Albemarle breaks $163 as traders position for a push higher thiCurrent Price: 163.37 (Analysis was generated on Monday Morning)

Direction: LONG

Confidence level: 66%(Several professional traders point to buyable dips above $160 and upside toward the high $160s, while X sentiment supports continuation despite limited volume)

Targets

Target 1: 168.00

Target 2: 172.50

Stop Levels

Stop 1: 160.00

Stop 2: 158.00

Key Insights:

Here’s what’s driving this idea. Multiple traders are watching ALB hold above its 50‑day and 200‑day moving averages, both sitting well below the current price. That structure tells me buyers are still in control. What stands out is how often the $168–$170 zone comes up in trader discussions. It’s viewed as the next real test, and a clean push into that area could bring momentum traders back in quickly.

On the sentiment side, X is leaning positive despite low tweet volume. Traders there keep pointing to falling short interest and call‑heavy options positioning. That combination doesn’t guarantee upside, but it does reduce near‑term selling pressure, which supports a long bias for the next few sessions.

Recent Performance:

This all showed up in the tape. ALB has rebounded strongly over the past three months and is trading near $163 after a sharp daily move. Volume hasn’t exploded yet, but the stock is holding gains instead of fading, which suggests sellers aren’t very aggressive at these levels.

Expert Analysis:

Several professional traders I track highlighted RSI sitting in the low‑60s, a zone that often supports continuation rather than reversals. MACD is still below zero, but it’s tightening, which traders often see as an early improvement signal. The shared takeaway from the trading community is simple: stay constructive above $160 and reassess only if that level fails.

News Impact:

Recent analyst upgrades and ongoing discussion around U.S. strategic‑minerals policy are helping the bullish narrative. Traders are also positioning ahead of the upcoming earnings report, with implied volatility elevated. That sets the stage for a bigger move, even within this week.

Trading Recommendation:

Putting it all together, I’m LONG Albemarle for this week. I’m targeting a move toward $168 first, with $172.50 as the stretch goal if momentum builds. Risk is clearly defined with a stop at $160 and a wider protection level at $158. Confidence isn’t extreme, so position sizing matters here, but the balance of trader insight and sentiment favors upside over the next 5–7 trading days.

Albemarle Corporation

No trades

What traders are saying

ALB Breaks Higher as Lithium Deficit Narrative Gains Traction:Current Price: 189.51 (Analysis was generated on Monday Morning)

Direction: LONG

Confidence level: 62%(Based on bullish trader language, supportive social sentiment, and constructive news flow, but with limited volume from professional trader videos)

Targets

Target 1: 195.00

Target 2: 200.00

Stop Levels

Stop 1: 185.00

Stop 2: 179.00

Key Insights:

Here’s what’s really driving this setup. Traders are increasingly focused on the lithium supply-demand story shifting into deficit territory in 2026. Several market experts highlighted that expectation as a major tailwind for Albemarle’s earnings power, especially as lithium pricing stabilizes after a brutal downturn. That narrative keeps coming up, and it matters because ALB is one of the cleanest ways to express that theme.

What also caught my attention is how traders are talking about the chart. Multiple traders pointed out that ALB is pressing up against a long-term downward trendline that’s been in place since 2022. When I see repeated references to a trendline test combined with improving fundamentals, I pay attention. It suggests traders are positioning early for a potential breakout rather than chasing later.

Recent Performance:

You can see this story playing out in the price action. ALB has rebounded sharply from last year’s lows and is now trading just under its recent highs near $192. The stock pushed higher over the past week, holding gains despite broader market volatility. That kind of behavior usually tells me buyers are still in control, even at elevated levels.

Expert Analysis:

From a trader perspective, the $185 area keeps coming up as an important near-term floor. Several traders referenced this zone as a level where buyers previously stepped in. On the upside, the $195 to $200 range is the most common target area I’m seeing mentioned, both from technical traders watching resistance and from analysts tying valuation to improving lithium fundamentals. That clustering of views strengthens those levels for this week.

News Impact:

The news flow is adding fuel here. Analysts are openly discussing a future lithium deficit, and at least one major firm raised its price target toward the $200 area. On top of that, Albemarle’s steady dividend announcement reinforces balance sheet confidence. None of this feels speculative hype; it’s more a slow rebuild of credibility after a tough cycle.

Trading Recommendation:

Putting it all together, I’m staying LONG on ALB for the week. I like entries near current levels with a first objective at $195 and a stretch move toward $200 if momentum holds. I’d manage risk closely with a stop near $185, and step aside if $179 breaks, because that would signal this breakout attempt failed. This isn’t a max-conviction trade, but the risk-reward looks solid enough to participate while keeping position size reasonable.

