TRG Pakistan Limited - Technical Analysis ReportDate: November 04, 2025

Current Price: PKR 83.05

Change: +2.24 (+2.77%)

Volume: 9.78M

Executive Summary

TRG Pakistan Limited exhibits a highly bullish technical setup with multiple confirming patterns signaling a potential major reversal. The stock has broken out from both a falling wedge and a cup and handle formation, both accompanied by significant volume expansion. This confluence of bullish indicators suggests strong upside potential.

Pattern Analysis

1. Cup and Handle Formation (Primary Pattern)

The Cup (Mid-2024 to Late 2024)

Left Rim: ~94 PKR

Base/Bottom: 43-48 PKR (rounded bottom formation)

Right Rim: Recovered to ~74-76 PKR

Duration: Approximately 12-15 months

Shape: Well-defined U-shaped cup (optimal formation)

The Handle (Sep-Oct 2025)

Formation Zone: 66-76 PKR consolidation

Retracement: Approximately 1/3 of cup's advance (healthy)

Volume Profile: Declining during handle formation (textbook pattern)

Breakout Level: ~75 PKR

Pattern Quality: Excellent

✓ U-shaped cup (not V-shaped)

✓ Proper handle retracement (1/3 to 1/2 of advance)

✓ Volume confirmation on breakout

✓ Declining volume in handle

2. Falling Wedge Pattern (Secondary Confirmation)

Structure:

Formation Period: Q2 2024 to Q4 2024

Pattern Type: Bullish reversal

Breakout: Successfully cleared upper trendline

Volume: Strong expansion on breakout

Significance:

The falling wedge nested within the cup's right side provides additional confirmation of accumulation and bullish sentiment. The breakout from this pattern coincides with the cup and handle breakout, creating a powerful dual-signal.

Key Technical Levels

Resistance Levels

88-94 PKR - Major long-term descending trendline from 2022 highs (immediate target)

100 PKR - Psychological level and previous support/resistance

125-130 PKR - Cup and handle measured move target

Support Levels

74-76 PKR - Breakout zone and previous wedge resistance (now support)

66-68 PKR - Handle low and secondary support

60 PKR - Psychological support level

Volume Analysis

Recent Activity:

Significant volume spikes marked at key reversal points (labeled 'E' on chart)

Current volume: 9.78M - well above recent average

Volume profile confirms institutional accumulation

Interpretation:

The volume expansion during breakout phases indicates genuine buying pressure and not just technical short-covering. This is a critical confirmation factor for the bullish thesis.

Price Targets & Projections

Conservative Target (High Probability)

88-94 PKR (6-13% upside)

Testing major descending trendline

Previous resistance zone

Timeframe: 2-4 weeks

Moderate Target (Medium Probability)

100-110 PKR (20-32% upside)

Breaking through long-term resistance

Psychological milestone

Timeframe: 1-3 months

Aggressive Target (Cup & Handle Measured Move)

125-130 PKR (50-56% upside)

Cup depth: ~51 points (94 - 43)

Measured from breakout at 75

Timeframe: 3-6 months

Risk Management

Bullish Scenario Remains Valid If:

Price holds above 74 PKR (breakout level)

Volume remains elevated on up days

Closes above major trendline (88-94 range)

Pattern Invalidation/Stop Loss

Critical Support: 74 PKR

Recommended Stop Loss: 72 PKR (below breakout with buffer)

Pattern Failure: Sustained close below 68 PKR

Risk-Reward Ratio

Entry at current levels (~83 PKR)

Stop loss at 72 PKR (11 points risk)

Target at 125 PKR (42 points reward)

R:R Ratio: 1:3.8 (Excellent)

Trading Strategy Recommendations

For Aggressive Traders

Entry: Current levels (82-85 PKR)

Stop Loss: 72 PKR

Target 1: 94 PKR (partial booking)

Target 2: 110 PKR (partial booking)

Target 3: 125 PKR (exit remaining)

For Conservative Traders

Entry: Wait for pullback to 76-78 PKR OR confirmation above 88 PKR

Stop Loss: 74 PKR (if entered on pullback) / 82 PKR (if entered on breakout)

Target: 100-110 PKR

Position Sizing

Given the technical strength but considering general market volatility, recommended position sizing: 2-4% of portfolio for aggressive traders, 1-2% for conservative traders.

Conclusion

TRG Pakistan Limited presents a compelling bullish opportunity with multiple technical confirmations:

Dual Pattern Breakout: Both cup and handle and falling wedge patterns have triggered

Volume Confirmation: Strong institutional buying evident

Risk-Reward: Favorable at current levels

Momentum: Building positive momentum after extended consolidation

Overall Rating: ⭐⭐⭐⭐ (4/5 - Strong Buy Signal)

The primary risk remains the overhead resistance from the long-term descending trendline. A confirmed break above 90-94 PKR would open the path to significantly higher levels. However, failure to hold above 74 PKR would invalidate the bullish setup and require reassessment.

