Trade ideas

BIDU - China's Domestic NVIDIA replacement?Baidu has stepped up as a significant domestic AI chip supplier as Nvidia faces restrictions on AI chip exports. Baidu's Kunlun processor poses as a favourable domestic alternative, with plans to unleash Kunlun M-100 in 2026 and the M-300 in 2027 amongst other initiatives.

Can they deliver, and can China facilitate such advanced node manufacturing within this timeframe? The market will be watching closely.

Our Team has identified a point of potential interest & volatility in this code NASDAQ:BIDU

If price can hold above $101.50 ... Significant Bullish potential may be unlocked.

If however price falls below $101.50 ... Significant Bearish risk may come into play.

We're inspired to bring you the latest developments across worldwide markets, helping you look in the right place, at the right time.

Thank you for reading! Stay tuned for further updates, and we look forward to being of service along your trading & investing journey...

Disclaimer: Please note all information contained within this post and all other Bullfinder-official Tradingview content is strictly for informational purposes only and is not intended to be investment advice. Please DYOR & Consult your licensed financial advisors before acting on any information contained within this post, or any other Bullfinder-official TV content.

BIDU Alert: Oversold Pre-Earnings, Bullish Calls AheadBIDU Earnings CALL Signal

Ticker: BIDU

Date: 2025-11-17

Signal: BUY CALLS

Confidence: 65% | Conviction: Medium

Strike: $115.00

Entry Range: $4.10 – $4.15 | Mid: $4.12

Target 1: $6.15 (≈50% gain)

Target 2: $8.20 (≈100% gain)

Stop Loss: $2.87 (≈30% risk)

Expiry: 2025-11-21 (4 days)

Position Size: 2% of portfolio

Technical Snapshot:

Current Price: $114.90

RSI: 36.6 → oversold, potential bounce

MACD: 0.3301 → mild bullish momentum

Support: $114.85 | Resistance: $120.29

Pre-earnings move: -4.13% on low volume (0.4x avg) → potential selling exhaustion

Options Flow:

Put/Call Ratio: 0.68 → bullish institutional positioning

Max volume: $114 CALL → concentrated upside bets

Implied Move: $8.22 (7.2%) → post-earnings volatility expected

AI / Market Vision:

Katy AI: Neutral with slight upward bias, 50% confidence

Predicts price $114.90 → $116.15 pre-earnings, supporting cautious bullish stance

Institutional stake increase (Appaloosa Management) adds fundamental support

Risk Level: MODERATE ⚠️

Low trading volume reduces conviction

Earnings binary risk → use conservative sizing

Monitor pre-market on 11-18 for confirmation

Edge / Rationale:

Oversold technicals + bullish options flow + strong fundamentals

Post-earnings rebound potential with tight 4-day expiry

Conservative strike selection above current price reduces downside risk

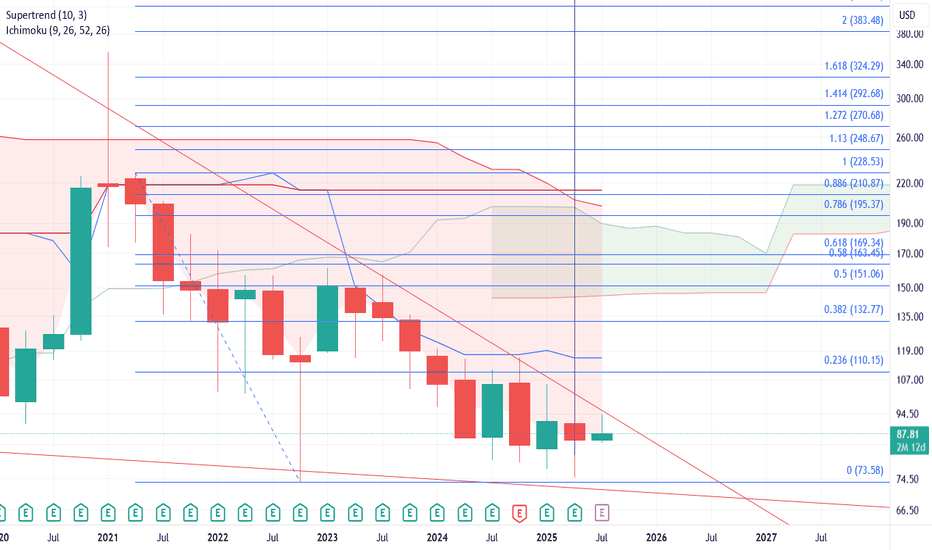

BIDU - Road to recovery=======

Volume

=======

- decreasing

==========

Price Action

==========

- Broken out of 4 year downtrend

=================

Technical Indicators

=================

- Ichimoku

>>> price above cloud

>>> Green kumo contracting slightly

>>> Tenken - Above clouds

>>> Kijun - Above clouds

>>> Chiku - Above clouds & pointing up slightly

=========

Oscillators

=========

- MACD turning bullish

- DMI turning bullish

- StochRSI, turning bullish, crossed and entered band

=========

Conclusion

=========

- short to long term breakout swing

- price may reverse at current level, to enter spot or wait for pullback at entry 2.

