FICO and the FedNow that NYSE:UNH has started to pick up due to the shares acquired by many large names, we need to turn our attention to companies not yet in the news cycle. One of these companies is NYSE:FICO , which handles credit worthiness scores. But why, in a time where home buyers and consumers are being crushed at every turn, would a credit solutions agency be a good buy? The answer is because it is forward looking, and we are looking toward a time of, more likely than not, lower interest rates.

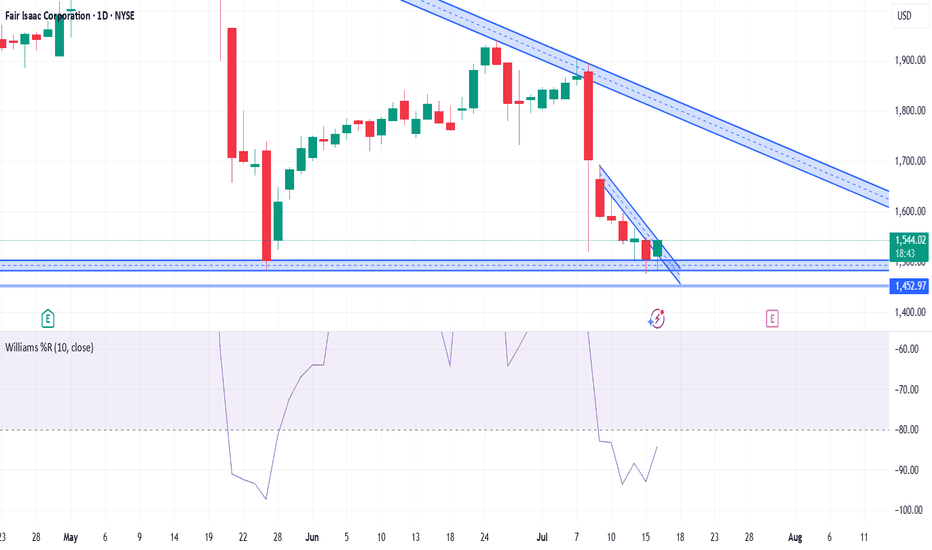

First let’s look at the charts...

As you can see, from the all-time high, FICO is at a 40% discount. So, we are following the universal rule of buying low. Now all we must do is sell high. Based on Powell's speech at Jackson Hole, we can see that the Fed is gearing up to cut interest rates. You can also see this is the case with the amount of debt-buying taking place in the bond market...

So, the problem is not IF they'll cut rates, but WHEN and by how much. In agreement with what most people see coming, expect the next meeting to lead to a 25 bps drop in the $FRED:FEDFUNDS. When this happens, you can also expect the credit agencies to blast off onto the horizon. (Written before Sep 16-17 meeting)

Before we get to the exit plan, we do have some housekeeping. It should be noted that FICO, in the practical sense, is no longer a monopoly. Equifax has been approved for its rating system by the government, so this trade does not come without risk. The good news is that as rates get lowered we can expect more people to take on more debt (because it is cheaper), which will boost the demand for FICO's rating abilities. We should aim for a timeframe before the next earnings call to get out of this trade, but the usual target of 3 to 6 months remains as the timeframe for holding this position. A longer period can be justified based off any unusual performance. The price target will be set at $2,000.

Trade ideas

How's your credit? Is FICO about to breakout?NYSE:FICO has caught our attention after being significantly beaten down and recently hitting a 52-week low. However, we're now seeing some encouraging strength as the stock approaches our VWAP resistance area, suggesting a potential reversal may be in play.

Trade Setup

Entry: Bullish above breakout level around $1,480

Target: Looking for a move toward $1,900 (representing a 25-30% upside potential)

Rationale

Technical bounce from oversold levels. Reclaimed 52 week breakdown lows.

The risk/reward setup looks attractive given the stock's recent weakness and current positioning near key technical levels. A clean break above $1,480 could signal the start of a meaningful recovery.

7/30/25 - $fico - Probs a buy7/30/25 :: VROCKSTAR :: NYSE:FICO

Probs a buy

- not really my cup of cottage cheese

- but these growth/ mgns and strong fcf generation (2.5% fwd) speak for themselves

- look at $LC... people are handing out debt to whichever person wants to finance their NYSE:CMG burrito with installments

- hard to imagine in a consumer-gone-wild environment this thing doesn't do well on these results

V

FICO's Monopoly: Cracks in the Credit Kingdom?For decades, Fair Isaac Corporation (FICO) has maintained an unparalleled grip on the American credit system. Its FICO score became the de facto standard for assessing creditworthiness, underpinning virtually every mortgage, loan, and credit card. This dominance was cemented by a highly profitable business model: the three major credit bureaus—Equifax, Experian, and TransUnion—each paid FICO for independent licenses, generating a significant percentage of revenue per inquiry and establishing a seemingly unassailable monopoly.

However, this long-standing reign now faces an unprecedented challenge. The Federal Housing Finance Agency (FHFA) Director, Bill Pulte, recently signaled a potential shift to a "2-out-of-3" model for credit bureaus. This seemingly technical adjustment carries profound implications, as it could render one of FICO's three bureau licenses redundant, potentially evaporating up to 33% of its highly profitable revenue. Director Pulte has also publicly criticized FICO's recent 41% increase in wholesale mortgage score fees, contributing to significant declines in FICO's stock price and drawing broader regulatory scrutiny over its perceived anti-competitive practices.

