What traders are saying

Sunrun (RUN)Sunrun (RUN) is the largest company in the U.S. residential solar systems market. It installs home solar panels and batteries under a “solar-as-a-service” model—customers enter into long-term leases or power purchase agreements (PPAs) instead of making a one-time equipment purchase. This approach lowers upfront costs for consumers switching to solar energy, while Sunrun generates the bulk of its revenue from recurring subscription payments and by monetizing renewable energy–related tax incentives. The company serves more than 1 million customers and operates in most key U.S. states. Together with the expansion of its product lineup (home batteries and energy management systems), this scale strengthens its leadership in the residential renewable energy segment.

Investment attractiveness factors

Market leadership and share growth

Sunrun holds approximately 20% of the U.S. market for new residential solar installations and about 40% of the home energy storage segment. The company significantly outpaces competitors due to its scale and leasing model: more than 95% of Sunrun’s sales come from subscriptions (about one-third of the entire subscription market). This strategy allows the company to directly benefit from tax incentives and offer customers a low barrier to entry—especially important amid rising interest rates. At the same time, several competitors have exited the market: in 2024–2025, major industry players (including SunPower and Sunnova) filed for bankruptcy, creating additional opportunities for Sunrun to capture displaced demand.

Rapid growth in energy storage

Sunrun is actively expanding its presence in the home battery segment. In Q3 2025, around 70% of new customers opted to add energy storage systems (up from ~60% a year earlier), and the company accounted for 42% of all new residential storage installations in the U.S. in Q2 2025. Through its “storage-first” strategy, Sunrun increases average revenue per customer and protects margins: additional storage services help offset less favorable net metering tariffs and create new revenue streams. More than 100,000 customers are already enrolled in virtual power plant (VPP) programs—a network of home batteries that sells energy back to the grid during peak demand—with participation growing by over 400% year over year. The development of this business not only drives battery sales but also turns stored solar energy into a commercial product, reinforcing Sunrun’s competitive advantage.

External drivers and partnerships

The macro environment and government support are favorable for the company. The Inflation Reduction Act (IRA, 2022) extended the 30% federal tax credit for residential solar installations through 2032, preserving long-term incentives for households to adopt solar energy. At the same time, rising electricity rates and more frequent power outages increase the appeal of home solar-plus-storage systems as a means of cost savings and backup power. Sunrun is also strengthening its position through technological advantages and partnerships: the company invests in software for managing distributed generation, collaborates with utilities and automakers (for example, integrating Ford F-150 Lightning electric vehicles into home energy systems), and works with major homebuilders to install solar panels in new homes. These factors support Sunrun’s sustainable business growth, enhancing revenue potential and return on invested capital.

Target price: $23.

$RUN Cup w/ Handle Breakout AnalysisOverview

SUNRUN has experienced a notable upward movement today, gaining 8.89% as of this writing. This increase has propelled the stock above what appears to be a Cup with Handle formation, a technical pattern often associated with a bullish breakout. Given this development, the current price area could be a favorable point for initiating a new position. Typically, a breakout is confirmed when the price moves above a long-term resistance level.

Position Details

I established a full-size position in SUNRUN in early August at a price of $10.80 per share. Later, in November, I added a smaller amount at $17.95 per share, which increased my average cost to $11.68 per share. Currently, I am up 69% on this position. I did not add more shares today, as I missed the initial surge and prefer not to pursue the price higher. My plan is to wait for the stock to consolidate, even if that occurs at a higher price, since there is no clear area to set a reasonable stop loss for additional shares at this time.

Outlook and Watchlist Recommendation

I am sharing this update because I believe SUNRUN has the potential for further significant gains and should be considered for your watchlist. I will continue to update this analysis when a favorable risk-reward entry point becomes apparent.

Important Disclaimer

Readers are strongly encouraged to perform their own analysis and adhere to personal trading strategies. Keep in mind that all investments carry inherent risk. Making thoughtful and informed decisions is crucial when allocating capital in financial markets.

