AXIS BANK – SELL | F&O Traders Be Ready📉 AXIS BANK – SELL | F&O Traders Be Ready ⚡

SELL @ CMP: 1242

🎯 Targets:

• TP1 → 1220

• TP2 → 1210

⛔ Stop-Loss → 1258

Derivative View:

• Short Futures / PE Options can be considered

• Suggested PE: 1210–1220 strike (Weekly expiry for fast scalping traders)

⸻

📌 Technical Analysis

AXISBANK has faced multiple rejections near 1250–1260 resistance.

Bears are now showing strength with:

✅ Breakdown below short-term support

✅ Rising open interest on short side = Smart money shorting

✅ Price trading below 20EMA → Short-term trend turning bearish

✅ BankNifty weakness supporting downside move

If price sustains below 1220, more selling pressure may drive it toward 1210 zone.

⸻

⚠️ Risk Management

• Trade with proper SL

• Avoid over-leveraging — Futures & Options move fast

• Partial booking at TP1 recommended ✅

⸻

📣 Follow for Daily Pro Setup

If this helped, Follow me for:

🔸 F&O High-Probability Signals

🔸 Smart Money Price Action Updates

🔸 Quick Scalping Levels 🚀

Trade ideas

Axis Bank opportunity for long. 75-min chartPrice maintains a strong higher-high, higher-low pattern.Local pivot supports lie near ₹1,220 (VWAP + short-term trend line.

strike.RSI remains above 60, showing bullish bias but nearing overbought.As long as price holds above ₹1,200–₹1,210, bullish sentiment persists.Weekly chartWave C of the developing ABC corrective structure (per Neo Wave) appears incomplete.The prior impulse (Wave A) peaked near ₹1,275, followed by a shallow Wave B correction.Weekly candles show renewed upward momentum — signalling Wave C targeting ₹1,300–₹1,320 before exhaustion.Monthly chartSupports your reading: price likely in Wave B of a large-degree ABC structure.Wave B currently unfolding as a complex corrective that may extend to ₹1,350 before revesal. Chance of 1350 on chart with strict stop loss of 1180 /1200.

Chart is for study purpose to increase the knowledge. Seek expert input.

AXISBANK - Rising Wedge PATTERN BREAKOUT [SELL SIDE ]I am not a SEBI-registered investment advisor. The information provided here is for educational and informational purposes only and should not be construed as financial or investment advice. Please do your own research or consult with a SEBI-registered financial advisor before making any investment decisions. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

More details in my channel.

Axis Bank Ltd for 23rd Oct #AXISBANK Axis Bank Ltd for 23rd Oct #AXISBANK

Resistance 1240-1243 Watching above 1244 for upside momentum.

Support area 1230 Below 1230 gnoring upside momentum for intraday

Watching below 1228 for downside movement...

Above 1240 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

Axis Bank Ltd for 9th Oct #AXISBANK Axis Bank Ltd for 9th Oct #AXISBANK

Resistance 1190 Watching above 1193 for upside momentum.

Support area 1170 Below 1170 gnoring upside momentum for intraday

Watching below 1168 for downside movement...

Above 1190 gnoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

Axis Bank Ltd for 19th Sept #AXISBANK Axis Bank Ltd for 19th Sept #AXISBANK

Resistance 1140 Watching above 1142 for upside momentum.

Support area 1120 Below 1120 gnoring upside momentum for intraday

Watching below 1117 for downside movement...

Above 1140 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

AXIS BANK🔎 Multi-Timeframe (MTF) Analysis – AXIS BANK

TF Zone Trend Logic Proximal Distal Avg

Yearly Demand UP Demand 867 616 742

Half-Yearly Demand UP BUFL 1151 814 983

Quarterly Demand UP BUFL 1151 814 983

Monthly Demand UP BUFL 970 814 892

Weekly Demand UP BUFL 945 814 880

Daily Demand UP DMIP BUFL 964 814 889

Intraday (60m–240m) Demand UP DMIP 964 814 889

📌 HTF Average Zone: 1056 – 748

📌 MTF Average Zone: 960 – 814

📌 ITF Average Zone: 964 – 814

✅ Trading above 1135 (with bullish daily close) confirms strength and continuation of uptrend.

