The Rally in Metals Is Not Over YetI believe the rally in metals is not over.The upward move could resume from current levels. While we have seen a slight pullback, the metals are holding up strongly. The stop-loss level would be quite wide, but I believe the chances of a continuation significantly outweigh the risks, making it a calculated risk worth taking. The chart shows a continuing uptrend. Metals are set to heat up the market, and at the moment, I like platinum the most.

📝Trading Plan

🟢Entry: current level -1630

🔴Stop: 1565

🎯Target: 1720 / 1925 / 2100 / 2200 / 2300 and beyond

Trade ideas

Bearish Candles Flash Warning: Platinum’s Rally May Be OverPlatinum’s breakneck rally since June looks at risk of reversing, with the last two weekly candles delivering notable topping patterns. A shooting star from above $1,700 was followed by an enormous bearish pin, doubling down on the message. With momentum indicators like RSI (14) and MACD rolling over but still in overbought territory, selling into rallies is preferred near term, especially if we see another push above $1,650 where bears were active in each of the past three weeks.

Downside targets for shorts include the July high of $1,516, with the February 2021 swing high of $1,350 and $1,300 as other options after that. Risk management is extremely important for anyone looking to act on the bearish price signals given how far the price has run over recent months, so make sure stop placements above entry are aligned with your desired risk-reward ratio from the trade.

Good luck!

DS

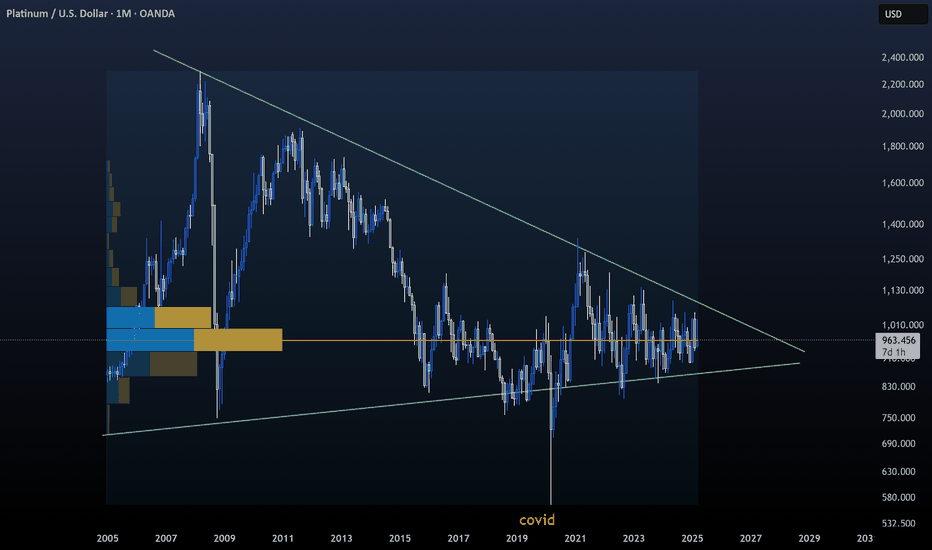

$PLATINUM (3-MONTH): WAVE 3, the MONEY WAVE is onCAPITALCOM:PLATINUM , the 3-MONTHLY chart showing all the price action in the XXI century, in case anyone still has any doubts re where precious metals are going next.

One dominant chart pattern, a 12-year-old FALLING WEDGE, text-book breakout during COVID (surpluses of production), retested, a few years of accumulation done (constant shortages since 2022, more demand than supply by roughly 1 Moz a year, on average), and finally a big BREAKOUT above the GOLDEN POCKET ($1063 - $1123) in Q1 to start 2025.

So, a clear WAVE 3, a.k.a the MONEY WAVE. Briefly hit $1737 and now we have got a 7% correction.

I have been in the market for a position in #platinum after missing out on this year's run solely due to engaging my free capital in other metals.

So, two potential long entries:

1) $1575, a 2% pullback from here, fib 0.382 retest and continuation upwards on that money wave.

2) between fib 0.5 ($1350) and a potential WAVE 4 first target ($1385). In case the WAVE 3 is finished, then dip-buying would make sense.

LONG (x10) LIMIT order set at $1575 for now.

The mentioned FALLING WEDGE has got a target at $2.4k. Very doable, it will take some time, but it will HIT👽💙

Platinum- While everyone is chasing Gold’s rally, I’ve got my eyes on Platinum.