100% Left in the tank?Bought this in July of last year when the RSI was severely OS. Sold at 100% gains and p**sied out to the top, but thinking we might make it up to the top of the channel over the next 6 months. I'd wait for a small correction into the 150-160's, but this doesn't look like it wants to let up if you have fairly high risk appetite. 3 mo RSI still right where we want it to be.

Good luck.

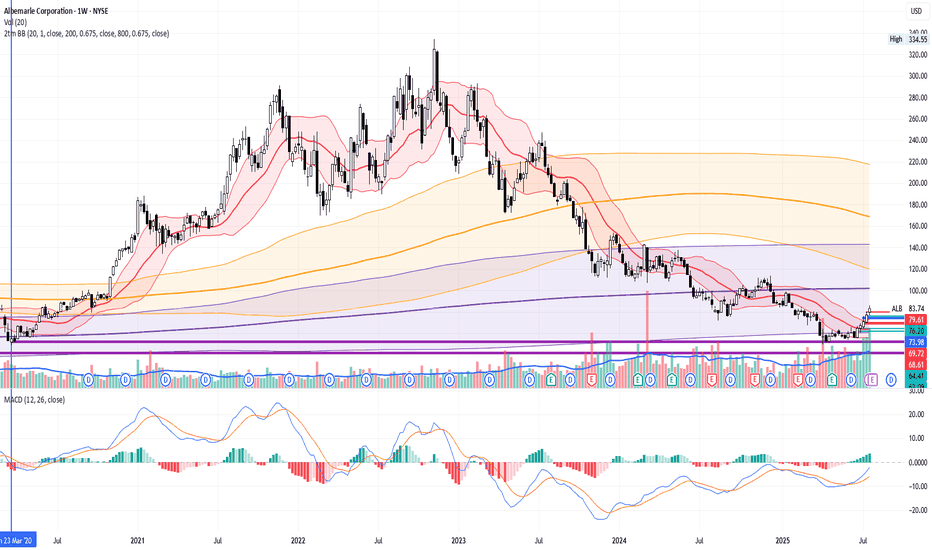

ALB (Weekly) — Structural Shift Confirmed ALB (Weekly) — Structural Reversal Backed by Macro Tailwinds

ALB has completed a multi-year markdown and is now in confirmed HTF expansion following a clean BOS + CHoCH from the discount/strong-low region (~70–90). Price is currently testing equilibrium (~160), which is typical for the first impulse leg after a prolonged base.

Macro & fundamental intelligence supporting the move:

• Lithium supply normalization narrative is shifting.

The market has already priced in peak pessimism from 2023–2024 (oversupply, China demand slowdown, pricing pressure). Marginal supply growth is now tightening as capex cuts, delayed projects, and higher-quality asset concentration favor incumbents.

• ALB is a tier-1 survivor, not a marginal producer.

Balance sheet strength, integrated production, and cost-curve positioning mean ALB benefits disproportionately when weaker producers are forced to slow or exit. This creates asymmetric upside during early-cycle recoveries.

• EV demand is stabilizing, not collapsing.

While growth has slowed, policy support (US/EU industrial strategy, IRA-linked supply chains) anchors long-term lithium demand. Markets tend to reprice before demand acceleration becomes visible in data.

• Commodity cycle rotation.

Capital is rotating back into real assets / strategic materials as rate volatility peaks and long-duration tech loses relative momentum. Lithium sits at the intersection of energy transition and industrial policy.

Technical roadmap:

• Current move = discount → equilibrium impulse

• Base case: Consolidation near 150–160, then continuation toward 200–230 premium imbalance

• Bullish retrace zone: 134–140 (HTF demand)

• Invalidation: Structural failure below ~110

This setup reflects early-cycle repricing, not late-stage speculation. Direction is established; the open question is pace, not bias.

ALB - Albemarle Corp - Re-Test Done.Hello Everyone, Follower,

Happy evening to all. I made a quick break , wathed Formula 1 and I am here again now to share today's last stock which is ALB - Albemarle Corp.

What they do?

Albemarle Corporation develops, manufactures, and markets highly engineered specialty chemicals around the world. The company focuses on lithium compounds, bromine-based products, and refining catalysts. With a history dating back to 1887, Albemarle was incorporated in 1994 and has its headquarters in Charlotte, North Carolina.

