BITDEER – Bullish Outlook as Blockchain Meets AI PowerhouseBitdeer Technologies Group NASDAQ:BTDR is gaining serious traction as a dual-play on blockchain infrastructure and AI-driven compute power. The company operates at the intersection of crypto mining and artificial intelligence cloud services, offering exposure to two of the most dynamic sectors in tech.

🔍 Key Catalysts:

🚀 Revenue Momentum

Q2 2025 revenue surged +56.8% YoY, driven by expanding mining operations and renewed Bitcoin market strength.

📈 Massive Hashrate Growth

Bitdeer targets 40 EH/s of self-mining capacity by October, making it one of the largest global mining operators, well-positioned to ride institutional Bitcoin adoption.

🧠 AI Infrastructure Expansion

Transitioning beyond pure crypto, BTDR is doubling down on high-performance computing (HPC). Its AI Cloud platform, which won the 2025 AI Breakthrough Award, utilizes 1.6 GW of power capacity to run demanding AI workloads—marking a major evolution in the company’s model.

🌍 Global Footprint

A diversified presence across multiple geographies adds scalability and shields against regulatory shifts—a key edge in today’s policy-sensitive environment.

📌 Technical Setup:

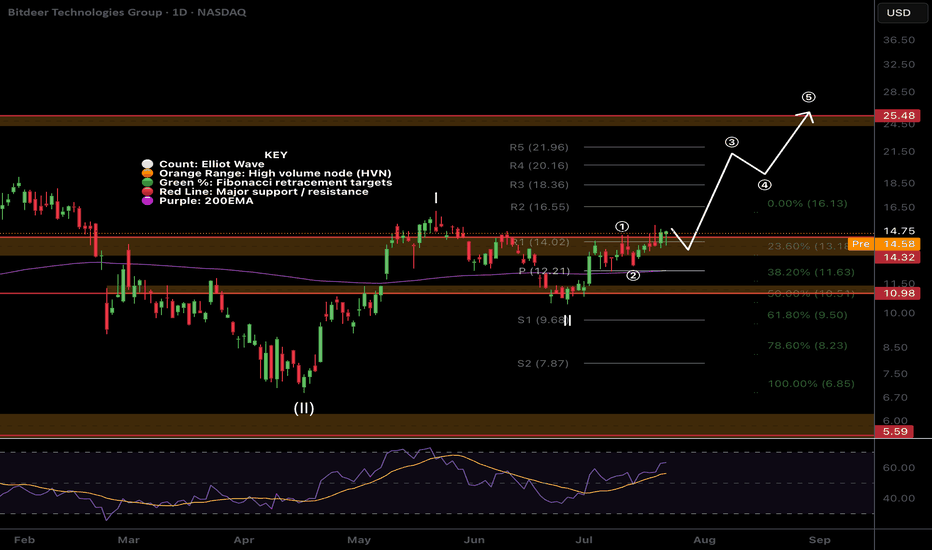

We are bullish above the $14.00–$14.25 breakout zone. Sustained price action above this level could pave the way for an upside target of $27.00–$28.00 in the medium term.

BTDR trade ideas

BTDR Closed above the weekly pivot!NASDAQ:BTDR Wave (3) is underway and price has overcome the weekly pivot for now and bulls want to see this hold! The trend is up, the supports have been tested and the all time High Volume Node is the next target $25.

Fibonacci extension targets are minimum if $38 at the 1.618 with possibility to overextended bringing up the next target of the R5 weekly pivot at $76

RSI is not overbought and has plenty of room to grow, reaching the next leg often kicks in serious momentum!

Safe trading

BTDR Bounces from previous swing high support!NASDAQ:BTDR found support at the at the wave 1 high and R1 pivot and looks poised to continue to the first take profit target and all time High Volume Node tat $25! Wave (3) of 3 appears to be underway so should continue to be powerful!

Analysis is invalidated if we drop below $13 and lose the High Volume Node support which sits at the Fibonacci golden from the wave (2) bottom.

RSI did not reach overbought so has room to grow.

Safe trading

BTDR - Breakout is Inevitable Now, this is originally a SPAC corporation, as such historical price movement is abnormal and choppy, so I do not have the long-term wavecount. However this is what I do know:

Structure on the initial impulse is CLEAN.

Condensing VWAP zone (origin of those points is ATH and SPAC merger date)

It looks like price is getting ready to form a third-wave extension to take us to $20 (oh look an analyst firm said $20 a share whaaaat)

However, with no long-term wave-count I can only give this

Wave-Count Confidence: Medium/Average

Bitdeer We got the Breakout! BTDRLocal Analysis / Targets / Elliot Wave

NASDAQ:BTDR Price is breaking out aggressively as predicted in previous analysis. We got the push above the descending resistance line. The next target is the $24 all time High Volume Node resistance but wave 3 minimum target is above $30 per the Fibonacci extension tool.

RSI is overbought but with no divergences yet and can remain this way for weeks.

Standard Deviation Band Analysis

Standard deviation bands fair value line was tested as support and price is about to breakout above the SD+3 threshold starting a new trend into price discovery with a $50 target. Traders should still be cautious of a rejection in this area.

