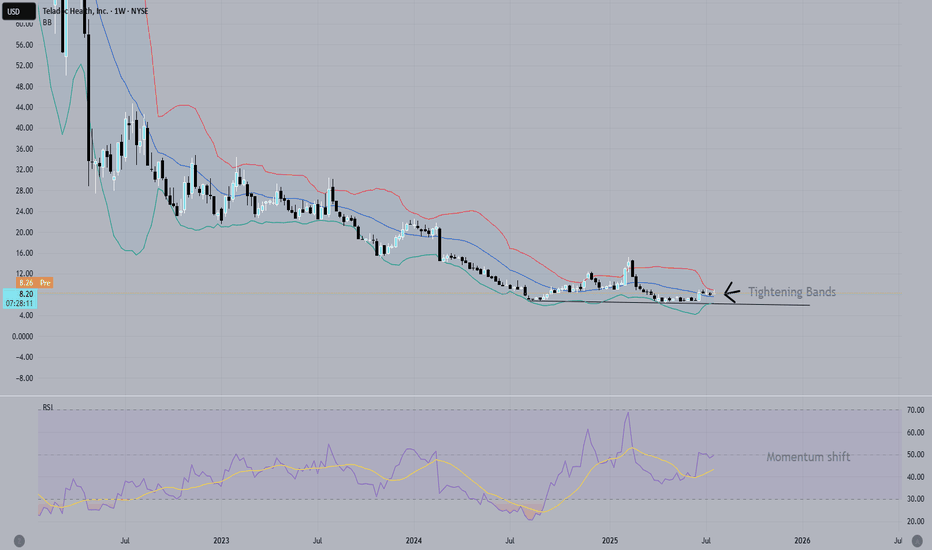

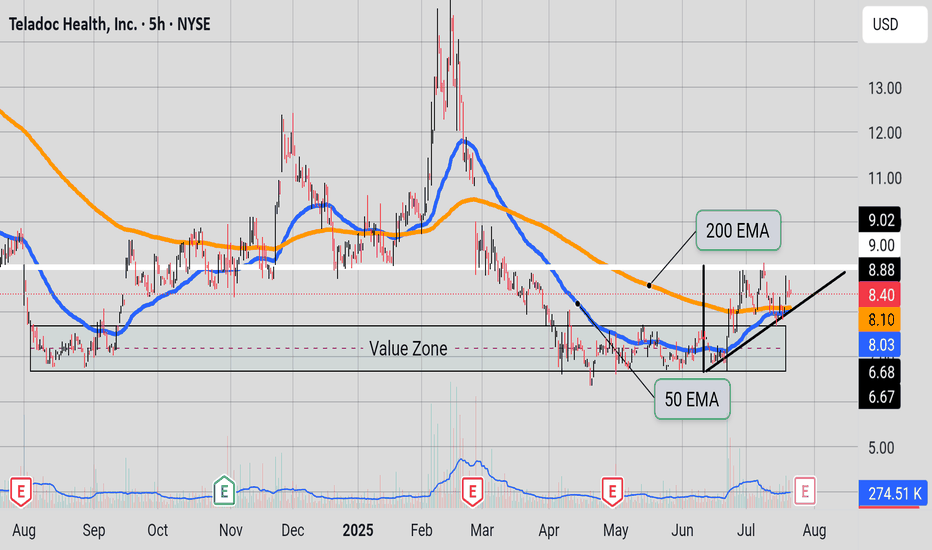

$TDOC - Improving Margins and Technical OutlookOnce again, NYSE:TDOC has been previously analyzed and shows improving financial profit margins, with the potential to reach breakeven. From a technical perspective, if my fundamental analysis is correct, $8.90 appears to be a temporary resistance level. The target is indicated in the chart above.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−1.28 USD

−1.00 B USD

2.57 B USD

175.52 M

About Teladoc Health, Inc.

Sector

Industry

CEO

Charles Divita

Website

Headquarters

New York

Founded

2002

ISIN

US87918A1051

FIGI

BBG00JVRM9W5

Teladoc Health, Inc. engages in the provision of telehealthcare services using a technology platform via mobile devices, the Internet, video and phone. It operates through the following segments: Teladoc Health Integrated Care, BetterHelp, and Others. The Teladoc Health Integrated Care segment offers virtual medical services. The BetterHelp segment includes virtual mental health and other wellness services. The company was founded in June 2002 by George Byron Brooks, Michael Gorton, and Gary Wald and is headquartered in New York, NY.

