6.32 PKR

1.25 B PKR

9.63 B PKR

49.97 M

About SPEL Limited

Sector

Industry

Website

Headquarters

Lahore

Founded

1982

ISIN

PK0109101011

FIGI

BBG0082Z96G2

SPEL Ltd. engages in the manufacturing and sale of plastic for auto parts, packaging for food and fast-moving consumer goods (FMCG) industry, and molds and dyes. Its products include face shield, baton, plastic packaging and crates, bottles, caps and closures, automotive, and off-road vehicle parts. The company was founded on May 16, 1982 and is headquartered in Lahore, Pakistan.

Related stocks

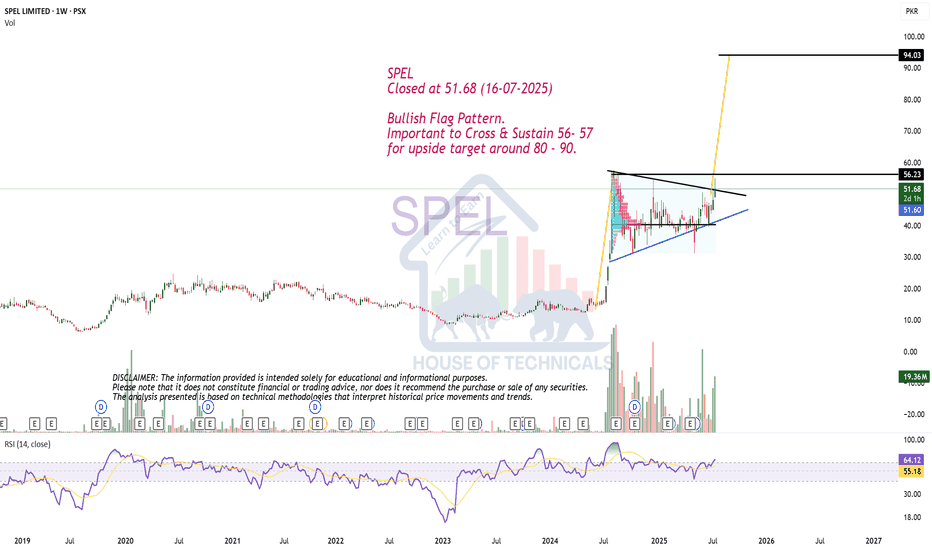

SPEL PSX📈 SPEL (PSX) – Buy Call (1-Day Outlook)

Technical View

Previously: Stock has broken out of a long-awaited rectangle consolidation pattern. And target was hit.

Structure now shifting into higher highs (HHs) and higher lows (HLs) → trend confirmation.

Price is currently holding in the golden zone (re

SPEL Limited (PSX: SPEL) – Weekly Chart📌 Pattern: Flag + Range Breakout

📌 Entry Zone: 58–62 PKR

📌 Target (TP): 82–84 PKR

📌 Stop Loss (SL): 50 PKR

📌 Bias: Bullish

Analysis:

SPEL has broken out of both a flag pattern and a range consolidation zone, with both patterns pointing to the same target. This confluence adds strength to the bullis

SPEL – LONG TRADE (THIRD STRIKE) | 09 JULY 2025SPEL – LONG TRADE (THIRD STRIKE) | 09 JULY 2025

SPEL is setting up for a third strike entry. On the 1-week timeframe, it has formed a Double Bottom Bull Flag, signaling potential for another strong leg upward. The price action is winding around an excess line with several bullish structures already

SPEL LONG TRADE (SECOND STRIKE)SPEL LONG TRADE (SECOND STRIKE)

SPEL went into uptrend with a Spike in July 2024. Making a high of 56, it pulled back in Wyckoff Re-Accumulation for months. Now it is in upward reversal as indicated by Volume Distribution. Price is trading above EMA-20. It showed a healthy pull back and now resuming

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of SPEL is 53.00 PKR — it has decreased by −3.50% in the past 24 hours. Watch SPEL Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on PSX exchange SPEL Limited stocks are traded under the ticker SPEL.

SPEL stock has fallen by −22.63% compared to the previous week, the month change is a −23.08% fall, over the last year SPEL Limited has showed a 35.90% increase.

SPEL reached its all-time high on Sep 12, 2025 with the price of 83.50 PKR, and its all-time low was 6.03 PKR and was reached on Aug 8, 2019. View more price dynamics on SPEL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SPEL stock is 7.42% volatile and has beta coefficient of 1.19. Track SPEL Limited stock price on the chart and check out the list of the most volatile stocks — is SPEL Limited there?

Today SPEL Limited has the market capitalization of 10.97 B, it has increased by 10.78% over the last week.

Yes, you can track SPEL Limited financials in yearly and quarterly reports right on TradingView.

SPEL net income for the last quarter is 261.61 M PKR, while the quarter before that showed 451.76 M PKR of net income which accounts for −42.09% change. Track more SPEL Limited financial stats to get the full picture.

SPEL Limited dividend yield was 2.20% in 2025, and payout ratio reached 15.14%. The year before the numbers were 5.03% and 23.80% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Oct 28, 2025, the company has 626 employees. See our rating of the largest employees — is SPEL Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SPEL Limited EBITDA is 2.46 B PKR, and current EBITDA margin is 23.48%. See more stats in SPEL Limited financial statements.

Like other stocks, SPEL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SPEL Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SPEL Limited technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SPEL Limited stock shows the buy signal. See more of SPEL Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.