PYPL Weekly Outlook (Oct 21–25): Buyers Defend the BaseCan Bulls Reclaim $70? 🚀

📆 Daily Chart — Macro Structure and Bias

Market Structure:

PayPal (PYPL) continues to trade within a broad descending channel but is showing early signs of structural stabilization. After several failed breakdowns, bulls defended the $64.50–$65.00 demand zone — a key level where prior liquidity sweeps triggered reversals. The most recent BOS (Break of Structure) around $69.00 indicates that smart money might be accumulating again within this base range.

We can see multiple CHoCH and BOS interactions suggesting buyers are quietly absorbing supply below $70, preparing for a potential structural shift back toward the mid-channel zone.

Supply & Demand / Order Blocks:

* Major Demand Zone: $64.00–$65.00 (deep OB and liquidity defense).

* Intermediate Supply Zone: $70.50–$71.00 (mid-channel resistance).

* Major Supply Zone: $79.00–$80.00 (top of the previous swing high cluster).

If bulls can maintain daily closes above $68.50, this could evolve into a mid-term reversal attempt toward $75+.

Indicator Confluence:

* 9 EMA vs 21 EMA: Bearish on macro view but flattening — momentum loss from sellers.

* MACD: Histogram is improving from deep negative; a cross above zero could confirm a macro shift.

* Stoch RSI: Rising sharply from oversold (10 → 45), signaling renewed buying strength.

* Volume: Buyer volume expanding near the base, consistent with accumulation phase behavior.

The daily structure remains in a potential bottoming phase; sustained closes above $69.50 will confirm a bullish shift.

⏱️ 1-Hour Chart — Short-Term Trend and Swing Bias

Market Structure:

The 1-hour timeframe paints a much clearer bullish microstructure after a decisive CHoCH from the descending wedge. Price reclaimed $67.00, then printed a BOS toward $69.20, completing the first leg of reversal structure.

We’re now consolidating just beneath $69.80–$70.00, which lines up with the mid-term supply zone and a key call wall on the GEX chart. The structure remains bullish as long as $68.00 holds as a higher low.

Supply & Demand / OB Zones:

* Demand Zone: $67.00–$68.00 (recent breakout OB).

* Supply Zone: $69.80–$70.50 (local resistance and liquidity pocket).

Indicator Confluence:

* 9 EMA > 21 EMA — clear bullish alignment, steep slope.

* MACD: Strong expansion with rising histogram, supporting upward bias.

* Stoch RSI: Hovering at 80+ — slightly overheated, but not reversing yet.

* Volume: Increasing on breakouts, declining during pullbacks — healthy pattern.

Trade Scenarios:

* Bullish Setup: Buy dips near $68.20–$68.50 → Target $70.00 / $71.00 → Stop $67.20.

* Bearish Setup: If rejection from $70.50 with divergence → Short to $68.00 / $67.00 → Stop $71.00.

If PYPL breaks and closes above $70, it will invalidate short setups and start targeting $72.50–$73.50 next.

🕒 15-Minute Chart — Intraday Momentum and Scalping Zones

Market Structure:

The 15-minute chart confirms strong short-term bullish control with stacked BOS and higher-low formations. Price is trending neatly along the rising intraday trendline, using the 9 EMA as dynamic support. Each micro pullback toward $68.80–$69.00 has been aggressively defended.

Supply & Demand / OB Levels:

* Demand Zone: $68.60–$68.80 (scalp OB and trendline support).

* Supply Zone: $69.80–$70.20 (intraday resistance + liquidity sweep potential).

Indicator Confluence:

* 9 EMA vs 21 EMA: Strong bullish slope; 9 EMA acting as perfect bounce line.

* MACD: Histogram slightly flattening after expansion — possible short-term cool-off.

* Stoch RSI: Overbought (>80), indicating potential short-term pause before continuation.

