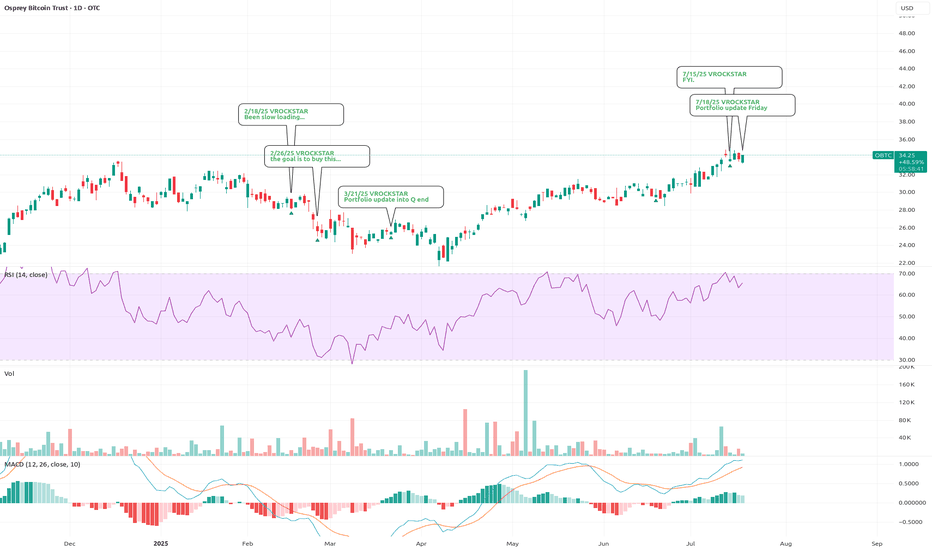

9/12/25 - $obtc - Move aside... $SMLR is my horse9/12/25 :: VROCKSTAR :: OTC:OBTC

Move aside... NASDAQ:SMLR is my horse

- with OTC:OBTC trading only 8-10% discount in last few sessions, i've been able to make some room for a few BIG trades and OTC:OBTC is no longer a major position for me b/c the spread has nicely narrowed as we've picked up a lot of the ticker at the $30s-ish lows.

- NASDAQ:SMLR is btc treasury co that trades 10-11% wide and i can put this on leverage (unlike OTC:OBTC ) where it's actually quite cheap to do deep ITM leaps low $20s strikes for barely any IV depsite:

- CRYPTOCAP:BTC being pretty discounted

- NASDAQ:SMLR being shorted!? lol

- ppl not doing work and complaining about a lawsuit that's now covered (so at worst this trades at parity with 1x mnav)

- and treasury co's actually deserve to trade at premium to nav (unlike closed end funds like OTC:OBTC or etfs like NASDAQ:IBIT ) b/c of the intelligent leverage. simple math says 20% leverage gives you about 1.1 to 1.25x mnav. let's just say, it's above 1x.

- and separately yours truly has been buying 80% of the OTC:OSOL (osprey's closed end solana fund) that is at a 30% discount (and this is 40% upside to nav). and I can hedge w/ SOLZ, GSOL (which is actually at a 20% premium)

- lastly oct 10 is the decision on whether sol gets an ETF, which means you have a catalyst here... for osol going to 1x nav and gsol going to 1x nav... nice spread.

Anyway.

35% cash. still preparing for some liquidity dump in the coming 2-3 wks (remember quad witch and quarter end tends to keep healthy markets locked), so while i won't be aggressively buying any dips of say 1-2%... i'd not be surprised to see those get bot. playing on the hedged side for early oct where i think we do a mini end-mar/apr situation again (not as big, wide or long).

be well. stay hedged.

V

Trade ideas

8/28/25 - $obtc - max downside is 10% upside hedged8/28/25 :: VROCKSTAR :: OTC:OBTC

max downside is 10% upside hedged

- basically you can buy this at 12% off spot

put in trading view: OTC:OBTC/BINANCE:BTCUSDT/0.000324

- so 12% off spot is .88 mnav. does it go to 1? well S-1 published early Aug. team speaks openly about that expectation. not like they're the first bunny to emerge from this bitcoin-only ETF hat.

