WULF / 4hToday's unexpected 7.3% surge suggests a reassessment of the current wave count. Specifically, it supports reverting to the alternate scenario I outlined on July 30—namely, a more complex wave iv (circled) corrective structure unfolding as a (w)-(x)-(y) combination. This adjustment precedes the ongoing advance in wave v (circled) of the continuing Minor degree wave C.

As a result, the Fibonacci extension target at 6.96 remains valid and continues to serve as the primary upside objective.

Trend Analysis >> Once Minor wave C completes, the countertrend advance of Intermediate wave (B)—in progress since April 9—is expected to give way to a decline marking the onset of wave (C) of the same degree. This upcoming downtrend may begin within the next few days and extend into year-end.

NASDAQ:WULF CRYPTOCAP:BTC MARKETSCOM:BITCOIN BITSTAMP:BTCUSD

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

Trade ideas

WULF / 4hNASDAQ:WULF – In alignment with my bearish alternative scenario on the weekly timeframe (published earlier this week), Minor degree wave C has reached its anticipated expansion target at 5.55, potentially marking the completion of wave C within the corrective wave (B) structure.

Following the mid-July high and the conclusion of the countertrend rally in Intermediate wave (B), NASDAQ:WULF appears to have begun forming a Leading Diagonal downward.

A further decline of approximately 10% is expected to complete the structure of this diagonal—reinforcing the bearish case for the medium term.

NASDAQ:WULF CRYPTOCAP:BTC MARKETSCOM:BITCOIN BITSTAMP:BTCUSD

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / WeeklyAs illustrated on the weekly chart of NASDAQ:WULF , the entire advance since March 2023 appears to have unfolded as a Leading Diagonal, forming a bullish pattern over nearly two years.

This structure likely represents wave 1(circled) at the Primary degree, marking the initial sequence within a broader Cycle degree uptrend.

The Leading Diagonal wave 2(circled) has been undergoing a correction through wave 2(circled) of the same degree since November.

Within this corrective phase, the second subdivision—a countertrend rally labeled wave (B)—has extended beyond the 0.618 Fibonacci retracement level as anticipated and now appears to be a completed corrective structure.

Consequently, a decline of up to 70% is anticipated in the Intermediate degree wave (C), continuing the overall correction in a (A)-(B)-(C) Zigzag formation. It potentially extends through the remainder of the year.

Trend Analysis >> Under this weekly alternative, the medium-term trend is expected to turn lower very soon. However, the Leading Diagonal, identified as the first wave at the Primary degree, aligns with a broader long-term bullish structure, reinforcing the strength of the prevailing Cycle degree uptrend.

NASDAQ:WULF CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 4hIn alignment with my bearish alternative scenario on the weekly timeframe, Minor degree wave C could have reached its anticipated expansion target at 5.55, potentially marking the completion of the advance.

Consequently, the entire wave (B) correction—developing since April 9 in a classic Zigzag structure—may have concluded at the mid-July high of 5.63.

Trend Analysis >> With Minor wave C now appearing complete, the countertrend advance of Intermediate wave (B)—which has unfolded since April 9—is likely concluded.

This suggests that the final leg lower, Intermediate wave (C), may have started! If confirmed, this downtrend could develop over the coming weeks and potentially extend through the remainder of the year in alignment with the broader bearish outlook in weekly frame.

NASDAQ:WULF CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 3hThe unexpected 4% decline today suggests a potential shift in the wave iv (circled) corrective structure—from the previously identified triangle pattern to a more complex (w)-(x)-(y) combination. While differing corrective variations remain possible, this alternate structure now appears to be nearing completion. It is likely to precede the anticipated advance of approximately 45% in wave v (circled) of the ongoing Minor degree wave C.

The Fibonacci extension target at 6.93 remains unchanged.

Trend Analysis >> Upon completion of Minor wave C, the countertrend advance of Intermediate wave (B)—in progress since April 9—is expected to give way to a decline in wave (C) of the same degree. This next downtrend may begin in the coming days and has the potential to extend through the end of the year.

NASDAQ:WULF CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 3hNASDAQ:WULF continued to consolidate sideways today, in line with expectations, with no material change to the broader outlook. The narrowing price action supports the current wave structure—specifically, a completed triangle in wave iv (circled), likely preceding the anticipated final advance of approximately 33% in wave v (circled) of the ongoing Minor degree wave C.

