NATURALGASCFD trade ideas

U.S. Natural Gas Hits 10-Month Low on Cool Weather OutlookU.S. Natural Gas Hits 10-Month Low on Cool Weather Outlook

U.S. natural gas futures slipped to $2.70/MMBtu, the lowest since November 2024, as cooler weather and weaker late-summer demand eased storage concerns. September NG1! fell 0.1%.

Analysts say strong power demand and limited injections expected earlier won’t materialize. Forecasts show below-normal temperatures for the next two weeks, while LNG exports rose to 15.9 bcfd in August. Lower-48 gas output hit 108.5 bcfd, near record highs.

Despite a smaller-than-expected storage build last week (+13 bcf), ample supply and higher production keep pressure on prices. U.S. LNG exports are projected to grow 10% annually through 2030, even as oil output plateaus.

European gas futures also slipped 1% to €33.5/MWh as Norway’s maintenance impact eased and storage builds continue ahead of winter.

2 Month Descending ChannelSeptember natural gas futures plunged to a nine-month low on August 22, dropping 4.5% amid near-record output, ample storage, and cooler weather reducing demand. Despite a rebound in LNG exports, prices have fallen for five straight weeks, down 24% overall.

Record U.S. production in August averages 108.4 bcfd, while storage remains 6% above normal. Demand, including exports, is expected to ease in coming weeks, with LNG feedgas rising to 16.2 bcfd as plants recover from outages. Hurricane activity in the Atlantic poses no immediate threat to U.S. supply. Analysts expect U.S. LNG exports to grow about 10% annually through 2030.

Natural gas is in the Selling directionHello Traders

In This Chart NATGAS HOURLY Forex Forecast By FOREX PLANET

today NATGAS analysis 👆

🟢This Chart includes_ (NATGAS market update)

🟢What is The Next Opportunity on NATGAS Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

LNG: Conditions Reached 30Y Median & Moderate Storage IncreaseThis LNG analysis was prepared by Dr. Igor Isaev in cooperation with Anastasia Volkova, LSE analyst.

Current prices vs. price spread 10 days before expiry by month since 2010

Total monthly price decline exceeded 17%. Near-term contracts NGU25, NGV25 are trading 3-5% below the average price 10 days prior to expiration for all expired contracts over the previous 15 years. NGX25 has reached the median. Prices of 2026 and 2027 contracts are also declining and are already trading at or below the upper quantile boundary for almost all months.

Forward curve vs. 2020-2024

The shape of the forward curve flattens out and comes closer and closer to the states of the curve on the same calendar day of the year as the curves of 2023, 2024. This is especially noticeable on contracts with delivery in 3 years and beyond. On contracts closer the divergence is still large.

Current inventory and forecast for next week compared to 2019-2024

For week 33 (Aug 11-17), we expect a +14BCF gain in storage. Fill rates are holding steady above the median for the previous 5 years. Injection rates remain positive, which reduces shortage risks and contributes to downward price pressure.

Weekly HDD+CDD total from current NOAA data and forecast for the next two weeks comparing 1994-2024

In a continental cross-section, the current week 34 weather is holding at the same level as the average values observed over the past 30 years. Next week (35), HDD+CDD values are forecast to be well below average, contributing to lower air conditioning electricity demand and downward price pressure.

Explanation of the chart: in candlesticks quantiles for 30 years from 1994 to 2024. Red dots 2024, green 2025, blue prediction 2025

Weekly HDD+CDD total from current NOAA data and forecast for the next two weeks compared to 1994-2024 by region

Forecasts by major regions are consistent with the overall picture. Temperatures are expected to be slightly above normal in week 34 in the Eastern, Western regions followed by a decrease in week 35. In the PACIFIC region, values remain high. On the contrary, the Atlantic regions are below normal.

Weekly cumulative supply/demand difference compared to 2014-2024

For the past 2 weeks, the supply/demand differential has held well above the upper 10-year range. Despite record production levels, total natural gas consumption also increased due to electricity demand, the industrial sector and LNG exports.

NATGAS - Catch The Impulse!As Wave Traders, our job is to spot corrections and catch the impulse, because that’s where the biggest moves happen.

On NATGAS, we completed Wave 1 with a leading diagonal, and are now finishing Wave 2 (an ABC correction). Once corrections are done, the next phase is Wave 3 - historically the longest and strongest wave in Elliott Wave Theory.

We've almost completed wave 2 and looking for a breakout for wave 3, which is the longest wave.

Trade Idea:

- Watch for break of the red trendline to indicate the start of wave 3

- enter with stops below breakout or below invalidation

- Targets: 5, 10, 13

NATGAS 12H Chart:

We'll be looking to enter on break of the red trendline with stops below breakout.

This setup is a textbook example of how Elliott Wave helps us prepare - not chase - the market.

Goodluck and as always, trade safe!

Natural Gas Breaks Out Again-Bullish Wedge in PlayNatural Gas Breaks Out Again – Bullish Wedge in Play

Natural gas has confirmed another bullish wedge pattern, after a period of unclear price direction.

For now, the price looks set to climb toward $3.15 and $3.35.

However, traders should stay cautious.

Ongoing peace talks between the U.S., Russia, and Ukraine could shift momentum quickly—either way.

