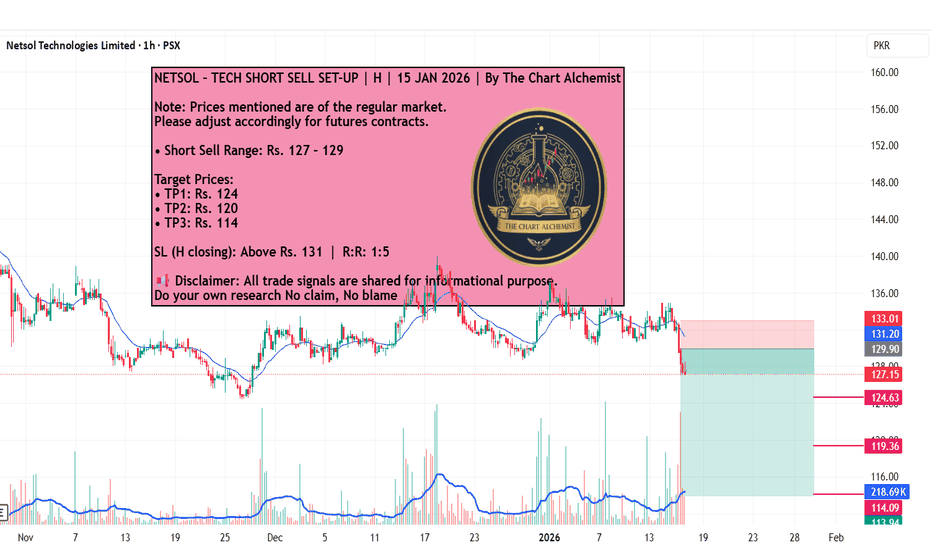

NETSOL – TECH SHORT SELL SET-UP | H | 15 JAN 2026 | By TCANETSOL – TECH SHORT SELL SET-UP | H | 15 JAN 2026 | By The Chart Alchemist

Note: Prices mentioned are of the regular market.

Please adjust accordingly for futures contracts.

• Short Sell Range: Rs. 127 – 129

Target Prices:

• TP1: Rs. 124

• TP2: Rs. 120

• TP3: Rs. 114

SL (H closing): Above Rs. 131 | R:R: 1:5

📢 Disclaimer: All trade signals are shared for informational purpose.

Do your own research No claim, No blame

Netsol Technologies Limited

No trades

What traders are saying

NETSOL – Inverse Head & Shoulders Breakout SetupNETSOL Technologies has formed a clear Inverse Head & Shoulders pattern on the 4H timeframe.

Price is approaching the neckline breakout zone, signaling a potential trend reversal and bullish continuation.

RSI is stabilizing above mid-levels, supporting upside momentum if the neckline is sustained.

Trade Plan:

Entry: 133

Targets:

TP1: 140.41

TP2: 149.71

TP3: 155.80

Stop Loss: Below right-shoulder support

> Favorable risk-to-reward setup

> Wait for confirmation and manage risk properly.

> Not financial advice.

NETSOL – Bullish Reversal Setup! 1:3 Risk/Reward Play Awaits VolNetSol Technologies (NETSOL) is forming a bullish reversal pattern on 4H — and the reward potential is huge!

Entry zone: 133.67 - 135.67

TP1: 140.35

TP2: 146.93

TP3: 154.09 (+17% upside)

Risk/Reward = 1:3 — exceptional for swing trade

Key Condition: Wait for high volume on breakout or retest — no chase without confirmation!

Disclaimer:

This idea is intended for educational and research purposes, based on technical patterns. It is not investment advice. Always conduct your own analysis (DYOR) and manage your risk carefully before entering any trade.

Making HH HL.NETSOL Analysis

CMP 157.71 (18-09-2025 12:51PM)

Making HH HL.

Took Support from an Important Level

and now moving towards its Resistance around

172 - 175

Crossing & Sustaining this level may lead it

towards 200 then 230+

On the flip side, 148 - 150 & then 133 - 135

seems to be an Important Support levels.

However, it should not break 108 now even in

extreme cases.

Though in Uptrend but..NETSOL

Closed at 145.06 (18-07-2025)

Though in Uptrend but Important

Support seems to be around 133 - 134

which is also a Channel bottom; Next

Support will be around 120 - 122.

Channel top is around 185 - 190.

However, in case of Extreme Selling Pressure,

103 - 105 is a Very Strong Trendline Support.

NETSOL | Swing Trade SetupTrading Note: NETSOL Technologies Ltd. (NETSOL) - Long Position Recommendation

Date: June 13, 2025

Subject: Potential Long Opportunity from Major Support Level

Overview:

This note recommends considering a long position on NETSOL from its significant major support level around 125. Recent price action suggests a compelling opportunity for a bounce from this historically pivotal zone.

Analysis of the 125 Support Level:

The price level of 125 stands out as a critical major support for NETSOL. This level has consistently acted as a strong demand zone, where buying interest has historically emerged to halt downward momentum and initiate price reversals. Looking at past performance, the price has made several notable pullbacks from this area. Each time NETSOL has approached 125, leading to a rebound in price. This repeated rejection of lower prices at 125 underscores its importance as a robust psychological and technical barrier, indicating strong underlying demand. The recent sharp drop and subsequent bounce reinforce the continued relevance of this level.

Recommendation:

Based on the strong historical significance and recent price action, a long position is recommended from the major support level around 125. Traders should consider entry points near this level, potentially with a stop-loss placed just below the immediate lower support marked by the red zone on the chart (around 120) to manage risk.

Target:

Initial targets could be set towards the previously established resistance around the 142 range, aligning with the potential for a rebound towards the upper boundary of the indicated channel.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Always conduct your own due diligence and consult with a qualified financial advisor before making any investment decisions.

Netsol - Inverse H&S into playNetsol is in its buyback phase which is about to be over in June.

Inverse H&S is in play where it hit its daily pivot level. If it now makes a higher high and higher low, 2nd shoulder will be confirmed. Alternatively, it may hit 123 (bottom of its first shoulder) before going upward. Upside short term target will be 183.

NETSOL LongIt is totally my assumption and can be wrong as well. This is not a buy / sell call.

Netsol is in accumulation phase and may touch the high and touch the trendline shown by Feb-Mar 2026.

The high it may touch will be its Fib level 1.618 i.e. 522 or best assumption can be 538 (difference of its previous high and recent low). Buyback by company is another strong indication of "Something's Cooking".

Have a blessed Ramazan and great trading experience.