Scalp Plan:

* Bullish Bias: Enter near $68.80 pullback → Target $69.80 / $70.20 → Stop below $68.20.

* Bearish Bias: If $70 rejects twice with fading MACD momentum → Short scalp to $68.80 → Stop $70.40.

Intraday bias stays bullish unless price closes below $68.50 — that would mark short-term exhaustion.

📊 GEX (Gamma Exposure) & Options Sentiment Overview

PYPL’s options structure shows a neutral-to-bullish gamma setup with dealers likely positioned to stabilize price between $66–$70. The highest positive NET GEX sits around $70, effectively pinning current price in a tight gamma range.

Key GEX Levels:

* Highest Positive Gamma: $70.00 (dealer magnet).

* Major Call Walls: $72.00 and $74.00 — resistance zones if momentum expands.

* Put Support: $65.00 and $64.00 — strong floor if pullback occurs.

* IVR: 58.6 — elevated but not extreme, indicating active trader participation.

* Call Flow: 35.2% (muted but rising), suggesting cautious optimism.

If price sustains above $70.00, dealer hedging could flip to positive gamma expansion, pressing for a gradual melt-up toward $73–$74. A rejection below $68.00, however, might trigger delta-neutral unwind and short-term reversion to $65.

🎯 Closing Outlook

PYPL enters the week with a constructive recovery tone. The broader daily structure suggests a possible bottoming phase, while the intraday trend shows active buyer defense near $68. The GEX map supports a magnetized range between $68–$70, with potential gamma breakout if momentum persists midweek.

I’m watching for a decisive daily close above $70 — if bulls manage that, $72.50–$74 could be in play before the week ends. Below $68, expect a controlled retest toward $65 before another attempt higher.

Disclaimer:

This analysis is for educational purposes only and not financial advice. Always do your own research and manage your risk.

PayPal Holdings, Inc. Shs -CAD hedged- Canadian Depositary Receipt Repr Shs Reg S

No trades

Trade ideas

Paypal Looking Bullish!! Lets Go!Paypal is looking Really bullish.

Setup is Based on AMD, Accumulation, Manipulation and Distribution phase.

It has been accumulating at this price range for a while and enough Manipulation has takenplace. Now it is TIME for Distribution and hunt SL of Sellers, that is BSL.

It is not a Financial advice. It is a speculative idea that i am publishing for educational purposes.

Do your own Research.

Leave a thumbs up if you like this idea.

PayPal's $67 Breakout Signals Bullish Opportunity for Q4 Current Price: $67.41

Direction: LONG

Targets:

- T1 = $71.00

- T2 = $75.00

Stop Levels:

- S1 = $65.50

- S2 = $63.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and industry leaders, leveraging their collective knowledge to pinpoint lucrative trading setups. Professional traders have observed PayPal's recent price behavior as a potential start of a short-term rally, buoyed by broader market movements and new operational advancements within the company. According to the wisdom of crowds, stocks like PayPal that maintain strong fundamentals amid current market conditions tend to align well with bullish developments.

**Key Insights:**

PayPal currently presents an attractive opportunity due to its strategic positioning in the fintech market and its continued expansion into financial solutions that cater to digital payments, a sector with significant tailwinds. As the world moves further towards cashless transactions, PayPal remains one of the most trusted global platforms. In 2025, analysts are increasingly focusing on its growth in services such as Buy Now, Pay Later (BNPL) and the integration of AI-driven systems to enhance customer engagement. Moreover, management's constant reinvestment into technological upgrades provides further long-term stability.

Technically, PayPal's current price action suggests bullish potential as it approaches its 200-day moving average, typically seen as a major resistance level. Breaking above this level tends to attract momentum traders and can act as a catalyst for further upside. Coupled with recent strong volume surges, the stock's relative strength index (RSI) indicates room for growth before reaching overbought levels, increasing its attractiveness as a longer-term trade.

