Trade ideas

Applied Digital Corporation (APLD) AnalysisCompany Overview:

Applied Digital NASDAQ:APLD is an AI and high-performance computing (HPC) infrastructure leader building next-gen data centers purpose-built for GPU computing, AI workloads, and digital assets. It’s positioning itself in the center of the AI infrastructure supercycle.

Key Catalysts:

Transformational Hyperscaler Deal:

Secured a $5B, 15-year lease with a top U.S. hyperscaler for 200 MW at its Polaris Forge 2 campus.

This places APLD among elite U.S. data center operators and locks in long-duration, recurring revenue.

Polaris Forge Build-Out:

Phase 1 (50 MW) at Polaris Forge Building 1 is Ready for Service (RFS).

Full 100 MW online by Q4 2025, with another 150 MW in development — pushing the company toward its 1 GW portfolio goal.

AI “Neo Cloud” Tailwind via CoreWeave:

A deeper CoreWeave partnership boosts utilization of APLD’s AI infrastructure and gives access to the fast-growing AI-specialized cloud market, where demand is outpacing legacy cloud capacity.

Strategic Positioning:

Purpose-built, power-efficient campuses

Aligned with massive AI GPU demand

Long-term contracted cash flows

Investment Outlook:

Bullish above: $27.00–$28.00

Target: $50.00–$52.00

Driven by contracted hyperscaler revenue, rapid MW ramp, and exposure to AI compute scarcity.

📢 APLD — building the power layer of the AI era. ⚡🏗️

A 10x on APLD ? Applied Digital has confirmed a multi-year symmetrical triangle breakout on the weekly chart, marked by immense volume and a clean breakout above long-term downtrend resistance. The base of the triangle spans several years, with consistent higher lows forming a solid support line.

🔺 Breakout Volume: Massive volume surge confirms strong institutional or speculative buying interest.

🟠 Heavy Resistance: $28.60 identified as the next major challenge before a full trend expansion.

🧠 Measured Move Target: Triangle projection suggests potential upside toward $140.00 , a 3,000%+ move from the breakout zone.

🟨 Support Zones: $11.00 (area of demand) and $4.50 (triangle confirmation level) now act as strong support.

APLD is showing early-stage parabolic potential after confirming a multi-year consolidation breakout. With strong volume, bullish structure, and long-term accumulation patterns, it now targets a multi-bagger move.

A pullback to $11.00 would offer a high-conviction re-entry zone.

APLD: might be starting a new upswing Price is showing a constructive reaction from the 30–26 support zone and might be starting a new uptrend toward the next mid-term resistance area at 60–75.

As long as price continues to hold above the support zone, I’ll keep this trend structure as my main scenario.

Chart:

Can a Crypto Miner Become an AI Infrastructure Giant?Applied Digital Corporation has undergone a dramatic transformation, pivoting from cryptocurrency mining infrastructure to become a key player in the rapidly expanding AI data center market. This strategic shift, completed in November 2022, has resulted in extraordinary stock performance with shares surging over 280% in the past year. The company has successfully repositioned itself from serving volatile crypto clients to securing long-term, stable contracts in the high-performance computing (HPC) sector, fundamentally de-risking its business model while capitalizing on the explosive demand for AI infrastructure.

The company's competitive advantage stems from its purpose-built approach to AI data centers, strategically located in North Dakota to leverage natural cooling advantages and access to abundant "stranded power" from renewable sources. Applied Digital's Polaris Forge campus can achieve over 220 days of free cooling annually, significantly outperforming traditional data center locations. This operational efficiency, combined with the ability to utilize otherwise curtailed renewable energy, creates a sustainable cost structure that traditional operators cannot easily replicate through simple retrofitting of existing facilities.

The transformative CoreWeave partnership represents the cornerstone of Applied Digital's growth strategy, with approximately $11 billion in contracted revenue over 15 years for a total capacity of 400 MW. This massive contract provides unprecedented revenue visibility and validates the company's approach to serving AI hyperscalers. The phased buildout schedule, commencing with a 100 MW facility in Q4 2025, provides predictable revenue growth while the company pursues additional hyperscale clients to diversify its customer base.

Despite current financial challenges including negative free cash flow and steep valuation multiples, institutional investors holding 65.67% of the stock demonstrate confidence in the long-term growth narrative. The company's success will ultimately depend on the execution of its buildout plans and ability to capitalize on the projected $165.73 billion AI data center market by 2034. Applied Digital has positioned itself at the intersection of favorable macroeconomic trends, geostrategic advantages, and technological innovation, transforming from a volatile crypto play into a strategic infrastructure provider for the AI revolution.

