Gamestop: Got To Love ItWell hasn't the narrative changed around GME

I've been WRONG and MORE WRONG about almost everything regarding pure timing with this one

But what I havent been wrong about is the fact that I said all last year that GME would hold that 20-22 region

What Im also not wrong on is the fact that there is NOTHING ABOVE 32

So what now?

No idea except I still feel the 20-22 region is the "floor" on GME and the price structure still points UP as far as I can tell

Where is the cat? No idea BUT I did say multiple times that GME DOES NOT NEED HIM TO RUN SIGNIFICANTLY HIGHER...and as we see someone else (i.e. Burry) is the recent viral catalyst

And the last question: Am I still in GME?

Of course :)

Good trading to you all!

P.S. I will not be responding to comments as this post is mainly just to document for myself a significant change in the GME story

GameStop Corp. Class A

No trades

What traders are saying

GME Eyes Big Acquisition: Bullish Targets AheadGME’s CEO recently hinted at a major strategic acquisition—an exciting signal of potential growth and market expansion.

In the chart, I’ve highlighted key short-to-medium term price targets, assuming the stock maintains its current bullish momentum. If the trend holds, it could open up compelling opportunities for investors and stakeholders alike.

A key moment to watch: company strategy and market performance are aligning, and the next moves could be game-changing.

This is not a financial advice.

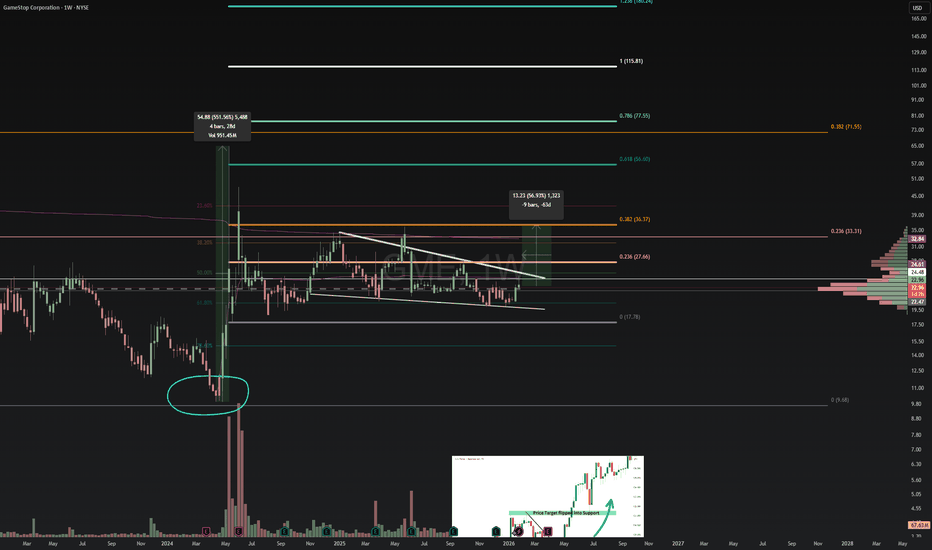

GMEGame Is On,Character Loop Online,Wedge Up,Monthly RSI UncagedThis is a follow-up on my previous harmonic / character / wedge posts ON GME – and so far the roadmap is getting more and more exciting!

What happened in the meanwhile:

The character loop did it again: that rounding top I highlighted in the demand zone actually formed, held, and price has been grinding higher from there. Still a quiet rhythm, but very constructive and, in my view, promising.

The big Bearish Crab + nested Bearish Bat on the higher timeframes are still in play. The 0.618 fib retrace inside major monthly support has held and the spring from the accumulation zone looks like it’s playing out instead of breaking down.

The falling wedge broke to the upside, exactly as mapped. That breakout pushes my first larger technical target toward the 38 USD zone, which lines up nicely with the VWAP from the 2021 high.

On the momentum side, ADX is sloping up on the weekly, with +DI curling higher and –DI pushing down – that’s the kind of backdrop I want to see behind a breakout, not just random noise.

Levels & roadmap I’m watching next:

On the daily fib retrace from the last high-to-low, we’re battling the 0.382. If price can really claim that, the door opens to the 0.618 around ~28.5 USD.

Above that, the wedge target around 38 USD becomes the next big checkpoint.

Further out, the fib extensions from the A to C legs of both harmonics stack into interesting confluence zones around 56 USD, 180 USD and 235 USD – potential areas where this whole harmonic game could start to exhaust if it really goes full script.