From a technical perspective, the setup remains bullish.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

XNGUSD came to a global support lineXNGUSD came to a global support line

Natural Gas has been declining since the beginning of June, forming the falling wedge. On Tuesday the price found support on a global trendline. The price is ready to reverse. Additionally, seasonals notice that shoulder season is about to get started, which historically means buying pressure for the natural gas, due to more natural gas is purchased before winter comes. Mid-term target may be the 3.4000 level.

thurs mani-POO-lationthe market always ranges before news. high probability that there will be a bullish breakout and the selloff will continue. the report last week was bullish but sellers still outweighed the bulls. this time i bet it will be no different despite the hot weather. its going to test the supp at $2.7 but it might break and continue till $2.6

Natural Gas consolidates nearby support level of 3.0000Natural Gas consolidates nearby support level of 3.0000

U.S. Natural Gas has been declining since mid-June, forming the bullish wedge. Since the end of July 4-h RSI shows us bullish divergence, the price consolidates nearby the 3.0000 support level. The price is expected to rise towards 3.4000 level as a first target with 3.6000 as a final target. Additionally, according to seasonals, since the second half of the august, natural gas prices go bullish due to the beginning of the shoulder season, which may be an extra support factor for the asset.

Long for short-coverMight have bottomed out finally. I think this might be one in a million chance to come out true but i believe that this setup has got a high probability. I can be wrong.. if so then i still have more to learn in order to actually trade this instrument but, if this runs with success then ill let you know behind my reasonings.

Natural Gas is in the Buying DirectionHello Traders

In This Chart NATGAS HOURLY Forex Forecast By FOREX PLANET

today NATGAS analysis 👆

🟢This Chart includes_ (NATGAS market update)

🟢What is The Next Opportunity on NATGAS Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

NATGAS TRADING PLANSlowly, very slowly, I'm transitioning from trading based on waves to trading waves through the filter of key levels and trend-moving averages.

Levels make me see scenarios that I used to ignore before.

Also, very slowly, I'm letting go of the habit of holding positions for too long.

Key levels for the next week are as follows:

Colored levels are a given. They act as magnets but also confirm the direction if the price continues pushing downward from the moving averages.

They will serve as confirmation of a trend reversal if the price breaks upward, retraces, and bounces off the levels and moving averages.

Such a filter + rules and avoiding tilt will ensure a return to profitable trading.

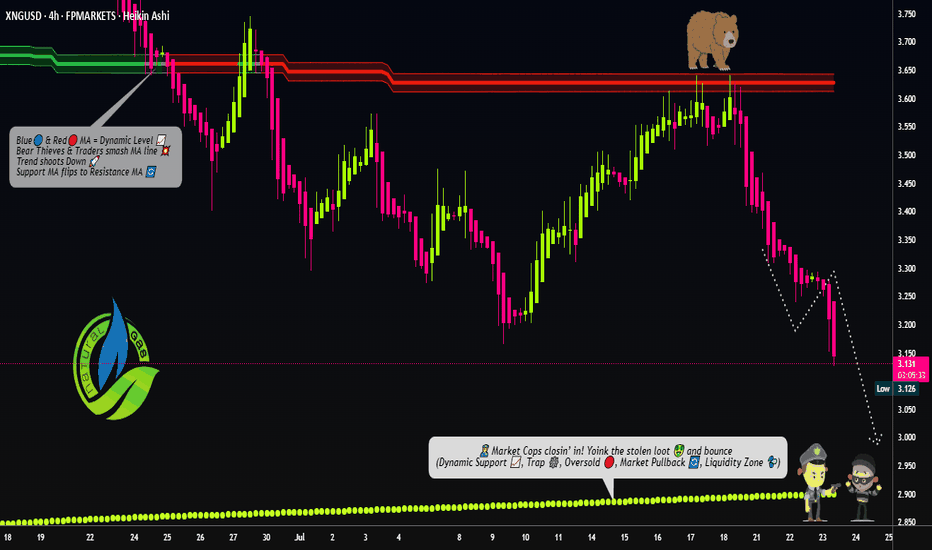

"NATURAL GAS PRICE THEFT IN PROGRESS – JOIN THE HEIST!"🔥 XNG/USD HEIST – BEARISH LOOT AWAITS! SWIPE & ESCAPE BEFORE THE COPS ARRIVE! 🔥

🌍 Greetings, Fellow Market Robbers! (Hola! Oi! Bonjour! Hallo! Marhaba!) 🚔💸

🚨 Mission Briefing:

Based on 🔥Thief Trading Intelligence™🔥, we’ve identified a prime robbery opportunity in the XNG/USD (Natural Gas) Energy Market. Our Bearish Heist Plan is locked & loaded—long entries are a trap, and the real loot lies in the downside escape.

🎯 Heist Strategy:

Entry (Swipe the Loot!) 🏦

"The vault is cracked! Bears are distracted—time to steal!"

Sell Limit Orders preferred (15m-30m pullback entries).

DCA/Layering Strategy for maximum loot efficiency.

Stop Loss (Escape Route) 🚨

SL at nearest swing high (4H basis) – 3.480 (Day/Swing Trade)

Adjust based on risk tolerance, lot size, & number of orders.

Target (Police Evasion Zone) 🎯 2.900 (or earlier if cops close in!)

🔪 Scalpers’ Quick Heist:

Short-side scalp ONLY!

Big money? Go direct. Small stack? Join the swing robbers.

Trailing SL = Your Getaway Car! 🚗💨

⚡ Why This Heist? (Bearish Forces at Play)

Fundamentals: Oversupply, weak demand, storage glut.

Technicals: Overbought, trend exhaustion, reversal signals.

Sentiment: Bulls are overconfident—perfect trap setup!

📰 Breaking News Alert (Stay Sharp!)

High-impact news = Volatility spikes!

Avoid new trades during releases.

Trailing SL = Your Shield. (Lock profits before the cops raid!)

💥 BOOST THIS HEIST!

👉 Hit LIKE & FOLLOW to fuel our next robbery! More loot = More strategies! 🚀💰

⚠️ WARNING (Legal Escape Plan):

Not financial advice!

Your risk, your loot.

Markets change—adapt or get caught!

🤑 NEXT HEIST COMING SOON… STAY TUNED, ROBBERS! 🐱👤🔥