NATF Breakout Daily & Weekly; Potential UpsideNATF – Weekly Breakout Setup

CMP: 389.64

Pattern: Curved base breakout continuation

Momentum: Strong +10% weekly move with volume surge

Buy Range: 385 – 395

Stop Loss: 351

Target Zone: 440 – 460

Upside Potential: ~19%

Risk: ~9%

NATF has resumed its long-term uptrend after retesting support from the curved base structure.

The breakout from the consolidation zone signals trend continuation with potential upside toward PKR 459–460, backed by strong volume and momentum.

Holding above 386 keeps the bullish bias intact.

Trade ideas

NATF – BUY TRADE | 1D | 20 Oct 2025 | TCA

NATF – TECH BUY CALL | 1D | 20 Oct 2025 | By The Chart Alchemist

NATF has completed a Wyckoff reaccumulation phase after reaching a high of PKR 450. The structure now signals readiness for a breakout, with potential for multiple equidistant upside moves as momentum builds. The setup reflects strong institutional participation and a renewed bullish leg formation.

📢 Technical Analysis by Mushtaque Muhammad (The Chart Alchemist).

NATIONAL FOODS SCRIPT GEARING FOR A RALLY UPSIDEThe script National Foods has shown a strong movement for making a rally in the bullish direction as the script was capped today with high volumes followed by good results and announcement of dividend.

The script is making Bullish flag pattern with projected targets as marked on the charts.

A potential good script to make profits.

NATFTrend & Price Movement

The stock (NATF) is in an uptrend, shown by the orange parallel lines forming a rising channel.

Rising channel: Price bounces between the lower support line and upper resistance line.

Support line (lower orange line) → where price tends to bounce up.

Resistance line (upper orange line) → where price tends to face selling pressure.

Currently, the price (355 ) is moving up within this channel, suggesting bullish momentum.

NATF – SECOND STRIKE | 01 AUGUST 2025 NATF – SECOND STRIKE | 01 AUGUST 2025

The stock is standing in an upward channel (marked light blue) and recently hit a high of Rs. 383. A healthy pullback followed, consolidating near the axis line, and briefly dipped below it as a spring. Today’s strong rebound confirms the pullback is likely over, signaling a second strike opportunity for continuation towards higher quantified targets.

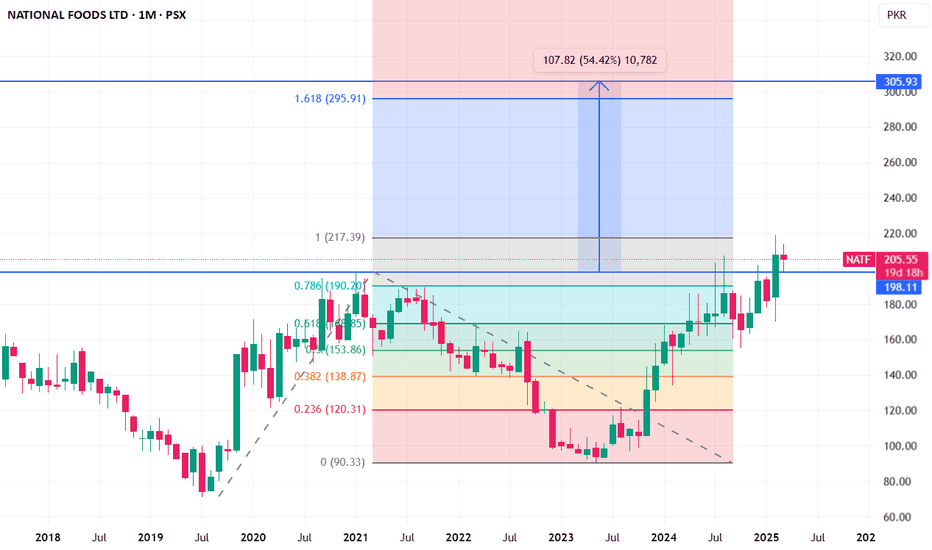

NATF - PSX - SHOWING a Flag PatternNATF Stock Analysis:

- *Buying Opportunity:* NATF is providing a buying opportunity.

- *Buying Range:* 205-200

- *Stop Loss:* 195

- *Target Levels:*

- Initial target: 215

- Final target: 238

- *Key Notes:*

- Hold the position until the target is reached.

- Use stop loss to minimize potential losses.