Related stocks

$TDOC: Above the 100MA with Resistance AheadTDOC (Teladoc Health) demonstrates improving financial efficiency and maintains consistent revenue performance, with a current valuation around $1.46 billion. Assuming this trend persists, and considering the 100-MA average as a technical reference point, there is potential for upward movement in th

$TDOC Breakout Play- NYSE:TDOC is in process of breaking out of multi-year downward trendline.

- There are so many tailwinds which should propel the stock higher including AI in healthcare.

- Aging population in US would need access to doctors and there are shortages of doctor. Telemedicine would be faster, easier

Teladoc Mid-Long term ideaTeladoc Health is a company specializing in telemedicine and virtual healthcare.

The company gained wide popularity during the covid-19 pandemic.

The company has historically expanded its operations through M&A:

In 2013 and 2014, the acquisition of Consult A Doctor, AmeriDoc allowed Teladoc to becom

Buy z dips doctorTeladoc (TDOC) looks like a classic turnaround setup — high risk, but with meaningful upside if execution plays out. The stock is trading around $8 after a brutal drawdown, pricing in a lot of pessimism. But under new leadership, Teladoc is aggressively cutting costs, improving free cash flow, and r

TrianglesThe asset is forming an asymmetrical triangle. The resistance is at $9. The support is at the 50 EMA and the 200 EMA. And the moving averages might make a golden cross. Bulls need the price to break the $9 resistance while a golden cross happens. Bears wouldn't mind price to go back to the value zon

Value Zone and DreamsPrice maybe ready to break free from the value zone; If this week close out with these readings intact. Significant increase in volume; RSI is close to 50; SAR just flash bullish, MACD sloping upward, and just flashed green. To be safe one may go to a lower time(TF) frame like the 4 hour TF and look

Teladoc Stock Chart Fibonacci Analysis 051625Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 7.3/61.80%

Chart time frame: B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of 0LDR is 6.96 USD — it has decreased by −0.22% in the past 24 hours. Watch Teladoc Health, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on LSE exchange Teladoc Health, Inc. stocks are traded under the ticker 0LDR.

0LDR stock has fallen by −8.07% compared to the previous week, the month change is a −19.93% fall, over the last year Teladoc Health, Inc. has showed a −20.11% decrease.

We've gathered analysts' opinions on Teladoc Health, Inc. future price: according to them, 0LDR price has a max estimate of 12.00 USD and a min estimate of 7.00 USD. Watch 0LDR chart and read a more detailed Teladoc Health, Inc. stock forecast: see what analysts think of Teladoc Health, Inc. and suggest that you do with its stocks.

0LDR reached its all-time high on Feb 16, 2021 with the price of 307.54 USD, and its all-time low was 6.50 USD and was reached on Aug 14, 2024. View more price dynamics on 0LDR chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

0LDR stock is 3.60% volatile and has beta coefficient of 1.83. Track Teladoc Health, Inc. stock price on the chart and check out the list of the most volatile stocks — is Teladoc Health, Inc. there?

Today Teladoc Health, Inc. has the market capitalization of 1.24 B, it has decreased by −6.11% over the last week.

Yes, you can track Teladoc Health, Inc. financials in yearly and quarterly reports right on TradingView.

Teladoc Health, Inc. is going to release the next earnings report on Feb 24, 2026. Keep track of upcoming events with our Earnings Calendar.

0LDR earnings for the last quarter are −0.28 USD per share, whereas the estimation was −0.26 USD resulting in a −6.23% surprise. The estimated earnings for the next quarter are −0.18 USD per share. See more details about Teladoc Health, Inc. earnings.

Teladoc Health, Inc. revenue for the last quarter amounts to 626.44 M USD, despite the estimated figure of 625.76 M USD. In the next quarter, revenue is expected to reach 635.05 M USD.

0LDR net income for the last quarter is −49.51 M USD, while the quarter before that showed −32.66 M USD of net income which accounts for −51.58% change. Track more Teladoc Health, Inc. financial stats to get the full picture.

No, 0LDR doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Nov 20, 2025, the company has 5.5 K employees. See our rating of the largest employees — is Teladoc Health, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Teladoc Health, Inc. EBITDA is 190.30 M USD, and current EBITDA margin is 6.77%. See more stats in Teladoc Health, Inc. financial statements.

Like other stocks, 0LDR shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Teladoc Health, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Teladoc Health, Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Teladoc Health, Inc. stock shows the sell signal. See more of Teladoc Health, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.