Trade ideas

HCAR CATHING THE EYE FOR THE BULLSThe script HCAR is showing positive signs for the breakout of the consolidation box to make new highs towards the level of 495 having a main hurdle/resistance at 355. The consolidation looks solid and the company is fundamentally looking strong . The index is ready to explode and so do HCAR ...

What are your opinions ????

Honda Atlas Cars (HCAR) Ready to fly Honda Atlas Cars (HCAR) is forming a textbook Cup & Handle pattern on the weekly timeframe — signaling a potential medium-term bullish reversal.

Momentum indicators and rising volume support a breakout scenario.

A confirmed weekly close above PKR 325–330 can ignite a strong move toward PKR 400–450, completing the Cup & Handle projection.

5. Trade Setup

➡️ Entry Plan

• Aggressive Entry: PKR 306–312 (anticipating breakout before confirmation)

• Conservative Entry: Weekly close above 325–330 with volume

Strict stop loss 295

6. Trade Management

• Phase 1: Buy near 306–312; add on breakout confirmation above 325.

• Phase 2: Take 25–30% profit at 349; trail SL to breakeven.

• Phase 3: Hold remainder toward 400–453 with trailing stop under each weekly higher low.

• Volume Watch: Maintain position only if weekly volume stays above average.

Summary

Bias: Bullish

Pattern: Cup & Handle Breakout

Targets: 400–453 PKR

Risk/Reward: ~1 : 5

Timeframe: 1–3 months

HCAR – Bullish Flag Breakout on Weekly ChartHCAR has broken out of a bullish flag pattern around the 295 level on the weekly timeframe, confirming a continuation of its prior uptrend. The breakout was supported by strong momentum, suggesting further upside potential.

Key Levels:

Breakout: 295

Current Price: ~313

Target (TP): 570

Stop Loss (SL): 260

Technical Outlook:

The price has successfully retested the breakout zone and is now holding above it. Sustaining this level may drive the next bullish leg toward the 570 resistance zone. The structure remains strong unless the price falls back below 260.

Bias: Bullish

Pattern: Bullish Flag Breakout

Timeframe: Weekly

HCAR – Time Cycle Complete, Ready to Ride!The chart is showing strong accumulation with massive volumes, signaling smart money activity. Price has spent significant time in a sideways cycle, suggesting consolidation is now near completion.

🔑 Key Levels & Plans

Plan 1: Buy near CMP / 285 | SL: 240 | TP1: 340 | TP2: 400

Plan 2: Buy above 340 (on sustained breakout) | TP1: 395 | TP2: 495 | TP3: 595

⚠️ Caution: Strong resistance around 318–340. A breakout above this zone could trigger the next rally, but failure may lead to another pullback.

📌 Conclusion: Stock looks ready for a potential ride, but breakout confirmation is crucial before entering aggressively.

Honda Atlas Cars (Pakistan) Ltd. (HCAR) – PSX technical AnalysisTechnical Analysis: Honda Atlas Cars (Pakistan) Ltd. (HCAR) – PSX

Time Frame: Weekly

Pattern: Consolidation Box with Trendline Support

Pattern Observation

HCAR has been trading in a sideways consolidation box for the last 490 days.

The critical resistance for breakout is at Rs. 322.

If price sustains above this level, the next move can target Rs. 407, and eventually extend towards Rs. 907 (historical high).

The previous box breakout occurred in 371 days, suggesting long-term accumulation before a strong move.

📈 Trade Plan (after Box Breakout)

Buy Stop: Rs. 428

Stop Loss (SL): Rs. 335

Take Profit Targets:

TP1: Rs. 518

TP2: Rs. 559

TP3: Rs. 595

TP4: Rs. 704

TP5: Rs. 930

📊 RSI Divergence Indicator

Current RSI = 54.10, showing mid-level momentum with room for upside.

Historical bullish divergences (green) marked strong reversals from bottoms.

Past bearish divergences (red) correctly aligned with tops.

At present, RSI indicates neutrality but leans towards bullish continuation if breakout occurs.

🚀 Projection Path

Breakout above 322 → move towards 407.

From there, sequential upside targets at 518 → 559 → 595 → 704 → 930.

Long-term potential to retest historical highs near Rs. 907–930.

⚠️ Risk Considerations

Breakdown below Rs. 335 would invalidate the bullish setup.

Extended consolidation may continue if the breakout doesn’t hold.

Watch for weekly closing confirmation above resistance before entering.

✅ Conclusion: HCAR is in a prolonged consolidation phase on the weekly chart. A decisive breakout above Rs. 322 and confirmation at Rs. 428 can unlock a strong upside rally with multi-level targets, potentially retesting Rs. 900+.