**Recent Performance:**

PayPal has demonstrated resilience following a challenging start to the year in 2025. The stock rebounded from lows near $60 earlier in the year and has now consolidated around the $67 mark, representing a near 13% recovery from mid-year levels. The past quarter’s results showed better-than-expected earnings per share (EPS) growth, driven in part by improved cost efficiencies and steady user growth in key markets. This consistent rebound has caught traders’ attention and suggests stronger demand levels at current prices.

**Expert Analysis:**

Experienced analysts remain cautiously optimistic about PayPal's outlook heading into the final quarter of 2025. They highlight its robust user base growth and improved transaction volumes, which have benefited from consumers’ accelerated adoption of digital payment ecosystems. PayPal has also enhanced its market competitiveness with expanded features, catering to both businesses and individual buyers in underserved regions. Technical signals, including bullish divergences in momentum oscillators and breaking previous resistance at $65, underscore renewed confidence among traders and long-term investors.

Strategically, PayPal’s management has maintained a forward-looking attitude towards monetizing its Venmo platform and leveraging partnerships with other e-commerce giants like Amazon and Shopify. This is expected to amplify active user engagement and transaction-based revenues leading into 2025's holiday season—a critical period for payment providers.

**News Impact:**

Recent reports of PayPal’s enhanced focus on artificial intelligence tools have been well received in financial markets. By integrating AI into its user verification and fraud detection algorithms, the company is positioning itself as a leader in secure payments infrastructure. Furthermore, PayPal has announced new cross-border payment capabilities, which have sparked bullish expectations for expanded market capture among international customers. These announcements align well with macroeconomic data showing strong growth in e-commerce spending leading into Q4 2025.

**Trading Recommendation:**

Based on the compelling factors outlined above, PayPal is a strong candidate for a bullish trade heading into the end of 2025. The combination of favorable technical indicators, strategic growth initiatives in BNPL and AI technology, and a rebound in consumer e-commerce spending bolster PayPal’s outlook for stronger upside potential. Traders are advised to take a LONG position above $67.41, targeting $71 as an initial level, with a potential for further gains to $75. Stop-loss levels should be managed prudently to limit downside exposure. A sustained break below $65.50 could invalidate the bullish setup, so traders should seek additional confirmation before re-entering positions.

Do you want to save hours every week? Register for the free weekly update in your language!

Trade Plan 10/18 Post: $PYPL #PYPLTrade Plan 10/18 Post: NASDAQ:PYPL #PYPL

📊 Setup Overview:

• NASDAQ:PYPL is forming a large symmetrical triangle, tightening range between $65.70 support and $70.66 resistance (magnet zone).

• The stock is coiling near the apex, setting up for a potential breakout or breakdown in the coming sessions.

• Momentum remains neutral but leaning bullish while price holds above the rising trendline.

🐂 Bullish Scenario:

• Hold above $65.70 and reclaim $70.66 for upside continuation.

• Breakout above $70.66 targets → $75 → $82 → $93.66.

• Watch volume — confirmation requires expansion above average daily volume.

🐻 Bearish Scenario:

• Lose $65.70 = breakdown from structure.

• Downside targets → $61 → $56.13 → $50.58.

• Sustained close below $56 would confirm a larger bearish trend resumption.

⚖️ Key Levels:

• Resistance → $70.66 / $75 / $82 / $93.66

• Support → $65.71 / $61 / $56.13 / $50.58

🕓 What I’m Watching:

• Confluence between trendline support and horizontal resistance near $68–70 — volatility likely.

• RSI and MACD compression signaling a breakout setup.

• Ideal trade: Wait for confirmation candle above or below the triangle with volume spike.

💬 If you found this helpful, drop a like and comment if you’re watching $PYPL.

Follow

@optibiz_trades

for daily setups, breakout alerts, and market analysis!

PAYPAL(PYPL) 1D - gaining traction On the daily chart, the price has confidently broken through the descending trendline — the first strong sign of a bullish shift.

