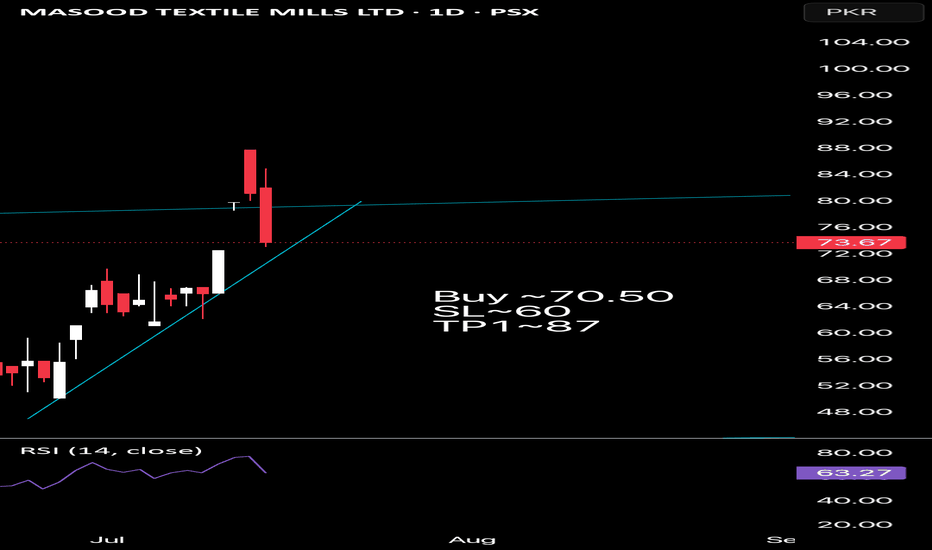

MSOT - Post Breakout Continuation; Targeting 88 - 114MSOT has broken out of a long falling wedge with strong volume. Price is now above key Fibonacci levels (50% & 61.8%), showing a clear trend reversal. Holding above 66 keeps momentum strong, with next resistance at 71. Above that, upside opens toward 88–114. SL below 61.

This is not financial advice. All stock market investments carry risk. Always conduct your own research and consult a licensed financial advisor before acting on any analysis.

Masood Textile Mills Limited

No trades

Trade ideas

MSOT Long1. Long-Term Trend Overview

From 2014–2016, the stock had a massive bull run, reaching an all-time high near PKR 186.

After that, a long-term downtrend followed until around 2022, showing a multi-year bear phase.

Since late 2022, the chart shows base-building — a slow and steady accumulation pattern with higher lows forming.

This suggests the downtrend is likely over and the stock may be entering a recovery or accumulation phase.

2. Current Price Action

Current Price: 57.80

Pivot (P): 54.53 — price is trading above the pivot, indicating a short-term bullish bias.

The stock has been respecting support near 50–54, rebounding multiple times from this zone.

The last few candles show higher lows, signaling buyers stepping in at dips.

3. Key Pivot Levels (Resistance / Support)

Level Price (PKR) Significance

R1 69.02 First major resistance; breakout above can trigger momentum

R2 83.49 Next resistance; target if R1 breaks

R3 97.98 Strong resistance zone (psychological round number)

R4–R5 112–127 Long-term resistances; potential only if strong volume expansion occurs

S1 40.06 Key downside support

S2 25.57 Deep support zone from historical lows

4. Volume & Momentum

Recent volume spikes (2024–2025) suggest institutional accumulation.

This typically happens before a larger move.

However, the momentum remains sideways to slightly bullish — still consolidating under R1 (69 zone).

5. Technical Outlook

Bullish Scenario:

If price closes above PKR 69 (R1) on monthly basis:

Short-term targets: 83 → 98 PKR

Long-term target zone: 112–127 PKR

Bearish Scenario:

If price falls below PKR 54 (Pivot) and closes under PKR 50:

It could retest S1 = 40 PKR

Deeper correction toward 25 PKR (S2) possible if sentiment weakens