Gold Price Movement Analysis (XAU/USD)Based on the technical analysis of the XAU/USD (Gold Spot per US Dollar) chart image you provided, here are the key points and probable next movements for the gold price:

1. Trend Analysis

Long-Term Trend: The chart clearly shows a very strong uptrend (bullish) since early 2024 up to the present. The price is currently at a new high within this charted period.

Short-Term Trend: After consolidating around the $3,200−$3,525 area for several months, the price recently broke its previous high and is moving sharply higher toward ∼$3,800.

2. Fibonacci Retracement Analysis

The Fibonacci Retracement is drawn from the low (around $2,538) to the current high (around $3,815). Since the price is now above the 0 Fibonacci level ($3,815), it indicates that the upward trend remains dominant.

Potential Support Levels (If a correction occurs):

23.6%: ∼$3,525 (This was a previous resistance area that now acts as critical support).

38.2%: ∼$3,345

50.0%: ∼$3,200 (A strong psychological and historical support level).

3. RSI (Relative Strength Index) Analysis

The RSI is currently at 77.80, which is significantly above the 70 level. This places the asset firmly in the overbought zone.

An overbought condition increases the probability of a price correction (pullback) occurring in the near term, even if the primary trend remains bullish.

The chart shows previous instances of Bearish Divergence (indicated by the "Bear" labels), where price made higher highs but RSI made lower highs. Keep an eye out for a similar pattern forming now as the RSI is near its peak.

Gold Price Movement Prediction

Combining the analysis above, there are two main scenarios likely to occur:

Scenario 1: Continuation of the Uptrend (Strong Momentum)

Direction: The price will continue its ascent, leveraging the strong bullish momentum.

Potential Targets: Since the price is in All-Time or Multi-Year Highs territory, the next targets would be determined by Fibonacci Extension or major psychological levels (e.g., $4,000).

Trigger: Extremely positive fundamental news for gold (such as escalating geopolitical uncertainty or significant US Dollar weakness).

Scenario 2: Price Correction (High Probability)

Direction: The price will experience a downward correction after reaching the highly overbought condition (RSI>70).

Correction Targets: The price is likely to seek support at the mentioned Fibonacci levels:

Target 1: ∼$3,525 (The 23.6% Fibonacci level).

Target 2: ∼$3,345 (The 38.2% Fibonacci level).

Trigger: Profit-taking by traders, or a confirmed Bearish Divergence signal.

Conclusion

Currently, the gold price is showing explosive upward momentum, but the RSI indicator is signaling a very high potential for an overbought condition.

A cautious approach would be to:

Be wary of a potential short-term correction. The key support area to watch is ∼$3,525.

If the price manages to break new psychological highs (e.g., ∼$3,900) without a deep correction, the upward momentum could continue.

Disclaimer: This analysis is based purely on the technical data visible on the chart. Trading decisions should always consider fundamental analysis and personal risk management.

GOLDCFD trade ideas

XAUUSD on swing upside XAUUSD is still intact on bullish trend towards 3930!!

In our previous commantary we are expecting 3830 with the next session.

My stance on XAUUSD?

I'm expecting bit retracement for again pump.

-First point of buying will be 3785-3795 area , just H4 candle should closes above it , my target will be 3830 then 3845. Although i took buy at 3800 and holding.

- Secondly if H4 candle closes below 3780 then our buying will be compromised.

Additional TIP: Buy the dips

XAUUSD: Trend in 30-Min timeframeThe color levels are very accurate levels of support and resistance in different time frames, and we have to wait for their reaction in these areas.

So, Please pay special attention to the very accurate trend, colored levels, channels, and you must know that SETUP is very sensitive.

Be careful

BEST

MT

Gold Spot XAU - Intraday Technical Analysis - 29 Sept.OANDA:XAUUSD

Gold is consolidating near 3,759.85 after a pullback from recent highs, testing the zero line and critical inflection bands in a triangle breakout structure.