For now, the story is simple for me: the spring held, the character loop showed up again, the wedge broke up, and momentum is starting to support the move. As long as those structures stay intact, I’m treating dips as part of the climb rather than the end of the idea.

Not financial advice – just sharing my fantasy

GME Bulls Reloading? MA Breakout Strategy Explained🎮 GAMESTOP (NYSE: GME) — "THIEF HEIST LAYERING STRATEGY" 💰

Multi-Entry Breakout Accumulation Playbook | Day/Swing Trading

🔥 "THE GRAND THEFT PROFIT OPERATION" — Executive Setup

Current Market Data ✅ Feb 4, 2026 — Real-Time Feed

Price: $24.52 | Range: $23.84 - $26.09 (Today) | Trend: Bullish Momentum 📈 | Volume: Above Average | Bias: LONG

🎯 THE HEIST BREAKDOWN

What's the Setup? 🎪

Think of this like a professional heist crew approaching a vault. We're using a moving average breakout + retest strategy combined with multi-layer limit orders (Thief layering technique) to accumulate positions at discounted levels. When price pulls back to confirm support on the MA line, that's our signal to stack the bags like a seasoned criminal! 😎

Technical Foundation: 🛠️

Indicator: Double Exponential Moving Average (DEMA) — acts as dynamic support on pullbacks

Pattern: Breakout + Retest continuation (classic bullish reversal pattern)

Timeframe: 3-Hour candles (optimal swing trade window)

Risk Profile: Moderate-High (GME volatility = 8.43%) ⚡

💎 ENTRY STRATEGY — "BUILDING THE HEIST CREW"

Multi-Layer Buy Limit Orders (The Thief Layering Method) 🔓

Instead of YOLO'ing into one entry, we deploy MULTIPLE limit orders at strategic price levels. This is how professionals steal profits! 🏴☠️

🔴 ENTRY LAYER 1: $23.00 ← Scout Position (Risk Capital)

🔴 ENTRY LAYER 2: $23.50 ← Core Accumulation (Main Position)

🔴 ENTRY LAYER 3: $24.00 ← Momentum Confirmation

🔴 ENTRY LAYER 4: $24.50 ← Final Entry (Breakout Confirmation)

🎓 PRO TRADER NOTES:

You can CUSTOMIZE YOUR LAYERS based on:

💰 How much capital you're willing to deploy

📊 Your risk tolerance & position sizing

⚡ Volatility conditions (add more layers if IV is high, fewer if calm)

📈 Support/resistance levels on your chart

This is YOUR game — set 2 layers, 5 layers, 10 layers — whatever matches YOUR plan!

🎯 PROFIT TARGET — "THE GREAT ESCAPE WITH LOOT"

Primary Target: $28.00 🚀💵

Why $28?

✅ +14.3% Upside from current $24.52 entry zone

✅ EMA Resistance Cluster — where previous rallies stalled (Police Barricade) 🚓

✅ Overbought Zone Approaching — RSI signals caution above 70

✅ Natural Profit-Taking Level — institutions dump here historically

The "Trap Alert" 🪤

Price often tricks retail into holding too long after touching resistance. When you see RSI > 70 + price touching MA resistance + volume declining, that's the escape signal! Take profits, don't get greedy.

⚠️ CRITICAL DISCLAIMER ON PROFIT TARGETS:

🎤 Dear Thief OG's & Trading Fam, this $28.00 target is just a suggestion based on technical analysis. YOU control your exits! Taking profits at $26, $27, $27.50, or $29 is 100% YOUR choice. Different market conditions = different exits. Risk-reward ratios matter more than hitting exact levels. Do NOT blindly follow my target — adapt like a professional.

🛑 STOP LOSS — "THE EMERGENCY ESCAPE PLAN"

Hard SL: $22.00 🚨

Why $22?

✅ -8.25% Risk/Position — acceptable loss for swing trade framework

✅ Below Key Support Zone — breaks here = downtrend confirmed

✅ Protects Your Capital — if fundamentals shift, you're protected

⚠️ CRITICAL DISCLAIMER ON STOP LOSS:

🎤 Dear Thief OG's, your stop loss is YOUR responsibility! Setting it tighter ($21.50), wider ($21.00), or using trailing stops is your discretion. Position sizing matters more than SL placement. Protect capital first, chase profits second. This is education, not financial advice.

