To know where you are, you need a Compass. Opendoor Technology's ( NASDAQ:OPEN ) recent surge (20x of lows) caused me to wonder what the theme is. After all, rarely is a movement motivated by nothing.

I've determined the only logical conclusion is the correlation of Real Estate to interest rates.

Opendoor is a REIT disguised as a tech company and without the hefty dividend. While they offer tools for homeowners to exit / enter homes quickly, they really are just operating a fat inventory of housing. This is a difficult asset to manage at scale and of course is why they had a difficult 3.5 years after IPO AND the quickest increase of interest rates since the 1980s. This post isn't meant to talk trash on OPEN. I am very happy with what the asset did and may very well continue to do.

Compass, Inc. ( NYSE:COMP ) operates a set of tools to allow real estate agents a simpler buying / selling process for their clients. A very similar value proposition to OPEN, but without the heavy real estate inventory on the balance sheet. The lack of bloat on the balance sheet allows COMP to focus on their main customers intently. What this means is a decrease in interest rates will likely allow their base to do more business and frankly a significantly larger amount of business when compared to 2022-2024.

The current DD is simple.

* COMP price-to-sales of 0.7, i.e. they're market capitalization is 70% of their annual revenue. This means they are trading at a discount to their current business model and NO growth is priced in.

* Interest rates are coming down next week. The only question is if the Federal Reserve will lower rates by 0.25 of 0.5. If you think I'm just making this up, check out this link --> www.cmegroup.com

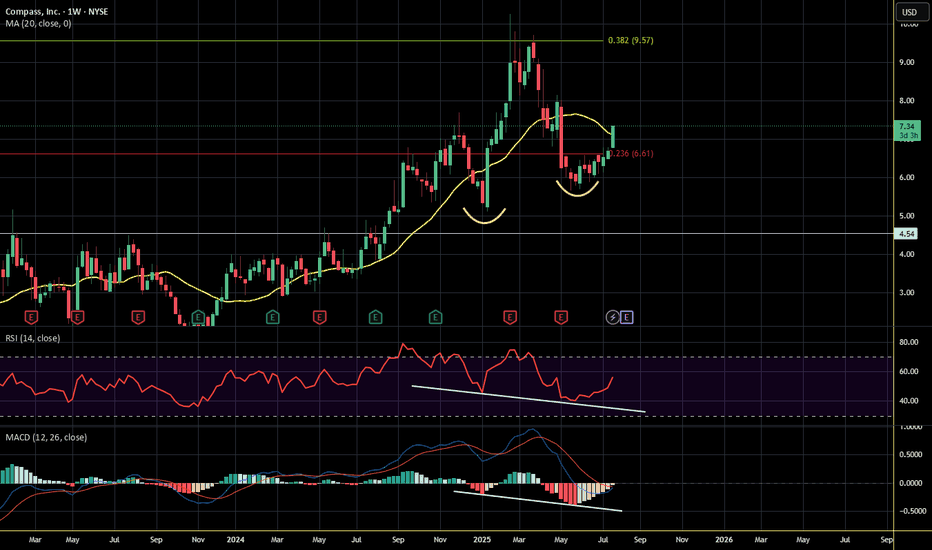

* The chart suggest Compass has completed a multi-year Cup and Handle pattern. The end of the handle is generally quite bullish. As well, the volume profile notates only a single node of transaction volume above at about ~$13.5. Outside of that level, it's wide open above without much price resistance.

My main price target for this trade is IPO value, which is around ~$18 aka 100% away.

Trade ideas

Hello BullishHello Again, entered long for Compass Inc. with shown entry, SL and TP1 and TP2 points.

I see daily candle confirmation. along with expected incoming interest rate variation, I expect booming. Let's us. Compare my analysis to yours and take it on your own responsibility.

As usual, this is not a financial advice.

Give me your thoughts!

Compass well placed for US housing bounceCompass sits at the heart of the US residential real estate recovery. As housing demand rebounds, Compass stands to gain directly from rising activity. Its tech-enabled platform and scale afford it an edge when sellers return.