Bullish (Long) Setup

Long Entry (3,765):

Initiate longs above 3,765, as this level marks a breakout above resistance after reclaiming short-term momentum from the descending channel and zero line, suggesting buyers are in control.

Additional positions can be considered at 3,759 if dips are supported, anchoring to higher low formations.

Upside Targets:

3,790 (Target 1): Mapped local resistance, ideal for partial profit on momentum continuation.

3,809 (Target 2): The next target and upper channel extension.

Stop Loss:

Use below 3,753 to reduce downside risk if the breakout is rejected.

Bearish (Short) Setup

Short Entry (3,753):

Shorts can be initiated below 3,753, confirming a breakdown of support and invalidating the trend reversal setup.

Downside Targets:

3,729 (Target 1): Logical for profit booking if the downward move persists.

3,710 (Target 2): Further extension and mapped support.

Stop Loss:

Cover shorts above 3,765 on failed breakdown and reversal attempts.

Neutral/Range Logic

Zero Line (3,760):

Price oscillation here signals uncertainty; best to await a clear break above the long entry or below the short entry zone for directional trades.

Sustained action above 3,765 confirms bullish control, while below 3,753 supports a bearish view.

This structure supports risk-managed, disciplined trading of Gold Spot/USD for both breakout and reversal moves.

Follow Chart Pathik for More Day to Day Update on Gold Comex Spot Analysis.

Elliott Wave Analysis XAUUSD – 28/09/2025

________________________________________

🔹 Momentum

• D1: Momentum is still declining → next week we may continue to see sideways movement or further downside following D1 momentum.

• H4: Momentum is also decreasing → on Monday, we expect a continuation of the downtrend.

• H1: Momentum is oversold and preparing to rise → during the Asian session on Monday, a short-term upward move is likely.

________________________________________

🔹 Wave Structure

• D1 timeframe:

o Price is still within wave 5 (yellow).

o If D1 momentum enters the oversold zone and then turns upward, but price remains sideways without reaching 3632, then wave 5 (yellow) may still extend toward the second target at 3887.

• H4 timeframe:

o A corrective WXY structure is forming.

o With H4 momentum turning down, it is likely that wave Y is unfolding.

• H1 timeframe:

o A declining ABC (blue) structure appeared, followed by a rising ABC (blue) structure toward 3784.

o Within this, wave B formed a triangle abcde (red).

o This shows two ABC (blue) corrective structures developing within the adjustment, suggesting multiple possibilities for wave Y:

1️⃣ Flat 3-3-5: Wave Y may unfold as a 5-wave sharp decline, with an ideal target around 3713 → this is the expected Buy zone.

2️⃣ Triangle: Price may consolidate sideways above 3718 → patience is required to wait for the pattern to complete.

3️⃣ Large-scale Triangle: If the entire correction is a triangle, price will also sideway above 3718 → wait for completion before acting.

• Note: If price breaks above 3792, it may confirm that the corrective structure is complete → next upside target would be 3810.

________________________________________

🔹 Trade Plan

• Buy Zone: 3714 – 3711

• SL: 3703

• TP: 3733

________________________________________

👉 Conclusion:

The optimal approach is to wait for confirmation:

• Either the triangle structure completes,

• Or price declines into the 3713 – 3711 zone to set up a Buy entry.

Reaching the High Point. Price Retracement?After a period of consolidation this week, gold surged upwards, reaching a new all-time high near $3791. However, following the retracement on Wednesday, the upward momentum weakened. On Friday, during the US session, gold briefly touched $3783 before retracing, closing near $3759. It remains above the moving average, suggesting a potential second wave of upward movement.

Overall, the market sentiment remains bullish, and a series of bullish patterns suggest that gold may continue its upward trend next week. The Friday pullback could be seen as a consolidation by the bulls. The resistance level around $3770, where the previous high and low were formed, will be an important short-term resistance level.

If the Asian market opens at 3770 under downward pressure on Monday, it is very likely to break down again in the later period, and the low point of 3717 generated last week may also be broken.

