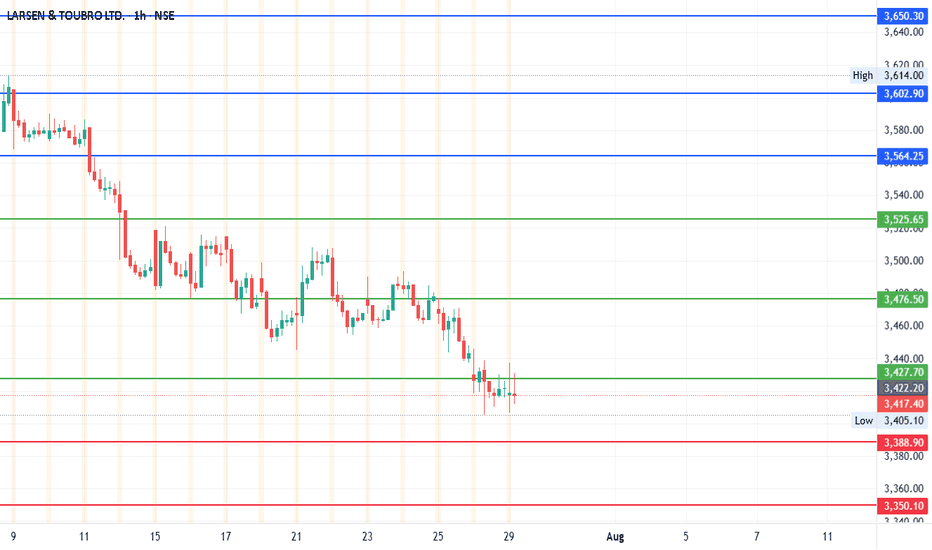

L&T – BOX BREAKOUT → RETEST → RESUMING UPSIDE🏗️ L&T – BOX BREAKOUT → RETEST → RESUMING UPSIDE

LT gave a box breakout 4 weeks ago, followed by a clean retest, and now the stock is showing strength again — indicating continuation of the uptrend.

📊 Technical Structure:

• Box range breakout confirmed

• Retest successfully completed

• Higher-low

Larsen & Toubro Limited Shs Sponsored Global Depositary Receipt Repr 1 Sh Reg-S

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.38 EUR

1.64 B EUR

27.93 B EUR

About Larsen & Toubro Limited

Sector

Industry

CEO

Sekharipuram Narayan Subrahmanyan

Website

Headquarters

Mumbai

Founded

2007

ISIN

USY5217N1183

FIGI

BBG00FGX3R30

Larsen & Toubro Ltd. is an investment holding company, which engages in technology, engineering, construction, manufacturing, and financial activities. It operates through the following business segments: Infrastructure, Hydrocarbon, Power, Heavy Engineering, Defence Engineering, IT and Technology Services, Financial Services, Development Projects, and Others. The Infrastructure segment is composed of engineering and construction of buildings and factories, transportation infrastructure, heavy civil infrastructure, power transmission and distribution and water and renewable energy projects. The Hydrocarbon segment provides engineering procurement, construction and commissioning solutions for the global oil and gas Industry from front-end design through detailed engineering, modular fabrication, procurement, project management, construction, installation and commissioning. The Power segment includes turnkey solutions for coal-based and gas-based thermal power plants including power generation equipment with associated systems and balance-of-plant packages. The Heavy Engineering segment manufactures and distributes custom designed, engineered critical equipment and systems to core sector industries like fertiliser, refinery, petrochemical, chemical, oil and gas, thermal and nuclear power, aerospace and defence. The Defence Engineering segment refers to the design, development, and serial production and through life-support of equipment, systems and platforms for Defence and Aerospace sectors; and design, construction, and repair of defense vessels. The IT and Technology Services segment represents global IT services, digital solutions, and engineering and research and development. The Financial Services segment deals with the provision of retail finance, wholesale finance, and investment management services. The Development Projects segment refers to the roads and transmission projects, the Hyderabad Metro Rail project, and power development projects. The Others segment encompasses realty, smart world, and communication projects, marketing and servicing of construction and mining machinery and parts thereof and manufacture, sale of rubber processing machinery and digital platforms. The company was founded by Henning Holck-Larsen and Soren Kristian Toubro in 1938 and is headquartered in Mumbai, India.