- 12% off spot is 1/(1-.88) = 15% upside into YE

- my weapon for hedge is a (admittedly) fairly naunced package of IBIT ATM and slightly OTM puts from sep, oct, nov, dec and jan expires.

- but if you're going to keep it simple and touch grass, you can hedge 100% of this position with january ATM IBIT puts.

- both IBIT and OBTC use coinbase as the custodian. so it's the same wallets that hold the bitcoin for both. the closest thing you can get to a pure trade with 15% upside w/ catalyst in 4 mo as i've ever seen.

- but as i've ever seen *lol*... i've been doing this for 5 years. this is the last one left. so yeah.

- and the 5% isn't "actually" 5%. it's 5% for hedge AND optionality. if BTC nukes say 20% in sep/oct before convert. you can close hedge, pour it into more spot exposure w/o loss. you can reduce hedge. you can re-roll hedge. and if discount widens in the next 3-4 months or narrows... you can take advantage. so it's actually 5% minus X% and that X% is TBD.

so 15% upside (assuming convert) minus 5% plus X% optionality.

the beauty of doing this is that say BTC doubles. you capture the full extent of upside beta and only lose the 5% hedge. perhaps there might be some mgmt, rolling, expire here as that happens. but it's pretty low stress way to end the year.

- welp. that's all i got for now. closing a lot of positions to make way for this as my only position.

V

8/27/25 - $obtc - BTC under $100k8/27/25 :: VROCKSTAR :: OTC:OBTC

BTC under $100k

- at $31.75 as of this writing, you're buying BTC at $98k, which is about a 12.5% discount to spot. Upside to parity is ~15%.

- Osprey has republished their S-1 at the beginning of the month

- Conversion in the next several months

- Liquidity deep enough in IBIT to either hedge out this spread entirely (and capture the 15% for a few months) or my preference is to use ITM IBIT puts in order to incorporate some optionality into the equation (about 5% buys you full protection, I'm opting for about 50% coverage at 2.5%).

- The optionality allowed me to weather the recent draw down, closed the puts and went naked for a day and a half

- But seeing BTC put in a bit of a floor here and recover, I've started to re-accumulate OBTC and re-incorporate some fresh hedges too.

- back to about a 60% position for me (30% net) and i'm considering taking back toward 70%. it's the last best closed end trade in this ecosystem before the gains become harder.

- "V why the discount". Easy. Small cap (nobody knows it). Low liquidity (can't get in and out, hence the hedge/ flexibility). Mistrust (they fumbled this before, but now have it under control). Nothing's a slam dunk in the world of risk, but there are interesting ways to monetize this that aren't available in other pockets of the mkt.

Enjoy.

V

7/18/25 - $obtc - Portfolio update Friday7/18/25 :: VROCKSTAR :: OTC:OBTC

Portfolio update Friday

- it should be no surprise to you if you've followed my notes (to myself, which is really the point to airing everything out - though the friendships I've made have been a wonderful bonus)... that CRYPTOCAP:BTC is really the asset I know best, have cleared POV on and where my edge comes from (the intersection of understanding deeply the supply/mining, demand, deep tech stack/ dev side, and tradfi angles).

- so at this point, spot CRYPTOCAP:BTC at $120k is v strong.

- are there some signals here/ there that we reject $120k and head back to $100? $90k? sure, ofc. it's not where i spend most of my time. and why? b/c the direction is much higher. at this stage, there's 450 BTC mined a day. there are magnitudes more demand (5-10x on a given day). that's simple to understand if i gave you one ST data pt that is pretty illustrative. so $100k gets bought fast, $90k gets bought faster, $80k... i think might be off the table save for a black swan (always be ready for this) and upside is likely from $150k to $500k in a 12-18 mo context, i'd guess.

