Powerful Gold Strategy for 2026 - Scalping , Day, Swing TradingHey what’s up traders,

Before we go full focused on trading In 2025. I want to share a simple but effective way to analyze and trade Gold (and honestly, it works on almost anything). The reason is simple: it’s built around liquidity sweeps and the “fake breakout” behavior that keeps showing up in

About CFDs on Gold (US$ / OZ)

Gold price is widely followed in financial markets around the world. Gold was the basis of economic capitalism for hundreds of years until the repeal of the Gold standard, which led to the expansion of a fiat currency system in which paper money doesn't have an implied backing with any physical form of monetization. AU is the code for Gold on the Periodic table of elements, and the price above is Gold quoted in US Dollars, which is the common yardstick for measuring the value of Gold across the world.

XAUUSDHello Traders! 👋

What are your thoughts on GOLD?

After a strong bullish rally, Gold has entered a range-bound consolidation phase between clearly defined support and resistance zones.

At the moment, price is trading within the range, and positions taken in the middle of the range carry elevated r

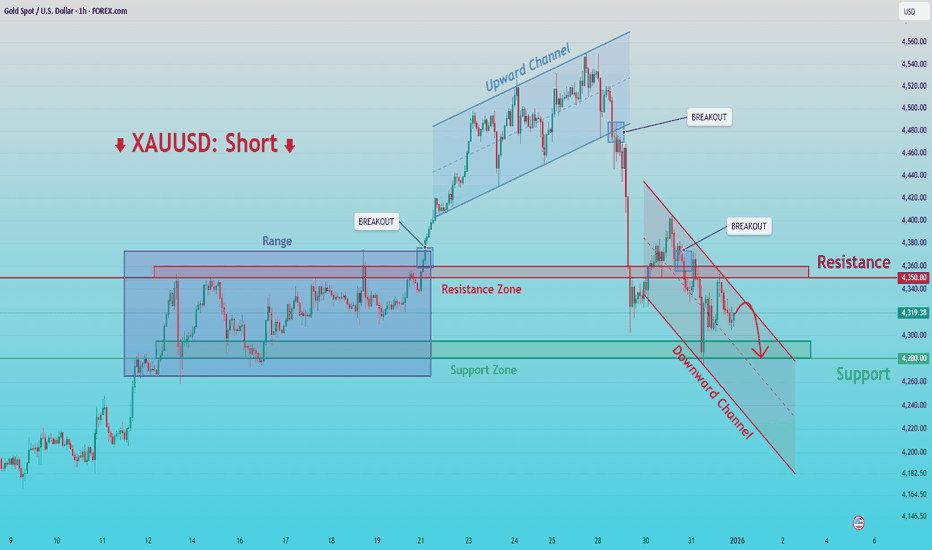

XAUUSD: Rejection at 4,350 Resistance Signals Further DownsideHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD previously traded within a well-defined upward channel, confirming a strong bullish structure during that phase. Price then broke down from the channel, signaling a loss of bullish momentum and a shift in mar

XAUUSDHello Traders! 👋

What are your thoughts on Gold?

Gold entered a corrective phase after reaching the upper boundary of the ascending channel. This correction extended toward the lower boundary of the channel and the marked support zone, where price showed a strong bullish reaction. The subsequent r

XAU/USD | Gold Sharp Sell-Off After ATH, Liquidity Void in Play!By analyzing the #Gold chart on the 4H timeframe, we can see that after our last analysis, price rallied to $4550 and delivered over 700 more pips of profit. After that strong move, gold entered a very aggressive correction. In less than 16 hours, price dropped from $4550 to $4300, which means a $25

GOLD Weekly Levels: Buy/Hold 4270/4300 Target 4500/4633 🔱 GOLD WEEKLY SNAPSHOT — EXECUTIVE SUMMARY

✨ Gold in wave-4 accumulation after extended impulse

🟡 Primary impulse complete: 3910 → 4500 (H2/H4)

🔄 Current pullback: 4500 → 4268 = corrective, not reversal

🧱 Accumulation zone: 4300–4268 (buy dips only)

📈 Trend remains bullish while above 4210

🚀 Wave-

XAUUSD Buyers Step In at Key Level - Momentum StabilizesHello traders! Here’s my technical outlook on XAUUSD (1H) based on the current chart structure. Gold is trading within a broader bullish structure after a strong impulsive rally from lower levels. Earlier, price moved inside a consolidation range, signaling accumulation before breaking out to the up

Lingrid | GOLD Swap Zone Bounce Signals Trend ContinuationOANDA:XAUUSD reacted strongly after pulling back from the 2025 high, finding demand inside the 4,270–4,280 swap zone, where prior structure and the rising trendline converge. The rebound from this area suggests selling pressure may be losing control rather than accelerating into a trend reversal.

XAUUSD 30M – Support Hold & Trendline Break SetupPrice is reacting from a strong support zone around 4,300–4,320 after forming a descending trendline, suggesting a potential short-term reversal.

A break above trendline and resistance at 4,345–4,360 may confirm bullish momentum toward first TP at 4,390–4,400.

Further continuation above 4,405 opens

XAUUSD 30M – Support Hold & Bullish Recovery SetupPrice is reacting from a well-defined support zone around 4,310–4,330, showing signs of a short-term bullish recovery

A break and close above 4,360–4,380 can confirm upside momentum toward the first TP near 4,395–4,400

Sustained strength above 4,415 opens the path toward the main target at 4,450–4,4

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.