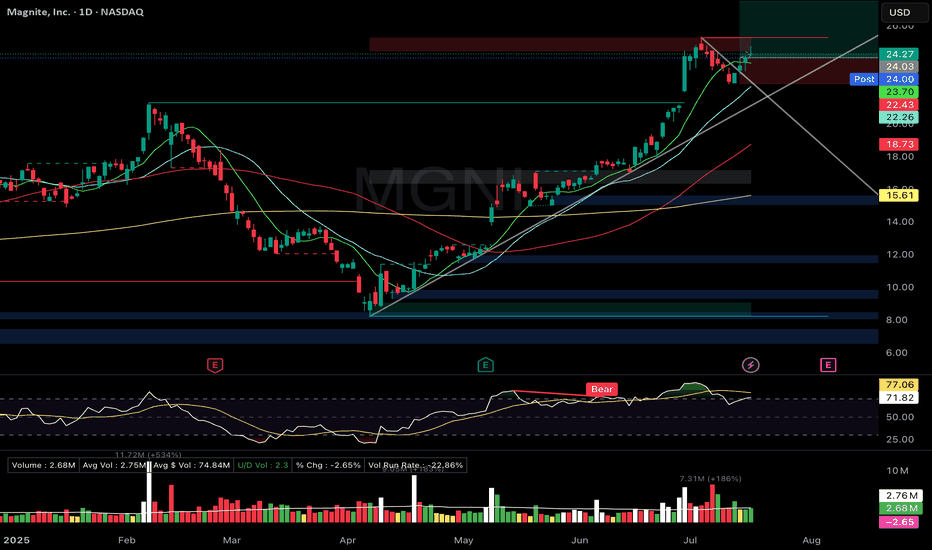

MGNI- Flag breakout. Long upper wick → cooling expectedMGNI – Magnite Inc.

Setup Grade: B+

• Entry: $24.03 (7/17)

• Status: Active

• Stop: $22.43

• Setup: Flag breakout. Long upper wick → cooling expected. RSI ~71.8 (overbought). ATH = $25.27.

• Plan: Hold unless stop breaks. Let RSI cool, watch for continuation.

• Earnings: August 6

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.26 EUR

22.01 M EUR

645.44 M EUR

138.99 M

About Magnite, Inc.

Sector

Industry

CEO

Michael G. Barrett

Website

Headquarters

New York

Founded

2007

ISIN

US55955D1000

FIGI

BBG01TNX9ZV6

Magnite, Inc. provides a technology solution to automate the purchase and sale of digital advertising inventory for buyers and sellers. It features applications and services for digital advertising sellers including websites, mobile applications, and other digital media properties. The company was founded by Frank Addante, Duc Chau, Craig Roah, Julie Mattern and Brian D. Baumgart on April 20, 2007 and is headquartered in New York, NY.

Related stocks

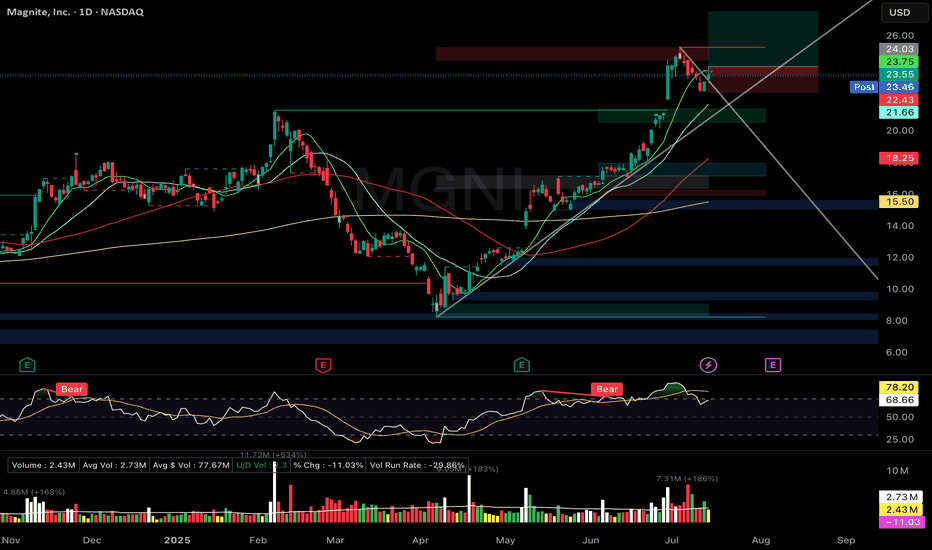

MGNI Zanger-style Bull Flag Breakout PullbackMagnite Inc. (MGNI)

🚀 Entry: $24.03

📊 Setup: Zanger-style Bull Flag Breakout Pullback

🛑 Stop: $22.43

🎯 Target: $27.50

🔑 Why I Entered:

Picture-perfect bull-flag pullback pattern with volume drying significantly, tapping precisely on the rising trendline.

Price action holding strong above risi

Long Trade Setup Breakdown for Magnite, Inc. (MGNI) - 30-Min!📊

🔹 Asset: Magnite, Inc. (MGNI)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Symmetrical Triangle Breakout

🚀 Trade Plan (Long Position):

✅ Entry Zone: $20.52 (Breakout Confirmation)

✅ Stop-Loss (SL): $19.72 (Below Support)

🎯 Take Profit Targets (Long Trade):

📌 TP1: $21.27 (First Resistance)

📌 TP2: $2

MGNI - Dec 24 Opening Sustainable Momentum

Grading B 6 points

No idea, it is a pure technical play +1

Greater force - There is alignment with RUT +2

Technicals - Break of consolidation, break below H1 SMA100, H1 Opening candle bull rejection candle +3

Opening Sustainable Momentum 🧑🏻🚀

Strategy

Signals identify market opening H1 candl

MGNI following value channel 2021 trendline

Establishing it's rising trajectory prior to 2021, MGNI has established a value channel trend from 4 near today's price of 13. With the current pullback into the fib pocket I can see a possibility of the price being supported and continuing through the trend channel paired with positive developme

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Frequently Asked Questions

The current price of 1MGNI is 20.70 EUR — it hasn't changed in the past 24 hours. Watch Magnite, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange Magnite, Inc. stocks are traded under the ticker 1MGNI.

1MGNI stock has fallen by −7.59% compared to the previous week, the month change is a 3.99% rise, over the last year Magnite, Inc. has showed a 94.27% increase.

We've gathered analysts' opinions on Magnite, Inc. future price: according to them, 1MGNI price has a max estimate of 33.34 EUR and a min estimate of 20.51 EUR. Watch 1MGNI chart and read a more detailed Magnite, Inc. stock forecast: see what analysts think of Magnite, Inc. and suggest that you do with its stocks.

1MGNI reached its all-time high on Sep 1, 2025 with the price of 22.40 EUR, and its all-time low was 10.66 EUR and was reached on Apr 25, 2025. View more price dynamics on 1MGNI chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

1MGNI stock is 0.00% volatile and has beta coefficient of 1.72. Track Magnite, Inc. stock price on the chart and check out the list of the most volatile stocks — is Magnite, Inc. there?

Today Magnite, Inc. has the market capitalization of 2.91 B, it has increased by 1.89% over the last week.

Yes, you can track Magnite, Inc. financials in yearly and quarterly reports right on TradingView.

Magnite, Inc. is going to release the next earnings report on Nov 5, 2025. Keep track of upcoming events with our Earnings Calendar.

1MGNI earnings for the last quarter are 0.17 EUR per share, whereas the estimation was 0.14 EUR resulting in a 20.19% surprise. The estimated earnings for the next quarter are 0.17 EUR per share. See more details about Magnite, Inc. earnings.

Magnite, Inc. revenue for the last quarter amounts to 137.52 M EUR, despite the estimated figure of 133.65 M EUR. In the next quarter, revenue is expected to reach 139.55 M EUR.

1MGNI net income for the last quarter is 9.46 M EUR, while the quarter before that showed −8.91 M EUR of net income which accounts for 206.19% change. Track more Magnite, Inc. financial stats to get the full picture.

No, 1MGNI doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Sep 11, 2025, the company has 905 employees. See our rating of the largest employees — is Magnite, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Magnite, Inc. EBITDA is 114.14 M EUR, and current EBITDA margin is 16.40%. See more stats in Magnite, Inc. financial statements.

Like other stocks, 1MGNI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Magnite, Inc. stock right from TradingView charts — choose your broker and connect to your account.