- and i can hedge out this ST tape that keeps me feeling like i'm waking up in the twilight zone. retail is going bananas on profitless garbage. but here's the thing guys. retail DOESN'T OWN BTC. so don't let people tell you "they will come" or "they will dump if their other chitcoin stonks dump". they're priced out. don't let the unit bias freak you out. you get what you pay for, a lot, in life. so while yes you could buy a lotto stock, leverage the hell out of it and "be rich", this is usually the fast lane to financial irrelevancy and never "getting ahead" before you just throw in the towel, forever. take the long game seriously. compounding 20-30% pa for many years might not be what X financial "gurus" are showing you. but i'd guess 80% of them won't be around 3-5 yr from now. i've done this long enough to have conviction on this POV. the sooner you realize that patience, consistency (singles not homeruns) are what drive LT success over a 30 year (and god willing) 50 year career... you'll see what i mean: ***the singles you hit in 10Y are today's grand slams in terms of their size***

- so with that all being said, i'm hedging my 70% OBTC position (which has taken a v long time to get to that size w/o affecting px too much) with IBIT ATM P's through Oct

- I've spoken to Osprey and the convert is going to happen. v likely they're trying to do an in-kind mechanism (which btw they should get sued for b/c it's for their advantage and at the disadvantage to investors seeking liquidity for YEARS) but nevertheless, their error and everyone's impatience gives you a 13-14% discount to SPOT bitcoin as I write this

- so the IBIT hedge allows me to "use" 3% of my capital and hedge almost HALF of this 70% (so 30-35% effective short). the idea being, if we do dump, it likely/ always happens fast (rolling liquidations) and i have bought myself the option to close the short and roll into more OBTC, or just keep my exposure w/o hedge. if OBTC converts early, great, i get a 10-15% pop. if OBTC converts on it's own terms, and we run into YE, i pay "3%" sure... but way more than make up for this in the px action of spot+OBTC px action.

- in other words:

- heads i win

- tails i win, maybe a bit less

NXT, GAMB and TSLA represent my only stock exposure at the moment

SES is small given it's market cap, and i have that locked up (sold a bunch of covered calls given today's px action) at the $1 strike for oct, so it's just a super high yield cash position for me at this rate

Hope that helps.

Have a good weekend my friends.

V

7/15/25 - $obtc - FYI.7/15/25 :: VROCKSTAR :: OTC:OBTC

FYI.

- out of pocket this week, but wanted to comment here given it's my largest position and BTC trade has worked in terms of how i'm managing this

- go read last posts for context

- OBTC remains at >10% discount to spot BTC. so as of writing this morning, you're still buying equivalent of $103k/BTC

- talked w the Osprey/ Rex team the other week, and my impression is the conversion WILL happen, but it WONT happen in the immediate term (or that will be a gift) - i can get into that in the comments.

- which is to say, I'd expect late Sep/Oct to remain the bogey

- that's 3 mo away, so expect this to edge closer to 1x mNAV (vs. 0.88 mNAV) today as we get closer to that event.

- i'm using IBIT as my hedge here to reduce my risk on underlying risk in the meanwhile

- so what that means is of BTC trades back down to say $100k and OBTC remains at a 10% discount, we're looking at something like a simple $3-4/shr off $OBTC. I also have a slightly larger exposure to OTC:OBTC that I like to hedge. so I'm basically taking 25% of my size, which is ~50% of book in $OBTC... which means 25% of 50% is about 12.5%. I can buy the Oct ATM strikes ~$67 on IBIT for about $6-ish. and I need about 1.25% to 1.5% size in these (b/c they're 10x-1) to reach this ~12.5% exposure on the short/ hedge size.

- hope that makes sense - it's the simplest/ purest way i can think to hedge

- if anyone has other ideas LMK

- i am watching mkts, but a bit disconnected (touching grass this week), so will do my best to respond, but unless it's urgent or worth responding immediately i'll let it bake until next week

be well and stack sats.

V

6/18/25 - $obtc - Portfolio update during Papa Powell6/18/25 :: VROCKSTAR :: OTC:OBTC

Portfolio update during Papa Powell

- as you have all noticed (if you follow along), i'm usually early... and i've started building more strategic short spots and putting on more and more cash

- we've traded a few stocks around, esp in the end-mar and april context. esp semi's like NYSE:TSM etc.

- but ultimately, my alpha is in understanding CRYPTOCAP:BTC better than anyone.