Safe trading

BTDR US ( Bitdeer Technologies Group) Long#Invest #US #BTDR #BTC #USDT

Bitdeer Technologies Group

Demonstrates Growth Through a Combination of Operational Improvements, Industry Trends, and Strategic Initiatives

Now, in order:

Bitdeer reported a significant 56.8% year-over-year revenue increase in Q2 2025 to $155.6 million. This growth was driven by a 42% increase in mining revenue and mining hardware sales

The company increased its monthly bitcoin mining volume by 45.6% in April 2025 compared to March

The rise in the price of bitcoin has directly impacted the profitability of Bitdeer's mining operations

Tether, the issuer of USDT , increased its stake in Bitdeer to 21.4% in March 2025, and then to over 24% in April

The company is actively expanding its energy and data center capacity. 361 MW of capacity has been commissioned since the beginning of 2025, with the total available electrical capacity reaching 1.3 GW. This is expected to increase to 1.6 GW by the end of the year

Bitdeer has confirmed that it is on track to reach its own hashrate of 40 EH/s by the end of October 2025, and plans to exceed this figure by the end of the year

The company is focusing on the SEALMINER A4 project, which aims to achieve unprecedented chip efficiency of around 5 J/Th

Bitdeer plans to set up a production line in the US

Bitdeer held 1,502 bitcoins (worth around $170 million at the time) at the end of Q2 2025, up significantly from 113 BTC the year before

BTDR - Bitdeer Technologies - Break out with high VolumeHello Everyone,

Hope you have a good Weekend so far and happy Sunday in advance ;)

Today i will share some stocks to watch out for next week and Frist one is Bitdeer Technologies.

What are they doing?

Bitdeer Technologies Group is a leading global provider of digital asset mining services. The company offers a range of services, including cloud mining, colocation mining and mining management. It is based in Singapore and has mining data centres in the United States and Norway.

Operating in the technology industry, Bitdeer Technologies Group is committed to providing customers with reliable and efficient digital asset mining services. The company's cloud mining platform allows users to mine digital assets without the need to purchase or maintain their own mining hardware.

As you can understand they are depended on Bitcoin .

Financials:

Market Cap : 3.18 B

Revenue : 356.76 M

P/E Ratio : - 7.43

EPS : -2.1726

End of 2024 Net Change in Cash : 185.93 M This is a good sign for business sustainability

Technical Part:

On Friday they made a good jump over %14 and volume is supporting this Jump. I see that it also broke up the down trend to UP ,and i am expecting to continue this trend. It could try to re-test and go back to 14.90 - 15.10 , if it will do this then these Levels would be a good entry point. If not then I will wait to break up of 16.60 and if it close over this level then i could jump in it. My first target is 20.00 - 20.50 which is approx %25 over from today's price.

I have already added BTDR to my watch list and i will wait for best price to buy.

This is just my thinking and it is not invesment suggestion , please do not make any decision with my analysis.

Have a good evening and happy Sunday to all

BTDR Still in a triangle, Wave c of (C) downNASDAQ:BTDR Bitdeer was rejected harshly on the 4th test of the High Volume Node (HVN) resistance, each test weakening the Node and adding probability to a breakout.

Wave c of an ABC within a triangle wave (C) appears to be underway with price closing below both the daily pivot and 200EMA. RSI has slight bullish divergence.

Until we get a break below wave (A) or a above wave (B) the analysis is good. Will readjust and update if anything changes. A breakdown below the triangle has a wave 2 target of the golden pocket Fibonacci retracement and HVN support at $9.63 and may offer a great buying opportunity.

Breakout target is the R5 daily pivot at $21.84

Safe trading

$BTDR Pressure Building?NASDAQ:BTDR still appears to be in a wave 2 triangle building pressure for a significant wave 3 up into price discovery.

Wave (II) found support a the golden pocket, shallower than the other miners! Price has tested the upper boundary of the triangle and High Volume Node multiple times at $15 and only once at the bottom threshold hinting at a breakout upwards. Each test makes the boundary weaker.

The weekly pivot point at $17 is the first area of resistance to watch followed by the all time high at $25

Analysis is invalidated below $6.44. RSI is only at the EQ so has room to grow.

Safe trading

$BTDR Closed above resistance!NASDAQ:BTDR Bitdeer closed above major resistance yesterday, despite BTC and alt coins having a bearish day, triggering our long signal in the Weekly Trade signals substack.

I am looking for price to start to accelerate in wave 3 and resistance now support to hold. If BTC reverses it will add additional tailwinds with a target of the major resistance above the R5 daily pivot $24

Safe trading

2/25/25 - $btdr - Time to get large2/25/25 :: VROCKSTAR :: NASDAQ:BTDR

Time to get large

- novel way to save energy in chips

- nobody knows

- the results, who cares

- wrong day to be a bitcoin company

- ape'd on the LT options $5 calls for '27. started building my longer-dated warchest now that we're below $10 level i was looking for.