The Fibonacci extension target at 6.93 remains valid.

Trend Analysis >> Upon completion of Minor degree wave C, the countertrend advance of Intermediate degree wave (B), which has been unfolding since April 9, is likely to give way to a decline in wave (C) of the same degree. This downtrend might begin in the coming days and potentially extend through the end of the year!!

NASDAQ:WULF CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 3hNASDAQ:WULF traded sideways today, as expected, with no significant change to the broader outlook. The ongoing consolidation continues to support the current wave structure—specifically, a developing triangle in wave iv (circled), which may be forming ahead of the anticipated final advance in wave v (circled).

The Fibonacci extension target >> 6.93 remains valid.

Trend Analysis >> Upon completion of Minor degree wave C, the countertrend advance of Intermediate degree wave (B), which has been unfolding since April 9, is likely to give way to a decline in wave (C) of the same degree. This downtrend might begin in the coming days and potentially extend through the end of the year!!

NASDAQ:WULF CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 3hWave Analysis >> While the overall outlook on NASDAQ:WULF remains consistent with the previous analysis, the ongoing sideways volatility suggests a need to reassess the wave count on the final stages of Minor degree impulsive advance in wave C.

The Fib extension target remains intact >> 6.93

Trend Analysis >> Upon completion of Minor degree wave C, the countertrend advance of Intermediate degree wave (B), which has been unfolding since April 9, is likely to give way to a decline in wave (C) of the same degree. This downtrend might begin in the coming days and potentially extend through the end of the year!!

NASDAQ:WULF CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

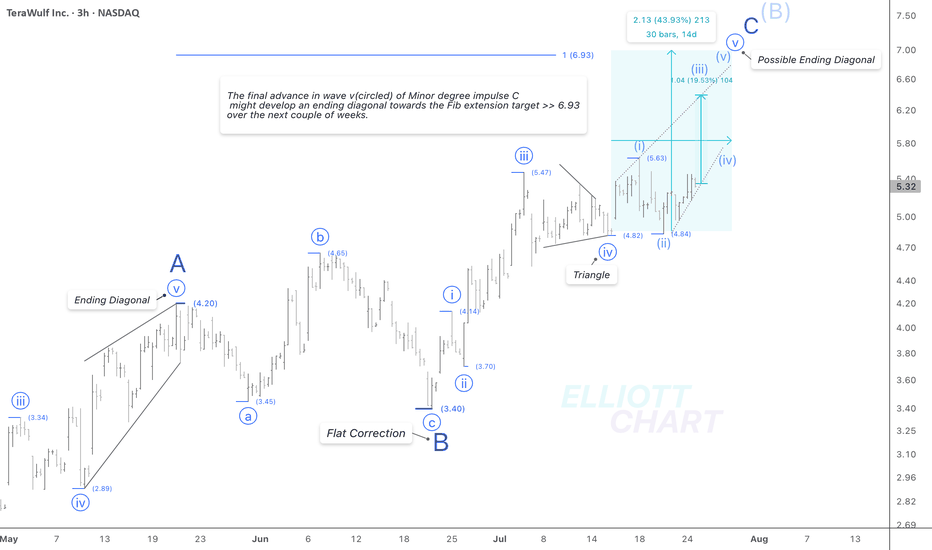

WULF / 3hWave Analysis >> While the current outlook on WULF remains consistent with previous analysis, the internal structure of wave v (circled) suggests the potential development of an ending diagonal in the final leg of Minor degree wave C.

Trend Analysis >> Upon completion of Minor degree wave C, the countertrend advance of Intermediate degree wave (B), which has been unfolding since April 9, is likely to give way to a decline in wave (C) of the same degree. This downtrend might begin in the coming days and potentially extend through the end of the year.

