Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

20.19 PKR

6.10 B PKR

23.07 B PKR

88.08 M

About Pakistan Aluminium Beverage Cans Ltd.

Sector

Industry

CEO

Zain Ashraf Mukaty

Website

Headquarters

Faisalabad

Founded

2014

ISIN

PK0126301016

FIGI

BBG011C68FD3

IPO date

Jul 16, 2021

IPO offer price

0.31 USD

Pakistan Aluminium Beverage Cans Ltd. engages is the manufacture of aluminum-based beverage cans. The company was founded on December 4, 2014 and is headquartered in Faisalabad, Pakistan.

Related stocks

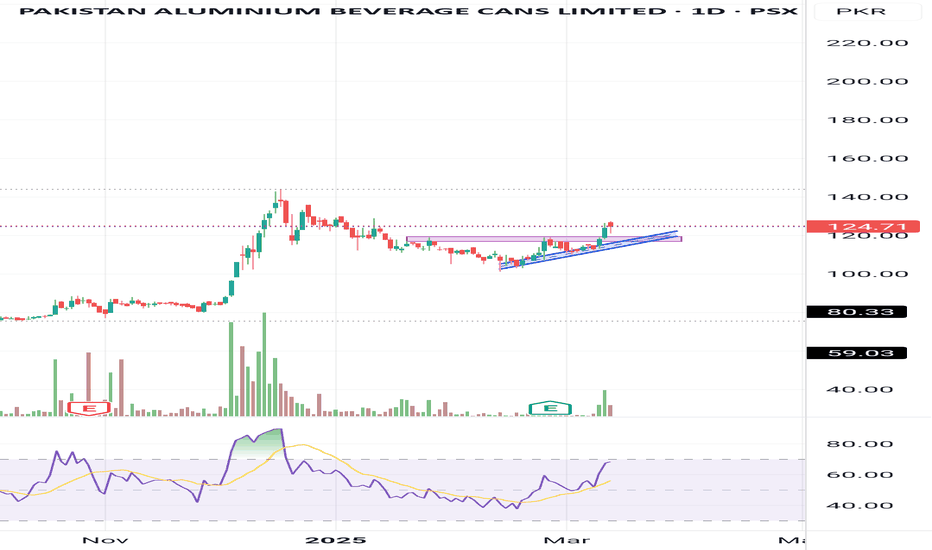

PABC – BUY TRADE | 1D TF | 22 OCT 2025 | TCA

PABC – TECH BUY CALL | 1D TF | 22 OCT 2025 | By The Chart Alchemist

The stock PABC previously surged from PKR 80 to PKR 144 and then entered a pullback, forming a Wyckoff-style reaccumulation phase followed by a DB Bull Flag. After breaking out of that phase, the stock developed another reaccumula

PABC –TECH BUY CALL by THE CHART ALCHEMIST-27 Sept 2025 (1H TF)PABC – TECH BUY CALL by THE CHART ALCHEMIST -27 Sept 2025 (1H TF)

The stock previously spiked, achieving a high of Rs. 144, then pulled back into a DB Bull Flag (marked in light blue). After breaking out and achieving a quantified displacement target, it pulled back again after reaching Rs. 171. Th

PABC – TECHNICAL BUY CALL | 16 AUG 2025 (1H TF) PABC – TECHNICAL BUY CALL | 16 AUG 2025 (1H TF)

The stock made a bullish break of structure and is now trading in a sideways range (light blue channel). Recent price action shows an MB bull flag, and the stock is ready to move upward from a key support level (dark blue line).

PABC | Formation of CUPThe stock displays a cup pattern on strong volume, trading confidently above both the 20 and 200-day EMAs, suggesting robust upward momentum. Previous session candle was bullish and need pull back for taking a long position near 130 level for the approach of its neck line resistance near 144. Use a

PABC🚀 Stock Alert: PABC

📈 Investment View: Technically Bullish 📈

🔍 Quick Info:

📈 Buying Range : 65-65.50

🎯 First Targets : 67.50

🎯 Second Targets : 72.50

⚠ Stop Loss: 62.50

⏳ Nature of Trade: Mid Term

📉 Risk Level: Medium

☪ Shariah Compliant: YES

💰 Dividend Paying: YES

📰 Technical View: *PABC* is curr

PABC is BullishPABC has been in a trending phase since few months and although bears forced a correction, the price still did not dip below previous higher low, which indicates that bulls are still in control of the price action. It is looking good for a bullish rally which could take the price close to 100. Targe

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of PABC is 129.40 PKR — it has increased by 0.83% in the past 24 hours. Watch Pakistan Aluminium Beverage Cans Ltd. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on PSX exchange Pakistan Aluminium Beverage Cans Ltd. stocks are traded under the ticker PABC.

PABC stock has fallen by −0.45% compared to the previous week, the month change is a −8.87% fall, over the last year Pakistan Aluminium Beverage Cans Ltd. has showed a 19.26% increase.

We've gathered analysts' opinions on Pakistan Aluminium Beverage Cans Ltd. future price: according to them, PABC price has a max estimate of 124.00 PKR and a min estimate of 124.00 PKR. Watch PABC chart and read a more detailed Pakistan Aluminium Beverage Cans Ltd. stock forecast: see what analysts think of Pakistan Aluminium Beverage Cans Ltd. and suggest that you do with its stocks.

PABC reached its all-time high on Aug 1, 2025 with the price of 170.85 PKR, and its all-time low was 25.50 PKR and was reached on Mar 8, 2022. View more price dynamics on PABC chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

PABC stock is 3.57% volatile and has beta coefficient of 0.83. Track Pakistan Aluminium Beverage Cans Ltd. stock price on the chart and check out the list of the most volatile stocks — is Pakistan Aluminium Beverage Cans Ltd. there?

Today Pakistan Aluminium Beverage Cans Ltd. has the market capitalization of 46.34 B, it has decreased by −4.61% over the last week.

Yes, you can track Pakistan Aluminium Beverage Cans Ltd. financials in yearly and quarterly reports right on TradingView.

Pakistan Aluminium Beverage Cans Ltd. is going to release the next earnings report on Feb 25, 2026. Keep track of upcoming events with our Earnings Calendar.

PABC net income for the last quarter is 1.77 B PKR, while the quarter before that showed 2.61 B PKR of net income which accounts for −32.42% change. Track more Pakistan Aluminium Beverage Cans Ltd. financial stats to get the full picture.

Pakistan Aluminium Beverage Cans Ltd. dividend yield was 0.00% in 2024, and payout ratio reached 0.00%. The year before the numbers were 4.63% and 25.19% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Dec 10, 2025, the company has 240 employees. See our rating of the largest employees — is Pakistan Aluminium Beverage Cans Ltd. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Pakistan Aluminium Beverage Cans Ltd. EBITDA is 7.03 B PKR, and current EBITDA margin is 27.07%. See more stats in Pakistan Aluminium Beverage Cans Ltd. financial statements.

Like other stocks, PABC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Pakistan Aluminium Beverage Cans Ltd. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Pakistan Aluminium Beverage Cans Ltd. technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Pakistan Aluminium Beverage Cans Ltd. stock shows the buy signal. See more of Pakistan Aluminium Beverage Cans Ltd. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.