- That doesn’t mean Gold is a bad investment, it just means it’s already had its moment.

- Platinum feels “delayed,” but its time is coming.

- Observe closely, this simple graph reveals a tightening triangle.

Remember my first rule: Buy the blood, not the moon.

Stay sharp. Diversify. Never go all in.

Happy Tr4Ding

Platinum 10 years accumulation 2 000 USD Overview of Catalysts

Here’s a detailed look at the top 10 key catalysts influencing platinum prices—and how they stack up on a 0–10 impact scale 🎯.

1. Supply Deficits (Mining Shortfalls) ⛏️

Trend: Persistent structural deficits—the largest since 2013—with a projected deficit of \~598 koz in 2024.

Drivers: Declining output in South Africa and Russia, underinvestment, and aging mines.

Impact Score: 10/10 – Direct upward pressure on price.

2. Industrial Demand & Green-Energy Growth 🏭

Trend: Industrial consumption is booming, with strong growth in sectors like wind turbines, glass, and electronics.

Support: This broad demand fuels a large part of the supply deficit, and goes well beyond automotive use.

Impact Score: 9/10 – Strong structural support.

3. Auto Catalyst Substitution (Pd → Pt) 🔄

Trend: Cost-effective substitution as platinum approaches price parity with palladium; significant volume was substituted in 2023, with more projected for 2024.

Significance: Boosts automotive demand in an area previously dominated by palladium.

Impact Score: 8/10.

4. Electric Vehicle Adoption (EVs) ⚡

Trend: EVs don’t use platinum in catalytic converters, which is a structural hit to demand as EV growth continues.

Significance: Long-term downside pressure.

Impact Score: 7/10.

5. Hydrogen Fuel Cell Demand 💧

Trend: Hydrogen vehicles use platinum, with projected demand growth toward 2030.

Limitations: Growth remains slower than battery EVs.

Impact Score: 6/10.

6. Recycling Constraints 🔄

Trend: Recycling, which provides about a quarter of supply, is falling due to fewer end-of-life vehicles and glass, reducing the supply buffer.

Market Effect: This amplifies supply tightness.

Impact Score: 6/10.

7. Chinese Emission Policies 🏭

Trend: China’s tightening emissions regulations are supporting demand, with end uses well protected against a slowdown.

Importance: China is the largest platinum user; policy gives stability.

Impact Score: 7/10.

8. Jewellery & Investment Trends 💍

Trend: Jewellery demand remains steady, and investment demand is rising.

Note: This is a smaller demand segment, but it is supportive.

Impact Score: 5/10.

9. Macroeconomic & Auto Production Outlook 📉

Trend: Weak global auto production is lowering platinum use, but recovery in auto could lift demand.

Aftermath: Economic rebound could support prices.

Impact Score:** 5/10.

10. Speculative Sentiment & Positioning 📈

Trend: Inventories are depleted; investors are waiting for a breakout.

Tipping Point: A price surge could spark momentum-driven demand.

Impact Score:** 4/10.

| Rank | Catalyst | Score (/10) |

| ---- | ---------------------------------- | ----------- |

| 1 | Supply Deficit | 10 |

| 2 | Industrial / Green-Energy Demand | 9 |

| 3 | Auto Catalyst Pd → Pt Substitution | 8 |

| 4 | EV Adoption (Negative Impact) | 7 |

| 5 | Chinese Emission Policies | 7 |

| 6 | Hydrogen Fuel Cell Growth | 6 |

| 7 | Recycling Constraints | 6 |

| 8 | Jewellery & Investment Demand | 5 |

| 9 | Macro Slowdowns / Auto Production | 5 |

| 10 | Speculative Positioning | 4 |

📌 Key Insights & Outlook

* Tight supply and diversified demand—especially from green energy and industrial sectors—are the strongest bullish forces for platinum.

* Auto-driven substitution offers further upside, while EV growth and recycling limitations act as constraints.

* Chinese regulations add resilience; hydrogen offers potential if growth accelerates.

* Jewellery and investment flows remain minor but supportive.

* Much depends on auto sector recovery and investor psychology—momentum effects could amplify gains if technical levels break.

🔮 Final Take

Platinum remains positioned for medium-term strength, thanks to severe supply tightness and robust non-auto demand drivers. For investors, key areas to watch are further deficits, industrial trends, and catalytic substitution. Be mindful of potential headwinds from EV adoption and macroeconomic softness, but the structural case remains compelling.