APLD - Near-term upside, entry coming upAPLD is near the end of a very solid and strong third wave impulse to the upside.

With this end nearing and the price territory of the end of wave 1 being so near, it makes me give this Wave-count confidence rating: Weak

I will be waiting to see what structure and price action comes in the next few weeks, there may be a decent trade to be made out of this though

$APLD 2027 LEAPS: The Next NVDA? Long-Term AI/HPC Power Play

# 🚀 APLD LEAP Options Setup | AI Mega-Trend Play 💡📊

### 🔥 Trade Thesis

APLD riding the **AI/HPC CoreWeave \$11B partnership** + secular AI infra boom.

Weekly chart = **bullish momentum**, monthly cooling but intact trend.

Low VIX → perfect setup for **LEAP calls**.

---

### 📊 TRADE SETUP

* 🎯 **Instrument**: APLD

* 🔀 **Direction**: CALL (LONG LEAP)

* 💵 **Strike**: \$17.50

* 📅 **Expiry**: Jan 15, 2027 (502 days)

* 💰 **Entry Price**: \$5.85

* 🛑 **Stop Loss**: \$3.80 (-35%)

* 🎯 **Profit Target**: \$11.70 (+100%)

* 📏 **Size**: 1 contract

* ⏰ **Entry Timing**: Market Open

---

### 📈 Confidence Level

✅ 75% (Moderate conviction, majority model consensus)

---

### ⚠️ Key Risks

* Near resistance (\$16.78–\$17.60) → possible pullback.

* Monthly RSI cooling → could mean consolidation.

* Market/macro risk + option liquidity.

---

### 🚨 Final Call

👉 **BUY 1 APLD Jan 2027 \$17 .50CALL @ \$5.85**

📌 Take partial profit at +100%, let runners ride for AI mega-trend upside.

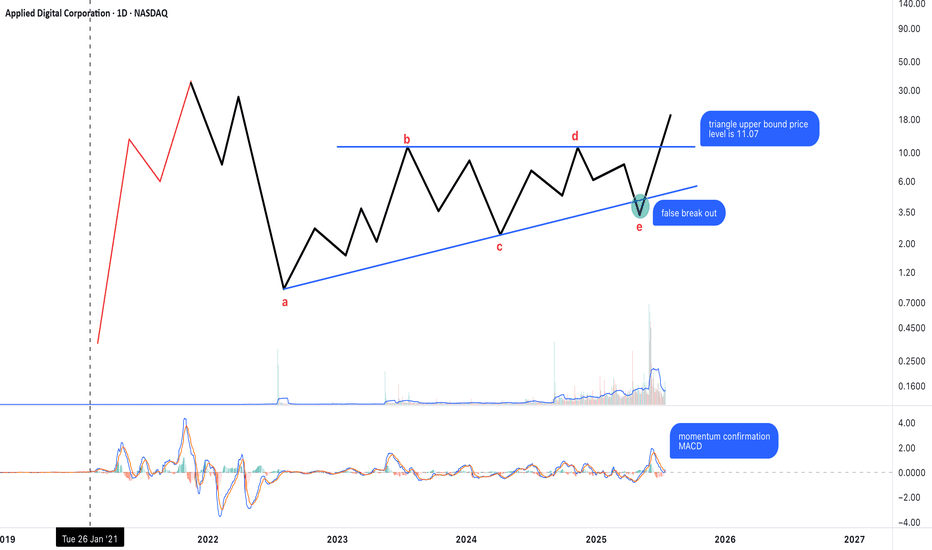

Possible Neutral Triangle Breakout – Key Level at 11.07The chart appears to show a completed neutral triangle (a–b–c–d–e), with a breakout emerging above the upper boundary at 11.07.

Wave a looks like a complex structure (possibly elongated flat or flat + zigzag).

The rest of the legs are mostly zigzag forms, consistent with triangle rules.

False breakdown below wave e followed by a strong reversal.

MACD is confirming momentum during the breakout attempt.

As long as price stays above 11.07, this breakout may be sustained. If confirmed, the next target zone could align with the height of the triangle projected upward.

APLD Gamma Squeeze Watch: Calls Loading Into Expiry! 🚀 APLD Weekly Options Trade Analysis (2025-08-18)

### 🔎 Comprehensive Summary

APLD weekly options data shows **strong bullish sentiment**, supported by:

* **Call/Put Ratio:** 2.40 (heavy call bias)

* **RSI:** >70, confirming strong momentum

* **Institutional Flow:** Aligns with bullish catalysts (price target upgrades)

⚠️ **Weakness:** Weekly volume didn’t surpass the prior week, raising some caution.