📊 FUNDAMENTAL CATALYSTS — "THE REAL TREASURE MAP"

🔥 GAME-CHANGING EVENTS (Next 2-3 Months)

1. TRANSFORMATIONAL M&A MEGA-DEAL 🏢💰

CEO Ryan Cohen announced plans for a "very, very, very big" acquisition of a publicly traded consumer company. This is potentially 10x market cap expansion! He's targeting a Berkshire Hathaway-style holding company model. Timeline: Q1 2026 announcement possible. Impact: Could trigger 20-100% rally if deal announced. Capital: $9B war chest ready to deploy.

2. SHAREHOLDER VOTE — COHEN PERFORMANCE AWARDS ⏰📅

Event: Special meeting March/April 2026

Details: 171.5M share options at $20.66 strike

Vesting: Full payout if $100B market cap + $10B cumulative EBITDA achieved

Signal: Cohen is 100% aligned with shareholders — "skin in the game" = bullish psychology

3. INSIDER BUYING ACCUMULATION 💼📈

Ryan Cohen personally bought 500K shares on Jan 20-21 at $21.11 average. He now owns 9.2% of company (41.58M shares). When insiders buy heavy, smart money follows. This is real capital at risk from the CEO himself.

4. MICHAEL BURRY BACKING THE PLAY 🎯

Famous "Big Short" investor Michael Burry disclosed he's BUYING GME shares! Burry stated: "I believe in Ryan... the setup, governance, and strategy are compelling." This adds institutional credibility to the transformation narrative. Burry doesn't make casual bets.

💹 POSITIVE ECONOMIC TAILWINDS

✅ Q1 2026 Earnings Beat — Last quarter surprised 20% above estimates (EPS: $0.24 vs $0.20 expected)

✅ Next Earnings: March 31, 2026 (estimated $0.37 EPS)

✅ Free Cash Flow Positive: $130-160M annually — company is self-sustaining

✅ $9B+ War Chest: Fortress balance sheet for aggressive expansion

✅ Retail Sector Sentiment: Improving as Fed signals spring rate cuts

⚠️ RISK FACTORS TO MONITOR

❌ Execution Risk: M&A integration historically difficult in retail

❌ Macro Slowdown: Consumer discretionary vulnerable to recession

❌ Valuation Risk: Requires flawless execution to hit $100B target

❌ Bitcoin Exposure: $368M holdings could be liquidated (creates uncertainty)

❌ Inflation Persistence: Weak consumer spending in lower-income brackets

🔗 CORRELATED PAIRS TO WATCH — "THE CREW'S RELATED PLAYS"

Consumer Discretionary Sector Movers 📊

Strong Correlation Pairs:

🔵 BBY (Best Buy) — $65.57 — Electronics retailer, benefits from Fed rate cuts

Key Correlation: +0.67 correlation to GME (positive tech trend moves together)

Watch: Q1 earnings, consumer electronics demand trends

🔵 HD (Home Depot) — Furniture/Home Focus — Consumer discretionary bellwether

Key Correlation: +0.54 (macro consumer health indicator)

Watch: Housing starts, mortgage rate movements

🔵 TJX (TJMaxx) — $90+ range — Value retail leader with strong fundamentals

Key Correlation: +0.48 (bargain-hunting consumer sentiment)

Watch: Discount retailer strength = weakness in full-price retail

🔵 XRT (Retail Sector ETF) — Broad retail exposure

Key Correlation: +0.61 (sector momentum indicator)

Watch: If XRT breaks above 50-day MA, GME tailwinds strengthen

Inverse Correlation (Risk Monitor):

🔴 VIX (Volatility Index) — Stock market fear gauge

Watch: If VIX spikes above 25, expect sector rotation OUT of retail

Key Points on Correlations:

🎯 When consumer discretionary sector rallies (interest rate cuts expected spring 2026), GME typically follows higher. If Fed holds rates "higher for longer," discretionary plays face headwinds.

🎯 GME has lower beta (0.54) than broader market = more stable than sector peers, but higher than S&P 500.

🎯 If BBY or HD earnings disappoint, GME could face sympathy selling despite strong fundamentals.

🎓 TRADER'S MINDSET — "THE THIEF CODE"

💪 Rule #1: Never bet what you can't afford to lose — this is speculation, not investment

💪 Rule #2: Your entry layers = YOUR choice, not mine

💪 Rule #3: Your exit price = YOUR choice, not mine

💪 Rule #4: Position size = YOUR responsibility

💪 Rule #5: Enjoy the journey, respect the risk 🎯

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

📌 DISCLAIMER — "THIEF STYLE TRADING STRATEGY — ENTERTAINMENT ONLY"

This analysis is created purely for educational entertainment purposes using the "Thief Strategy" concept for creative flair. This is NOT financial advice, and I am not a registered financial advisor. GameStop (GME) is a volatile, speculative stock with significant risk. Past performance does not guarantee future results.