- Entry and exits depends on your time horizon and risk management.

=========

Positions

=========

Entry 1 - $127

Entry 2 - $112

Stop - $100

Exit 1 - $138

Exit 2 - $179

Exit 3 - $210

Exit 4 - $245

Exit 5 - $290

Baidu -the awakening of the Chinese giantBaidu (BIDU) has been moving within a descending channel, and the price is now testing the lower boundary of a key demand zone. On the monthly chart, the stock is attempting to hold above the 115–120 range, which could signal the beginning of a mid-term reversal. The upside potential extends toward 163, 205, and 357, where major supply zones and the upper border of the long-term channel are located.

Baidu remains a leader in China’s AI and internet search industries. The company continues to invest heavily in autonomous driving and cloud technologies, reinforcing its long-term position. With the yuan weakening and expectations of a softer monetary stance from Beijing, the tech sector gains additional tailwinds.

The stock is consolidating near key support, and a breakout above the range may trigger a new bullish phase. Investors should watch the 115–120 zone as a potential launch point for growth. Volatility may stay elevated, so risk management remains essential.

Baidu Wave Analysis – 6 October 2025

- Baidu rising inside weekly impulse wave C

- Likely to rise to resistance level 156.35

Baidu recently reversed up from the key support level 141.50 (former monthly high from September, acting as the support after it was broken).

The upward reversal from the support level 141.50 continues the active weekly impulse wave C of the ABC correction (2) from April.

Given the strength of the active impulse wave C, Baidu can be expected to rise to the next resistance level 156.35 (former powerful resistance from 2023).

BAIDU 63.6% cash & short term inv., P/E 8.7,possible rotation TABaidu largest search engine in china but way less monopoly in china, there is also bing.

Baidu invests heavily in AI and autonomous driving by apollo go.

China economy is in deleveraging and seems to start growing again.

China devlation problems comapnies sitting on cash.

Baidu advertisment income will come back if the chinese economy improves.

BIDU 1D: triangle breakoutBIDU 1D: triangle breakout + real-world AI deployment boosts bulls

Baidu (BIDU) breaks out of a triangle within a falling channel on the daily chart, with solid volume, reclaim of the 50MA, and approach to the 200MA. $90.09 flips into support. Targets stretch to $105.47 / $113.68 / $124.06 (Fibo levels).

Fundamentally, Car Inc just launched a robo-car rental service powered by Baidu’s Apollo unit. Fully autonomous, bookable for 4 hours to 7 days — this is not future tech, it’s live now. With a $32.6B market cap and low P/E (~12), BIDU looks positioned for revaluation if sentiment shifts.

Tactical setup: entry by market or retest of $90, stop below $82.

When the robot drives customers - you just drive the trade.

BIDU Daily Outlook – Smart Money Play in Motion🔹 Key Observations:

Clear Break of Structure (BOS) to the upside, signaling bullish intent.

Volume spikes confirm institutional activity around recent lows.

Fib extension targets align with supply zones at $95.23 – $105.19.

If $105 breaks, the liquidity pocket toward $115.73 opens up.

🔹 Levels to Watch:

Support: $81.11 / $74.46

First resistance: $95.23

Major supply: $102.95 – $105.19

Expansion target: $115.73

🔹 Gameplan:

Accumulation between $82–90 offers favorable risk-reward.

Watch for rejection/absorption at $95–105 zone.

If price clears $105 with strength → next leg likely toward $115+.

⚠️ Risks: Macro uncertainty in Chinese equities, global tech sector volatility, and earnings in late Q4.

✅ Bias: Bullish continuation setup in progress.

#BIDU #SmartMoneyConcepts #Stocks #TechnicalAnalysis #TradingView

Baidu | BIDU | Long at $82.50Baidu NASDAQ:BIDU - the Google of China. This one is being ignored by AI investors, and may be an opportunity. Maybe... nothing is certain (especially with the "risks" of Chinese investments).