Monitoring Points

Watch for daily closes above 88 PKR (trendline break)

Monitor volume on down days (should be declining)

Track broader Pakistan equity market sentiment

Observe any fundamental news/catalysts

TRG Pakistan Limited

No trades

Market insights

TRG Pakistan Limited – Breakout and Technical OutlookTRG Pakistan Limited (PSX: TRG) has been consolidating within a multi-year descending channel and is now approaching a critical technical juncture.

Technical Structure

Downtrend Resistance: The stock has remained under a long-term declining trendline since early 2021, consistently making lower highs.

Support Base: Strong demand has been observed in the 44–50 PKR zone, which has acted as a multi-touch support level.

Immediate Resistance:

68.66 PKR – near-term breakout level.

80.51 PKR – mid-term resistance.

93.73 PKR and 100.76 PKR – long-term upside targets upon a sustained breakout.

Price Outlook

A close above 68.66 PKR would indicate a potential structural shift, opening room toward the 80–100 PKR range.

Sustained price action above the descending trendline would confirm a long-term reversal and potentially attract institutional participation.

Conversely, failure to hold above current levels could lead to a retest of the 50–44 PKR demand zone.

Strategic View

TRG remains in a neutral-to-bullish posture in the short term. A confirmed breakout above resistance levels will improve risk-reward dynamics for medium- to long-term investors, while the downside remains capped by a well-defined support base.

TRG – BUY TRADE | 1W | 11 OCT 2025 | TCATRG – TECH BUY CALL | 1W | 11 OCT 2025 | By The Chart Alchemist

After a strong bearish trend from Rs. 153 to Rs. 43.9, the stock broke out of a bearish channel (marked light pink) and consolidated within a trading range, forming a Wyckoff accumulation structure. The stock has now broken out of this accumulation phase, signaling the potential start of a new bullish cycle.

📢 Technical Analysis by Mushtaque Muhammad (The Chart Alchemist).

TRG Pakistan – Key Resistance at 83 | Possible Pullback AheadTRG is testing a major long-term downtrend line around 83 PKR, which aligns with the upper boundary of its short-term rising channel. This confluence has historically acted as strong resistance.

🚩 Resistance Zone: 82–85 PKR

📉 Possible Pullback Targets: 75 → 62 PKR

✅ Bullish Scenario: A clean breakout above 87 with volume could open the way toward 100+ PKR

⚠️ Bearish Scenario: Rejection here likely brings a correction back to channel support.

Conclusion:

Price action suggests a high-probability pullback unless TRG can decisively break above the downtrend line. Traders should watch 82–85 closely for confirmation.

TRG From 58 -- 75 in no time (+29%) after our call TRG From 58 -- 75in no time (+29%) after our call — breakout delivering strong gains

TRG ELITE KATCHRA💎

CMP: 58.76

From forgotten junk to potential multi-bagger 2x... 3X...4X...? will see what unfolds...

TRG is showing signs of a potential long-term reversal after a multi-year downtrend. Price action is compressing within a large falling wedge pattern, typically a bullish formation. A breakout above the upper trendline (~60–62) with volume could trigger a major upside move 110 - 120, with a long-term price target potentially reaching 153 - 200+.

Watch closely for confirmation abv 76.00 on weekly.

This analysis is for educational and informational purposes only. It does not constitute investment advice or a recommendation to buy or sell any security. Always conduct your own research or consult with a licensed financial advisor before making investment decisions. Past performance is not indicative of future results.

#kse100 #psx #tradeflow #trg #pakistan

As of 05, July 2025

TRG – Bear Flag at Critical SupportTRG is currently testing a major trendline support. The chart is showing a bear flag formation — if the price fails to hold this zone, more downside pressure could follow.

📉 Pattern: Bear Flag

📌 Critical Support: ~57 PKR trendline

⚠️ Breakdown Risk: If broken, potential drop toward 10.90 PKR

🛡️ Invalidation: Holding above the trendline & breaking out of the flag could negate the bearish view

This is a make-or-break zone for TRG — watch closely for confirmation.

⚠️ Not financial advice. Trade safe & manage risk.