Your Capital, Your Responsibility:

Do not trade with money you can't lose

Always conduct your own due diligence

Consult a licensed financial advisor before making investment decisions

GME remains a high-risk speculation — position size accordingly

The acquisition thesis is unproven; execution risk is real

Trade with intelligence, trade with discipline, trade with respect for risk. 🎯

$GME Cycle Swap BULLISHPrice previously made strong impulsive moves off long-term support and is now consolidating without breaking structure. If this resolves upward, the first reaction area is around 27.50, followed by 32 and then 40 based on prior resistance, with a higher-risk extension toward 55 if momentum expands. There’s no set timeline, but any move would likely develop over the coming weeks and is fully dependent on price holding current support. This is not financial advice.

I like the stock. Ryan likes the stock. Burry likes the stock. Directors like the stock. Kitty's brother likes the stock. Twitter likes the stock. I like the stock. I hope all of you like the stock :).

Symbol: GME

Average Price: $23.09

Mark / Last: $22.96

Quantity: 333.929348

Market Value: $7,667.02 I am but a simple man. I do not have a lot of money. But that's why we are all here for future growth. I will keep adding to the stock. Good stock if you ask me. Near the bottom is a great place to add. NFA

GAMESTOP Coiling While Market Waits on Cohen’s Next MoveI'm bullish NYSE:GME now, with that I bought some $28 call contracts last Friday before market closed.

Why?

1. High-profile insider buying

2. Burry’s accumulation and long-term angle

3. Big acquisition narrative from Cohen (this is the moment of truth)***

***Market likes surprises. The first 2 catalyst were already known, so it's priced in.

Gamestop CEO, Ryan Cohen plan is ambitious and I believed in him. He wants to build GameStop to a $100 billion+ valuation because it’s tied to a massive stock-based incentive package for him.

Maybe NYSE:GME is ready to become a totally different company after all.

Let's see if this will rip this February :)

