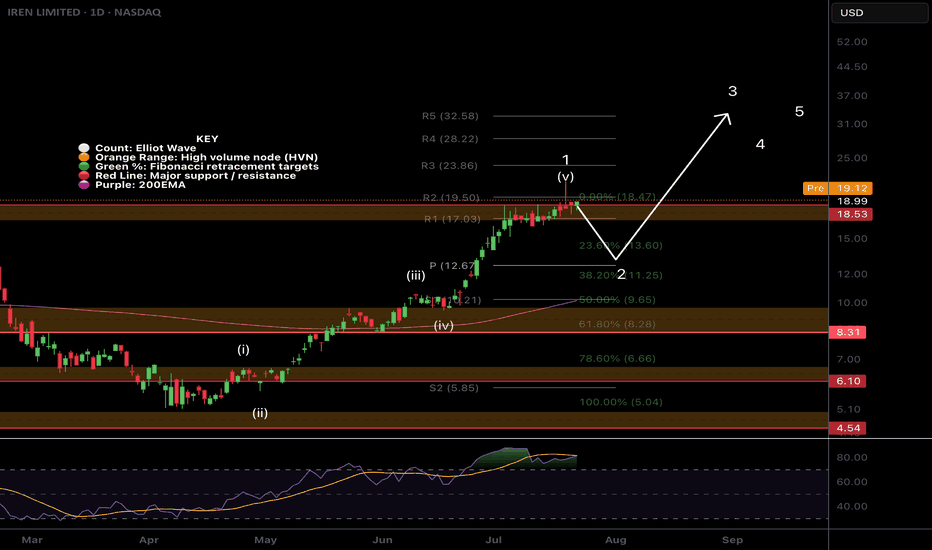

IREN / 4hAs illustrated in the NASDAQ:IREN 4H chart above, Minor Wave 5 may be unfolding as a potential ending diagonal , targeting the Fibonacci level where it would match Minor Wave 1 in length. This projected advance would complete Intermediate Wave (5) within a broader leading diagonal — a potentially bullish structure forming Primary Wave ① (not shown in this frame).

🎯 Fib Target >> 27.74

NASDAQ:IREN CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #IREN #BTCMining #Bitcoin #BitcoinMining #BTC

F8P trade ideas

$IREN / 4hAs illustrated in the NASDAQ:IREN 4H chart below, Minor Wave 5 is extending toward the Fibonacci extension targets, completing Intermediate Wave (5) within a leading diagonal — a potential bullish structure forming Primary Wave ① (not shown in this frame).

🎯 Fib Extension Targets >> 22.69, 25.84

#CryptoStocks #IREN #BTCMining #Bitcoin #BitcoinMining #BTC #AI

NASDAQ:IREN NYSE:AI CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

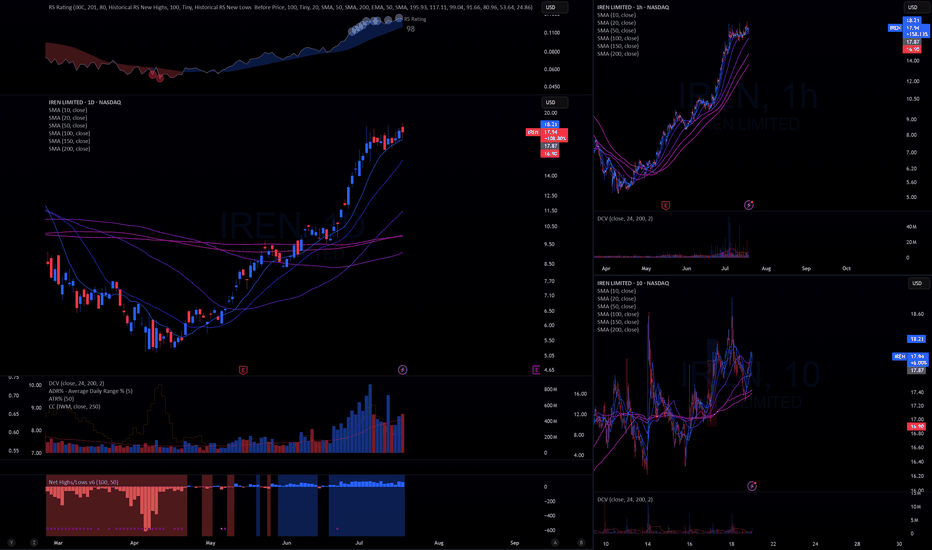

Iren remains bullishIren is one of my recent adds. I recently added on my target but did not get enough and have been averaging in. The yellow line is the IPO's all-time high. Proving once again that IPOs on launch are usually not a great idea and come with immense risk. Since we are once again on the weekly chart, this is a longer-term setup. Both momentum and volatility have plenty of room to run. Do remember, if you are just buying shares, you don't need to worry WAY too much about the perfect entry. There is technically no resistance here on the chart.