HCAR Long || Breakout is NearHCAR is in a symmetric triangle / pennant pattern for over a year now.

It has tested the upper trendline multiple times and monthly closing above 310 will confirm the breakout of pennant.

Target as per ABCD pattern is 570.

Stoploss: 255

This is my personal opinion, not a buy / sell call.

HCAR LONG TRADEHCAR has been in Bearish Channel which actually acts as Bull Flag.

It went below the channel in false breakdown to facilitate Selling Climax which is transfer of possession from Weak Hands ( Individuals ) to Strong Hands ( Institutions ).

This process and its components are actually a fuel for future uptrend.

Low Wave volume during Selling Climax/ Bear Trap are signs of Fake Breakdown to influence weak hands to sell their shares so that institutions have ownership during uptrend

BUY HCAR 290-300

TP1 320

TP2 340

SL BELOW 280

HCAR Stock Buying Strategy HCAR Buying Opportunity:

Key Levels:

1. Current price: 314

2. Buy zone: Below 300

3. Stop loss: 282

4. Targets: 324, 338, and final target 348

Strategy:

1. Buy on weakness: Enter the trade if the price dips below 300.

2. Risk management: Set a stop loss at 282.

3. Profit targets: Aim for 324, 338, and 348.

Considerations:

1. Market conditions: Monitor market trends and news.

2. Risk tolerance: Adjust position size according to risk appetite.

This strategy is based on the provided information. Always conduct your own research and consider consulting a financial advisor before making investment decisions.

Buy HCARHCAR after completing its Elliott Wave cycle in December 2023 has gone into complex correction. First phase of correction completed with type ABC Irregular Failure following all rules both price and time-wise. Now it is forming its second phase of correction with contracting triangle. It has fulfilled its criteria for formation of e-wave. It can start its trending move any time at the levels 289-278. However, there are also chances that e-wave may go further into formation of another small triangle. In that case, this small triangle will be formed without affecting price level to the down-side. It is matter of time only that HCAR may start its upward move towards 417. BUY @ cmp is recommended.

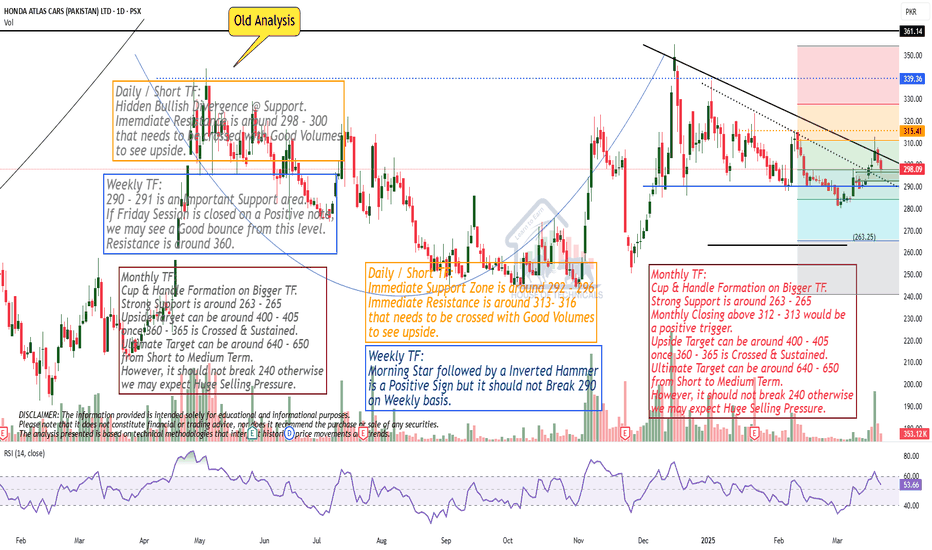

Monthly TF:

Cup & Handle Formation on Bigger TF.

Strong Support is around 263 - 265

Monthly Closing above 312 - 313 would be

a positive trigger.

Upside Target can be around 400 - 405

once 360 - 365 is Crossed & Sustained.

Ultimate Target can be around 640 - 650

from Short to Medium Term.

However, it should not break 240 otherwise

we may expect Huge Selling Pressure.

HCAR - LongThe auto sector as a whole has seen movement, but HCAR has yet to perform, primarily due to the lack of new product launches, making it less competitive against peers. However, sales for the January–March quarter have shown a significant increase , which is expected to reflect positively in profitability.

From a technical perspective, the stock needs to close above 312 with a strong green candle to gain momentum. All target levels are marked on the chart.

Please conduct your own research before making any investment decisions.