9/12/25 - $obtc - Move aside... $SMLR is my horse9/12/25 :: VROCKSTAR :: OTC:OBTC

Move aside... NASDAQ:SMLR is my horse

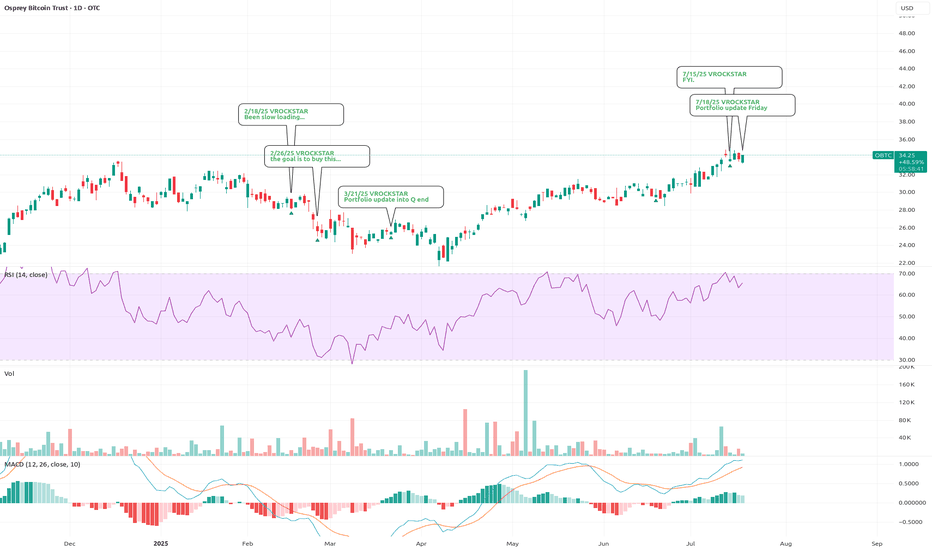

- with OTC:OBTC trading only 8-10% discount in last few sessions, i've been able to make some room for a few BIG trades and OTC:OBTC is no longer a major position for me b/c the spread has nicely narrowed as we've picked

Key stats

About Osprey Bitcoin Trust

Sector

Industry

Headquarters

Fairfield

ISIN

US68839C2061

FIGI

BBG00YXVK613

Osprey Bitcoin Trust is a low-cost provider of digital asset solutions dedicated to building smarter investment products that offer secure and transparent access. The company is headquartered in Fairfield, CT.

Related stocks

8/28/25 - $obtc - max downside is 10% upside hedged8/28/25 :: VROCKSTAR :: OTC:OBTC

max downside is 10% upside hedged

- basically you can buy this at 12% off spot

put in trading view: OTC:OBTC/BINANCE:BTCUSDT/0.000324

- so 12% off spot is .88 mnav. does it go to 1? well S-1 published early Aug. team speaks openly about that expectation. not like

8/27/25 - $obtc - BTC under $100k8/27/25 :: VROCKSTAR :: OTC:OBTC

BTC under $100k

- at $31.75 as of this writing, you're buying BTC at $98k, which is about a 12.5% discount to spot. Upside to parity is ~15%.

- Osprey has republished their S-1 at the beginning of the month

- Conversion in the next several months

- Liquidity deep

7/18/25 - $obtc - Portfolio update Friday7/18/25 :: VROCKSTAR :: OTC:OBTC

Portfolio update Friday

- it should be no surprise to you if you've followed my notes (to myself, which is really the point to airing everything out - though the friendships I've made have been a wonderful bonus)... that CRYPTOCAP:BTC is really the asset I know

7/15/25 - $obtc - FYI.7/15/25 :: VROCKSTAR :: OTC:OBTC

FYI.

- out of pocket this week, but wanted to comment here given it's my largest position and BTC trade has worked in terms of how i'm managing this

- go read last posts for context

- OBTC remains at >10% discount to spot BTC. so as of writing this morning, you're

6/18/25 - $obtc - Portfolio update during Papa Powell6/18/25 :: VROCKSTAR :: OTC:OBTC

Portfolio update during Papa Powell

- as you have all noticed (if you follow along), i'm usually early... and i've started building more strategic short spots and putting on more and more cash

- we've traded a few stocks around, esp in the end-mar and april contex

3/21/25 - $obtc - Portfolio update into Q end3/21/25 :: VROCKSTAR :: OTC:OBTC

Portfolio update into Q end

- thanks for your comments, suggestions, and to the trolls and of course those who challenge my thinking with reason (you know who you are - and I appreciate you keeping me sane and keeping emotion in check).

- as I roll into Q end and

2/26/25 - $obtc - the goal is to buy this...2/26/25 :: VROCKSTAR :: OTC:OBTC

the goal is to buy this...

- the goal is to accumulate bitcoin

- not panic sell it because jim cramer told ur mom's boyfriend it's going to zero

- obtc buys it 10% off, in other words, mid 70s.

- does it go lower? V says. idk and idc.

- the end game is stack sats

2/18/25 - $obtc - Been slow loading...2/18/25 :: VROCKSTAR :: OTC:OBTC

Been slow loading...

- keep OTC:OBTC in your watchlist

- AND

- keep OTC:OBTC/BINANCE:BTCUSDT/0.000332

- the above formula gives you the discount to NAV bc OBTC is a closed end fund

- they've had some complications turning this into an ETF (lucky us). i know this

Bitcoin (OBTC) levels to watch during this pullbackI have outlined some important levels in this asset. From the looks of it it may bottom around the .5 fib and tail down to 9.45. The night is young so we will see how this plays out. Some of these ETP's front run BTCUSD price and tell a different story.

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.