Trade ideas

GGL – TECH BUY CALL | 2H | 24 Nov 2025 | By The Chart Alchemist GGL – TECH BUY CALL | 2H | 24 Nov 2025 | By The Chart Alchemist

GGL has been moving within a bullish channel and recently completed its bearish leg at Rs. 21.70. The stock has shown a strong reversal with multiple bullish structures forming, indicating renewed upward momentum toward higher targets.

📢 Technical Analysis by Mushtaque Muhammad (The Chart Alchemist).

GGL – BUY TRADE | 2H TF | 22 OCT 2025 | TCA

GGL – TECH BUY CALL | 2H TF | 22 OCT 2025 | By The Chart Alchemist

The stock GGL has been trading within a bullish channel and recently formed a reaccumulation phase. After testing the lower boundary of this phase, the stock has shown a strong upward reversal, indicating the beginning of a fresh bullish leg.

📢 Technical Analysis by Mushtaque Muhammad (The Chart Alchemist).

Ghani Global Holdings Ltd. (GGL) Technical Analysis Overall Trend

On the weekly timeframe, the stock has turned bullish, making clear Higher Highs (HH) and Higher Lows (HL).

After a long consolidation phase (sideways box), price has broken out strongly and is trending upwards.

📈 Chart Highlights

Breakout from Consolidation

The stock traded in a sideways range (boxed zone) for nearly two years.

A breakout happened with strong bullish candles, confirming a trend reversal from accumulation to uptrend.

Entry Strategy

Buy instant at current levels (~23.29 PKR).

Or accumulate on pullbacks near 21–18 PKR zone (higher low region).

Stop Loss & Risk Control

Stop Loss: 13.95 PKR (below strong support & structure low).

Target Levels (Take Profit)

TP1: 31.58 PKR (intermediate resistance & previous swing projection).

TP2: 39.96 PKR (major resistance & projected higher move).

📊 Indicators

RSI Divergence Indicator (14):

Currently at 78.73, showing strong bullish momentum.

Earlier bullish divergences supported the breakout from consolidation.

Overbought, but this is often a sign of strength in breakouts on higher timeframes.

Trading View

GGL has moved from a long consolidation into a clear uptrend.

The bullish structure remains valid as long as HL > 18 PKR.

If the price corrects, it may retest 21–20 PKR zone before resuming the rally toward TP1 and TP2.

Summary: Ghani Global Holdings (GGL) on PSX has broken out of multi-year consolidation and is trending bullish on the weekly timeframe. Buy entries are valid around current levels or dips toward 21–18, with stop loss at 13.95. Targets are 31.58 and 39.96, supported by strong momentum and bullish RSI signals.

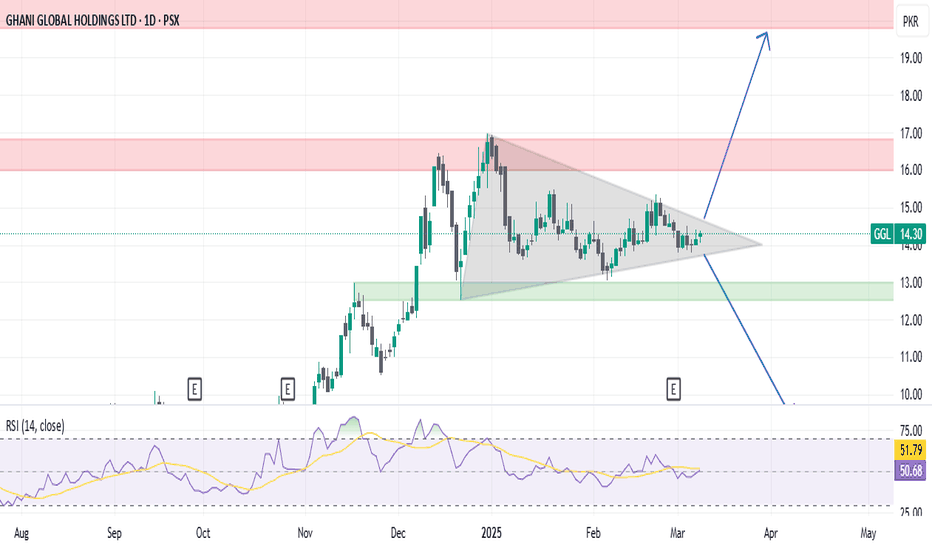

GGL Likely to Touch PKR 20.62 SoonGhani Global Holdings Limited (PSX: GGL) is displaying strong bullish signals, with rising volume and a steady uptrend pushing the price closer to key resistance levels. The stock recently rebounded from support around PKR 12.00 and has been forming higher lows on the daily chart — a classic bullish structure.

Momentum indicators like RSI remain in healthy territory, and a breakout above PKR 16.96 (the 52-week high) could trigger a rally toward PKR 20.62. With improving investor sentiment and positive fundamentals, GGL looks poised to test this level in the short to medium term.

This is not buy or sell call do your own research.