---

### 📊 Agreement & Disagreement

✅ **Agreement Across Models:**

* Strong bullish trend confirmed by RSI & call/put ratio

* Volatility environment favorable (low VIX)

* Best trade setup: **Calls**

❌ **Disagreement:**

* Some models emphasize weak volume as a potential risk

* Others dismiss this due to strength in bullish momentum

---

### 📝 Trade Plan

* **Overall Market Direction:** ✅ Bullish

* **Strategy:** Buy single-leg, naked calls with strong liquidity

**Trade Setup**

* 🎯 **Strike:** \$17.00 Call

* 📅 **Expiry:** Aug 22, 2025 (4 DTE)

* 💵 **Entry Price:** \$0.45

* 🛑 **Stop Loss:** \$0.23 (\~50% premium)

* 🎯 **Profit Target:** \$0.90 – \$1.12 (100-150% gain)

* ⏰ **Entry Timing:** Market open

* 📈 **Confidence Level:** 80%

---

### ⚠️ Key Risks

* **Gamma Risk:** High with only 4 DTE — position requires tight monitoring

* **Volume Weakness:** May hinder sustained breakout if institutional support falters

---

## 📊 Trade Snapshot

* **Instrument:** APLD

* **Direction:** CALL (LONG)

* **Strike:** \$17.00

* **Entry Price:** \$0.45

* **Target:** \$1.00+

* **Stop:** \$0.23

* **Expiry:** 08/22/2025

* **Size:** 1 contract

* **Confidence:** 80%

* **Signal Time:** 2025-08-18 12:05:33 EDT

APLD 0DTE TRADE IDEA (AUG 1, 2025)

## 🔥 APLD 0DTE TRADE IDEA (AUG 1, 2025)

**💡 Multi-AI Model Consensus | High Risk-Reward | Gamma Alert**

### 🧠 AI Model Summary

✔️ **Bullish Momentum** confirmed across all models

📉 **Volume Weakness** = key caution signal

⚠️ **Gamma Risk HIGH** → Most recommend entry *next session* (Monday)

---

### 🛠 TRADE SETUP (Based on Consensus Call)

| Field | Value |

| -------------- | ------------------------------ |

| 📈 Direction | **CALL (Bullish)** |

| 🎯 Strike | **\$13.50** |

| ⏰ Expiry | **Aug 1 (0DTE)** |

| 💰 Entry Price | **\$0.23** (ask) |

| 🎯 Target | **\$0.35** |

| 🛑 Stop Loss | **\$0.12** |

| 🔁 Size | 1 Contract |

| 📊 Confidence | **75%** |

| 🕒 Entry Time | **Next session OPEN (Monday)** |

---

### 🔍 Key Model Insights

* 📊 **Call/Put Ratio Bullish** across all platforms

* 📉 **Weak Volume** warns of unsustainable moves

* 🧨 **High Gamma Sensitivity** → rapid profit/loss shifts

* 🧠 **Claude / Grok / DeepSeek** all flag for rapid exit if entered today

---

### 📌 TradingView Viral Caption

> ⚠️ \ NASDAQ:APLD 0DTE 🔥

> Models agree: 🚀 bullish trend, 💀 dangerous gamma

> ✅ \$13.50 CALL @ \$0.23 → Target: \$0.35

> ⏱️ Most say: **WAIT ‘til Monday open**

> 🔍 Risk tight. Exit fast. Volume light.

> \#APLD #OptionsTrading #0DTE #FlowTrading #AIModels #GammaSqueeze #FridayTrades #TradingViewIdeas

