Breakout? NYSE:EQT presents an interesting opportunity. After bouncing strong off its support near $48-49, we’re now pushing up into a resistance zone around $54-$56. If this zone yields, a clean breakout could spark a nice rally.

Key risks: if we fail to break resistance, a pullback is likely, possibly t

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.595 EUR

222.73 M EUR

5.04 B EUR

618.10 M

About EQT Corporation

Sector

Industry

CEO

Toby Z. Rice

Website

Headquarters

Pittsburgh

Founded

1888

ISIN

US26884L1098

FIGI

BBG01TNYGB49

EQT Corp. is a natural gas production company, which engages in the provision of supply, transmission, and distribution of natural gas. The company was founded in 1888 and is headquartered in Pittsburgh, PA.

Related stocks

EQT bounce?NYSE:EQT Energy/Oil & Gas sector

NYSE:EQT made a strong green weekly candle and pushed back near the 20 SMA. This shows solid bullish momentum after a period of consolidation.

In my opinion, it looks like a solid setup for a medium-term trade (1–2 months). If the momentum continues, a realist

Natural Gas Equities Showing Relative StrengthNatural Gas was briefly red today but saw a bit of a bullish recovery.

Price action came very close to filling the weekly downside gap but just missed it.

Inventories are set to be released tomorrow at 10:30am

Interestingly, Nat Gas stocks like NYSE:AR & NYSE:EQT showed great relative stre

Natural Gas - The Epic Reversal? Natural gas had an astonishing move to the upside. Closing up over 5% today.

This volatility can make all tarders head spin if youre not used to it.

Why did Nat gas pop today?

Partly from being oversold and into really good technical support, Natural gas inventories were released today at 10:3

NATURAL GAS - Who can Predict this wild beast?Natural gas got demolished today, down over 8%.

The one headline we saw hitting the tape that is having some partial influence:

"Vessel Arrives at LNG Canada to Load First Cargo, Strengthening Global Supply Outlook – LNG Recap"

Today, we did hedge our core long UNG position with a short dated $5

Natural Gas - Silver Lining!Natural gas is ending the day with a daily bottoming tail.

Potentially forming an inverse head and shoulder pattern that takes us above the key $3.83 level.

We took profits on our EQT put hedge! The put contract went up over 100%

Lets see if Nat gas can build some pressure.

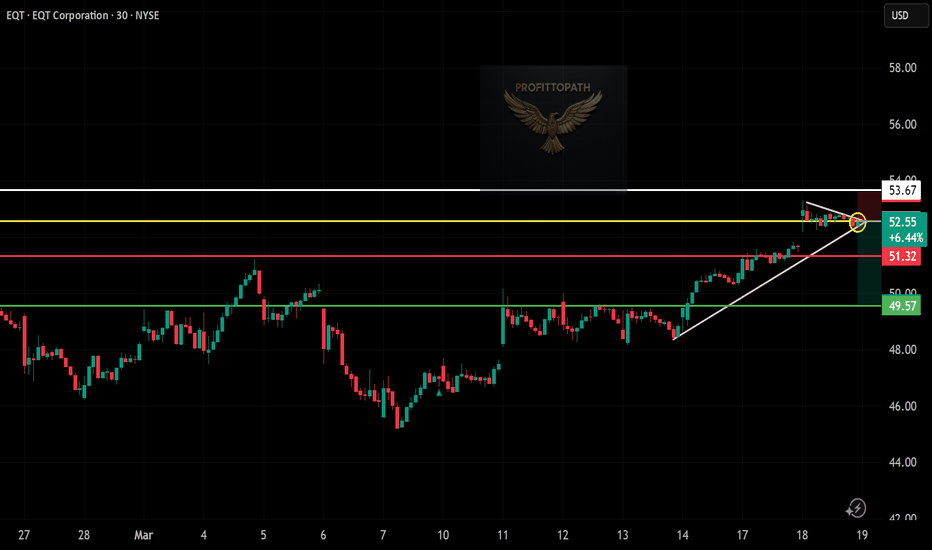

EQT – 30-Min Long Trade Setup!📈

🔹 Ticker: EQT (NYSE)

🔹 Setup Type: Triangle Breakout + Support Retest

🔸 Breakout Price: ~$53.84

📊 Trade Plan (Long Position)

✅ Entry Zone: $53.70–$53.90 (breakout above yellow zone)

✅ Stop Loss (SL): Below $53.13 (white structure support)

✅ Take Profit Targets:

📌 TP1: $55.00 (red zone – short-ter

$EQT - BREAKOUT INCOMING LONG TERM BULLISHEQT Corp. is a leading natural gas production company that's been around for over 135 years! Founded in 1888, this Pittsburgh-based company specializes in providing supply, transmission, and distribution of natural gas.