Iren has ridden the 5 EMA on the weekly since the start of this run. They were around 4x sales before the recent bitcoin price movement. I believe this is another misunderstood company. Unlike the typical miner, they sell Bitcoin daily to sustain and grow operations. Their next big plan is to expand AI and cloud infrastructure. If you build it they will come. They already have several thousand NVDA Blackwell GPUs; let's see who is behind their first contract.

IREN Limited (IREN) Grows With Renewable Bitcoin MiningIREN Limited (IREN) is a global Bitcoin mining and data center operator integrating renewable energy into its operations. By leveraging low-cost, clean power sources, IREN reduces operating costs and supports ESG-focused growth. The company’s expansion is fueled by increasing Bitcoin adoption, demand for high-performance computing, and strategic renewable energy partnerships that provide long-term operational advantages.

On the chart, a confirmation bar with rising volume shows strong buying momentum. The price has entered the momentum zone by moving above the .236 Fibonacci level. A trailing stop can be set just below this level using the Fibonacci snap tool, helping protect gains while leaving room for further upside.

$IREN wave B complete?After its mammoth rally NASDAQ:IREN appears to have completed a wave 1 of 3 with wave 2 underway. The recent push up into the previous all time high resistance appears to be wave b of c in a corrective wave 2.

My initial target for wave 2 is the ascending daily 200EMA and .5 Fibonacci retracement at $10.44. This is also just above the weekly pivot and major High Volume Node support which remains untested.

Weekly RSI has reached oversold, not significantly, but price did have decent retracement the last few times it was reached.

Bitcoin stocks have all had a decent retracement causing me to upgrade my Elliot Wave count to a completed macro wave 1 with wave 2 now underway, suggesting the best returns are still to come over the next months for this category asset class in wave 3!

Analysis is invalidated if we go to new highs above $21.7 or lose $5.08

New long signals are certainly building in the DEMA PBR and Price Action strategies so keep an eye out on the Trade Signals Substack as we have made very food profits lately in these markets!

Safe trading

Strong Fundamentals, Stretched ValuationThe Bull Case - Operational Excellence:

IREN delivered another impressive month with record monthly revenue of $86m, record 728 BTC (#1 among Bitcoin miners and surpassed Mara, Cleanspark, Cango, Riot, and BitFuFu) and record hardware profits of $66m in July IREN July 2025 Monthly Update. The company's operational metrics are genuinely strong:

Mining Efficiency: 45.4 EH/s average operating hashrate with best-in-class efficiency (15 J/TH) and healthy 76% hardware profit margin

AI Pivot Execution: Successfully expanding beyond Bitcoin with 2.4k NVIDIA B200/B300 GPUs and 98% hardware profit margin on AI services

Infrastructure Scale: Massive pipeline with 1,400MW Sweetwater 1 and additional 600MW Sweetwater 2 projects

The Valuation Concern:

However, the market appears to have gotten ahead of itself. IREN is trading at $18.32 with a 52-week range of $5.13 to $21.54, representing a ~257% gain from its lows. Current analyst consensus shows mixed signals - while 12 analysts give it a Buy rating with an $17.78 price target, this suggests minimal upside at current levels.

Key Risk Factors:

Bitcoin Dependency: Despite AI diversification, Bitcoin still drives 97% of revenue (~$83.6M vs $2.3M AI)

Execution Risk: Aggressive expansion timeline with April 2026 energization for Sweetwater 1 creates delivery pressure

Capital Intensity: Massive CapEx requirements for 2GW+ of planned capacity in a rising rate environment

IREN is operationally executing exceptionally well, but the stock price already reflects much of this success. The 320%+ rally from 2024 lows has created a situation where even strong execution may not drive meaningful returns from current levels. The company's transformation into a diversified digital infrastructure play is promising, but investors are paying a premium multiple for what remains largely a Bitcoin mining operation.

IREN Cup & Handle Breakout New Wedge Structure in PlayIREN confirms a classic Cup and Handle breakout above neckline, now transitioning into an ascending broadening wedge. Price is pulling back into the buy-back zone, offering a fresh opportunity to ride the next leg up.

Targets stretch from $40 to $63, as shown on the chart. RSI supports the move, and the overall structure remains bullish. Watch for reaction within the wedge for the next impulse.

📝 Share your thoughts

$IREN More downside after huge rally!NASDAQ:IREN is printing bearish divergence on the daily RSI at all tie high resistance.

An Elliot wave motif wave appears complete and wave looks underway with a shallow target of the daily pivot, 0.382 Fibonacci retracement and ascending daily 200EMA.

The daily red wick after printing a 20% start to the day is reminiscent of a blow off top in this asset trapping newbs with FOMO price discovery pump. Market behaviour in action!

Analysis is invalidated if price returns to all time high.