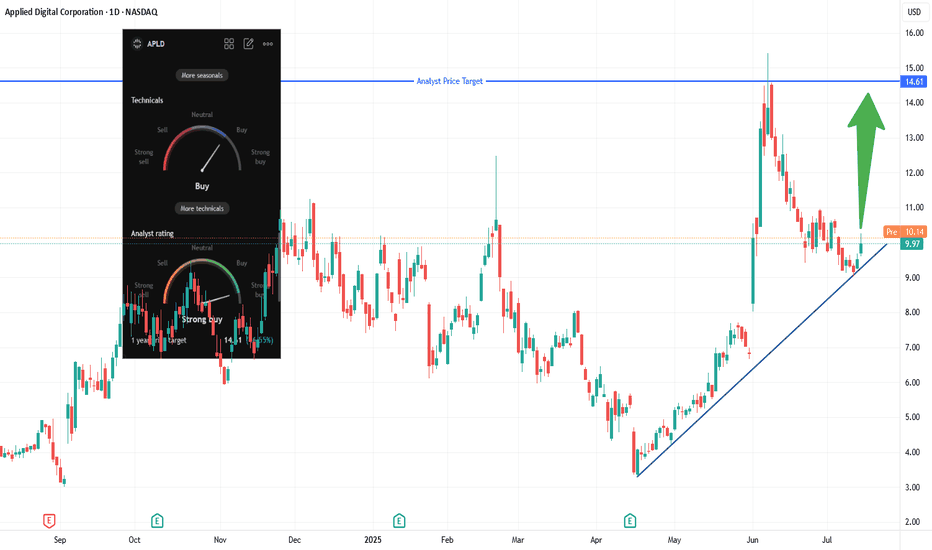

APLD (Applied Digital):EARNINGS TRADE SETUP (2025-07-30)

🚨 **EARNINGS TRADE SETUP: APLD (Applied Digital)**

🗓️ Earnings: **July 31 (AMC)**

💥 Confidence: **65% Moderate Bullish**

🔥 Recent Run: **+94% past 3 months**

🧠 AI Infrastructure Hype + High IV = Opportunity

---

### 📊 FUNDAMENTALS SNAPSHOT

🟢 **Revenue Growth**: +22.1% YoY

🔴 **Profit Margin**: -110.4%

🔴 **Operating Margin**: -34.7%

⚠️ Historical EPS Beat Rate: **12% only**

📈 Analyst Target: **\$14.61** (+42.8% upside)

🔎 **Verdict**: High growth, deep losses — speculative with upside

---

### 🧠 OPTIONS FLOW

💣 **High IV Crush Risk**

🟥 **Put Wall**: \$10.00 (6,700 contracts)

🟩 **Speculative Calls**: \$10.50 & \$11.00 loaded

⚖️ Mixed Sentiment → Tilted Bullish

---

### 📉 TECHNICAL CHECK

💹 Price: **\$10.12**

📉 Below 20D MA (\$10.31)

📌 Support: **\$10.00**

📌 Resistance: **\$10.50**

⚠️ RSI Cooling → Watch for breakout or rejection

---

### 💥 TRADE IDEA

**🎯 Call Option — Strike \$10.50 — Exp 08/01**

💵 Entry: \$0.57

🚀 Profit Target: \$2.28 (200–400% ROI zone)

🛑 Stop Loss: \$0.285

📈 Size: 1 contract (2% of portfolio)

🕓 Exit: 1–2 hours post earnings to avoid IV crush

---

### 🧠 TRADE LOGIC

Risky setup — but technicals + AI narrative + speculative flow = **earnings lotto ticket with strategy.**

💬 *"Speculation with structure beats blind YOLO."*

---

📌 Tag a trader who likes calculated risk 📈

📉 Don’t forget to scale OUT, not just IN.

\#APLD #EarningsPlay #OptionsTrading #TradingView #AIStocks #YOLOWithStops #IVCrushProof #CallOptions #SwingTrade #BullishSetup

APLD heads up at $13.10: Golden Genesis fib may stop the SurgeAPLD on a massive surge over various company news.

Currently about to hit a Golden Genesis fib at $8.10

Looking for usual Dip-to-Fib or Break-and-Retest to buy.

It is PROBABLE that we "orbit" this fib a few times.

It is POSSIBLE that we get a significant dip from here.

It is PLAUSIBLE that we break and run if bulls are hyper.

.

See "Related Publications" for previous EXACT plots --------------------->>>>>>>

.

APLD Trade Setup

🔹 Target: $22.67

🔹 Stop Loss: $9.13

🔹 Entry Zone: Around $15.50 or better on a dip

🔹 Risk/Reward: ~1:1 at CMP, ~2:1 if entry near $13.50

🔹 Bullish momentum intact if it holds above $11.65

📌 Watching for continuation toward 2.0 extension level. Trade safe!

#APLD #TradingView #Stocks #Fibonacci #SwingTrade

APLD Long: Trendline Bounce + CoreWeave AI Lease🎯 Trade Setup Overview

Entry: Market at Open

Stop‑Loss: Below the trendline at ~$9.00

Primary Target: $14.60–$15.50 (analyst zone + historical highs)

Reward/Risk: ~50–60% upside vs ~7–10% downside = solid R:R ~5:1

📈 Technical Rationale

The stock recently bounced off a long‑term ascending trendline, confirming it as key support. A breakout above ~$10.40 would challenge the analyst consensus target zone ($14–15), projecting a favorable conviction trade.