This regulatory pressure extends beyond FICO's immediate revenue, hinting at a broader dismantling of the traditional credit monopoly. The FHFA's actions could pave the way for alternative credit scoring models, like VantageScore, and encourage innovation from fintech companies and other data sources. This increased competition threatens to reshape the landscape of credit assessment, potentially leading to a more diversified and competitive market where FICO's once-unchallenged position is significantly diluted.

Despite these formidable headwinds, FICO retains considerable financial strength, boasting impressive profit margins and robust revenue growth, particularly within its Scores segment. The company's Software segment, offering a decision intelligence platform, also presents a significant growth opportunity, with projected increases in annual recurring revenue. While FICO navigates this pivotal period of regulatory scrutiny and emerging competition, its ability to adapt and leverage its diversified business will be crucial in determining its future role in the evolving American credit market.

Looking to get into ficoThis may take awhile to play out because i think this correction will be very choppy. But I have alerts/buys setup to but at $1300. Fundamentally and technically this seems like a good area to buy into this high quality business. Green horizontals are my levels of interest, i'd like to see these hold or break and then recover quickly. The 50 month ema has been a good spot to buy historically, that looks to be in play as time progresses.

Fair Isaac at fair value?The chart suggests we topped out in Wave 5, now we’re in the wave C of a corrective move. Great company, but trading above its fair value. I wouldn’t touch this stock until the correction is over and we find a base. There’s levels of support below, so keep an eye out on this one if you want to go long or invest in this great company.

Not financial advice

$FICOFICO has formed a textbook double bottom, signaling a bullish reversal. The stock surged ~18% from the pattern’s low (~$1,600) to the breakout above the neckline (~$1,910). Simple TA suggests a total move of ~36% from the bottom, targeting ~$2,300. With the breakout confirmed and FICO halfway through the post-breakout move (~9% gained, ~9% remaining), there’s still meaningful upside. Volume confirmation and strong fundamentals support the move, along with earnings.

About to curve on the MACD but still has major support at 280sThe MACD is already positioned to start curving the stochastic, and the RSI is way oversold but can run flat daily along with a DT on the RSI, with no confirmation on other indicators or oscillators. This is headed towards filling a gap beginning at the 1980 mark, but I wouldn't be surprised to see it hit the 1960s when the Bollinger starts to narrow, which could also be used as support, short term.

Will $FICO continue its ascend? After the bottom in May of 2022, the price gapped up and broke through its resistance in $550.

Then formed a base to digest this move before continuing its trend up, this was my signal to buy as it broke out above $636. After that it didn't follow through and its RSI signaled weakness so I sold.

I don't like to hold positions that aren't going anywhere even if I'm on profit.

Still, its relative strength againts its benchmark ( AMEX:IJH ) shows leadership and the price is still near highs so, I'll wait and see if it can breakout this base-over-base.

The RS ratio already broke out, the price could follow.

If not, I won't buy it again.

$FICO with a slight bullish outlook after earnings$FICO posted its earnings with positive under reaction following the release with the PEAD projecting a slight bullish outlook for the stock.

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

Look at the signs before going LONG4Price action tells you a lot about the timing to go long or short. Some traders got it fairly accurately, able to catch the bottom or top while others still find it illusionary and mysterious.

Now, let's say you have done your research and are keen to buy this stock.

By looking closely at the chart, it tells us several things :

1. Price has come to some sort of a standstill since early June

2. It stays sideway for a while before attempting to break out of the resistance at 436.98 on 31 July 2020.

3. It failed and tumbled down until 31 August 2020.

4. On 1st Sept, 17th Sep & 7th Oct - it tried to break out again but both attempts were failure.

5. Now, we are at the bullish trend line and within this week, it will attempt once more to break the resistance level. If it cleared the 436.98 level, it might face another challenge at 450.47. This critical level must be broken up before we can consider it to go even higher.

6. Failure to do so, we can safely expect the price to tumble to 400 level. There, we have to wait and see if it gains any support. If not, the next level will be 346.52.

With this basic information, if you want to long this counter, does it not tell you to be patient and put it in the watch list first ? We want to buy low, like 346.52 or 400 compared to current price and the only way to get at that price is to WAIT. Being patient is a virtue in investing and one must learn to cultivate that.

However, there is a difference between being patient and being a procrastinator. The latter appears to be patient on the surface but in reality, he finds excuses why he should not go long. He has too many "What ifs" on his mind and choose to wait to see the outcome first. He needs assurance and safety but his commitment to action is minimal at best. He kept waiting , believing given time, he will have more resources, better equipped , blah blah blah to make his decisions. In actual fact, he did not take any action other than inaction.

Analysis paralysis in any facets of our lives serve us no purpose. There are always fresh information that can affect the price , the company's revenue or a new competitor ,etc. We can't have COMPLETE information on hand before making a decision. We deal with what we have on hand and make a projection , based on past historical patterns and data provided.

The outcome will tell us what is the probability of us being right or wrong OVER TIME.