ENGROH- KSE100- Possible setup.EngroH Buy Setup

Entry (Buy Above): 223

Stop Loss: 205.6

Take Profit Targets:

TP1: 240

TP2: 260

Technical Context:

Price is currently holding at the 38.2% Fibonacci retracement level, which is acting as strong support. As long as the price sustains above this level, upside momentum remains intact and a breakout above 223 could trigger a continuation move toward higher targets.

Trade ideas

Bullish on Weekly tf.ENGROH

Closed at 237.63 (27-10-2025)

Bullish on Weekly tf.

But there is a Resistance around

238 - 240.

Crossing this may lead it towards

249 - 250 & then even upside towards

258 - 265.

On the flip side, 225 - 227 seems to be

an important support zone.

It should not break 209 now.

Engro Holdings Limited ENGROH

Engro Holdings Limited :

Trading within an ascending parallel channel, indicating a medium-term bullish trend.

The recent bounce from the lower trendline (PKR 225–230) shows strong institutional buying activity — this area is considered an institutional buy zone.

As long as the price stays above this zone, the overall trend remains positive and accumulative.

Price Action

Current Price: PKR 237.55

Lower channel line near PKR 225 acted as strong support and institutional accumulation zone.

Immediate resistance: PKR 245–250; next strong resistance at PKR 261 (upper channel).

A breakout above PKR 250 could trigger continuation toward PKR 261

Support & Resistance Levels:

224–230 Institutional Buy Zone / Support Channel bottom + accumulation zone

245–250 Resistance Minor horizontal resistance

261 Major Resistance Upper channel & previous swing high

200 Major Support Next key level if channel breaks

Technical Outlook:

The price action confirms institutional accumulation near the 225–230 zone, aligning with technical support.

Momentum indicators support a bullish continuation if the price remains above this area.

Watch for confirmation above PKR 245–250 for the next upside leg.

Trading Plan (Technical View) :

Institutional Buy Zone: 225–230

Buy Range: 230–235

Target 1: 245

Target 2: 261

Stop Loss: Below 224

EngroH Bounce expectedEngroH is going to form an M pattern for which it has to take a bounce and then will fall back.

Bounce can be expected to Fib-0.618 (212) or Fib-0.786 level (245).

RSI and Stoch are in recovery phase. MACD still bearish.

Playing on levels should be prioritized with trailing stoploss once it reaches 212.

Exit should be planned near 245. Staying long can be fatal.

This is my personal opinion, not a buy / sell call.

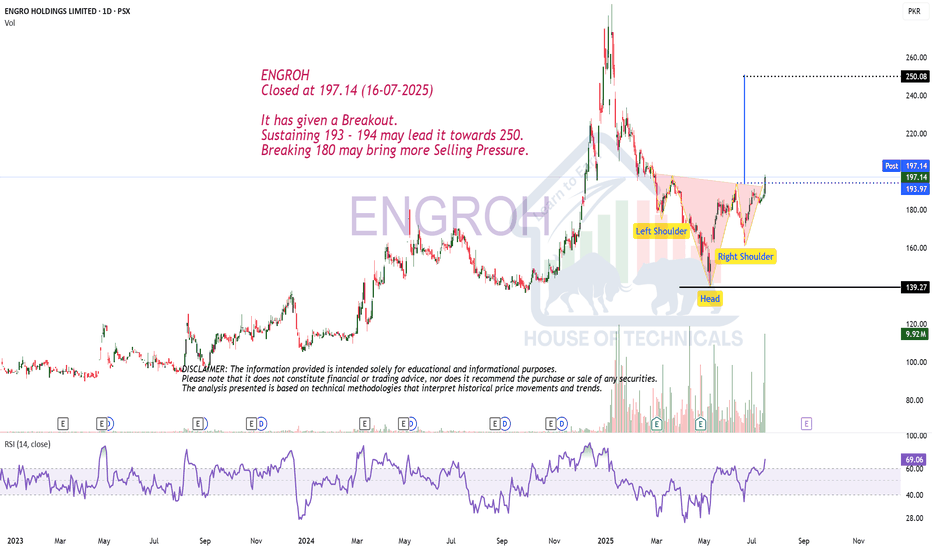

PSX ENGROH OutlookENGROH holding had completed the correction cycle and breakout from last high.

1. Breakout of head& shoulder pattern

2. Breakout of last high

3. Breakout of EMA convergence

4. Confirmation of Bullish Divergence breakout

5. Start the sub wave3 of primary Wave3 targeting the 247 level

6. if WAVE 3 is extending then target will be 302

Bullish Divergence on Daily tf.ENGROH

Closed at 182.38 (27-06-2025)

Bullish Divergence on Daily tf.

Immediate Resistance is around

193 - 194.

Crossing it with Good Volumes may result

in upward price movement towards 200+

However, if 160 is broken this time,

we may witness further selling pressure

towards 145 - 150.

Bullish divergence in ENGROHBullish divergence is observed in the daily timeframe for ENGROH. The current downtrend is expected to reverse after the bullish divergence. The current downtrend is likely to reverse into an uptrend and reach levels indicated on the chart. When the trend starts to reverse and breaks the entry point level indicated on the chart, it will be considered a confirmation of the trend reverse and a good point to take a long position.

ENGROH-Long term Buying CallAt present, ENGROH is in bearish trend after making head and Shoulder pattern, and making LL and LH. At the moment, it is taking support at 78.6% Fib level. if it breaks this level, then possible support level will be around 135 which is also projection of Head & Shoulder pattern. For long term buying, suggested level ranges between 135-125.