Related stocks

L&T - Cup and Handle Formation Near Breakout ZoneChart Structure:

Larsen & Toubro is forming a textbook Cup and Handle pattern that’s now testing its neckline around ₹3,780–₹3,800. The base extends nearly 10 months, creating a strong accumulation structure with a shallow handle - ideal for a breakout continuation.

Technical Highlights:

Cup

LT Weekly Breakout In this stock we clearly see the Channel pattern is formed and Ready for Breakout , Wait for candle Close in 1D with good volume , then we can see very good move up to 15% nearly .

As now nifty is given Breakout from 1D Channel pattern and in Market Breadth 1D has given breakout and in weekly marke

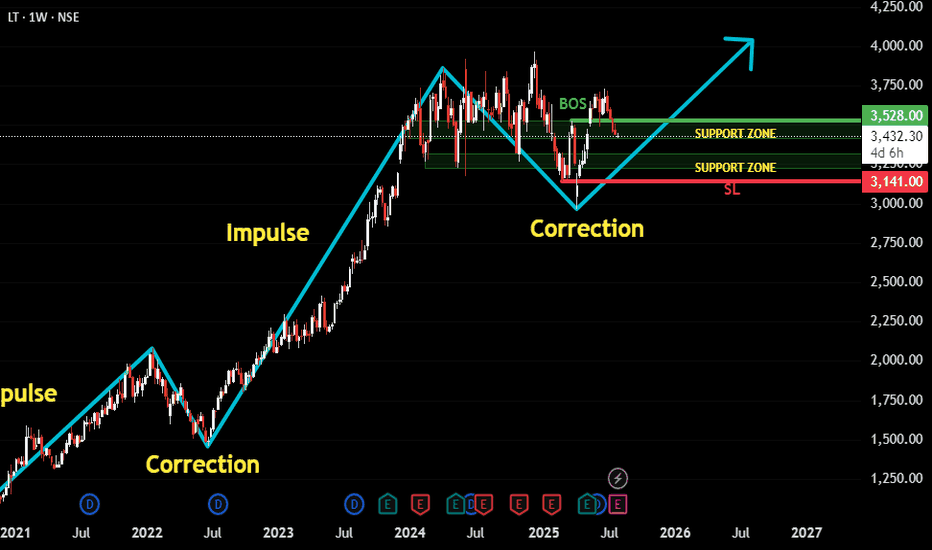

LT Following Classic Impulse-Correction Rhythm.This is a trend-following setup on LT (Larsen & Toubro) where we’ve observed a clear repeating pattern of Impulse → Correction → Impulse. The recent price action suggests that the latest correction has matured, and the structure now hints at a potential next impulse wave beginning.

Here’s the thoug

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

658LTMRH26

L&T Metro Rail (Hyderabad) Ltd. 6.58% 30-APR-2026Yield to maturity

—

Maturity date

Apr 30, 2026

914KTL30

Kudgi Transmission Limited 9.14% 25-APR-2030Yield to maturity

—

Maturity date

Apr 25, 2030

95KTL36

Kudgi Transmission Limited 9.5% 25-APR-2036Yield to maturity

—

Maturity date

Apr 25, 2036

95KTL38

Kudgi Transmission Limited 9.5% 25-APR-2038Yield to maturity

—

Maturity date

Apr 25, 2038

914KTL32

Kudgi Transmission Limited 9.14% 25-APR-2032Yield to maturity

—

Maturity date

Apr 25, 2032

88KTL26

Kudgi Transmission Limited 8.8% 25-APR-2026Yield to maturity

—

Maturity date

Apr 25, 2026

95KTL39

Kudgi Transmission Limited 9.5% 25-APR-2039Yield to maturity

—

Maturity date

Apr 25, 2039

95KTL35

Kudgi Transmission Limited 9.5% 25-APR-2035Yield to maturity

—

Maturity date

Apr 25, 2035

95KTL37

Kudgi Transmission Limited 9.5% 25-APR-2037Yield to maturity

—

Maturity date

Apr 25, 2037

95KTL34

Kudgi Transmission Limited 9.5% 25-APR-2034Yield to maturity

—

Maturity date

Apr 25, 2034

914KTL31

Kudgi Transmission Limited 9.14% 25-APR-2031Yield to maturity

—

Maturity date

Apr 25, 2031

See all LTO bonds

IQMA

Invesco Markets II PLC - Invesco Emerging Markets Enhanced Equity UCITS ETF Unhedged USDWeight

1.15%

Market value

819.86 K

USD

Explore more ETFs

Curated watchlists where LTO is featured.

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks