Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.180 EUR

−76.78 M EUR

58.55 M EUR

474.45 M

About Uranium Energy Corp.

Sector

Industry

CEO

Amir Adnani

Website

Headquarters

Corpus Christi

Founded

2003

ISIN

US9168961038

FIGI

BBG01TNXP606

Uranium Energy Corp. engages in the provision of uranium and titanium mining and related activities, including exploration, pre-extraction, extraction, and processing of uranium concentrates, and titanium minerals. It operates through the following geographical segments: Wyoming, Texas, Saskatchewan, and Others. The company was founded by Alan P. Lindsay and Amir Adnani on May 16, 2003 and is headquartered in Corpus Christi, TX.

Related stocks

Uranium Energy Corp Weekly Outlook (Count 1)Here is my weekly outlook on AMEX:UEC .

UEC is one of my bigger holdings, I've added at various times as shown on the chart (see green dashed lines).

In this outlook i am viewing the price action from the lows in Mar 2020 to the end point of wave (1) as a leading diagonal pattern. After that we

UEC - Catching a Knife I've had UEC on my watchlist for some time and have been waiting to jump in on a meaningful pullback. I believe there was some micro-wave count that I can't seem to fully track for the midst of wave 3, but this isn't uncommon. There is a chance I'm entering long too early here, if this local low fal

UEC eyes on $11.64: Golden Genesis fib Break-n-Run in progress? UEC just stabbed through a Golden Genesis fib at $11.64

Last ATH print was during orbit of this fib, before rejection.

After retrace it has now broken through, possibly for good.

.

Previous Analysis that caught the BOTTOM

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

============

Uranium Energy Corp. (UEC) Rises on Nuclear DemandUranium Energy Corp. (UEC) is a U.S.-based uranium mining and exploration company with a growing portfolio of projects across North and South America. Focused on in-situ recovery mining, UEC supplies uranium for nuclear power, supporting the clean energy transition and energy security goals. The com