All key moving averages (MA, EMA, SMA) sit below the price, showing that buyers are clearly in control.

Buy zone: 74.50.

A retest in this area (74.5–76) looks likely before another push higher.

First resistance: 79.47.

This level might trigger a short-term pullback, but a breakout above it opens the way toward targets at 85.90 and 94.00.

In short - the structure looks healthy, the breakout is done, and PayPal may be just warming up for a bigger move. Stay sharp - dips could be opportunities, not danger.

PYPL - one last drop before a bull run startshi traders,

Currently, PayPal is trading around the $68 level, but the chart suggests that the stock may not yet be ready to resume a sustained bullish trend. Based on the technical setup, we anticipate a possible drop in the coming months before a new bull run begins.

The key buy zone to watch is in the range of $54–$50. This area aligns with a strong support zone and potential trendline confluence, making it an attractive entry level for long-term investors.

Our expectation is that price action will retest this zone before reversing upward and starting the next significant bullish leg. Traders should remain patient and look for confirmation signals once PayPal approaches this support area.

Long Setup on PayPal (PYPL) – 1H Charthi traders

PayPal is currently trading around $66.80 – $67.00 after retesting a key support level that has held multiple times in recent sessions. The price action shows consolidation near support, with potential for a bullish reversal.

Entry Zone:

Around $66.80 – $67.00 (current support area).

Stop Loss (SL):

Below $65.78 (recent swing low and invalidation zone).

Take Profit (TP):

Targeting $70.60 – $70.70 (strong resistance and recent highs).

Risk/Reward Ratio (RRR):

Approximately 1:3, favorable setup for a long position.

Trade Thesis:

The chart suggests a bounce from support with momentum building for an upside move.

If the price holds above the $66.80 support zone, there is room for a bullish push toward the $70.60 resistance.

Confirmation can come from bullish candles forming around the current level.

Plan:

Go long near $67.00.

Place stop below $65.78.

Aim for $70.60+ as the first profit target.

Partial profits may be secured on the way up, with stop moved to breakeven for risk management.

PayPal: Trading Sideways Amid VolatilityPayPal has recently experienced notable volatility but has continued to trade sideways within a certain range. Our primary expectation is that further downward momentum will dominate, potentially driving price below both support levels at $54.78 and $50.18 to complete the correction of beige wave II. However, there is also a 37% chance that PYPL has already finished beige wave alt.II at $54.78. In that scenario, the stock would already be building a sustained magenta upward impulse and could break out above the resistance levels at $80.65 and $94.97 during wave alt. .

PayPal poised for upward breakout as technical momentum builds Current Price: $68.22

Direction: LONG

Targets:

- T1 = $72.50

- T2 = $76.00

Stop Levels:

- S1 = $66.00

- S2 = $64.50

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market analysts, leveraging their expertise to uncover high-probability setups in PayPal’s stock. PayPal has been identified as a potentially strong recovery play after its recent consolidation phase. Using the wisdom of crowds principle, the general consensus points to continued upside potential driven by improving sentiment around fintech and digital payment platforms. Traders suggest focusing on key technical levels that signal breakout opportunities in the coming weeks.

**Key Insights:**

PayPal's stock has faced challenges over the past year, driven by competitive pressures in the fintech space and slowing growth in its core payment services. However, as of September 2025, the company appears to be stabilizing, with management implementing structural improvements to focus on user retention and operational efficiency. The company’s recent moves to integrate AI-driven payment insights and enhance its merchant services have been well-received by analysts. With increased adoption in online payment systems and sustained demand for cross-border transactions, PayPal's fundamentals show early signs of recovery.

Technically, PayPal's current price range suggests strong support near $66.00 and resistance near $72. Analysts observe that the Relative Strength Index (RSI) remains below overbought territory, allowing for upside movement. Seasonality trends and institutional positioning further reinforce a bullish outlook for Q4 2025 as investors prepare for the holiday shopping season, traditionally a catalyst for payment platforms like PayPal.