XPT/USD: Re-Accumulation or Just Another Trap?🏴☠️ PLATINUM HEIST: The Metal Market Profit Playbook | XPT/USD Swing/Day Trade Setup

📊 Asset Overview

XPT/USD - Platinum vs. U.S. Dollar

Market: Precious Metals

Trading Style: Swing/Day Trade

Strategy: Thief's Layered Entry Method 🎯

🎭 The Setup: Re-Accumulation Zone Confirmed

Bias: BULLISH 🐂

Platinum is currently consolidating in what appears to be a re-accumulation zone – the perfect opportunity for strategic entries before the next potential leg up. The "Thief Strategy" uses multiple limit orders (layering) to build a position across key price levels, minimizing risk while maximizing opportunity.

🎯 Entry Strategy: The Layered Approach

Entry Method: Multi-Layer Limit Orders (Thief's Ladder Style)

Instead of going all-in at one price, we're spreading entries across multiple levels:

Layer 1: $1,600.00

Layer 2: $1,620.00

Layer 3: $1,640.00

You can add more layers based on your capital and risk appetite. This approach averages your entry and reduces timing risk.

Alternative: Market entry at current levels is acceptable if you prefer immediate exposure.

🛑 Risk Management: The Exit Door

Stop Loss: $1,560.00

⚠️ Important Note: Dear Ladies & Gentlemen (Thief OGs), this is MY stop loss level based on my analysis and risk tolerance. You should determine your own based on your account size and risk management rules. Trade at your own risk and always protect your capital first!

💰 Target: The Police Barricade Zone

Take Profit Target: $1,760.00

This level represents a confluence of:

Strong resistance (the "police barricade" 🚨)

Potential overbought conditions

Historical reversal zone (the trap)

Profit Potential: ~$160 per ounce from mid-entry point (~10% move)

⚠️ Important Note: Dear Ladies & Gentlemen (Thief OGs), this is MY take profit target. You're free to scale out earlier, trail stops, or extend targets based on your trading plan. Secure profits when YOU feel comfortable – it's your hard-earned money!

🔗 Related Markets to Watch (Correlation Play)

Keep an eye on these correlated assets:

GC/USD (Gold) - Platinum typically follows gold trends due to precious metals correlation

DXY (U.S. Dollar Index) - Inverse correlation; weak dollar = stronger platinum

SI/USD (Silver) - Often moves in tandem with platinum in industrial demand cycles

CL/USD (Crude Oil) - Industrial demand correlation (platinum used in catalytic converters)

PA/USD (Palladium) - Sister metal with automotive industry demand overlap

Key Point: A weakening dollar combined with rising gold prices typically supports platinum rallies. Watch the DXY for confirmation of dollar weakness.

📈 Technical Key Points

✅ Re-accumulation phase confirmed

✅ Layered entry reduces timing risk

✅ Risk-reward ratio favorable (~4:1)

✅ Clear invalidation level ($1,560)

✅ Strong resistance identified ($1,760)

⚡ Quick Action Plan

Set your layered limit orders OR enter at market

Place stop loss according to YOUR risk tolerance

Monitor correlated markets (especially DXY and Gold)

Scale out profits as price approaches target

Move stop to breakeven once position is profitable

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

⚠️ Disclaimer

This analysis represents the "Thief Style" trading strategy and is for educational and entertainment purposes only. This is NOT financial advice. Trading precious metals and forex carries substantial risk of loss. Always conduct your own research, use proper risk management, and never risk more than you can afford to lose. Past performance does not guarantee future results.

#XPTUSD #Platinum #PreciousMetals #ForexTrading #SwingTrading #DayTrading #TradingStrategy #MetalsTrading #TechnicalAnalysis #ThiefStrategy #LayeredEntry #RiskManagement #TradingView #ForexSignals #PlatinumTrading #MetalMarkets

🏴☠️ Trade smart, trade safe, and may the profits be ever in your favor!

Platinum chartPlatinum is commencing wave E on the monthly chart. The E wave could unfold as a Triangle or Diametric — opening the door for a massive rally. Targets: $5K+ 🚀

The upcoming wave E could evolve as a Triangle or Diametric pattern, potentially fueling a powerful bullish rally.

This suggests the current consolidation is not the end — but the setup for the next explosive leg upward.