The current unilateral trend is not clear. Try to short near 3770 when the Asian market opens next Monday. Focus on the profit range near 3730 and set a stop loss at 3780. If there is no sign of decline in the European session, adjust the strategy in time in the US session.

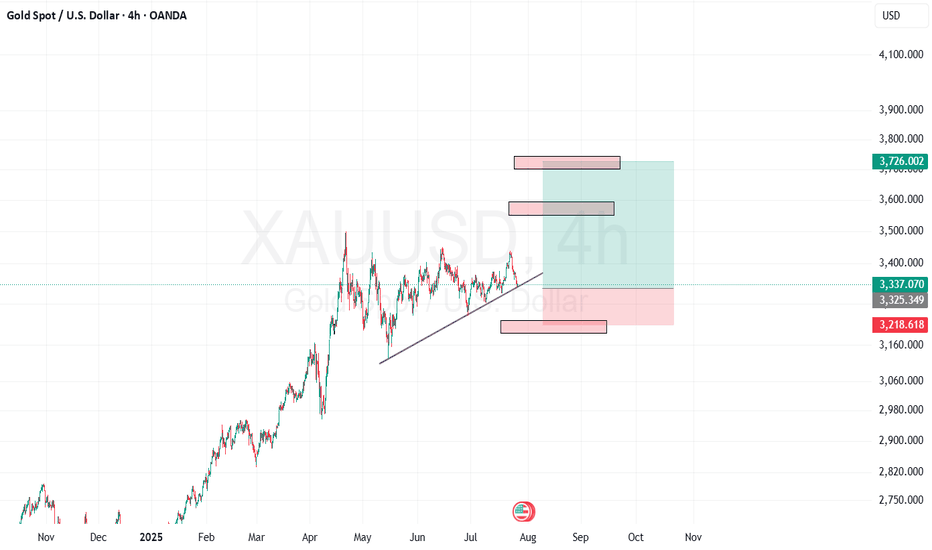

XAUUSD 4H🔹 Overall Outlook and Potential Price Movements

In the charts above, we have outlined the overall outlook and possible price movement paths.

As shown, each analysis highlights a key support or resistance zone near the current market price. The market’s reaction to these zones — whether a breakout or rejection — will likely determine the next direction of the price toward the specified levels.

⚠️ Important Note:

The purpose of these trading perspectives is to identify key upcoming price levels and assess potential market reactions. The provided analyses are not trading signals in any way.

✅ Recommendation for Use:

To make effective use of these analyses, it is advised to manually draw the marked zones on your chart. Then, on the 15-minute time frame, monitor the candlestick behavior and look for valid entry triggers before making any trading decisions.

XAUUSD Long Opportunity from SupportHello fellow traders,

This is a technical analysis of Gold Spot / U.S. Dollar (XAUUSD) on the 15-minute timeframe.

My analysis suggests a potential long opportunity. The price is currently testing a significant support level around the 3,750.00 area, which has previously acted as resistance and is now showing signs of holding as support.

My trade idea is as follows:

Entry: Around 3,760.58

Stop Loss: Below the support level, around 3,737.02, to protect against a breakdown.

Take Profit: Targeting the next resistance level, around 3,849.53.

This setup offers a risk/reward ratio that aligns with my trading strategy. As always, this is not financial advice but my personal view on the market. I welcome any constructive feedback or alternative perspectives in the comments. Please do your own research before making any trading decisions.

Happy trading

Gold Trade Set Up Sep 25 2025Last night we caught a buy from 15m demand securing 300 pips followed by a sell at 1m supply securing 100 pips then now another sell from 15m supply currently running 200 pips aiming for 350 pips at 15m demand

overall im bearish for now until it hits a 4h demand at 3658-3644 to continue its bullish move back to ATH

Volume Profile Signals Potential ReversaFenzoFx—Gold rose from $3,729.50 today, testing the resistance at $3,751.30. Interestingly, the cumulative volume profile did not form a new higher high, indicating bearish divergence.

The immediate support is at $3,747.00. From a technical perspective, XAU/USD could dip if the price crosses and stabilizes below the support. Traders should monitor the short-term resistance and the cumulative volume delta closely for bearish setups.