Albemarle's products are used in a wide range of products, ranging from pharmaceuticals to cleaning, water treatment, agricultural, electronic, paper, and photographic products. The company operates its business through three segments, including Lithium, Bromine Specialties, and Catalysts. Albemarle's Lithium segment develops and manufactures lithium-based compounds, value-added lithium specialties, and reagents. The Bromine Specialties segment is focused on fire safety solutions and other specialty chemicals applications. The company's Catalysts segment manufactures three main product lines: performance catalyst solutions (PCS); fluidized catalytic cracking (FCC) catalysts and additives; and Clean Fuels Technologies, which includes hydroprocessing catalysts (HPC) and isomerization and akylation catalysts.

As of December 2021, the company employs approximately 5,400 people and serves clients in around 100 countries. On 30 September 2021, Albemarle announced reaching an agreement with Guangxi Tianyuan New Energy Materials Co., Ltd., a China-based lithium converter, to acquire all outstanding equity in the company for approximately $200m.

Financials :

Market Cap : 10.38 B

Revenue : 4.99 B

P/E Ratio : -9.46

EPS : -9.3269

Dividend (Yield) : 1.62 (1.84%)

Technical Part:

Now our part :)

Last week it broke the Down trade to UP and then Re-test the break level. Everything works as expected. I am expecting this trend to continue.

If it breaks the 92.30 - 92.50 and stay above this level then it will confirm the Break Up and these levels would be a good level to get ALB.

Other possibility is re-test the 83.30 - 83.50 again then go Up , if it would do this then these levels also could be another good levels to get , and for me it is much better level.

My personal thinking is quite Positive for ALB. Their sector is being demanded because of the Electrical Autos and i see the good opportunity on it.

My First Target is between 113 to 118 which is approx %30 - %35 above from today's price level.

I have already added ALB to my watch list for next week.

This is just my thinking and it is not invesment suggestion , please do not make any decision with my anaylsis.

Have a lovely Sunday to all.

Stock - Albermale Corporation - Short SetupAlbemarle Corporation (ALB) – Short Setup Technical Analysis

Albemarle is currently trading within the dominant trend, where price has formed a harmonic structure directly at the Anchored VWAP. While the market has respected the VWAP as dynamic support during the prior impulse, the latest price action shows momentum exhaustion into this level, suggesting weakening buyer commitment.

From a tactical perspective, this setup favors a short continuation or rejection trade rather than trend expansion. Acceptance below the Anchored VWAP would confirm bearish control and open downside potential toward the prior volume node and structural support zone.

Bias: Short on rejection at VWAP

Invalidation: Sustained acceptance above the Anchored VWAP

Context: Harmonic completion + VWAP confluence = asymmetric short opportunity

ALB Repeat of last year?ALB chart pattern is almost identical to last year, even more so than XLF because it's at the same price level as last year. Just keep in mind Nov pump was elections last year.

We could also get a big gap up Monday if they compromise on the Fed shutdown.

Not a stock I would hold long term, but interesting chart.

Cup and Handle Breakout – ALB (Albemarle Corporation)ALB is showing a cup and handle formation on the daily chart. Price is now testing the $84–$87 resistance zone which aligns with the long-term descending trendline.

A confirmed breakout above this level could trigger a bullish continuation, with a measured move target near $115 (+41%).

📈 Entry: On breakout and daily close above $87

🎯 Target: $115

🔻 Invalidation: Below $75 (handle low)

This setup suggests strong bullish potential if resistance is cleared with volume.

Not financial advice. No responsibility for any actions taken.

ALB Technical Outlook – Symmetrical Triangle at Key Inflection⚡ ALB Technical Outlook – Symmetrical Triangle at Key Inflection

Ticker: ALB (Albemarle Corp.)

Timeframe: 30-minute candles

🔍 Current Setup

ALB has been in a long-term uptrend, holding an ascending support trendline since late June. After peaking near ~87, price has pulled back and is now consolidating within a symmetrical triangle.

Descending resistance: ~84–85.

Ascending support: ~76–77.

Current price: ~81.40, sitting inside the triangle and nearing the apex.

This structure reflects compression — energy building for a decisive breakout.

📊 Breakout Levels

🚀 Upside (Bullish Scenario)

Trigger: Break and close above 85.

Intermediate Targets:

87–88 → Prior swing high.

90+ → Psychological round number.

Measured Move Target: ~92–94 (triangle height projection).

🔻 Downside (Bearish Scenario)

Trigger: Break below 77, confirmation under 76.