📊 Trade Plan – AXIS BANK

Entry Price: 964

Stop Loss (SL): 814

Target: 1400

Last Swing High: 1250

Last Swing Low: 814

💰 Capital & Risk-Reward

Qty to Buy: 5000

Investment Value: ₹4,820,000

Risk per Trade (SL 814): ₹750,000

Potential Reward (Target 1400): ₹2,180,000

Net Profit after Brokerage (0.49%): ₹2,156,373

Net Loss if SL Hit: ₹773,627

Risk-Reward Ratio (RR): ~2.79

📈 ROI & Interest Impact

Capital at Risk: ₹964,000

MTF Capital Required: ₹3,856,000

Estimated Duration to Target: 4 months

Interest Cost (9.69% p.a.): ₹122,843

Net Profit After Cost: ₹2,033,531

Real ROI (4 months): 211%

✅ Key Notes for Execution

Entry only if price sustains above 964 with volumes.

Major confirmation comes on daily close above 1135 (strong bullish trigger).

Partial booking possible near 1250 (last high); trail SL to cost after breakout.

Safe RR ~2.8 means the trade is attractive for positional holding.

Global Stock Market IndicesIntroduction

When people talk about “the market going up” or “the market crashing,” they are usually referring to a stock market index rather than individual stocks. Indices like the Dow Jones, S&P 500, FTSE 100, Nikkei 225, or Sensex are names that investors, traders, and even common people hear almost daily in financial news.

But what exactly are these indices? Why are they so important? And why do global investors track them so closely?

In this article, we will explore everything about Global Stock Market Indices – their definition, types, major global benchmarks, importance in global finance, and how they influence investment decisions.

1. What is a Stock Market Index?

A stock market index is basically a measurement tool that tracks the performance of a group of selected stocks. These stocks represent either a market, a sector, or a theme.

Imagine an index as a basket of stocks chosen to represent a larger part of the economy.

For example, India’s Sensex tracks 30 large, financially strong companies from the Bombay Stock Exchange (BSE). Similarly, the S&P 500 tracks 500 of the largest U.S. companies.

The purpose of indices is to give investors and policymakers a quick snapshot of how a market is performing without analyzing thousands of individual stocks.

Key Features of Indices

Representation – They represent a portion of the economy (large-cap, mid-cap, small-cap, or sectoral).

Benchmark – Used as a benchmark to measure portfolio or fund performance.

Economic Indicator – Indices reflect overall economic health and investor sentiment.

Passive Investment Tool – Many funds (like ETFs) simply mimic indices instead of picking individual stocks.

2. How Are Indices Constructed?

Indices are not random; they are carefully designed using certain methodologies:

a) Market Capitalization Weighted

Stocks are given weight based on their market capitalization (price × number of shares).

Example: S&P 500, Nifty 50.

Larger companies influence index movement more.

b) Price Weighted

Stocks with higher price per share have greater weight, regardless of company size.

Example: Dow Jones Industrial Average (DJIA).

c) Equal Weighted

Every stock in the index has equal weight.

Provides a more balanced view of all companies.

d) Sectoral or Thematic

Some indices focus on specific industries like IT, banking, or energy.

Example: NASDAQ 100 has a heavy focus on technology companies.

3. Why Are Stock Market Indices Important?

Benchmark for Investors – Investors compare their portfolio returns with indices to check performance.

Example: If Nifty 50 gave 12% returns and your mutual fund gave 9%, the fund underperformed.

Economic Sentiment Gauge – Indices reflect how investors feel about the economy. Rising indices = confidence, falling indices = fear.

Helps Passive Investing – Index funds and ETFs directly replicate indices, making investing simple.