BULLISH ANALYSIS OF XPTUSD ( PLATINUM SPOT VS US DOLLAR)As of October 3, 2025, the XPT/USD stands at approximately $1,571 per troy ounce, reflecting a robust year-to-date (YTD) gain of over 58% from early 2025 levels around $992. This surge has propelled platinum out of a decade long consolidation, marking it as one of the top-performing precious metals in 2025. The World Platinum Investment Council (WPIC) projects an average annual deficit of 620,000–727,000 ounces (koz) from 2025 through 2029, equivalent to 8–9% of average demand. XPT/USD has broken out of a decade-long trading range ($800–$1,100), signaling the start of a new uptrend. While short-term volatility remains a risk, the structural case for platinum's rise is compelling, with forecasts pointing to sustained deficits and prices potentially exceeding $1,700–$2,000 by year-end or into 2026. A buying opportunity presents on the recent bullish breakout on the weekly Timeframe, which was confirmed by above average volume.

PLAT/GOLD ratio: why my stockpick number 4 will start to fly !!Platinum is usually 1 to 2 times more expensiv than Gold historically (between 1.17 and 2.37 times from 1998 until 2008).

After the Great Financial Crisis things went out of wack ! The ratio fell inside a bullish descending wedge until it touched its low point around 0.39 !

At the peak of the Corona Crisis you could buy 2.5 ounces of Platinum with 1 ounce of Gold !

This undervaluation is of factor 3 compared with its average.

This means Platinum could very well outperform Gold by 3 times in the future.

Intresting is that price formed a double bottom with its recent March low and that a bullish divergeance formed between the March 2020 and March 2024 low.

Whereas the March 2020 low was a FALSE breakout of the wedge. The March 2024 is a REAL backtest of the apex of the bullish wedge.

The future price movement of the ratio, and especially the price movement of the PLG (Platinum Group Metals - stock pick number 4/10) should be dramatic !!

Precious Metals: Bullish Momentum IntactThe picture remains unchanged — trading should be done only from the long side.

The trend is still strongly bullish, with all major metals showing solid growth.

The greatest upside potential remains in silver, platinum, and palladium.

The market environment continues to favor buyers, so it makes sense to hold existing long positions or add to longs on pullbacks.

Platinum Breakout Pending! Layered Entry + Macro Edge Inside🔒💎 XPT/USD (Platinum vs. U.S. Dollar) — Swing/Scalping Thief Plan

📌 Trade Plan (Bullish Setup)

Asset: XPT/USD (Platinum vs. U.S. Dollar)

Bias: Bullish (Pending Order Plan)

Breakout Entry: Watching $1400.00 ⚡ (Resistance Breakout)

Layered Buy Entries (Thief Strategy):

$1380 (Layer 1)

$1390 (Layer 2)

$1400 (Layer 3 / Breakout Confirm)

(You can increase/adjust layering based on your own risk strategy — set alerts on TradingView for breakout confirmation 📲)

Stop Loss (Thief SL): $1360.00 (after breakout confirmation).

Note: Adjust SL based on your own risk management — not a fixed recommendation.

Target (Escape Point): $1460.00 🎯

Resistance + Overbought + Trap Zone → exit with stolen money before the vault closes!

💡 Why This Thief Plan?

Combines Thief Layer Strategy (multiple buy limits around breakout) with macro, fundamental, and sentiment drivers.

Breakout level @ $1400 is technically + psychologically key.

Layering ensures better risk-adjusted entry & scaling opportunities.

Target chosen at resistance/overbought zone — escape before trap triggers.

📊 Real-Time Market Data (Sept 8, 2025)

Current Change: +5.39 (+0.39%)

Previous Close: $1,376.35

Day’s Range: $1,369.14 – $1,407.52

52-Week Range: $887.50 – $1,486.23

😰 Fear & Greed Sentiment

Index: 53 → Neutral 😊

Market is balanced, showing cautious optimism with no extreme fear/greed.

🧑🤝🧑 Sentiment Breakdown

Retail Traders: 55% Long 🐂 | 45% Short 🐻

Institutions: 60% Long 🐂 | 40% Short 🐻

Institutions lean bullish, supported by macroeconomic shifts & rate-cut optimism.

🌍 Fundamental & Macro Drivers

Fed Rate Cuts Expected → Weak labor data fuels precious metal demand.

Global Equity Breadth → Broadening bull market supports commodities.