P/E = 9x

Debt/Equity = 0.27x

Price/Sales = 1.55x

Price/Book = 0.80x

Price/Cash flow = 7.59x

Thus, at $82.50, NASDAQ:BIDU is in a personal buy zone.

Targets:

$109.00

$125.00

$150.00

$BIDU Summary Analysis & OutlookSummary Analysis & Outlook

Summary Analysis & Outlook

Factor Insight

Trend Upward short- and long-term trend.

Momentum Mixed signals: MACD positive, RSI neutral, low ADX suggests trend not strong yet.

Support zones $87–90 area acts as crucial base.

Resistance zones Key near-term resistance at $97–98, with a longer-term hurdle at ~$111.

Potential upside Your $103–105 target falls within consensus (~10–17% upside).

Analyst sentiment Broadly “Moderate Buy” to “Strong Buy.”

Baidu (BIDU) Long-Term Technical Outlook📊 Baidu (BIDU) Long-Term Technical Outlook

BIDU is testing a critical demand zone between $74 – $82, holding firm after years of consistent decline.

🔹 Price Action:

The long-term downtrend (red trendline) from the 2021 peak is being challenged.

Current monthly candles show compression near historical support levels.

Buyers defending this zone since 2015 indicate institutional interest.

🔹 Key Levels:

Support: $74.46 – $81.11

Resistance: $100, $120, $144 (if reversal confirms)

Long-term upside targets stretch toward $260+, but confirmation requires sustained breakout above $100.

🔹 Outlook:

As long as BIDU holds above $74, risk/reward favors accumulation.

Breakout from the downtrend line could trigger a multi-year reversal.

Failure to hold support risks retest of lower uncharted levels.

⚠️ Earnings, China tech policy, and U.S.–China trade developments remain key macro risks.

✅ Watchlist Setup:

Entry zone: $74–90

Breakout trigger: Above $100 with volume

Stop-loss (long-term investors): Below $70

📌 This is a long-term play with asymmetric upside if structural reversal unfolds.

#BIDU #Stocks #TradingView #TechnicalAnalysis #ValuePlay #ChinaTech

$biduyieahhh

awesome risk vs reward.

This is a monthly time frame.

A mix of gann, elliot, noodle soup etc. Take the Gann with a grain of salt as I am new to this.

Elliot a bit weird. Wave 2 seems to have halted right at .78 fib and looks ready to start wave 3 of wave 3. MACD and RSI curving. MACD not above 0 but I ain't waiting for that as the train may leave the station before so just like the previous rally from 2020.

$200 incoming.

Baidu Wave Analysis – 21 August 2025- Baidu reversed from the support area

- Likely to rise to resistance level 93.20

Baidu recently reversed from the support area between the support level 84.40 (which is the lower border of the sideways price range inside which the price has been trading from April) and the lower daily Bollinger Band.

The upward reversal from the support level 84.40 stopped the earlier impulse waves iii and 3.

Baidu can be expected to rise to the next resistance level 93.20, which is the upper border of the active sideways price range.

Baidu (BIDU) –AI Upgrades + Open-Source Strategy Powering GrowthCompany Snapshot:

Baidu NASDAQ:BIDU is cementing its position as a top AI platform leader in China, combining core search dominance with cutting-edge AI innovations and strategic open-source moves.

Key Catalysts:

Next-Gen AI Infrastructure ⚙️

Major Qianfan platform upgrades and PaddlePaddle 3.0 launch streamline model training & deployment for China’s AI developer ecosystem.

Reduces barriers to AI adoption, expanding the company’s developer base and ecosystem stickiness.

Open-Source Breakthrough 📂

ERNIE language models released under Apache 2.0 license—mirroring successful U.S. big-tech strategies.

Aims to accelerate adoption, attract global partnerships, and enhance monetization over the long term.

Rising User Engagement 📱

724M MAUs (+7% YoY) on Baidu’s mobile app.

AI-generated content now on 35% of search pages (up from 22% in January), increasing ad monetization potential.

Investment Outlook:

Bullish Entry Zone: Above $76.00–$78.00

Upside Target: $160.00–$165.00, fueled by AI leadership, developer adoption, and rising engagement metrics.

📈 Baidu’s combination of AI innovation, open-source strategy, and a massive user base creates a strong runway for both near-term revenue growth and long-term platform dominance.

#BIDU #AI #PaddlePaddle #ERNIE #OpenSource #ChinaTech #Search #CloudComputing #ArtificialIntelligence #BigData #DigitalTransformation #TechStocks