BEFORE THE RUN: Cup & Handle SUNRUNNASDAQ:RUN is building a clean Cup & Handle setup and is now sitting right in the sweet spot of the Handle - the zone where strong bases tighten up before they break. Price action is contracting, volume has dried up, and the chart is squeezing out the last bit of supply. The breakout trigger is straightforward: a decisive push and close above the horizontal rim of the cup. Crucially, it only matters with real volume - no volume, no breakout; a genuine expansion confirms institutional interest and validates the move. Risk is tight and well-defined: the stop goes right below the recent Handle low. The structure is complete, the Handle is tightening, and NASDAQ:RUN is essentially waiting for the switch to flip. The next move could be the RUN - all eyes on the breakout level 🎯

9/26/25 - $run - Ticker says it all: RUN9/26/25 :: VROCKSTAR :: NASDAQ:RUN

Ticker says it all: RUN

- was joking w/ a chat the other day about how "we need to find shorts that trump hates"

- well look no further than solar

- and how about a business as big as NYSE:OKLO at nearly $18B ent value

- and unlike oklo these guys will burn about $2B next year

- leave it to consensus to forecast "hockey stick growth"

- while rates that drive this business remain insanely high

- one might say solar on yo roof is the biggest discretionary purchase anyone can make

- so yeah. good luck w this one.

- short.

V

8/22/25 - $run - Pretty obvious short8/22/25 :: VROCKSTAR :: NASDAQ:RUN

Pretty obvious short

- it's great to see papa powell pump our beloved NASDAQ:NXT

- but just the other day daddi trump decided to eat taco bell (if you've been paying attention - this is when he tweets something from the 3am squat that's anti-solar)... and not chipotle.

- solar has had a nice run.

- i've written ad nauseam about it being the obvious generation tech in the next 10 yrs. edgeking elon agrees. idk if that's good or bad.

- but in the retail front let's just review some real basics

- usually in a mkt i get the "yes everyone can see the multiples". and yes that's true. but honestly it's somehow an edge to just put this into context with a modicum of logic.

- for NASDAQ:RUN you get:

- 7.5x sales (lol!)

- low teens EBITDA mgns (adds back D&A! lol)

- trust me bro FCF in 2028

- so yeah

- hard pass at 18 bn valuation

- it's one where the equity can certainly do cray cray things b/c it's so small in the capital stack

- but ultimately. NASDAQ:RUN will go BK. i've made a number of these calls in the past year, many of them are returning to fair value. zero-aroni.

be safe out there.

friends don't let friends buy NASDAQ:RUN just 'cause it's a fun ticker.

V

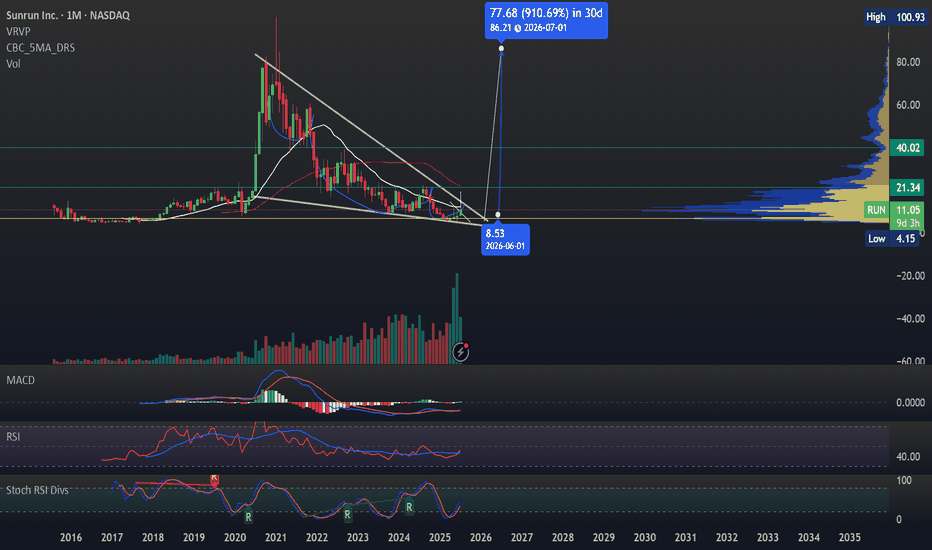

very bullish on SunRun inc. been wait for the right time to hop in on this

1. its in a huge inverse heand and shoulders

2 on the monthly the stochs are just turning up

3 its screaming with divergence price action going down rsi going up

4 falling price volume moving up

if you have patience this can make you some real money but you have to have conviction

possible 9X this show liquidity is moving back into the market i sold some things that where over bought only time will tell let me know what you think thanks

2/6/25 - $run - donut. stay away.2/6/25 :: VROCKSTAR :: NASDAQ:RUN

donut. stay away.

- this thing will be volatile given 90% of the cap structure is debt

- but it doesn't generate any +ve fcf for the next years

- any uplift in solar will benefit NASDAQ:FSLR and $enph... everything else is trash.