Intermediate Supports:

74–73 → First demand zone.

70–68 → Stronger support.

Measured Move Target: ~67 (triangle height projection downward).

📈 Volume Analysis

Volume has been declining during the triangle formation — normal for consolidation.

Expect a sharp volume expansion once price escapes the triangle.

⚖️ Probability Bias

The broader trend has been upward, which slightly favors a bullish continuation if resistance at 85 is cleared.

However, a failure below 76–77 would invalidate the bullish structure and trigger a breakdown.

✅ Takeaway

ALB is at a critical decision point within a symmetrical triangle:

Bullish Break > 85: Targets 88 → 90 → 92–94

Bearish Break < 76–77: Targets 74 → 70 → 67

The breakout direction — confirmed by volume — will likely define ALB’s next major move.

ALB Long, Resurrection of lithium trendALB have started to rise in recent weeks. It's price stays near 5-year lows.

Long-term Price Levels already have worked to bounce the stock by around 50%+.

Most likely funds have started to trade it in Mean Reversion strategies. So, the movement back to 200MA and 800MA on Weekly time-frame is quite possible.

As fast as banks would start to rise stock's rating - it will go sky high.

Recently UBS already cut it's rating to "Sell". Yet, trend already is mighty enough and just kept going higher.

Full margin on every black 1D candle!

Correction over? Worth keeping an eye on itIs this the end of the final 5th wave? It’s hard to tell. This stock has been a disaster for those trying to pick bottoms. I’m waiting for a sign of strength before jumping in. We may be seeing that as the RSI is slowly gaining strength.

Personally I’d like to see it change market structure and take out some resistance levels to the upside.

Keeping an eye on this before I pull the trigger.

ALB | Price PredictionNYSE:ALB is one of my key assets in the stock portfolio. I believe that the price of this stock is highly related to the resource price and cycles. I expect massive upside because of the potential rise in lithium demand. Moreover, new EVs, robots, drones, and next-gen gadgets all need lithium.

Price Prediction is based on my platform, so I'm sharing it here. I believe that the key levels are "Base" and "Bullish".

$Albemarle Harmonic Pattern and Short stock infoLooking at the daily chart for Albemarle, it appears to be to have a short sale harmonic pattern. The second pattern finished up today's trading with dramatic fashion. I'm looking for the same rebound to the $110 area in the next few weeks.

First go at publishing an idea!

$ALB suggesting potential undervaluation.Albemarle Corporation (NYSE: ALB) is a leading global producer of lithium, a critical component in electric vehicle (EV) batteries. The company's performance is closely tied to lithium market dynamics, which have experienced significant fluctuations recently.

Technical Analysis:

As of February 15, 2025, ALB's stock price stands at $81.21. The stock has faced a downward trend, with a 52-week price change of -30.95%. The 50-day moving average is $93.35, and the 200-day moving average is $98.91, indicating a bearish trend. The Relative Strength Index (RSI) is at 30.29, suggesting the stock is approaching oversold territory.

STOCKANALYSIS.COM

Resistance levels are identified at $111.30, with support around $85.23.

Fundamental Analysis:

Albemarle's recent financial performance reflects challenges in the lithium market. In Q4 2024, the company reported a profit of $33.6 million, a significant turnaround from a loss of $617.7 million in the same period the previous year. However, adjusted results showed a loss of $1.09 per share, missing analyst expectations of a $0.70 loss. This underperformance is largely due to a substantial drop in lithium prices, leading to a $1.1 billion revenue decline in the Energy Storage division.

In response to market conditions, Albemarle has implemented cost-cutting measures, including workforce reductions and the suspension of expansion projects, such as a key U.S. lithium refinery. Capital expenditures for 2025 are projected to be $700-$800 million, approximately half of the previous year's budget.

Analysts have adjusted their outlooks accordingly. UBS Group recently lowered its price target for ALB from $99.00 to $86.00, maintaining a 'Neutral' rating.

Despite these challenges, the intrinsic value of ALB stock is estimated at $173.10 under a base case scenario, suggesting potential undervaluation.

Investment Considerations:

Given the provided trading parameters:

Target Price: $92.75

Profit Potential: 14.2%

Stop/Trailing Stop: $77.14

Potential Loss: 5%

Profit/Loss Ratio: 2.8:1

These parameters indicate a favorable risk-reward ratio. However, investors should remain cautious due to the volatile lithium market and Albemarle's recent financial adjustments. Monitoring lithium price trends and Albemarle's strategic responses will be crucial in assessing the viability of this investment.