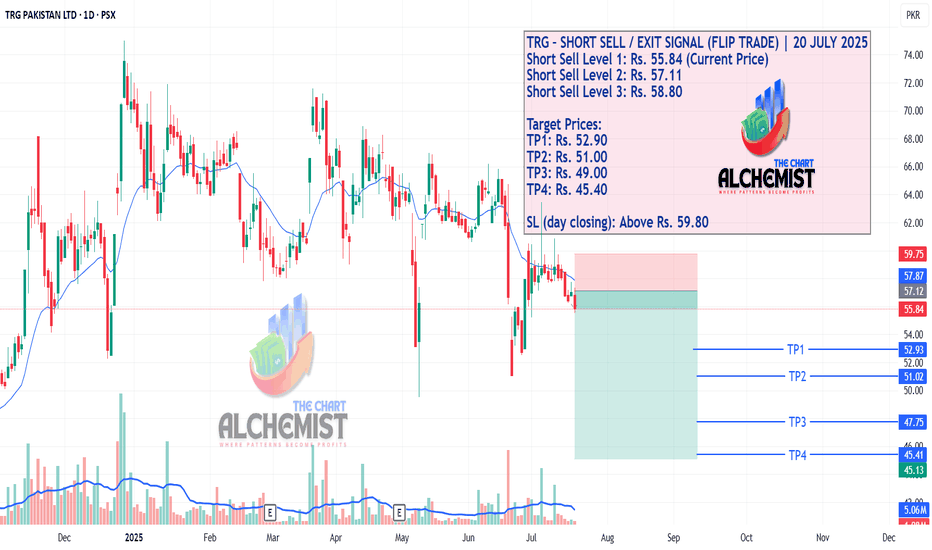

TRG – SHORT SELL / EXIT SIGNAL (FLIP TRADE) | 20 JULY 2025TRG – SHORT SELL / EXIT SIGNAL (FLIP TRADE) | 20 JULY 2025

TRG has maintained a bearish market structure, consistently printing lower highs and lower lows—confirming an established downtrend. After a short-term retracement to the 20 EMA, the stock has resumed its downward movement, suggesting that further downside is likely. This setup presents a clear opportunity for short sellers or an exit point for long holders.

TRG FALLING WEDGE 2x... 3X...4X...?TRG ELITE KATCHRA💎

CMP: 58.76

From forgotten junk to potential multi-bagger 2x... 3X...4X...? will see what unfolds...

TRG is showing signs of a potential long-term reversal after a multi-year downtrend. Price action is compressing within a large falling wedge pattern, typically a bullish formation. A breakout above the upper trendline (~60–62) with volume could trigger a major upside move 110 - 120, with a long-term price target potentially reaching 153 - 200+.

Watch closely for confirmation abv 76.00 on weekly.

This analysis is for educational and informational purposes only. It does not constitute investment advice or a recommendation to buy or sell any security. Always conduct your own research or consult with a licensed financial advisor before making investment decisions. Past performance is not indicative of future results.

#kse100 #psx #tradeflow #trg #pakistan

TRG LongTRG has made a perfect bullish harmonic pattern where it has retraced to exact 127.2% of its last top and now will move till 161.8% of its all-time high which is nearly 295. This is not a buy/sell call, its just my own analysis and you may disagree. However, I'd urge you to study bullish and bearish harmonic patterns which are not so common in Pakistani market but some international players often run a stock through this pattern. Similar patterns can be noticed in GHNI and GAL as well.

TRG LONG TRADETRG was in BULL RUN since March 2020 to April 21, it is trending in bullish channel since 2020, it has now bottomed out in this channel as seen in 1W chart at bottom.

As seen in 1D chart it has given bullish reversal on heavy volumes on upward leg and much lighter volume on downward pullback, furthermore it has successfully created an Spring or Bear Trap which is precursor to up move.

Price Action also suggests an impending uptrend since the pullback is in the form of Bear wedge which is in fact a Bull Flag that has completed its three pushes on downside. It also confirms the take off to upside

BUY TRG 56-60

TP1 69.5

TP2 82.5

SL 51.1

TRG LONGTERM ANALYSIS AND NEW ALL TIME HIGH COMINGTRG has been in Pullback since May 2021 when it posted its ATH of Rs 186.

It has reached 78% level of retracement and is rebounding from !M FVG(Fair Value Gap).

It is very much likely to start a long term bullish move after it crosses Rs74 level to make new high of Rs 230 In Sha Allah

TRG Bullish Reversal: Buy at Golden PocketTRG is trending after a prolonged bearish phase, forming higher highs and higher lows. It is currently trading around the Fibonacci golden pocket. A buy entry at the current market price is suggested, with a stop loss below the last low and a target at the recent high.

TRG is BullishPrice was in a strong downtrend, respecting the descending trendline, however a matured bullish divergence on daily time frame suggests that bulls are trying to assume control of the price action. Now it seems that the descending trendline would be broken by bullish momentum which would potentially lead of a bullish reversal as per Dow theory. Targets are mentioned on the chart.

TRG Ready for another 16% rideThe stock after breakout its bearish cycle, continuing its bullish ride, recently retraced to mark its LH @ 54 which will be out SL for the trade.

Enter at the breakout of symmetrical triangle at a price of 64.35 for the target price of 74.7 which will be out first TP, approximately 16% gains