China Deflation Battle → Bond yields ~1.8% → key for platinum demand.

Weak U.S. Labor Market → Only 22K jobs added in Aug → rate cut hopes rise.

Oil Price Decline → Brent at $65.50 → signals demand concerns, indirectly hitting industrial metals.

🐂📉 Market Outlook

Bullish Score: 65% ✅

Bearish Score: 35% ❌

Summary: Platinum supported by rate cut expectations, weak labor data, and institutional flows. Risks remain due to oil price volatility & broader economic uncertainty.

🔍 Related Pairs to Watch

OANDA:XAUUSD (Gold)

OANDA:XAGUSD (Silver)

$PALLUSD (Palladium)

TVC:DXY (U.S. Dollar Index)

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#Platinum #XPTUSD #Metals #SwingTrade #Scalping #LayerStrategy #Breakout #ThiefTrader #Commodities #TradingPlan #TechnicalAnalysis #MacroAnalysis

XPT/USD BULL HEIST ALERT! Breakout & Layering Strategy!🌟 XPT/USD "THE PLATINUM HEIST" - BULL MARKET SWING PLAN 🌟

Greetings, Fellow Thieves & Market Robbers! 🤑💎✂️

The vault on XPT/USD (Platinum) is primed for a major bull heist. Our intel suggests a massive breakout is imminent. This is not a drill! Time to execute the plan and fill our bags with shiny loot. 🚨💣🚔

🏦 THE MASTER HEIST PLAN (BULLISH SWING) 🏦

📍 ENTRY PROTOCOL: THE BREAKOUT TRIGGER ⚡

The main vault door is at 1380.00. We do not enter until this level is CONFIRMED BROKEN. 🚨 SET YOUR TRADINGVIEW ALARMS! 🚨 Do not miss the signal! This is crucial!

🤵♂️ THE "LAYERING" STRATEGY: (Thief's Signature Move)

Once the breakout is confirmed, we deploy multiple limit orders to maximize our haul. The classic thief method:

LAYER 1 BUY LIMIT: 1370.00

LAYER 2 BUY LIMIT: 1360.00

LAYER 3 BUY LIMIT: 1350.00

LAYER 4 BUY LIMIT: 1340.00

(Add more layers based on your own risk appetite, you cunning criminals!)

🛑 STOP LOSS: THIEF'S ESCAPE ROUTE

This is a HEIST, not a holiday. Our emergency exit is far below at 12400.0 to avoid any market whipsaw traps.

⚠️ Dear Ladies & Gentleman (Thief OG's), adjust your SL based on your own strategy & risk tolerance! Protect your capital!⚠️

🎯 TARGET: CASH OUT & VANISH!

The police have set a barricade at 25500.0. Our mission is to escape with the stolen money BEFORE we get there! Take your profits at 25400.0 and disappear into the night! 🚓💨💰

⚠️ HEIST SAFETY BRIEFING ⚠️

NEWS CANCEL HEISTS: Economic data can cause chaos. Avoid opening new positions during high-impact news events. 🗞️🔍

MANAGE YOUR LOOT: This is a SWING/DAY plan. Size your positions wisely. Greedy thieves get caught! 🚓👮♂️

THE MARKET IS A TRAP: Stay vigilant. Price can fake out at any moment. Trust the plan, not your emotions.

💖 SUPPORT THE CREW!

Smash that 👍 LIKE button and 🔔 FOLLOW to boost the signal! Your support funds our next market robbery and keeps the heist plans coming! Let's get this platinum! 🏆💎🚀

I'll see you on the next job. Stay sharp, thieves! 🤑🐱👤

Platinum Trend Still Intact, But Correction Risks Are RisingThe uptrend in metals is not over yet.

Of course, the risks of a correction are increasing. And here I want to emphasize that this view is not based on specific factors or a particular chart setup, but rather on the general understanding that no asset can rise forever — there must be pullback phases.

I keep this in mind, but I don’t let it dominate my analysis. Right now, I like the setup on the chart. I will go long on platinum again with a stop below Tuesday’s low at 1545. The stop is relatively wide, so it’s important to size the position carefully to avoid risking the entire deposited capital in the brokerage account.

Last time, I was stopped out around 1575. That’s the current price, and that’s where I’ll enter again. If I get stopped out once more, I’ll step aside and wait for a correction toward lower levels — somewhere around 1475 or even 1435.