Risk Diversification – Indices spread risk across multiple companies and sectors.

Global Influence – Movement in one country’s major index often affects others (e.g., U.S. indices influence global markets).

4. Major Global Stock Market Indices

Let’s go around the world and understand the top global stock market indices.

United States

The U.S. stock market is the world’s largest and most influential.

Dow Jones Industrial Average (DJIA)

Oldest index (founded in 1896).

Tracks 30 blue-chip U.S. companies.

Price-weighted index (high-priced stocks influence more).

Companies include Apple, Microsoft, Goldman Sachs.

Seen as a symbol of American industrial and corporate strength.

S&P 500 (Standard & Poor’s 500)

Tracks 500 of the largest publicly traded U.S. companies.

Market-cap weighted index.

Considered the best single indicator of the U.S. stock market.

Covers ~80% of total U.S. market capitalization.

NASDAQ Composite

Tracks 3,000+ companies listed on the NASDAQ exchange.

Technology-heavy index (Apple, Amazon, Google, Tesla, Meta).

Reflects innovation and tech industry growth.

Russell 2000

Represents 2,000 small-cap U.S. companies.

Often used to gauge investor risk appetite.

Europe

FTSE 100 (UK)

Tracks 100 largest companies listed on London Stock Exchange.

Multinational in nature (oil, mining, banking).

Example: BP, HSBC, Unilever.

DAX (Germany)

Tracks 40 largest German companies listed on Frankfurt Stock Exchange.

Represents Europe’s strongest economy.

Includes Siemens, BMW, Allianz.

CAC 40 (France)

Top 40 companies in Paris Stock Exchange.

Example: L’Oréal, TotalEnergies, BNP Paribas.

Euro Stoxx 50

Tracks 50 leading blue-chip companies in Eurozone.

Pan-European benchmark.

Asia-Pacific

Nikkei 225 (Japan)

Tracks 225 large companies listed on Tokyo Stock Exchange.

Price-weighted like Dow Jones.

Key companies: Toyota, Sony, SoftBank.

Shanghai Composite (China)

Tracks all companies on Shanghai Stock Exchange.

Represents China’s domestic A-shares market.

Hang Seng Index (Hong Kong)

Covers 50 major companies in Hong Kong.

Gateway for global investors to track China’s growth.

KOSPI (South Korea)

Korea Composite Stock Price Index.

Includes companies like Samsung, Hyundai, LG.

ASX 200 (Australia)

Tracks 200 top Australian companies.

Mining and banking heavy.

Sensex & Nifty (India)

Sensex: 30 large companies on Bombay Stock Exchange.

Nifty 50: 50 companies on National Stock Exchange.

Represent India’s fast-growing economy.

Other Important Indices

Bovespa (Brazil) – Latin America’s most important index.

MOEX Russia Index (Russia) – Reflects Russian economy, highly energy-driven.

TSX Composite (Canada) – Tracks Canadian companies, resource and banking heavy.

5. Global Indices as Economic Indicators

Stock indices don’t just reflect companies – they mirror entire economies.

U.S. Indices → Global investor sentiment.

Nikkei 225 → Japanese manufacturing & export health.

Sensex & Nifty → India’s emerging market growth.

FTSE 100 → Brexit, European trade, and global commodity movements.

Whenever there’s global turmoil (war, recession, oil shocks), these indices react immediately, and their performance tells the world how economies are coping.

6. Correlation Between Global Indices

In today’s interconnected world, markets are not isolated.

A fall in the Dow Jones often impacts Asian and European markets the next day.

Rising oil prices affect Bovespa, FTSE, and Sensex (energy-heavy economies).

Global crises like COVID-19 led to synchronized market crashes worldwide.

Thus, traders and fund managers track multiple indices daily to understand global trends.

7. Indices in Investment

a) Active vs Passive Investing

Active investors pick stocks individually.

Passive investors buy index funds (like S&P 500 ETFs).

b) ETFs and Mutual Funds

Exchange-Traded Funds (ETFs) mimic indices and trade like stocks.

