BNL – BUY TRADE | 2H | 05 Oct 2025 | TCABNL – TECH BUY CALL | 2H | 05 Oct 2025 | By The Chart Alchemist

The stock has been moving in an expanding triangle, a form of consolidation pattern. The recent price action suggests the expanding triangle is converting into a continuation pattern. Furthermore, the recent bearish leg (marked with light blue) has taken the shape of a bull flag and conducted several selling climaxes. We expect the stock to rise from this level and achieve multiple quantified displacement targets.

📢 Technical Analysis by Mushtaque Muhammad (The Chart Alchemist).

Trade ideas

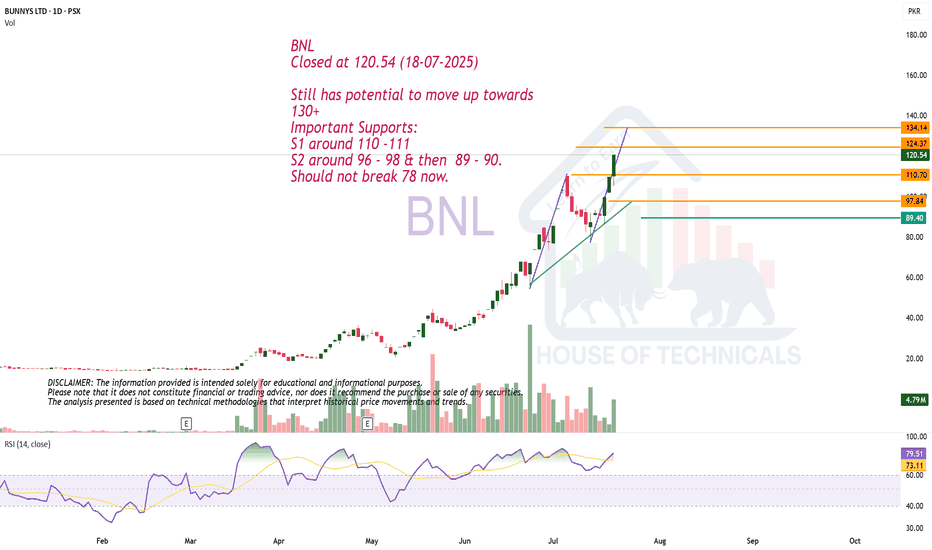

BNL Technical ViewBNL is showing signs of a potential reversal as bullish divergence is forming with rising volumes, while RSI on the 4-hour timeframe is in the oversold zone. A confirmation from the trend indicator with a buy signal could trigger an upside move towards 110–111 , and if momentum sustains, the price may further extend towards 124 . Use top loss at 88 , just below previous swing low, to manage your risk.

Weekly Closing is OK. BNL

Closed at 110.12 (07-09-2025)

Immediate Resistance is around 113 - 115.

Weekly Closing is OK.

There seems to be an upside movement (may be

towards 130) if it remains above 96 - 98 for couple

of days / or on hourly basis with Good Volumes.

Now it should not break 88 even in worst cases.

50% retracement from the top. BNL Analysis

Closed at 89.48 (01-09-2025)

It bounced from 93 till 103 - 104.

Though it has broken its HL but Bullish Divergence is there & also

50% retracement from the top.

Now if the current level is not honored as a Good Support (couple of Bullish

Candles Required), we may witness 72 - 73.

Upside Immediate Resistance is around 104 - 105 (as mentioned earlier.)

Levels to Play!BNL

CMP 131.35 (15-08-2025)

as mentioned earlier about Bearish Divergence,

it has started playing.

May print HL and then move up; but for this

upside move towards new Highs is only possible if

it crosses & sustains 157 - 158 with Good Volumes.

Important Supports:

S1 around 132 - 133

S2 around 124 - 125

Should not break 93 now.