Slowing economic data and persistent high rates will eventually force the Fed’s hand. As data turns softer, rate cuts will arrive sooner than expected. Lower rates fuel home buying, Compass’s core driver.

Buyer and seller behaviour matters deeply. As more homes come to market, Compass gains supply. As buyers push in, its tech and platform drive conversions. That sensitivity gives it upside leverage when inertia lifts on both sides.

Since going public, Compass has delivered five straight free-cash-flow-positive quarters. Full-year 2024 saw over $100 million in free cash flow. Momentum continued into early 2025, confirming financial discipline and operating leverage.

The US market remains fragmented. Compass is building a national footprint with aggressive agent recruitment, retention, and its proprietary tech stack. Organic transactions are growing faster than the market. It continues to gain share while competitors retreat.

Technically, Compass has bounced back well above its 200-day moving average of $7.30 per share. The stock recently broke through key resistance and holds near $9.65. Momentum is strong. A push to $11 is on the cards if the macro backdrop continues to support housing.

The forecasts provided herein are intended for informational purposes only and should not be construed as guarantees of future performance. This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

COMP/USD – 30-Min Breakout Trade Setup!📌

🔹 Asset: Compass, Inc. (COMP/USD)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Symmetrical Triangle Breakout

📌 Trade Plan (Long Position)

✅ Entry Zone: Above $9.10 (Breakout Confirmation)

✅ Stop-Loss (SL): Below $8.60 (Break of Support & Triangle)

🎯 Take Profit Targets

📌 TP1: $9.61 (First Resistance Level)

📌 TP2: $10.28 (Final Target – Extended Move)

📊 Risk-Reward Ratio Calculation

📈 Risk (SL Distance): $9.10 - $8.60 = $0.50 risk per share

📈 Reward to TP1: $9.61 - $9.10 = $0.51 (1:1.02 R/R)

📈 Reward to TP2: $10.28 - $9.10 = $1.18 (1:2.36 R/R)

🔍 Technical Analysis & Strategy

📌 Symmetrical Triangle Breakout: COMP is forming a consolidation pattern with a breakout above $9.10 signaling bullish momentum.

📌 Trendline & Support Bounce: Price is testing key trendline resistance, with a breakout likely to push it toward higher resistance levels.

📌 Breakout Confirmation: A strong bullish candle closing above $9.10 with increasing volume confirms the trade.

📌 Momentum Shift Expected: Holding above $9.10 could trigger a rally toward TP1 ($9.61) and TP2 ($10.28).

📊 Key Support & Resistance Levels

🟢 $8.60 – Strong Support / Stop-Loss Level

🟡 $9.10 – Entry / Breakout Level

🔴 $9.61 – First Resistance / TP1

🟢 $10.28 – Final Target / TP2

🚀 Trade Execution & Risk Management

📊 Volume Confirmation: Ensure strong buying volume above $9.10 before entering.

📈 Trailing Stop Strategy: Move SL to entry ($9.10) after TP1 ($9.61) is hit.

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at $9.61, let the rest run to $10.28.

✔ Adjust Stop-Loss to Break-even ($9.10) after TP1 is reached.

⚠️ Fake Breakout Risk

❌ If price fails to hold above $9.10 and falls back, it could indicate a false breakout—exit early.

❌ Wait for a strong candle close above $9.10 for confirmation before entering aggressively.

🚀 Final Thoughts

✔ Bullish Setup – Holding above $9.10 could lead to higher targets.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:1.02 to TP1, 1:2.36 to TP2.

💡 Stick to the plan, manage risk, and trade smart! 🚀🏆

🔗 #StockTrading #COMP #BreakoutTrade #TechnicalAnalysis #MomentumStocks #ProfittoPath #TradingView #StockMarket #SwingTrading #RiskManagement #ChartAnalysis 🚀📈

COMP/USD – 30-Min Long Trade Setup!📊 🚀

🔹 Asset: COMP/USD

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bullish Wedge Breakout

🚀 Trade Plan (Long Position):

✅ Entry Zone: Above 10.23 USD (Breakout Confirmation)

✅ Stop-Loss (SL): Below 9.60 USD (Breakout Invalidated)

🎯 Take Profit Targets:

📌 TP1: 11.08 USD (First Resistance Level)

📌 TP2: 12.06 USD (Extended Bullish Target)

📊 Risk-Reward Ratio Calculation:

📈 Risk (SL Distance): Below 9.60 USD

📈 Reward to TP1: 11.08 USD

📈 Reward to TP2: 12.06 USD

🔍 Technical Analysis & Strategy:

📌 Breakout Confirmation: A strong push above 10.23 USD signals bullish momentum.