XAUUSDPrice action trading is a methodology where traders make decisions based on the interpretation of actual price movements on a chart, rather than relying primarily on lagging indicators. It involves observing and analyzing candlestick patterns, trend lines, support and resistance levels, and volume to identify potential trading opportunities and manage risk. The focus is on understanding the story the market is telling through its price behavior.

Elliott Wave Analysis XAUUSD – September 25, 2025

________________________________________

🔹 Momentum

• D1: Momentum on the daily chart has turned bearish, indicating that the main downtrend may continue.

• H4: Momentum on H4 is about to turn bullish, suggesting a possible upward move today. However, if this bullish reversal fails to break the previous high, the downtrend will remain intact.

• H1: Momentum on H1 is declining and about to enter the oversold zone. This downward move may need around 2 more H1 candles before entering oversold territory and reversing.

________________________________________

🔹 Wave Structure

• D1:

o The first target of wave 5 (yellow) was reached at 3789.

o Price is currently reacting at this level. With D1 momentum turning bearish, there is a strong possibility that wave 5 (yellow) has already completed, meaning price could move towards 3632 and potentially break below it.

• H4: An ABC corrective structure (blue) has formed, opening three scenarios:

1. The correction is complete → price rallies strongly, breaking the previous high to continue the uptrend.

2. Price rallies but with overlap, forming a Flat 3-3-5 pattern → price may rise toward the previous high at 3793.

3. Price remains in a zigzag structure → another decline may occur to complete wave C.

👉 Given the bearish momentum on D1, I lean more towards scenario 2 and 3.

👉 Note: In scenarios (1) and (2), price must hold above 3729, then break 3752, which could lead to a minimum rally towards 3777.

• H1: Under scenario 3 (further decline to complete wave C):

o Price may break below 3718.

o Wave 5 (black) targets:

3713 (first target).

3698 (second target).

________________________________________

🔹 Trade Plan

• Buy Zone 1: 3729 – 3726

o SL: 3717

o TP: 3751

• Buy Zone 2: 3714 – 3711

o SL: 3703

o TP: 3751

________________________________________

⚠️ Important Note

The market is likely in a corrective wave at a higher structure.

• Characteristic: Price often shows overlapping moves.

• Therefore: Manage trades carefully, avoid over-risking, as reversals can happen at any time – this is typical of corrective waves.

XAUUSD 4HR TECHNICAL ANALYSIS

🟡 XAU/USD (Gold) 4H Technical Analysis

1. Overall Market Structure

• The Elliott Wave count suggests the market is in wave (4) corrective phase, with a potential start of Wave (5) impulse upward.

• Price is still within a larger ascending channel, meaning the broader trend remains bullish.

2. Key Levels

• Immediate Support:

• Around 3,735 (current price) – coincides with FVG/OB zone.

• 3,707 – near your stop loss and aligns with previous structure lows.

• 3,628 – strong demand zone (would invalidate the bullish setup if price breaks this level).

• Immediate Resistance:

• 3,745 – 3,751 (local high zone & OR level)

• 3,775 – 3,791 (previous swing high and potential Wave (5) target)

3. Wave Count & Projection

• If Wave (4) is complete at the OB/FVG zone, Wave (5) could target:

• Minimum: Equal length to Wave (1) projected from Wave (4) bottom → ~3,775

• Extended Target: 1.618 Fibonacci extension of Wave (1) → could push toward 3,790–3,800

4. Trade Setup Evaluation

• Risk/Reward Ratio:

• Entry ~3,735, Stop ~3,707 → Risk ≈ $28

• Target ~3,775+ → Reward ≈ $40+

• Risk-to-Reward Ratio ≈ 1.4:1 (decent but could be improved with a higher target at 3,790).

• Bullish Case:

• Price holds above 3,735 (OB/FVG zone) and starts forming higher lows → good confirmation for Wave (5) rally.

