stock forecast: see what analysts think of Ghandhara Automobiles Limited and suggest that you do with its stocks.

GAL stock is 2.49% volatile and has beta coefficient of 1.21. Track Ghandhara Automobiles Limited stock price on the chart and check out the list of the most volatile stocks — is Ghandhara Automobiles Limited there?

Today Ghandhara Automobiles Limited has the market capitalization of 29.59 B, it has decreased by −2.41% over the last week.

Yes, you can track Ghandhara Automobiles Limited financials in yearly and quarterly reports right on TradingView.

Ghandhara Automobiles Limited is going to release the next earnings report on Feb 25, 2026. Keep track of upcoming events with our Earnings Calendar.

GAL net income for the last quarter is 1.67 B PKR, while the quarter before that showed 1.82 B PKR of net income which accounts for −8.21% change. Track more Ghandhara Automobiles Limited financial stats to get the full picture.

Yes, GAL dividends are paid annually. The last dividend per share was 10.00 PKR. As of today, Dividend Yield (TTM)% is 1.93%. Tracking Ghandhara Automobiles Limited dividends might help you take more informed decisions.

Ghandhara Automobiles Limited dividend yield was 2.65% in 2025, and payout ratio reached 13.92%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 3, 2026, the company has 1.24 K employees. See our rating of the largest employees — is Ghandhara Automobiles Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Ghandhara Automobiles Limited EBITDA is 7.27 B PKR, and current EBITDA margin is 16.01%. See more stats in Ghandhara Automobiles Limited financial statements.

Like other stocks, GAL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Ghandhara Automobiles Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Ghandhara Automobiles Limited technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Ghandhara Automobiles Limited stock shows the buy signal. See more of Ghandhara Automobiles Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.