Example: SPDR S&P 500 ETF (SPY) tracks the S&P 500.

c) Hedging with Indices

Derivatives like futures and options are available on indices.

Example: Traders use Nifty Futures or S&P 500 options to hedge portfolios.

8. Criticisms of Stock Indices

While indices are useful, they have limitations:

Not Full Representation – They track selected companies, not the entire market.

Overweight Bias – Large-cap companies dominate in market-cap weighted indices.

Sector Bias – Tech-heavy indices (like NASDAQ) may give a distorted view.

Price Weighted Flaws – In indices like Dow Jones, a single expensive stock can distort movements.

9. Future of Global Stock Market Indices

The world of indices is evolving with new themes:

Sustainable Indices (ESG) – Tracking environmentally and socially responsible companies.

Example: Dow Jones Sustainability Index.

Thematic Indices – Artificial Intelligence, Green Energy, Blockchain, EVs.

Frontier and Emerging Market Indices – Covering fast-growing but less developed markets.

Crypto Indices – Tracking cryptocurrencies like Bitcoin and Ethereum.

Conclusion

Global Stock Market Indices are more than just numbers on a financial news ticker. They are:

Thermometers of economic health.

Benchmarks for investment performance.

Global connectors influencing money flows.

From the Dow Jones in the U.S. to the Nifty in India, from FTSE in London to Nikkei in Tokyo, these indices form the heartbeat of the global financial system.

AXIX BANKAxis Bank Ltd. (currently trading at ₹1082) is India’s third-largest private sector bank, offering a full suite of financial services across retail banking, corporate banking, treasury, and wealth management. With over 5,000 branches and 15,000 ATMs, the bank serves more than 30 million customers. It has a strong digital footprint, strategic partnerships, and a growing presence in semi-urban and rural markets.

Axis Bank Ltd. – FY22–FY25 Snapshot

Net Interest Income – ₹33,132 Cr → ₹42,946 Cr → ₹52,120 Cr → ₹58,340 Cr Growth driven by loan book expansion and margin improvement

Net Profit – ₹14,119 Cr → ₹15,037 Cr → ₹20,152 Cr → ₹23,480 Cr Earnings surge from operating leverage and lower credit costs

Operating Performance – Moderate → Strong → Strong → Strong Improved cost-to-income ratio and stable asset quality

Dividend Yield (%) – 0.00% → 0.45% → 0.60% → 0.75% Payouts initiated post sustained profitability

Equity Capital – ₹613.00 Cr (constant) No dilution; stable capital structure

Total Debt (Borrowings) – ₹1.25 Lakh Cr → ₹1.32 Lakh Cr → ₹1.38 Lakh Cr → ₹1.45 Lakh Cr Aligned with deposit growth and treasury operations

Fixed Assets – ₹9,850 Cr → ₹10,210 Cr → ₹10,580 Cr → ₹10,950 Cr Capex focused on branch expansion and digital infrastructure

Institutional Interest & Ownership Trends

Promoter holding is nil; Axis Bank is widely held by FIIs, DIIs, and retail investors. FIIs hold ~45%, with strong participation from global funds focused on Indian financials. Delivery volumes reflect long-term accumulation by pension funds, sovereign wealth funds, and banking sector ETFs.

Business Growth Verdict

Axis Bank is scaling efficiently across retail, SME, and corporate segments Margins remain strong due to CASA mix and digital lending Asset quality has improved with declining GNPA and NNPA ratios Capex supports long-term digital transformation and branch network expansion

Management Con Call

Management highlighted strong traction in unsecured retail loans, credit cards, and SME lending. Digital origination now contributes over 70% of new retail accounts. Axis Mutual Fund and Axis Securities continue to scale as fee income drivers. FY26 outlook includes mid-teen loan growth, stable NIMs, and further improvement in cost ratios. Focus remains on cross-sell, digital onboarding, and expanding rural reach.