• Bearish Risk:

• Break below 3,707 would likely mean Wave (4) is extending deeper, potentially retesting 3,675 or even the strong demand zone at 3,628.

5. Confluence & Momentum

• Confluence:

• OB + FVG zone at current price = strong support

• Channel lower bound nearby = good risk-defined long setup

• Momentum:

• Watch for bullish divergence or strong reversal candles (hammer, engulfing) on 4H/1H timeframe to confirm entry.

📌 Summary

• Bias: Bullish as long as price holds above 3,707

• Wave (5) Target: 3,775 – 3,790

• Invalidation: Break below 3,707 → next major support 3,675 / 3,628

• Trade Setup: Attractive risk/reward if entered near OB/FVG with target above 3,775

GOLD Free Signal! Sell!

Hello,Traders!

GOLD is trading in a strong uptrend. And it is oversold now, so as the price has formed a double top pattern, we will be expecting a bearish correction. The confirmation for the entry will be the breakout of the neckline.

------------------

Stop Loss: 3,791$

Take Profit: 3,710$

Entry: 3,754$

Time Frame: 3H

------------------

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Analysis of gold price intraday trend!Market News:

In early Asian trading on Tuesday (September 30), spot gold continued its upward push, reaching a new high above $3,840, currently trading at $3,840 per ounce. As investors bet on a US interest rate cut, worried about an impending federal government shutdown, and escalating geopolitical tensions, spot gold prices surged nearly 2%, pushing the London gold price above $3,800 per ounce and reaching a new all-time high. The strongest recent driver of the international gold market has been the continued buildup of expectations for a Federal Reserve rate cut. The political deadlock in Washington has become another key factor driving gold's breakout. Recent developments in the Russia-Ukraine conflict have fueled the gold rally. Meanwhile, the US dollar index fell 0.24% to 97.92 on Monday, providing additional support for dollar-denominated gold. If the shutdown crisis is resolved and economic data remains strong, gold prices may face a short-term correction; however, if uncertainty persists or geopolitical conflicts escalate, the gold bull market still has significant room to run. Investors should closely monitor key events this week and rationally seize this golden opportunity to avoid missing out amidst market volatility.

Technical Analysis:

Gold trends are king, and results speak for themselves. Gold's medium- to long-term trend remains strong, and don't speculate on the top. With this momentum this year, if the monthly chart continues with four consecutive positive days, a potential high of $4,000 or even higher is possible! Gold is maintaining a buying trend, breaking through the 3,800 mark yesterday, reaching a new all-time high of 3,834. The daily chart closed strongly positive, with the RSI at a high of 80. The price is moving upwards along the 5-day moving average. The hourly and 4-hour Bollinger Bands are opening upwards, with the price moving along the upper middle Bollinger Band, and the moving average system maintains a golden cross with an upward opening. Note today's monthly close, and the long-term RSI indicator entering the overbought zone again, cautioning against the risk of a pullback after a surge. At least there won't be a significant pullback around the National Day holiday. Too many people are waiting for a pullback to buy, and some are constantly testing the bottom. Therefore, during this rally, some are either hesitant to buy at higher levels or repeatedly sell after testing the bottom. This leaves only a small number of investors holding onto bullish views, leading to the price continuing to rise and break through higher highs. Today's trading strategy is to primarily buy low on pullbacks, and sell high at key resistance levels combined with historical highs.

Trading Strategy:

Short-term gold buy at 3822-3825, stop loss at 3814, target at 3850-3880;

Short-term gold sell at 3870-3873, stop loss at 3882, target at 3840-3820;

Key Points:

First Support Level: 3825, Second Support Level: 3812, Third Support Level: 3805

First Resistance Level: 3857, Second Resistance Level: 3870, Third Resistance Level: 3889

1 October 2025 Trading Game of the Day Trading Plan :-

1-reversal pattern with a bearish market structure

2-Main BIAS as Bullish

3-market structure in reversal pattern is complex and difficult to trade due to simple cause which is against the trend.

LOOk for MS and trend the pullback of the trend in reversal pattern

Thank you