- solar is VERY VERY hard to own at the moment, even our favorite name NASDAQ:NXT is not the most obvious up and to the right chart (it should be, but remember we are in an industry tide still - perceived - go out)

- therefore, to maintain my NASDAQ:NXT exposure which is my largest position even tho i am packing a lot of cash on the books, generally, WAY more than usual... i need hedges or i need to risk manage NASDAQ:NXT

- NASDAQ:RUN 's chart is literally death.

- i wouldn't be surprised in a solar or mkt risk off to see this -50% and honestly, this company is for all intents and purposes a BK candidate.

- it's a donut. a bagel. a zero.

- so if you own it... you might want to re-think "why" and honestly i'm all ears considering i'm buying that short to zero, if you're inclined. otherwise we'll compare PnL on this thing at YE.

V

PS - the only ownable solar name in this tape IMVHO is $nxt. a far away next is NASDAQ:FSLR and then third is $enph. i'm staying far away from the rest. if i *had* to pick a 4 it would be NASDAQ:SHLS and if i had to pick a 5th... there is none, just buy BTC :)

2/6/25 :: VROCKSTAR :: NASDAQ:RUN

donut. stay away.

- this thing will be volatile given 90% of the cap structure is debt

- but it doesn't generate any +ve fcf for the next years

- any uplift in solar will benefit NASDAQ:FSLR and $enph... everything else is trash.

- solar is VERY VERY hard to own at the moment, even our favorite name NASDAQ:NXT is not the most obvious up and to the right chart (it should be, but remember we are in an industry tide still - perceived - go out)

- therefore, to maintain my NASDAQ:NXT exposure which is my largest position even tho i am packing a lot of cash on the books, generally, WAY more than usual... i need hedges or i need to risk manage NASDAQ:NXT

- NASDAQ:RUN 's chart is literally death.

- i wouldn't be surprised in a solar or mkt risk off to see this -50% and honestly, this company is for all intents and purposes a BK candidate.

- it's a donut. a bagel. a zero.

- so if you own it... you might want to re-think "why" and honestly i'm all ears considering i'm buying that short to zero, if you're inclined. otherwise we'll compare PnL on this thing at YE.

V

RUN - Nov 24 Opening Sustainable MomentumTrade idea

Fundamentals

This is a Trump trade, based on his agenda. Solar part of the clean energy sector will see a shift towards traditional energy sources like oil.

Bad Earnings

RUN had bad earnings with a quarterly loss of -$0.37 vs previous earnings of +$0.55.

The solar energy products distributor posted revenue of $537.2 million in the period, which also fell short of Street forecasts. Ten analysts surveyed by Zacks expected $560.6 million.

Technicals

Price opened with momentum, breaking out and creating new lows.

Risks

Opening momentum candle's ADR is 15.97%, ADR for the stock is 7.61%. After two days of deep drops, price could be over extended and result in it retracing.

Trigger: SPX, RUT, Trump winning the elections

Opening Sustainable Momentum 🧑🏻🚀

Strategy

Signals identify market opening H2 candles through momentum and behaviour change that potentially could indicate a shift in the current price overall structure (Price gaps and ADR %).

Risk

We use the signal candle's highs and lows for entry and stop loss. If price hits the stop loss, it is clear that the shift we expected did not come to fruitation.

Current SL is at 0.25Fib

Focus

Focus is never on the signal candle alone, but it's role in the larger structure and the direction it is inclined towards with a minimum Risk & Reward of 2R.

Stock must be in a pull back or consolidation area waiting for a broad market momentum to ignite it forward.

Character

Trend, Positive Skew

Sunrun (RUN) AnalysisCompany Overview: Sunrun is a leading U.S. residential solar energy company, providing solar panel installations and energy services across the country. The company's focus on sustainable energy solutions positions it to capitalize on the growing shift toward clean energy adoption.

Key Catalysts:

Rate-Cutting Cycle: A potential rate-cutting cycle by the Federal Reserve could make solar financing more affordable, increasing the economic appeal of residential solar projects. Lower interest rates would reduce borrowing costs for consumers, making Sunrun's solar installations more accessible and boosting sales.

Trade Policies: U.S. Treasury Secretary Janet Yellen's scrutiny of China's market practices, particularly regarding solar products, could mitigate low-cost competition from Chinese manufacturers. This would benefit domestic companies like Sunrun by leveling the playing field and potentially driving higher demand for U.S.-installed solar systems.

Federal Subsidies: Sunrun is well-positioned to benefit from federal clean energy subsidies provided by the Inflation Reduction Act (IRA). These subsidies are expected to reduce Sunrun's operating expenses and enhance profitability by offsetting costs associated with installations and energy storage solutions.