Whether you're interested in the energy industry or just want to learn more abo

EQT (EQT Corporation) – 30-Min Short Trade Setup! 📉🚨

🔹 Asset: EQT – NYSE

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bearish Breakdown (Rising Wedge Reversal)

📊 Trade Plan (Short Position)

✅ Entry Zone: Below $52.50 (Breakdown Confirmation)

✅ Stop-Loss (SL): Above $53.67 (Key Resistance Level)

🎯 Take Profit Targets

📌 TP1: $51.32 (Support Level)

📌 TP

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

EQT6034686

EQT Corporation 6.5% 15-JUL-2048Yield to maturity

6.94%

Maturity date

Jul 15, 2048

EQT6034693

EQT Corporation 7.5% 01-JUN-2027Yield to maturity

6.57%

Maturity date

Jun 1, 2027

EQT6034685

EQT Corporation 7.5% 01-JUN-2027Yield to maturity

6.17%

Maturity date

Jun 1, 2027

EQT6034678

EQT Corporation 6.5% 15-JUL-2048Yield to maturity

6.13%

Maturity date

Jul 15, 2048

EQT.GA

EQT Corporation 7.75% 15-JUL-2026Yield to maturity

5.46%

Maturity date

Jul 15, 2026

EQT6034689

EQT Corporation 6.375% 01-APR-2029Yield to maturity

5.30%

Maturity date

Apr 1, 2029

EQT6034688

EQT Corporation 7.5% 01-JUN-2030Yield to maturity

5.15%

Maturity date

Jun 1, 2030

EQT6034681

EQT Corporation 6.375% 01-APR-2029Yield to maturity

5.12%

Maturity date

Apr 1, 2029

EQT6034691

EQT Corporation 5.5% 15-JUL-2028Yield to maturity

5.03%

Maturity date

Jul 15, 2028

EQT5735917

EQT Corporation 5.75% 01-FEB-2034Yield to maturity

4.98%

Maturity date

Feb 1, 2034

EQT6034684

EQT Corporation 6.5% 01-JUL-2027Yield to maturity

4.96%

Maturity date

Jul 1, 2027

See all 1EQTC bonds

Curated watchlists where 1EQTC is featured.

Midstream oil: The middlemen of the energy sector

35 No. of Symbols

Upstream oil: Liquid gold extractors

34 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of 1EQTC is 48.590 EUR — it has increased by 3.61% in the past 24 hours. Watch EQT Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange EQT Corporation stocks are traded under the ticker 1EQTC.

1EQTC stock has risen by 8.25% compared to the previous week, the month change is a 9.20% rise, over the last year EQT Corporation has showed a 12.95% increase.

We've gathered analysts' opinions on EQT Corporation future price: according to them, 1EQTC price has a max estimate of 68.18 EUR and a min estimate of 41.76 EUR. Watch 1EQTC chart and read a more detailed EQT Corporation stock forecast: see what analysts think of EQT Corporation and suggest that you do with its stocks.

1EQTC reached its all-time high on Jun 20, 2025 with the price of 52.390 EUR, and its all-time low was 41.185 EUR and was reached on Sep 16, 2025. View more price dynamics on 1EQTC chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

1EQTC stock is 3.49% volatile and has beta coefficient of 0.73. Track EQT Corporation stock price on the chart and check out the list of the most volatile stocks — is EQT Corporation there?

Today EQT Corporation has the market capitalization of 28.96 B, it has increased by 2.58% over the last week.

Yes, you can track EQT Corporation financials in yearly and quarterly reports right on TradingView.

EQT Corporation is going to release the next earnings report on Oct 22, 2025. Keep track of upcoming events with our Earnings Calendar.

1EQTC earnings for the last quarter are 0.38 EUR per share, whereas the estimation was 0.36 EUR resulting in a 7.36% surprise. The estimated earnings for the next quarter are 0.40 EUR per share. See more details about EQT Corporation earnings.

EQT Corporation revenue for the last quarter amounts to 1.36 B EUR, despite the estimated figure of 1.50 B EUR. In the next quarter, revenue is expected to reach 1.58 B EUR.

1EQTC net income for the last quarter is 665.67 M EUR, while the quarter before that showed 223.82 M EUR of net income which accounts for 197.41% change. Track more EQT Corporation financial stats to get the full picture.

Yes, 1EQTC dividends are paid quarterly. The last dividend per share was 0.14 EUR. As of today, Dividend Yield (TTM)% is 1.16%. Tracking EQT Corporation dividends might help you take more informed decisions.

EQT Corporation dividend yield was 1.37% in 2024, and payout ratio reached 140.56%. The year before the numbers were 1.57% and 14.40% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Oct 2, 2025, the company has 1.46 K employees. See our rating of the largest employees — is EQT Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. EQT Corporation EBITDA is 3.63 B EUR, and current EBITDA margin is 40.78%. See more stats in EQT Corporation financial statements.

Like other stocks, 1EQTC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade EQT Corporation stock right from TradingView charts — choose your broker and connect to your account.