But the bigger picture hasn’t changed. Long-term, I expect platinum to move toward 1715 / 1925 / 2100 / 2200 / 2300 and beyond.

📝Trading Plan

🟢Entry: current level - 1575

🔴Stop: 1545

🎯Target: 1715 / 1925 / 2100 / 2200 / 2300 and beyond

Metals in a Phenomenal Rally: Platinum Takes the SpotlightMetals are showing a phenomenal rally.

Gold is simply skyrocketing.

Silver is just 2% away from historical highs, platinum has more than 40% to go, and palladium still has over 165% to reach its peak.

The commodity supercycle continues — and let’s not forget that commodity market cycles are long!

Right now, platinum looks the most attractive. The hourly chart shows a solid setup with excellent growth potential.

An additional advantage is the tight stop-loss level, just below yesterday’s low at 1585.

I’m entering a long position from the current level.

📝Trading Plan

🟢Entry: current level - 1610

🔴Stop: 1585

🎯Target: 1715 / 2300

PLATINUM IS COMPLETELY UNDERVALUED, BUY NOW!TVC:PLATINUM CAPITALCOM:PLATINUM

Platinum is absolutely undervalued and is currently trading at only $975 USD.

The Gold to Platinum Ratio just hit a new all time high with the Current Ratio being 3,09 even though Platinum has traded since the 1970s till 2016 at a consistent average of 1:1. Gold's all time low against Platinum was at 0,42 in June 2008; AKA the 'Great Financial Crisis'.

Every single indicator shows that right now is the perfect time to buy Platinum especially because the 'Gold rush' is in its absolute final stages.

Keep in mind that Platinum is around 15 times rarer than Gold on Planet Earth.

May fortune favor the bold, and as always - DYOR NFA ! ;)

CYANE

XPTUSD, Platinum ready for parabolic movePlatinum is breaking out after roughly two months of consolidation. Anticipating a parabolic Wave 3 with defined targets. Ratio charts of XPTUSD versus XAGUSD/XAUUSD suggest platinum will outperform gold and silver moving forward.

If you like this analysis, please share and boost! :)

Platinum (XPTUSD) – Buy on Break & Retest SetupPrice is consolidating near resistance. My plan:

Entry: Buy after a confirmed break above resistance and a clean retest.

Stop Loss: Below the recent support zone.

Target: Next liquidity level around 1460+.

This setup follows a simple break-and-retest strategy for continuation to the upside.

Platinum fundamental and technical analysis reportPlatinum: Data Overview.

1. Supply–Demand Imbalance

- 2025 mine supply: 7,000,000 oz

- 2025 total demand: 7,900,000 oz

- Annual deficit: 900,000 oz

- Q2 price change: +35 %

2. Price & Ratio

- Spot price: 1,402.00 current USD/oz

- Gold–Platinum ratio: ~2.0× (long-term norm: 1.2×)

3. Technical Analysis

Daily Timeframe

- Support at 1,360 USD

- Resistance at 1,420 USD

- Confirmed triple-bottom pattern

- Scenario 1 target: 1,460 USD (Fibonacci extension)

- Scenario 2 downside risk: 1,360 USD

Four-Hour Timeframe

- Local support at 1,380 USD

- Immediate resistance between 1,390–1,400 USD

- Scenario 1 target zone: 1,440–1,460 USD

- Scenario 2 retest level: 1,380 USD

4. Elliott Wave Projection

- Current count: Wave 3 of 5

- Wave 3 completion target: 1,480 USD

- Wave 4 corrective zone: 1,420–1,440 USD

5. COT & CFTC Positioning (NYMEX Platinum)

- Non-Commercial (speculators):

- Long: 53,057 contracts

- Short: 38,701 contracts

- Net: +14,356 contracts

- Commercial (hedgers/producers):

- Long: 20,511 contracts

- Short: 40,721 contracts

- Net: −20,210 contracts

- Non-Reportable (small traders):

- Long: 84,081 contracts

- Short: 89,935 contracts

- Net: −5,854 contracts

- Total open interest: 94,804 contracts

6. NYMEX On-Warrant Warehouse Inventory

- Platinum inventory: 42,500 oz

- Month-over-month change: −3.2 %

7. Key Watchpoints

- US Federal Reserve policy developments

- Chinese automotive demand and emissions regulations

- PGM lease rates and futures curve dynamics

- ETF flows and physical investment into platinum