Investment Outlook: Bullish Outlook: We are bullish on NASDAQ:RUN if it holds above the $17.50-$18.00 range. Upside Potential: The upside target for Sunrun is set at $29.00-$30.00, driven by favorable interest rate conditions, supportive trade policies, and federal clean energy subsidies.

☀️ Sunrun—ready to shine with rate cuts, trade advantages, and clean energy subsidies! #RUN #SolarEnergy 🚀🌱

Renewable energy stocks coming back?I saw some other stocks of the same segment doing bullish patterns. We have a potential double bottom fighting with downtrend line resistance. I think is going to bounce back and forward between the 13.5 support level and the downtrend line until something breaks. The double bottom (inverted HS in the daily timeframe) tells me that the price wants to break up the downtrend from September 2022. SL triggers if a weekly candle breaks down and closes under the 13.5 level support.

peeking at levels to trade $RUN into JulySunrun partnered with Lowe’s Companies, Inc. to provide solar and storage services in hundreds of Lowe’s stores across the country.

Storage capacity installed grew by 192% year-over-year, reaching 207 megawatt hours. Solar energy capacity installed was 177 megawatts, bringing the total networked solar energy capacity to 6.9 gigawatts. Net earning assets increased to $5.2 billion, including $783 million in total cash. Sunrun aims to generate $200 million to $500 million annually in cash by Q4 2024

5/8/24 - $run - "run" while you can. bad risk/reward. v bad.5/8/24 - vrockstar - burning a post for anyone reading this. 7x sales for no growth, high capital intensity industry w/ high rates, cash burn and comps trading rough (even industry leaders r failing to hold bid)... if you love it - perhaps sell into the print if you think they'll "beat". HOWEVER, be warned, too many names are failing to run EVEN WITH good prints and decent guidance. something that's 80% debt in the capital stack missing will send this down 30% and you won't even feel comfortable buying at that pt (bc it will slide for a while until we get to 2H and rates picture changes). second order thinking says... you can't buy a beat, and you can't buy a miss - so what's your risk/ return here guys. i'd dump it if i had it. contemplating a short, actually, but undecided mainly b/c shorting is such a miserable biz.

RUN long , inside Stage1The price is inside the stage1

But it breakout strongly the TL by

a very strong bullish bar on 11/12/2023

with a very huge volume

MA still flat RS is negative, the price retraced near MA

formed somme green bars with moderate volume ;

The long position is not perfect

I opend long at 13.58

SL 11.50

TP1 20

TP2 33

Sunrun Poised for Substantial GrowthSunrun is showing signs of a significant uptrend, with the weekly chart revealing an enticing Elliott Wave pattern that suggests a potential surge of more than 300%. This optimistic forecast is supported by the Williams Percent Range indicator, which is currently at a low point, often a precursor to a bullish reversal.

Renowned for their reliability, these technical indicators present a compelling case for Sunrun as a strong buy. Coupled with understated yet stable fundamental factors, the stock is poised for what could be a remarkable ascent. For investors looking to capitalize on growth, Sunrun's current landscape offers an exciting opportunity.

Good luck!

Sunrun Inc. Upgrade: Rising on Solar Energy's Bright FuturePiper Sandler analysts have upgraded Sunrun Inc.'s stock rating from "Neutral" to "Overweight". Experts view the recent statement by the US Federal Reserve about pausing interest rate hikes as an "unequivocally positive" catalyst for the solar energy sector in the coming year. This industry has developed thanks to "cheap" credit resources, so a reduction in rates will help lower Sunrun Inc.'s debt burden and positively impact the company's financial position.

Therefore, today, we turn our attention to the stock chart of Sunrun Inc. (RUN).

On the D1 timeframe, a support level was formed at 17.24, and the resistance at 18.98 was breached yesterday. A trend reversal from a downward to an upward trend is apparent. The breach of resistance increased the potential for further long-term growth in these stocks.

On the H1 timeframe, considering buying from current positions with a short-term target of 23.78 could be of interest. In the medium term, a long position can be maintained up to 32.52. An important signal for continuing the upward trend will be the consolidation of quotes above 18.98.

—

Ideas and other content presented on this page should not be considered as guidance for trading or an investment advice. RoboMarkets bears no responsibility for trading results based on trading opinions described in these analytical reviews.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law L. 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67.85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

RUN BUY Idea - Thanksgiving holiday week Sunrun (RUN) reached a significant support level, and could be a good pick for investors from a technical perspective. Recently, RUN broke through the 50-day moving average, which suggests a short-term bullish trend.

First trade I had to adjust scalp to swing because of the holiday week. Change to TP at 12.18