Safe trading

Market Update - 7/20/2025• Start of July was horrible, gave back all progress of the last 4-5 months, but then I made it back in the last week

• This was completely contrary to what the general indexes were doing so this made me realize that I should always prioritize my account feedback, rather than the general market for risk management decisions

• Crypto, quantum computing, aerospace & defense names are still leading

$IREN Killing It. More Upside?NASDAQ:IREN has poked above the true all time high range (Launch price dump excluded) in a high degree Elliot wave 3

Long term target remains the R5 weekly pivot at $40 but may over extend with a bullish Bitcoin and Macro economic tailwind, coupled with AI growth.

Many thought this was a greedy target at $5 but now that price is $16 it doesn't look so bad. You have to know when to let the runners run, that is were the big bucks are trading!

Any retracement of a decent degree should expect to find support at the weekly pivot $9.4 before continuing upwards and may present an excellent buying opportunity! I will be posting the signal levels on Substack.

As always ,all time high range will be the next support if price continues upwards from here.

Safe trading

$IREN Killing It. More Upside?NASDAQ:IREN has poked above the true all time high range (Launch price dump excluded) in a high degree Elliot wave 3

Long term target remains the R5 weekly pivot at $40 but may over extend with a bullish Bitcoin and Macro economic tailwind, coupled with AI growth.

Many thought this was a greedy target at $5 but now that price is $16 it doesn't look so bad. You have to know when to let the runners run, that is were the big bucks are trading!

Any retracement of a decent degree should expect to find support at the weekly pivot $9.4 before continuing upwards and may present an excellent buying opportunity! I will be posting the signal levels on Substack.

As always ,all time high range will be the next support if price continues upwards from here.

Safe trading

$IREN Long Setup – Ichimoku Cloud Breakout with MACD Momentum IREN is setting up for a strong long opportunity on the daily chart, showing clear bullish structure and momentum. Price has broken above the Ichimoku Cloud with confirmation from both Tenkan-sen and Kijun-sen alignment, and the future cloud remains bullish. This breakout has held for several weeks now, with consistent higher highs and higher lows forming since the April bottom. The MACD is also supporting the move, with both the MACD line and histogram in bullish territory and no immediate signs of bearish divergence. The setup presents a clean risk/reward profile: entry at $10.67, stop at $9.09 just below recent support and Tenkan-sen, and a target at $16.25, which aligns with the R2.5 pivot zone and historical resistance from mid-2023. That’s a risk/reward ratio of 3.53. Volume has been steadily building on up days, suggesting institutional accumulation. If price breaks and holds above the $11.25 pivot (R1), expect continuation toward the next resistance levels at $16.25 and potentially $19+. I’m viewing this as a 2–6 week swing trade based on the daily chart structure and overall trend.

$IREN Weekly Bb expansion + SMA bullish alignmentNASDAQ:IREN Weekly bollingers have only looked this sharply expansionary a couple times in history.

Weekly SMA total bullish alignment has likewise also happened a couple times in its history.

But this time the bullish cross confluence will happen from much higher levels with a much stronger fundamental position from an execution risk and near term catalyst standpoint.

IREN 09/06/2025Analysis HTF - Daily

execution LTF - 4H

Candle pattern - Bullish engulfing

Acceleration - Check

Volume - Check

Structure - lacking

Moving average - Check

Base rate - 70%(to hit stop loss)/30% To succeed

With the acceleration, volume pattern, and the break of the daily MA, I suggest a base rate of 60%/40%

IRENs Incredible Surge Continue next wWeek?NASDAQ:IREN has been on a rampage since the April surging 175% and nearing all time high! A great couple of trades for us so far!

Price is likely to hit all time high next week with such a strong trend, where resistance and a pullback is a high probability.

The weekly pivot is $9.77, the most likely area for price to find support just above the 0.382 Fibonacci retracement (which will be dragged up to the weekly pivot once a new high is made).

Price discovery terminal target are the R3 & R5 weekly pivot points at $28 and $40.

Safe trading

IREN has a couple resistances but will break through by the EOY

Support looks great and institutional buy will commence tomorrow pushing the stock higher. We will see higher prices as institutions look to sell at a higher price to retail in the future. Also AI is here to stay and they'll only make more money from GPU hosting and expansions.

Iren June PlayHad a good run up close to 10, healthy pullback especially given market conditions. Lots of instutional buyers bought at these prices and under. Classic structure shift into a sweep. Should be over 10 EOD Tuesday.

Extremely bullish crypto over a holiday weekend as well.

Not sure why bears so concerned about a 1-2% dilution. It's not all at once either.

A close below 8.7 would temporarily invalidate this entry.

Im 5k deep in calls since $6.8

Up quite a bit and rolled over to some deeper OTM contracts.

See you all at 15.

$IREN has the lowest all-in cost of mining a single coinNASDAQ:IREN is mining a single bitcoin at $40,000 all-in costs. When bitcoin appreciates to $150-200k, the miners with their rigs, land, infrastructure, balance sheet, hardware etc will be repriced higher. Thats the gain I would like to capture with this entry here at $9 a share.

This phenomenon will be seen throughout the entire sector, all miners will appreciate from here.