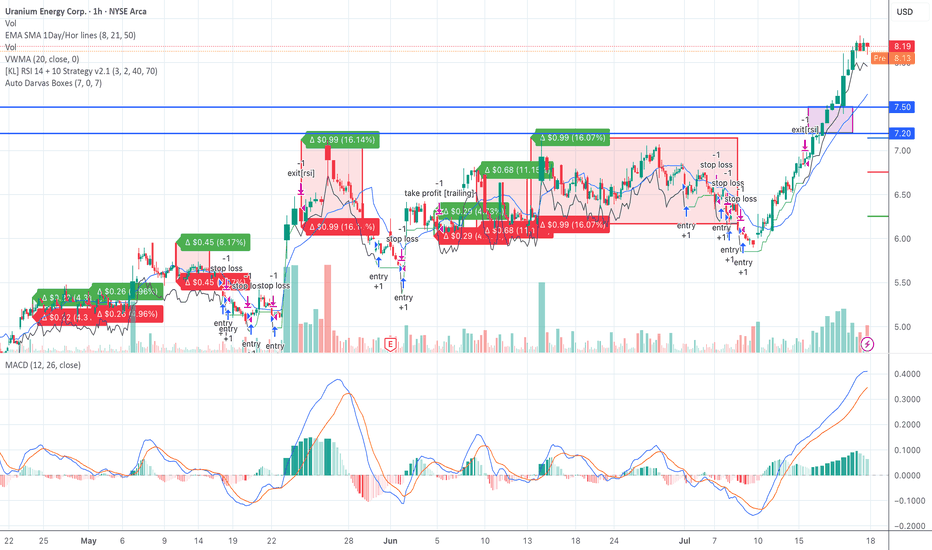

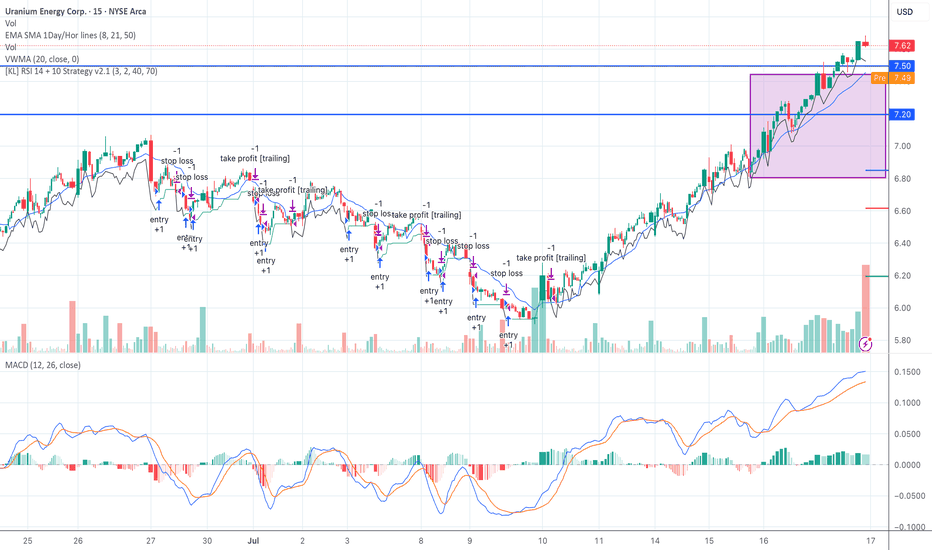

UEC Breakout Confirmed — Seed System Entry Active Above $7.50UEC confirmed a breakout above the $7.20–$7.50 Darvas Box we've been tracking.

Entry triggered at $7.51 on rising volume. Price is holding above VWMA ($7.64) and the EMA stack (8, 21, 50). MACD is showing strong momentum, and RSI remains in a healthy range.

Target 1: $8.50

Target 2: $9.00

Stop los

UEC Box Breakout Confirmed – Riding VWMA on VolumeUEC broke out of the $6.80–$7.45 box with volume and is holding strong. VWMA rising, MACD trending, and RSI strategy taking partials.

Watching $8.00 for target, $7.20 as trailing stop zone.

Classic Seed System box breakout — low risk, clean structure.

#UEC #SeedSystem #BreakoutTrade #VolumeConfir

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

NUKL

VanEck Uranium and Nuclear Technologies UCITS ETF Accum A USDWeight

5.34%

Market value

88.03 M

USD

Explore more ETFs

Frequently Asked Questions

The current price of 1UEC is 11.812 EUR — it has decreased by −0.62% in the past 24 hours. Watch Uranium Energy Corp. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange Uranium Energy Corp. stocks are traded under the ticker 1UEC.

1UEC stock has risen by 11.86% compared to the previous week, the month change is a 4.77% rise, over the last year Uranium Energy Corp. has showed a 159.40% increase.

We've gathered analysts' opinions on Uranium Energy Corp. future price: according to them, 1UEC price has a max estimate of 16.96 EUR and a min estimate of 12.02 EUR. Watch 1UEC chart and read a more detailed Uranium Energy Corp. stock forecast: see what analysts think of Uranium Energy Corp. and suggest that you do with its stocks.

1UEC reached its all-time high on Oct 16, 2025 with the price of 15.184 EUR, and its all-time low was 4.516 EUR and was reached on May 22, 2025. View more price dynamics on 1UEC chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

1UEC stock is 4.10% volatile and has beta coefficient of 1.27. Track Uranium Energy Corp. stock price on the chart and check out the list of the most volatile stocks — is Uranium Energy Corp. there?

Today Uranium Energy Corp. has the market capitalization of 5.71 B, it has increased by 0.80% over the last week.

Yes, you can track Uranium Energy Corp. financials in yearly and quarterly reports right on TradingView.

Uranium Energy Corp. is going to release the next earnings report on Dec 10, 2025. Keep track of upcoming events with our Earnings Calendar.

1UEC earnings for the last quarter are −0.05 EUR per share, whereas the estimation was −0.03 EUR resulting in a −69.49% surprise. The estimated earnings for the next quarter are −0.01 EUR per share. See more details about Uranium Energy Corp. earnings.

Uranium Energy Corp. revenue for the last quarter amounts to 0.00 EUR, despite the estimated figure of 7.45 M EUR. In the next quarter, revenue is expected to reach 4.90 M EUR.

1UEC net income for the last quarter is −23.70 M EUR, while the quarter before that showed −26.68 M EUR of net income which accounts for 11.17% change. Track more Uranium Energy Corp. financial stats to get the full picture.

No, 1UEC doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Dec 7, 2025, the company has 171 employees. See our rating of the largest employees — is Uranium Energy Corp. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Uranium Energy Corp. EBITDA is −60.31 M EUR, and current EBITDA margin is −103.01%. See more stats in Uranium Energy Corp. financial statements.

Like other stocks, 1UEC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Uranium Energy Corp. stock right from TradingView charts — choose your broker and connect to your account.