NASDAQ:WULF CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

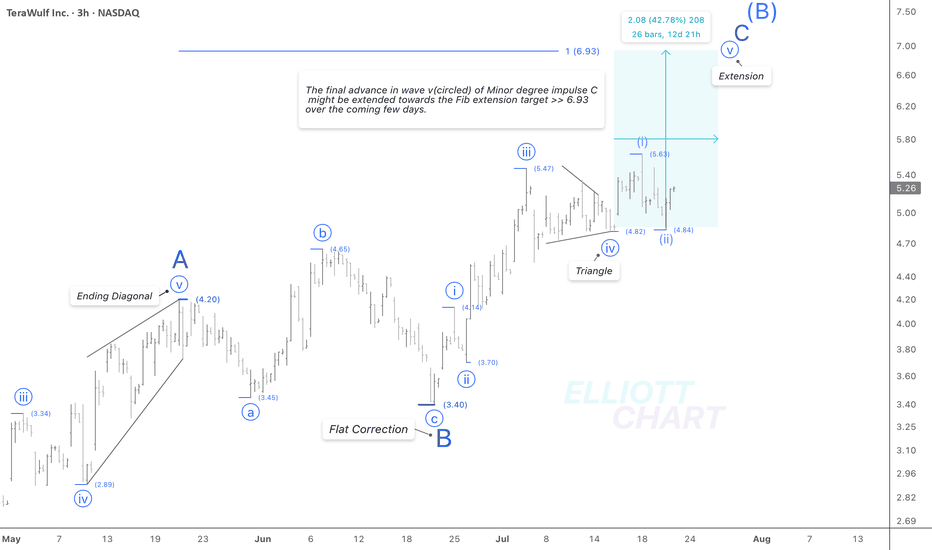

WULF / 3hThere is no specific change in the NASDAQ:WULF 's analysis; it might extend its final advance in an extension of wave v(circled) of the ongoing Minor degree wave C.

Trend Analysis >> After completion of the Minor degree wave C, the countertrend advance of Intermediate degree wave (B), which has developed since April 9, will probably turn to an ultimate decline in the same degree wave (C) in the coming few days! And it'll likely last until the end of the year!!

NASDAQ:WULF CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

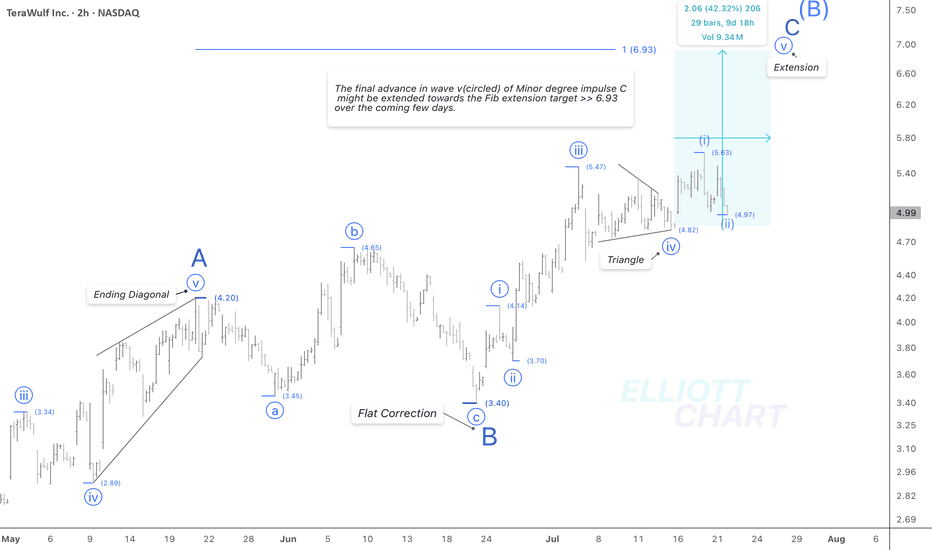

WULF / 2hThere is no change in the NASDAQ:WULF 's analysis; it might extend its final advance in an impulsive extension of wave v(circled) of the ongoing Minor degree wave C, in which the first and second subdivisions were done. An impulsive 3rd wave is anticipated.

Trend Analysis >> After completion of the Minor degree wave C, the countertrend advance of Intermediate degree wave (B), which has developed since April 9, will probably change to decline in the same degree wave (C) in the coming few days! And it'll likely last until the end of the year!!