**Recent Performance:**

PayPal's stock is trading at $68.22, up nearly 8% from its summer lows of around $63. This recovery has been driven by stronger-than-expected Q2 results, which reflected stabilized transaction volumes and increased revenue contributions from international markets. September price action indicates a tightening consolidation pattern, with volumes gradually increasing—often an indicator of impending breakout momentum. The stock's performance in the current quarter suggests renewed interest from institutional investors, with trading volumes reaching above-average levels over the last week.

**Expert Analysis:**

Market experts largely agree that PayPal’s valuation at current levels presents an attractive entry point for medium- and long-term investors. Multiple analysts have highlighted its price-to-earnings (P/E) ratio, which stands below peer averages, offering a discount compared to competitors like Block Inc. and Stripe. PayPal also benefits from robust cash flow generation, which it continues to reinvest into technological innovation and geographic expansion. Technically, chart analysts are closely watching the $70 resistance area, with many arguing a successful break above could lead to sustained upside toward $76 or higher. Recent bullish crossovers in both the MACD and Stochastic indicators confirm this view, signaling momentum is building for an upward move.

**News Impact:**

Recent news plays a major role in shaping PayPal's trajectory. The company's collaboration with Shopify to expand integration within e-commerce platforms has improved its competitive positioning, particularly for small businesses. Furthermore, rumors of further restructuring efforts aimed at cutting costs have generated enthusiasm around additional profitability gains in 2025. While regulatory scrutiny around payment providers remains a headwind, financial analysts believe PayPal’s long-standing compliance history will help mitigate risks. Additionally, its leadership in peer-to-peer payments through Venmo reinforces its ecosystem strength, reducing vulnerability to competitive entrants.

**Trading Recommendation:**

PayPal presents a compelling long opportunity at its current price level of $68.22. The stock appears to be entering an accumulation phase following a prolonged period of underperformance earlier this year. Key technical levels suggest that momentum is building, particularly with strong institutional activity and improved sentiment heading into Q4. A break above $72.50 could unlock further upside potential to $76.00, while downside risks can be managed effectively with stops at $66.00 and $64.50. Traders looking for fintech exposure should consider PayPal as it rebounds toward stronger growth metrics.

Do you want to save hours every week? Register for the free weekly update in your language!

$PYPL PainPal Bros have attained Nirvana! - Waiting for massive gains, they have grown old and achieved Nirvana!

- NASDAQ:PYPL is getting better in innovation but the company isn't innovative faster. It is bloated with legacy tech and in many places their teams are working in silos with duplicated initiatives and effort.

- Alex is great CEO but stock buyback alone won't help. Law of large numbers and massive competition by various fintech will always be a drag for $PYPL.

- Market likes growth (organic expansion of multiple) which is a like drug for the market participants or massive EPS growth ( inorganic )

Where does NASDAQ:PYPL stand?

year | 2025 | 2026 | 2027 | 2028

EPS | 5.26 | 5.82 | 6.61 | 7.07

eps% | 14.59% |10.81% | 13.45% | 6.96%

For a mid teen eps%, fair forward p/e would be 15

Fair stock value:

year | 2025 | 2026 | 2027 | 2028

price | 78.9 | 87.3 | 99.15 | 106.05

Trade Idea: $PYPL (PayPal Holdings)📝 Trade Idea: NASDAQ:PYPL (PayPal Holdings) —

Bias: Long-term bullish (wealth accumulation)

Entry Zone (Wholesale Area): $55 – $100

Stop Loss: Below $50 (structure break)

Target 1: $150 (mid-zone retest)

Target 2: $300 (Retail Supply Zone)

Risk/Reward: ~1:4+ if entering near $60–70

Rationale:

Price is consolidating inside a fresh Wholesale Demand Zone.