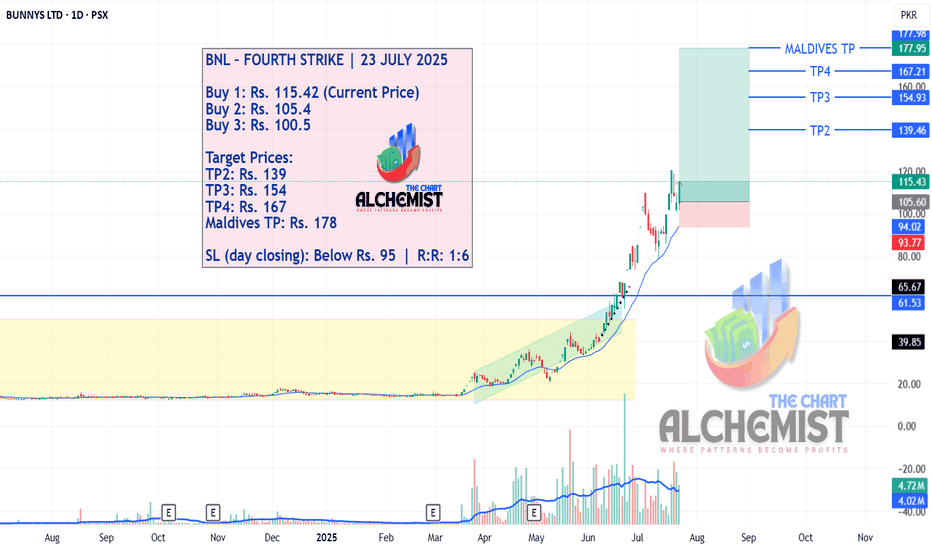

BNL – FOURTH STRIKE | 23 JULY 2025 BNL – FOURTH STRIKE | 23 JULY 2025

After taking three strikes—with all targets achieved for two strikes and TP1 achieved for the third—BNL stock went into a pullback. However, the pullback is now over, and the stock is expected to rise again to achieve multiple quantified displacement targets.

BNL LONG TRADE (SECOND STRIKE)BNL has recently completed second SPIKE Phase of its splendid uptrend with – it gave an optimum Pullback with befitting Volume Distribution. It is ready to resume its uptrend.

🚨 TECHNICAL BUY CALL –BNL 🚨

🎯BUY1: Rs. 34-35.5

📈 TP1 : Rs. 43.5

📈 TP2 : Rs. 48.11

📈 TP3 : Rs. 57.1

🛑 STOP LOSS: BELOW Rs. 30.5 (Daily Close)

📊 RISK-REWARD: 1:8.5

Caution: Please buy on levels in 3 parts. Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

Making HH HL.

Closed at 40.45 (04-06-2025)

Making HH HL.

Bearish Divergence played well &

dragged the price from 44 - 45 to around 33.

Printed HL & started moving upside.

If 45 is Crossed & Sustained, we may witness

new Highs around 55 - 57.

However this time, Stoploss should be 33.50

on Closing basis.

Though still in Uptrend, but BNL Closed at 37.39 (25-03-2025)

Though still in Uptrend, but

as mentioned earlier, bearish divergence

has started appearing on bigger tf, so

cautious approach should be taken.

It may re-test 35.20 - 36.20 & bounce as this

is an important Support level.

Otherwise next Support seems to be around

32.30 - 32.50

BNL - MULTIBAGGER ??

Current Price: 22.24

Chart Setup: Bullish Pennant and Breakout Pattern

BNL (Bunny's Ltd.) is currently showing a bullish pennant pattern, which is a continuation chart pattern that suggests a potential breakout to the upside. The price has been consolidating after a strong rally, forming a symmetrical triangle or pennant shape, with the upper boundary acting as resistance and the lower boundary as support. The breakout from this pattern is typically a sign of further upward momentum.

First Target (50% Extension): Once the breakout happens, the first target range for BNL could be around 25.48, followed by a potential move toward 28.50 in the medium term.

Extended Target: If the breakout holds and the bullish momentum continues, BNL could test higher resistance zones around 30.00–32.00 in the long term.

BNL OUR FIRST CALL INITIATED @ 14 LEVELS IN MARCH