- a lil apha here: the marginal cost of production is about $80k for the entire network. sure you'll see some armchair work here/ there to prove this. i have some pretty sophisticated models that i've built and kept to myself that validate this. AND SUCH THAT bitcoin is not broken (and it's definitely not), this level is a line in the sand - anything sub $80k will get bought VERY fast.

- so with that being said, OTC:OBTC is allowing me to size up here at $91k as of today.

add these to your trading view (without the quotes " ")

This is the nominal ticker px

OBTC

Each share holds 0.000324 BTC. I'd link you, but the last time i did this trading view thought i was shilling and getting paid (i'm definitely not- i'll never charge anyone for my views, i don't need the $... i just like to make friend and make my friends money).

Add: "OBTC/0.000324"

That will show you the effective price

Now add: "OBTC/BTCUSDT/0.000324" and this will show you the discount to spot. It's about 0.88 as of this writing - or about a 12% discount to spot.

I bring this all up, because I look at these three elements on my tradingview more than anything. OBTC is now 40% of my book and the goal is to make it 50... 60... 70... should the situation call for it. I don't trade stocks for the purpose of outperforming BTC. I trade stocks to tread water while BTC waffles so I can buy more BTC. Period and the end. My north is to stack as many sats as I can.

SO with this being said:

- I've taken my NASDAQ:NXT size to about 10% (nominal) and 15% gross

- I've taken GAMB to 9% (nominal) and leveraged is 35-40% gross

- i've added three shorts which i'll comment on in time

NASDAQ:BUG , NASDAQ:ROBT , NASDAQ:QUBT

- and i'm about 33% cash.

I want to simplify my PnL so I can start to make decisive moves and not worry about managing stuff that's not a game changing situation. So I've temporarily removed NYSE:ANF , $tsm... other stuff I do like (but it's not as good as BTC).

hope it helps your own process.

keep your eye on the prize. the prize is BTC.

V

3/21/25 - $obtc - Portfolio update into Q end3/21/25 :: VROCKSTAR :: OTC:OBTC

Portfolio update into Q end

- thanks for your comments, suggestions, and to the trolls and of course those who challenge my thinking with reason (you know who you are - and I appreciate you keeping me sane and keeping emotion in check).

- as I roll into Q end and think about 2Q a few things come to mind as i've chewed, slept and showered only thinking about markets, risk, alternatives and am thoroughly challenged and intellectually stimulated to say the least. gave up some early YTD gains, but some nice wins (if you've followed you know NXT, UBER in particular) keep me at a low double digit on the year. let's build on that.

- hard money will matter. we've seen gold make it's move and probably continues to head higher. but that "insurance and WTF premium" that is not yet embedded into BTC will find it's way into BTC. there's no harder money than BTC and it can hold a lot more flows. when i think through all my alternatives in risk, they're usually "can it outperform BTC" or "can it offer an asymmetric or orthogonal benefit?", if not (and most assets - the answer is no), i "ignore". so while it's VERY possible duration assets continue to bleed, the question you need to ask yourself is... if BTC at $60k or even lower is worth "the wait" and remaining out of the pool to stack or it makes sense to take a reasonable position here and weather the vol because the way back up likely is met with no offer.

- therefore OTC:OBTC goes back to a 33% position in my book (it was almost 100% this time last year, so this still is "reasonable" for me and i'm no stranger to it's vol). the asset still trades at a 6% discount to spot, so at today's price of $84k you're still buying sub $80k spot.

- i also continue to expect NASDAQ:NXT to massively outperform, and the asymmetric edge is a consensus and expectation and generally "shunned" industry (solar) that has not yet discovered this gem despite it actually holding up really well YTD (AND even on it's BTC pair!). i believe we'll start to print $1 bn revenue quarters this year and FCF will become 700-800 mn next year, not 500 mn and flat on cons. estimates, which will probably garner closer to a 7% discount rate (before market decides growing FCF at 15-20% p.a. for a few more years deserves 5% or lower)... and that 750 mm/0.075 = $10-11 bn... and that's a double. and it keeps running, so the re-investment or rearranging risk is low. this is a secular winner at the early innings, so i'd rather be larger exposure. as many of you know my preferred vehicle remains the deep ITM 2027 leaps for some leverage, but responsibly.