RSI reset, building a long base after heavy distribution.

Macro structure favors accumulation → long-term upside toward $300 Retail Zone.

Strong asymmetric play: limited downside risk, outsized reward if recovery unfolds.

PayPal: Stuck in Consolidation—Breakout or Breakdown Ahead?We expect PayPal to eventually break out of its current consolidation to the downside to complete the larger correction of beige wave II below the $50.18 support level. Alternatively, it’s possible that PYPL already finished wave alt.II back in April, which could set the stage for an early upside breakout—first above the $78.86 resistance and then even beyond the higher $94.97 level (probability: 30%).

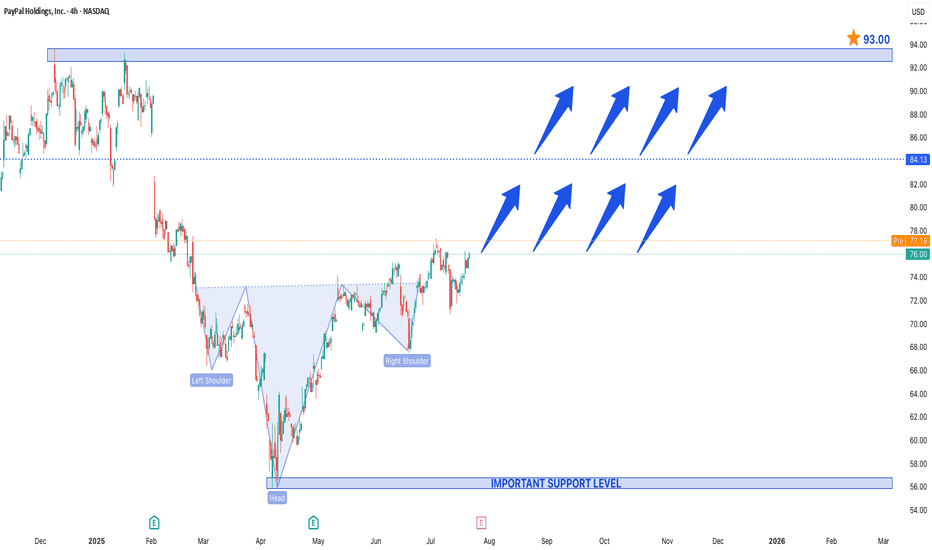

Head & Shoulders Pattern Spotted in PayPal Holdings IncHead & Shoulders Pattern Spotted in PayPal Holdings Inc.

A Head & Shoulders (H&S) pattern has been identified in PayPal Holdings Inc. (PYPL), but unlike the traditional bearish reversal setup, this could be an inverse Head & Shoulders, signaling a potential bullish turnaround.

Key Observations:

1. Left Shoulder – A decline followed by a rebound.

2. Head – A deeper low, then a recovery.

3. Right Shoulder – A higher low, suggesting weakening selling pressure.

4. Neckline Break – A decisive close above the resistance (neckline) confirms the bullish reversal.

Price Projections:

- Support at $55 – This level has held strong, acting as a critical demand zone. A bounce from here could fuel the next rally.

- Upside Target at $93 – A successful breakout above the neckline could propel PYPL toward $93, representing a ~40% upside from current levels.

Why This Matters for Traders:

- Bullish Momentum – The pattern suggests that sellers are exhausted, and buyers are stepping in.

- Volume Confirmation – Increasing volume on the breakout would strengthen the bullish case.

- Market Sentiment Shift – If PayPal sustains above key resistance, it could attract institutional interest.

Trading Strategy:

- Stop Loss – Below $55 for risk management.

- Target – $93, with interim resistance near $75 and $85.

Final Thoughts:

While technical patterns are not foolproof, the inverse H&S in PYPL suggests a potential trend reversal. If the breakout holds, $93 could be the next major target, making PayPal an interesting watch for swing traders and investors.