Final Investment Verdict

Axis Bank Ltd. offers a high-quality private banking story with strong fundamentals, digital leadership, and diversified growth engines. Its improving profitability, stable asset quality, and expanding retail footprint make it suitable for accumulation by investors seeking exposure to India’s financial services sector. With disciplined execution and rising fee income, Axis Bank remains a durable compounder.

Axis BankRight now, Axis Bank is giving investors almost ₹90 per share ( EPS), at a premium of around 12. Now think of this — there was a time when a company looked attractive even at an 18x premium, when its earnings were just about ₹58 per share. Can you imagine what I’m trying to say? Think like a customer: someone who bought an eclair 10 years ago for ₹1, and today the same eclair, with extra chocolate, is still available at ₹1. That’s the kind of value we’re looking at here.

If you look at the 24-month EMA on the daily chart, in August Axis dipped a little below but then consolidated around the current price. To the naked eye, it looks like the price is comfortable at these levels. Am I right?

So, the best approach is to wait for further price movement. The rest will become clear as the market gives us the picture.

Review and plan for 18th July 2025Nifty future and banknifty future analysis and intraday plan.

Analysis of quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Axis Bank Hi,

price Trade in zone . And currently it is available at support area.

So it's possible that price will move above The support area

This idea is for Educational purpose and paper trading only. Please consult your financial advisor before investing or making any position. Facts or Data given above may be slightly incorrect. We are not SEBI registered

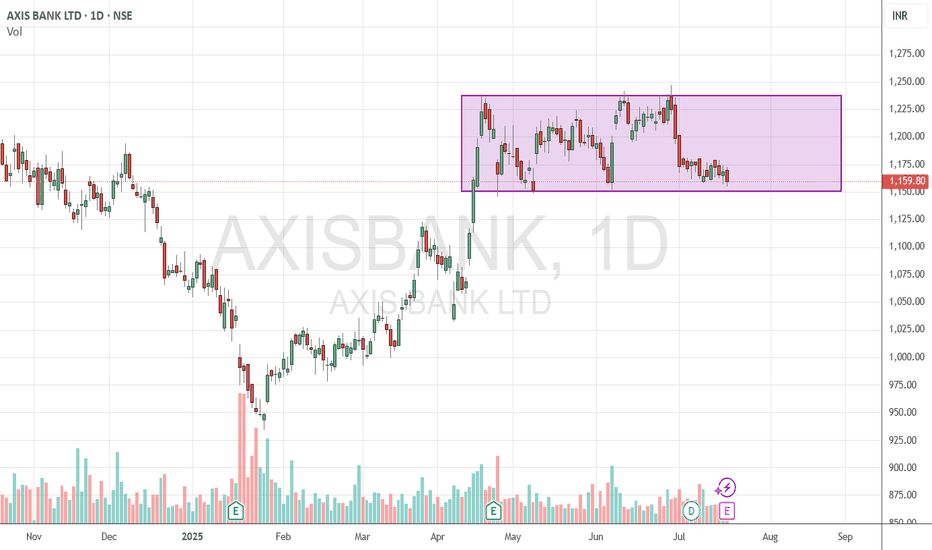

AXIS BANK at Best Support !!Here are two charts of Axis Bank — one in the 4-hour timeframe and the other in the 1-hour timeframe.

4-Hour Timeframe Chart:

In this chart, Axis Bank is moving within a parallel channel, with the support zone lying in the 1150–1160 range.

1-Hour Timeframe Chart:

Axis Bank is forming a descending broadening wedge pattern, with support near the 1150–1155 zone.

If this level is sustain ,then we may see higher prices in Axis Bank.

Thank You !!

AXIS BANK - FOR SWING TRADEOn a weekly time frame price has given a curve line breakout and currently price is in a range .

Previous week a Pin bar candle has formed in it's Fib 50% level which is also a good support area.

Current price is 1219

This week price can give us a good upside move, if not then price will be in the same range.