📌 Pattern Formation: Bullish Wedge Breakout, indicating a potential upside continuation.

📊 Key Support & Resistance Levels:

🟢 9.60 USD – Strong Support / Stop-Loss Level

🟡 10.23 USD – Breakout Zone / Entry Level

🔴 11.08 USD – First Profit Target / Resistance

🟢 12.06 USD – Final Target for Momentum Extension

🚀 Momentum Shift Expected:

📌 If price stays above 10.23 USD, it could rally towards 11.08 USD and 12.06 USD.

📌 A high-volume breakout would strengthen the trend continuation.

🔥 Trade Execution & Risk Management:

📊 Volume Confirmation: Ensure strong buying volume above 10.23 USD before entering.

📈 Trailing Stop Strategy: Move SL to entry (10.23 USD) after TP1 (11.08 USD) is hit.

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at 11.08 USD, let the rest run to 12.06 USD.

✔ Adjust Stop-Loss to Break-even (10.23 USD) after TP1 is reached.

⚠️ Fake Breakout Risk:

If price falls below 10.23 USD, wait for a retest before considering re-entry.

🚀 Final Thoughts:

✔ Bullish Setup – Holding above 10.23 USD could lead to higher targets.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:1.13 to TP1, 1:2.46 to TP2.

💡 Stick to the plan, manage risk, and trade smart! 🚀🏆

🔗 #StockTrading #COMPUSD #BreakoutTrade #TechnicalAnalysis #MarketTrends #ProfittoPath #DayTrading #MomentumStocks #SwingTrading #TradingView #LongTrade #TradeSmart #RiskManagement #StockBreakout #Investing #StockAlerts #ChartAnalysis 🚀📈

Symmetrical triangle on $COMP. Low Volatility ahead of earningsTechnical Setup: NYSE:COMP has shown lower highs and higher lows, forming a classic symmetrical triangle, suggesting potential for either a continuation of the current trend or a reversal.

Key Levels to Watch: Watch for a breakout above the upper trendline for a potential bullish move or a breakdown below the lower trendline for a bearish scenario.

Volatility Note: Low volatility is typical in symmetrical triangles; expect an increase in volume and price movement around earnings. Earnings reports are coming up on Wednesday, October 30th.

$compCan compass finally make a move after IPO? Was beat down during covid highs, beat down on interest rates, stock is down 90% since its public offering. Looks like it made a 100% move recently after hitting its 1.84 low... Stock looks like it is neutralizing- not sure how much longer the shorts can grab off a 90% sell off- looks like there is some opportunity opening up for bulls.

COMP long

Price is down 85% from the top at $22

They have been dumping equity stakes onto their own agents for 2 years as a voluntary alternative to paying out commission. Many people have been burned leading to a class action suit (several over their history)

They have 3 quarters of cash left

They are doing mass layoffs of 450 employees

I'm not giving away my price targets this time.

Get good.

$COMP: Double Bottom with Bullish Divergence Channel BreakoutCOMP is Double Bottoming after showing 3 Instances of Bullish Divergence on the RSI and is now trading above an Assumed Channel which if it hold could signal a Break Hook and Go that could take it up to as high as a 1.618 Fibonacci Extension.

COMP Trade zones Taking a look at this stock because of a screener alert.

Here's a chart with zones marked. It looks like in the really long term you might see upwards of $13, but I wouldn't expect it to be higher than $18.

I think currently, $9 seems to be where this stock is heading.

A Monday morning dip could definitely be a buy opportunity to $9.

I also, am noticing a lot of trends in the market leading to march 17th through the 23rd which are showing a possible big movement (crash maybe). I'll keep watching, but just be careful around those dates.