$Crypto $Stocks CRYPTOCAP:BTC MARKETSCOM:BITCOIN BITSTAMP:BTCUSD

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

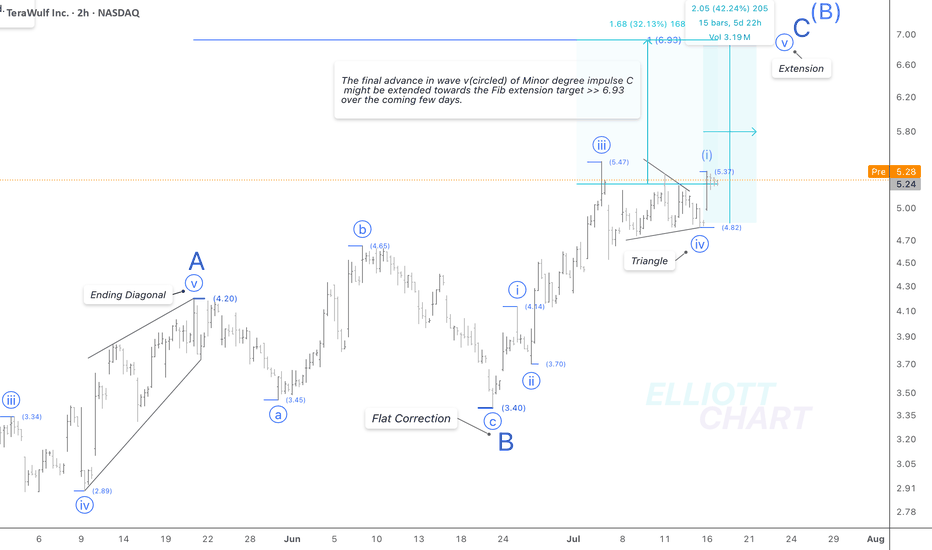

WULF / 2hAs depicted in the 2h-frame above, NASDAQ:WULF might extend its final advance in an impulsive extension of wave v(circled) of the ongoing Minor degree wave C. Hence, the target would adjust to the Fib extension target at 6.93.

Wave Analysis >> The triangle correction in wave iv(circled) worked well, followed by an initial swift advance of the same degree wave v(circled), which would likely extend towards the Fib extension target >> 6.93. So, an advance of 32% lies ahead to conclude the Minor degree wave C of the entire correction in an A-B-C zigzag as a countertrend advance in Intermediate degree wave (B).

Trend Analysis >> After completion of the Minor degree wave C, the countertrend advance of Intermediate degree wave (B), which has developed since April 9, will probably change to decline in the same degree wave (C) in the coming few days!

And it'll likely last until the end of the year!!

NASDAQ:WULF CRYPTOCAP:BTC MARKETSCOM:BITCOIN

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 3hAccording to the prior analysis, NASDAQ:WULF rose by 10.5% intraday in a swift advance as expected.

Wave Analysis >> The triangle correction in wave iv(circled) worked, followed by a swift advance in the same degree wave v(circled), which its 6% is left to conclude the Minor degree wave C of the entire correction in an A-B-C zigzag as a countertrend advance in Intermediate degree wave (B) >> Not shown in this frame.

Target >> The Fib expansion target at 5.55 remains intact >> Where Minor degree wave C would equal the same degree wave A.

Trend Analysis >> The countertrend advance as Intermediate degree wave (B) will probably change to decline in the same degree wave (C) very soon!! And it'll likely last until the end of the year!

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

NASDAQ:WULF CRYPTOCAP:BTC MARKETSCOM:BITCOIN

WULF / 3hAs a second alternative, NASDAQ:WULF may have developed a five-wave impulsive sequence as the Minor degree wave C, in which its 4th wave correction in a triangle appears to be over at 4.82.

So, the final advance by 15% in the same degree wave v(circled) lies ahead to conclude the Minor degree wave C of the entire correction in an A-B-C zigzag as a countertrend advance in Intermediate degree wave (B).

Trend Analysis >> The countertrend advance as Intermediate degree wave (B) will probably change to decline in the same degree wave (C) very soon!! And it'll likely last until the end of the year.

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

NASDAQ:WULF CRYPTOCAP:BTC MARKETSCOM:BITCOIN

WULF / 3hNASDAQ:WULF

According to the bearish alternative in my weekly frame (not the chart below and not posted recently), the entire countertrend rally, which has developed in an ABC zigzag sequence as anticipated in the analysis which I posted on May 12, may have reached a very late stage where an adjusted expanding diagonal as the thorough Minor degree wave C remains at the start point of a final advance as its 5th subdivision. It will conclude the entire correction upward since April 9.

NASDAQ:WULF 's Bearish Alternative :

Wave Analysis >> As depicted on this 3h-frame above, the structure of the entire countertrend advance, which has developed since April 9, may be considered in a thorough ABC zigzag correction, in which Minor degree wave C should have diagonally reached its very late stage now. It would likely achieve its expansion target >> 5.55.

