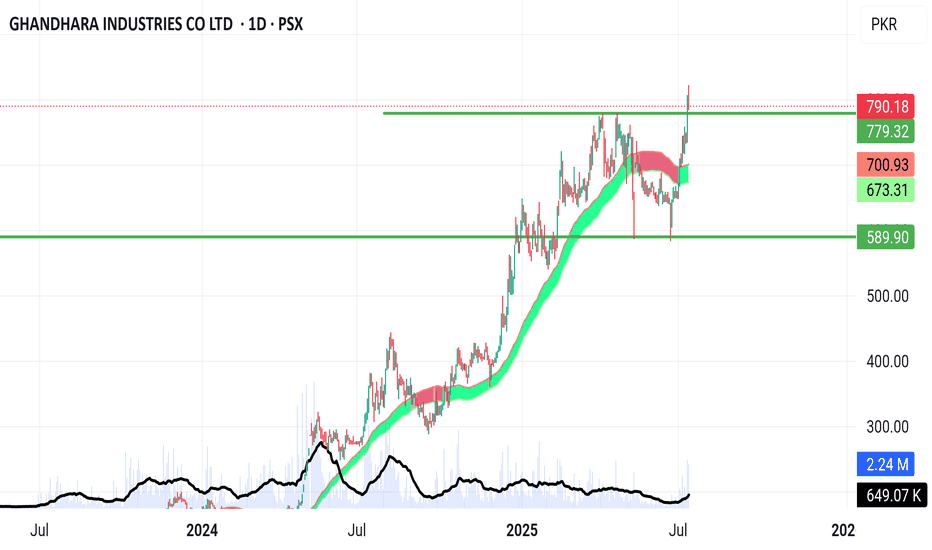

GHNI has started bearish cycleGHNI started its 5-wave Elliott Wave Cycle in June/23 and has now completed Cycle with 5th-wave extension around 910 in Oct/25. Its 5th-wave further sub-divided into Terminal Impulse Patten. Under EW rules, it has now started its downward journey, and it may retrace to 525. However, during its downw

Ghandhara Industries Limited

No trades

129.55 PKR

4.58 B PKR

37.46 B PKR

11.90 M

About Ghandhara Industries Limited

Sector

Industry

CEO

Ahmad Kuli Khan Khattak

Website

Headquarters

Karachi

Founded

1963

Identifiers

2

ISINPK0007101014

Ghandhara Industries Ltd. engages in the manufacture and market of vehicles. Its products include pickup, trucks, and buses. The company was founded by M. Habibullah Khan Khattak on February 23, 1963, and is headquartered in Karachi, Pakistan.

Related stocks

Hidden Bullish Divergence appeared.GHNI Analysis

Closed at 835.68 (02-12-2025)

Hidden Bullish Divergence on Bigger tf.

Also, if 775 is not broken, we may witness

upside towards 900+.

Crossing & Sustaining 910 with Good Volumes,

may lead the price towards 1000 - 1100.

Buy on Dips can be a Good Option. Otherwise a Good Support

seems t

GHNI – TECH BUY CALL | 1H TF | 21 Oct 2025 | By TCAGHNI – TECH BUY CALL | 1H TF | 21 Oct 2025 | By The Chart Alchemist

The stock GHNI has been showing bullish strength after reaccumulating in overlapping trading ranges. After achieving a high of PKR 908, it went into a pullback, forming a DB Bull Flag. The stock is now moving upwards with increased

GHNI – TECH BUY CALL |1H TF| 04 Oct 2025| By The Chart AlchemistGHNI – TECH BUY CALL | 1H TF | 04 Oct 2025 | By The Chart Alchemist

The stock is moving within a bullish channel (marked with light blue). After reaching a recent high of PKR 900, it entered a pullback phase that is now complete. Having broken out of the pullback channel (marked with light pink), th

GHNI TARGETING: 900 ??#GHNI has been consolidating in a range and is now showing signs of strength with upside potential. The chart suggests a possible move towards the target zone: 860 – 900 if momentum sustains.

Chart Highlights:

✅ Current price: 821.11

✅ Consolidation breakout attempt in progress.

📌 Resistance: 84

ABCD PatternGHNI Analysis

Closed at 738.08 (04-07-2025)

Monthly Closing above 648 would be

a positive sign.

784 - 785 is the Resistance for now.

It has the potential to touch 1000 - 1100

if it Crosses & Sustains 785 with Good Volumes.

On the flip side, 680 - 682 & then 657 - 660 may

act as a Support.

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of GHNI is 794.05 PKR — it has decreased by −0.39% in the past 24 hours. Watch Ghandhara Industries Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on PSX exchange Ghandhara Industries Limited stocks are traded under the ticker GHNI.

GHNI stock has fallen by −2.61% compared to the previous week, the month change is a 0.95% rise, over the last year Ghandhara Industries Limited has showed a 34.35% increase.

GHNI reached its all-time high on Sep 25, 2025 with the price of 910.00 PKR, and its all-time low was 3.20 PKR and was reached on Jan 4, 2013. View more price dynamics on GHNI chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

GHNI stock is 1.25% volatile and has beta coefficient of 1.14. Track Ghandhara Industries Limited stock price on the chart and check out the list of the most volatile stocks — is Ghandhara Industries Limited there?

Today Ghandhara Industries Limited has the market capitalization of 34.12 B, it has increased by 0.38% over the last week.

Yes, you can track Ghandhara Industries Limited financials in yearly and quarterly reports right on TradingView.

GHNI net income for the last quarter is 1.58 B PKR, while the quarter before that showed 1.65 B PKR of net income which accounts for −4.55% change. Track more Ghandhara Industries Limited financial stats to get the full picture.

Yes, GHNI dividends are paid annually. The last dividend per share was 10.00 PKR. As of today, Dividend Yield (TTM)% is 1.25%. Tracking Ghandhara Industries Limited dividends might help you take more informed decisions.

Ghandhara Industries Limited dividend yield was 1.54% in 2025, and payout ratio reached 9.30%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Dec 24, 2025, the company has 602 employees. See our rating of the largest employees — is Ghandhara Industries Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Ghandhara Industries Limited EBITDA is 8.16 B PKR, and current EBITDA margin is 16.67%. See more stats in Ghandhara Industries Limited financial statements.

Like other stocks, GHNI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Ghandhara Industries Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Ghandhara Industries Limited technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Ghandhara Industries Limited stock shows the buy signal. See more of Ghandhara Industries Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.