- and i have a rental book, and names i play on EPS here and there (i write up maybe 20% of the names i play to keep the digital pen moving). i like NYSE:UBER , NASDAQ:GAMB , NYSE:VRT , NASDAQ:BLDE and a few others. these are between 2 and 5% positions and I have them "rented" (covered calls) for some income on an otherwise cashy book.

- i still pack between 20-25% cash on any given week. just depends. but i'd like ammo to either add to NASDAQ:NXT , OTC:OBTC ... or if we get a dip back toward $100, something like NASDAQ:NVDA and to re-build NYSE:TSM (can we just get that dang INTC headline already!). the problem with these stocks is they're more rates-tariff-news-linked than fundamental. the IRL component matters more... and i'd rather stick to what i know best.

- hopefully that wasn't too confusing. here's where i stand right now +/-

33% OBTC

30% NXT LEAPS

5% VST (covered, renting ATM monthly)

5% UBER (covered, renting ATM monthly)

3% GAMB

2% BLDE

22% cash

so let's see. next few weeks *should* be green on my guess. flows. month end rebalance (to buy). i think we get a pause in tariffs etc. etc. but i think the ultimate put all the money to work "event" is yet to occur and might still be several weeks and some further chop to boot... around the corner. so i'm here playing the ups/downs/all arounds. i traded NYSE:NKE short last night. bid NYSE:DECK and am back out. so i'm being nimble on the corners to keep test driving and figuring out which vehicles i'll want to own once we get that "pencils down" event.

but we're not there yet. so i still want to keep my foot on the gas where risk/reward is favorable in a YE context (in a 2 or 3-1 basis hence OBTC and NXT), but where i'm still being practical and not digging my head in the sand and screaming into the wind. the market doesn't care what i or you or anyone thinks. and i need to keep reminding myself of that, because it's how i got to this point and losing sight of some of these basics and operating on emotion is where you get rekt and aren't prepared for what comes next.

heads up. keep me posted what you see. what other plays i need to keep high on the radar.

and let's roll into 2Q successfully together.

V

2/26/25 - $obtc - the goal is to buy this...2/26/25 :: VROCKSTAR :: OTC:OBTC

the goal is to buy this...

- the goal is to accumulate bitcoin

- not panic sell it because jim cramer told ur mom's boyfriend it's going to zero

- obtc buys it 10% off, in other words, mid 70s.

- does it go lower? V says. idk and idc.

- the end game is stack sats

- if you're not buying something today, you're doing it wrong.

a lil PSA for the lobotomized. and a reminder to my friends that it's 10% off w OBTC, use limit orders!

V

2/18/25 - $obtc - Been slow loading...2/18/25 :: VROCKSTAR :: OTC:OBTC

Been slow loading...

- keep OTC:OBTC in your watchlist

- AND

- keep OTC:OBTC/BINANCE:BTCUSDT/0.000332

- the above formula gives you the discount to NAV bc OBTC is a closed end fund

- they've had some complications turning this into an ETF (lucky us). i know this one well. many of you know i've been making the mkts in the closed end crypto stuff for the last many years, involving the depths of the grayscale BS

- in a world where BTC dominance (BTC.d) keeps going higher, where that's the ultimate winner from a risk/reward standpoint (i call this "bitcoin sharpe"), OTC:OBTC is my pure play vehicle of choice

- in time, we will return/ play OTC:GDLC , OTC:BITW , but rn it's hard enough to own the big winners (like btc) and so i just go with the top dogs of all categories.

- limit orders only. this is very illiquid. it's not a trade. it's a hold. you buy red/ discount (10% good, if we risk off and this goes 15...20% discount - i don't expect - but could), it's no- brainer.

enjoy.

V

Bitcoin (OBTC) levels to watch during this pullbackI have outlined some important levels in this asset. From the looks of it it may bottom around the .5 fib and tail down to 9.45. The night is young so we will see how this plays out. Some of these ETP's front run BTCUSD price and tell a different story.