And it would be a 170% gain of a countertrend rally at the end!!

Now, 8.6% of the advance remains to complete a possible ending expanding diagonal upward as the Minor degree wave C.

Trend Analysis >> The countertrend upward as Intermediate degree wave (B) will probably change to decline in the same degree wave (C) very soon!! And it'll likely last until the end of the year.

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

NASDAQ:WULF CRYPTOCAP:BTC MARKETSCOM:BITCOIN

WULF / 2hNASDAQ:WULF

According to the bearish alternative in my weekly frame (not the chart above and not posted recently), the entire countertrend rally, which has developed in an ABC zigzag sequence as anticipated in the analysis which I posted on May 12, may have reached a very late stage where an expanding diagonal remains at the start point of a final advance as its 5th subdivision. It would be an ending rise of the entire correction upward since April 9.

NASDAQ:WULF 's Bearish Alternative :

Wave Analysis >> As depicted on this 2h-frame above, the structure of the entire countertrend advance, which has developed since April 9, may be considered in a thorough ABC zigzag correction, in which Minor degree wave C should have reached its very late stage now. It would likely achieve its expansion target at 5.55.

And it was a 170% gain of a countertrend rally!!

>> Now, 13% advance is left to complete a possible ending expanding diagonal as the wave v(circled) of C.

Trend Analysis >> The uptrend would likely change to down in an Intermediate degree wave (C) very soon!! It will likely last until the end of the year.

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

$WULF Critical Resistance!NASDAQ:WULF has had a great come back but has just hit a triple sword resistance: weekly 200EMA, weekly pivot and High Volume Node where I expect it to struggle for a while!

Are CRYPTOCAP:BTC miners the new altcoins?

Bullish continuation through these resistances will flip them to support and demonstrate fundamental resilience on an improving macro economic background overcoming technical analysis.

Long term tailwind potential can be as high a10x from here but more realistic targets are the R3 weekly pivot $17 and R5 weekly pivot at $25.

Analysis is invalidated below the high degree wave (4) of a leading (or ending) diagonal Elliot Wave pattern.

Safe trading

WULF / 2hAccording to the prior analysis, NASDAQ:WULF has risen by 13.5% today.

Wave Analysis >> The ongoing impulsive wave c(circled) seems to be extending in its fifth wave.

Trend Analysis >> The Minor degree trend is up now in an impulsive wave c(circled).

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 2hNASDAQ:WULF has revealed an impulsive sequence that's gone beyond the June high >> 4.65.

And it would suggest a bullish alternative in which the correction of wave b(circled) could be thoroughly over at 3.40.

So, an impulsive advance in anticipated wave c(circled) should be underway.

Trend Analysis >> Trend has turned upward in impulse c(circled).

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 2hNASDAQ:WULF

Wave Analysis >> The counter-trend rally of wave (b) has unfolded an formation as a zigzag, and now a final advance of 7% is left to thoroughly over.

As illustrated on the 2h-frame above, the correction in wave b(circled) may expand an (a)-(b)-(c) flat formation in a three-wave sequence. After the completion of the counter-trend rally in wave (b), a final decline as the last subdivision in wave (c) of b(circled) is expected to follow.

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 2hAs anticipated in the prior analysis, NASDAQ:WULF started to retrace downward today after a 33% counter-trend rally of the week as the correction in wave (b) of Minute degree b(circled).

Wave Analysis >> As illustrated on the 2h-frame above, the correction in wave b(circled) may have remained in progress. After an impulsive counter-trend rally of 15.5% yesterday, the second subdivision in wave (b) unfolded into a three-wave sequence. A final decline as the last subdivision in wave (c) has started since the last-day high at 4.53 to complete the entire correction of wave b(circled) in a zigzag formation.

The retracement targets >> 3.36 >> 3.28 >> 3.05

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

WULF / 2hNASDAQ:WULF rose by 15.5% today! An unexpected counter-trend rally, which may be considered the last high in June.

Wave Analysis >> According to my bearish alternative >> as depicted on the 2h-frame above, the correction in wave b(circled) may have remained at the extreme of its second subdivision in wave (b), a final decline as the last subdivision in wave (c) would likely follow to complete the entire correction of wave b(circled) in a three-wave sequence like a zigzag or flat formation.

The expected targets >> 3.36 >> 3.28 >> 3.05

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC