Reliance Industries Ltd Sponsored GDR 144A

No trades

Key facts today

Reliance Industries secured a U.S. license to buy Venezuelan oil, allowing direct purchases and refining. Recently, it acquired 2 million barrels, offering a cheaper alternative to Russian oil.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.0 USD

8.24 B USD

113.89 B USD

6.77 B

About Reliance Industries Limited

Sector

Industry

CEO

Mukesh Dhirubhai Ambani

Website

Headquarters

Mumbai

Founded

1957

IPO date

Jan 1, 1977

Identifiers

3

ISIN US7594701077

Reliance Industries Ltd. engages in hydrocarbon exploration and production, petroleum refining and marketing, petrochemicals, retail, and telecommunications. It operates through the following segments: Oil to Chemicals (O2C), Oil & Gas, Retail, Digital Services, Financial Services, and Others. The O2C segment includes refining, petrochemicals, fuel retailing through Reliance BP Mobility Limited, aviation fuel and bulk wholesale marketing. The Oil and Gas segment engages in the exploration, development and production of crude oil and natural gas. The Retail segment includes consumer retail and range of related services. The Digital Services segment includes provision of a range of digital services. The Financial Services segment comprises of management and deployment of identified resources of the firm to various activities including non-banking financial services and insurance broking. The Others segment engages in Media, SEZ development, and textile business. The company was founded by Dhirubhai Hirachand Ambani in 1957 and is headquartered in Mumbai, India.

Related stocks

Reliance Industries Ltd. – Technical View: Bearish Continuation Reliance has completed a five-wave impulsive decline from the January 2026 high, indicating a clear shift in near-term trend structure. The subsequent recovery has unfolded as a three-wave corrective bounce, consistent with a counter-trend retracement rather than the start of a fresh impulsive up mo

NSE – NIFTY 750 | Reliance Industries | 04 Feb 2026Reliance Industries viewed through a purely structural lens on the monthly timeframe.

• Structure assessed from earliest reliable data

• Long-term rising channel structure observed

• Trend integrity remains intact on higher timeframes

This is a contextual reference , not a trading or directiona

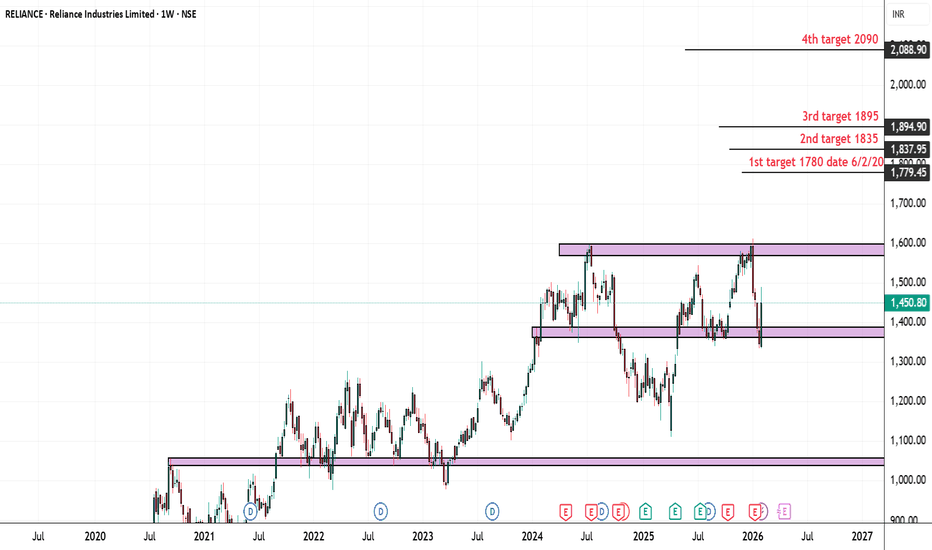

Reliance Industries Ltd (Weekly Chart) – Cup & Handle Formation Reliance Industries Ltd (Weekly Chart) – Cup & Handle Formation

Long-Term Bullish

Short-Term (Swing / Trading View):

Price is consolidating near ₹1,450–1,500, forming the handle portion of a larger Cup & Handle pattern.

Immediate support: ₹1,430–1,460 (handle base / channel support).

Immediate

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

USY72570AL17

Reliance Industries Limited 10.25% 15-JAN-2097Yield to maturity

7.29%

Maturity date

Jan 15, 2097

USY72570AG22

Reliance Industries Limited 10.5% 06-AUG-2046Yield to maturity

7.08%

Maturity date

Aug 6, 2046

RLNGF5335117

Reliance Industries Limited 3.625% 12-JAN-2052Yield to maturity

5.50%

Maturity date

Jan 12, 2052

RLNGF5335118

Reliance Industries Limited 3.75% 12-JAN-2062Yield to maturity

5.45%

Maturity date

Jan 12, 2062

RLNGF4208883

Reliance Industries Limited 4.875% 10-FEB-2045Yield to maturity

5.45%

Maturity date

Feb 10, 2045

RLNGF5059438

Reliance Industries Limited 6.25% 19-OCT-2040Yield to maturity

5.24%

Maturity date

Oct 19, 2040

RLNGF5335116

Reliance Industries Limited 2.875% 12-JAN-2032Yield to maturity

4.49%

Maturity date

Jan 12, 2032

RLNGF4567942

Reliance Industries Limited 3.667% 30-NOV-2027Yield to maturity

4.20%

Maturity date

Nov 30, 2027

USY72570AK34

Reliance Industries Limited 8.25% 15-JAN-2027Yield to maturity

3.88%

Maturity date

Jan 15, 2027

USY72570AF49

Reliance Industries Limited 9.375% 24-JUN-2026Yield to maturity

2.91%

Maturity date

Jun 24, 2026

J

790JUPPL28

Jamnagar Utilities & Power Pvt Ltd. 7.9% 10-AUG-2028Yield to maturity

—

Maturity date

Aug 10, 2028

See all RIGD bonds