The setup aligns with classic trend‑continuation patterns—lower risk entry at support with clear upside objective.

🤖 Fundamental/Bull Catalysts

Landmark CoreWeave Lease: APLD signed two 15-year leases (250 MW, + optional 150 MW) with Nvidia-backed CoreWeave, expected to generate ~$7 billion in revenue over the term.

Strong Sector Tailwinds: AI infrastructure is surging. CoreWeave is investing billions in new data centers (e.g., 100 MW→300 MW in Pennsylvania). APLD rides this wave as a data-center REIT pivot.

Analyst & Options Sentiment: Analysts target $12.70–13.40; unusual options flow shows heavy interest in calls up to $15 strikes.

📊 Volume & Momentum Metrics

The recent bounce was accompanied by increased volume—a signal of institutional demand and trend continuation.

Technical indicators confirm bullish momentum building.

📝 Trade Plan

Initiate long position around $10.00.

Place stop-loss just under trendline (~$9.00) to limit downside.

Scale out partial at $14.60 (analyst target) and consider holding a tranche toward $15.40 (historic high).

🛠 Risk Considerations

Trend support could fail—if trend breaks below $9.00, cut losses quickly.

Broader tech pullback or AI sector rotation could pressure price—always trail stops accordingly.

Applied Digital Preparing For Lift OffAPLD is looking great, it fell right into my pull back zone and looks like it will run again. I bought $4.50, but sold after bagging 200%. I have been patiently waiting for the next opportunity and I think this is it. I think we have a nice bull flag here that will lead us back up. Not financial advice. DYOR

APLD - SWING TRADE BUYING ZONESAPLD. The stock was in a perfect parallel channel accumulating zone for many days. Finally we saw a breakout 8.47$

The stock rallied almost a 100 percent after the breakout and is still in a good uptrend.

Major rejection was at 10.20 to 11.65 which is the weekly bearish order block. We have seen 4 to 5 sweeps inside this bearish order block previously and now there is no liquidity left inside the order block.

The stock has made a bullish retest on the previous bearish order block at 11.65 and now its acting as a bullish buying zone.

However, there are a lot of bullish Order blocks waiting to be filled in the uptrend.

In my opinion, best way to ride this stock is to wait and buy at the order blocks.

keep adding if it goes down to fill the other order blocks that are present at the breakout.

Good buying zones for a Swing trade are 10.40 , 10.00 and 8.50 which is the strongest and most reliable.

SO WAIT AND ENJOY!

APLD $13.86 buyApplied digital has been on a tear for the past few weeks fuelled by the news that Nvidia has bought a stake in the company and the deal with wall streets latest darling Coreveave.

Digging a little deeper, looking at the options chain there are a huge number of calls all the way up to $20. The short interest is quoted at 36.2% on market beat, as the price rises short sellers will be forced to close their positions by buying back shares fuelling further gains.

In addition to these factors institutional investors have recently been buying large chunks of shares.

This could very well go parabolic

6/4/25 - $apld - Math 101...6/4/25 :: VROCKSTAR :: NASDAQ:APLD

Math 101...

- if you haven't seen by now, NASDAQ:CRWV is the last meme to come out of the money slush go wheee

- i'm not going to short NASDAQ:CRWV , but it's worth significantly less

- i'm also not going to short NASDAQ:APLD b/c it's basically a beta on NASDAQ:CRWV

- but what i'll say is... burning a billy a year and having just deep throated the last earnings release such that the stock was well on it's way to zero (it would actually be worth less than zero if equity didn't get min'd at zero)... well that's one of these situations where you "stay away"

- many times in mkts, you can buy, sell or hold

- but what you don't hear a lot of people saying is "stay away/ ignore". they want to touch the stove. it's a parlay-style degen "investment".

- take it from someone who used to play this game, you ought to know what you're doing

- if you're just guessing... remember... you'll ultimately lose it all.

- IV on this puppy is so sky high that anything can happen next

- but i'll make a friendly bet:

- this stock goes back into the single digits by year-end

- and i'll parlay it all for the degens:

- it's a donut.

enjoy the ride. but beware the animal spirits. because animal spirits can sometimes be pretty low IQ feelings. and feelings don't work out in mkts.

V