- be safe out there

- wtf day.

V

2/19/25 - $btdr - Building core position <$152/19/25 :: VROCKSTAR :: NASDAQ:BTDR

Building core position <$15

- will post on this one a lot in the coming year(s)

- Jihan founded bitmain which supplies 90% of the bitcoin chips today, was kicked out and is coming back to own the whole industry

- NASDAQ:BTDR is a semiconductor company that looks to the untrained eye as "just another miner"

- the smartest players want to own as much of this as possible. Jihan has controlling interest, he's not selling, so they'll need to hit the open market

- genuinely hope they send this thing back to sub $10, and i'll take it to a 10-15% position and probably with big leverage too.

- for now, i'm starting with a 1.5% position and will look to grow it.

- when i say you need to buy stuff within bitcoin that will outperform the bitcoin pair in the LT... and because otherwise you just become a beta punching bag (like the other miners that are price takers), this name making it's own chips can do just that.

V

Bear Flags Are Everywhere. The Santa Rally Is Doomed.I’m going through my watch list this morning and I’m removing a lot of stocks from it that have formed bear flags after the selloff on Dec 18th.

If you’re a dip buyer maybe you like pullbacks. But if you’re a technical trader you can quickly spot the bear flag on this chart.

See that high volume distribution day followed by lower volume as the price trickles back up? I’d steer clear of this stock for the moment, because that’s classic bear flag behavior.

This stock, and many that look just like it, want to go lower.

Some of these look like they are about to recover. Let’s have a look at BTDR. It’s threatening to take out the previous high, and it might. But don’t jump at it too soon. Until it starts a proper uptrend it’s at high risk to break back down and take out previous lows.

Don’t be fooled into putting your cash into the market just because the Santa Rally is supposed to be coming. Odds are good that it’s not, or that only the strongest stocks and sectors will rally.

Until a stock proves itself a winner, by taking out previous highs, or proves itself a loser, by taking out the distribution day lows, steer clear and look elsewhere to invest your money.

BTDR - Daily - Overextended?"Click Here🖱️ and scroll down👇 for the technical, and more behind this trade!!!

________________________________________________________

________________________________________________________

========================

..........✋NFA👍..........

========================

📈Technical/Fundamental/Target Standpoint⬅️

1.) Rising Mining Difficulty: The recent increase in Bitcoin's mining difficulty poses a significant challenge for miners like BTDR, especially those who are not energy-efficient. This could erode their profit margins.

2.) Declining Financial Performance: The company's projected reduced revenue and negative net income for the past three quarters of 2024 indicate a concerning trend.

3.) Potential Lagging Correction: Given the recent correction in Cleanspark, a similar downward trend for BTDR seems likely, especially considering their similar business models.

🌎Global Market Sentiment⬅️

Bullish Factors:

- Historical Data: The 62% chance likely stems from historical data showing a tendency for positive performance in December.

- Potential Rate Cuts: Market expectations of potential rate cuts by the Fed could boost investor sentiment and drive asset prices higher.

Bearish Factors:

- Economic Uncertainty: The possibility of a recession could negatively impact market sentiment and lead to increased volatility.

- Fed's Tight Monetary Policy: The Fed's ongoing efforts to combat inflation through higher interest rates could put downward pressure on asset prices.

=================================

...🎉🎉🎉Before You Go🎉🎉🎉…

=================================

Leave a like👍 and/or comment💬.

We appreciate and value everyone's feedback!

- assetsandcoffee📈☕"

Technical Analysis of Bitdeer Technologies Group.Long Position:

Entry Point: Consider entering a long position if the stock breaks and holds above $12.00.

Target Price: $15.00

Stop Loss: $10.50 (to protect against significant downside risk)

Short Position:

Entry Point: A short position could be considered if the stock falls below $10.00.

Target Price: $8.50

Stop Loss: $11.00 (to limit potential losses)

Based on the technical indicators and current price action, Bitdeer Technologies Group exhibits strong potential for further growth. Analysts have set a 1-year price target of $15.06, representing a potential upside of approximately 31.16% from the current price.

Bullish Scenario: If the stock maintains its upward momentum, breaking through the resistance level at $12.50, we could see a quick rally towards $15.00. The strong buy rating from analysts further supports this view.

Bearish Scenario: Should the stock face downward pressure, critical support levels are at $10.50 and $9.50. A breach below these levels could indicate a trend reversal.

Bitdeer Technologies Group is positioned well for growth with its current bullish trend and positive technical indicators. However, traders should remain vigilant and use appropriate stop-loss orders to manage risk effectively. The stock's balanced RSI and strong moving averages make it an attractive candidate for long positions, with a speculative price target of $15.00 within the next year.

BITDEER deserves to be re-rated HIGHERBased on fundamentals and technicals of course!

This company I expect to comfortably trade as a double digit company by years end

And during the #Bitcoin bull top even has the potential to tag this log projection

we can see an Inverse head and shoulders clearly being formed.

Yet to trigger, but it has some impressive projections.

Will Bitdeer outperform it's more well known rival #Mining competitors?