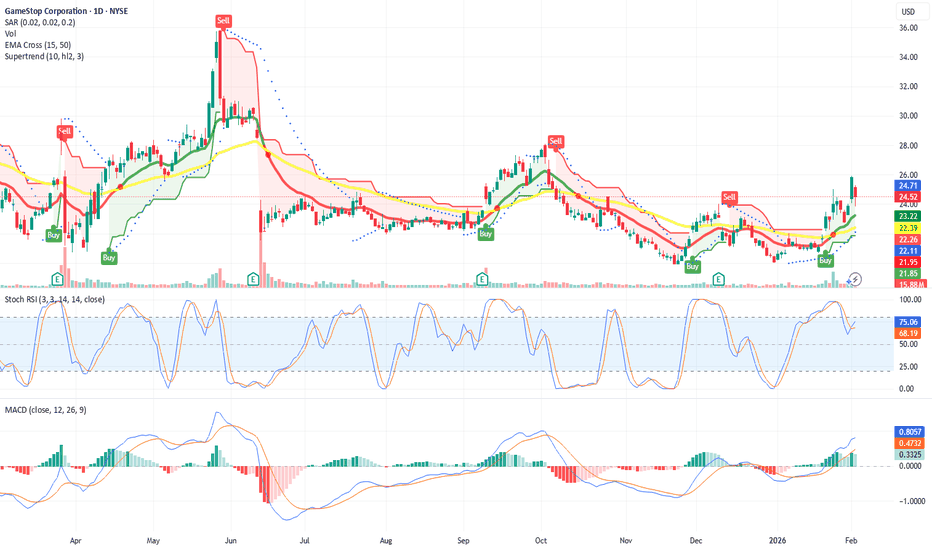

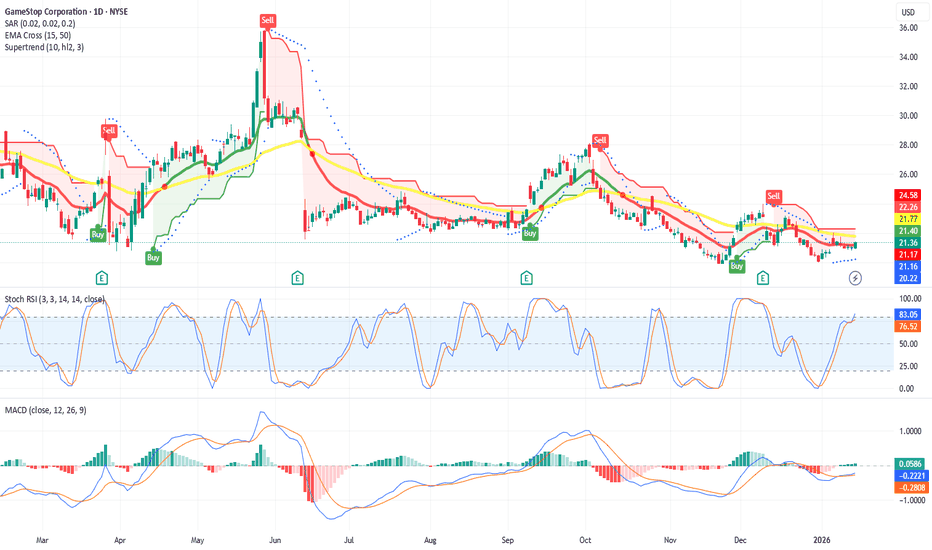

Gamestop short term buy 260204GME: bullish daily chart

Gamestop went through the short term resistance of $22.26 like I wrote in my previous post about GME.

Short term support: $21.85

But the weekly chart is still bearish, the mid term resistance is $25.79.

Short term indicators:

Par SAR: buy

EMA cross: buy

Supertrend: buy

Stoch RSI: buy

MACD: buy

Weekly chart: sell

Monthly chart: buy

Fundamentals are strong.

GameStop (GME) Ryan CohenP/E (TTM),~25.7x,HIGH ⚠️. The market is paying a premium for cash and volatility.

Forward P/E,~22.0x,Based on EPS estimates of around $1.00 in 2026

Free Cash Flow,~$130 - $160 million,POSITIVE ✅. They are managing to generate cash after the layoffs.

ROE,~9.4%,LOW ❌.

Debt/Equity,~0.78 (or 0.01 without leases),EXCELLENT ✅. They have virtually no traditional debt.

Revenue Growth,-4.5% (YoY),LOW ❌.

PEG Ratio,~0.47,UNDERESTATED ✅. Based on aggressive earnings growth.

Cash on Hand,~$8.83 billion,GROSS ✅. This is their strongest asset

FCF Margin,~4.2%,LOW ❌. Still in the process of restructuring.

Quick Ratio,~9.4,SUPER HIGH ✅. Can cover their debts 9 times.

Inst. Ownership,~30%,LOW ⚠️. Primarily held by Ryan Cohen and retail.

Current Ratio,10.39,SUPER HIGH ✅. Exceptional liquidity.

Analyst DCF,$100.24 (SWS),OVER-NEW ✅. Price (~$24) is 75% below model.

Wall St Target,$10.00 - $15.00,Analysts are pessimistic (40% potential downside).

Gross Margin,~33.3%,LOW ❌.

Sales Growth,-4.5%,

Altman Z-Score,2.5 - 2.8,GRAY ZONE ⚠️. Slightly below the safe 3.0.

Ryan Cohen and his $21.3 million bet

In January 2026, Ryan Cohen did what he does best – shocked the market with personal purchases:

January 20, 2026: Bought 500,000 shares at an average price of $21.12.

January 21, 2026: Bought another 500,000 shares at an average price of $21.60.

Result: He now owns over 42 million shares (~9.3%).

Why now? The board of directors just voted on a new compensation plan that is 100% tied to achieving a market cap of $100 billion (now ~$10 billion). This means Cohen will not receive a salary until the stock has risen 10 times.

Why is Michael Burry (The Big Short) back?

That same week, it was revealed that Michael Burry had once again built up a position in GME. His logic is simple:

Tangible Book Value: With $8.8 billion in cash in the bank and a market cap of $10 billion, you’re buying the entire GameStop business for just $1.2 billion. 2. Bitcoin Proxy: GME moved its Bitcoin assets to Coinbase Prime, suggesting active trading or use of crypto as a reserve currency.

$GME Only UpI strongly believe we’re on the edge of an aggressive move upward in the coming weeks. The recent convertible notes were for a large amount—with no detailed breakdown of where that money is going. Could Ryan be planning an acquisition? A major expansion? No one knows for sure.

But here's what we do know: the last time this exact playbook unfolded, the stock exploded.

Don’t let the fear-mongering shills shake you out of your position. In my opinion, this is the perfect time to buy. I'm holding firm.

They can't liquidate me.

My Position:

• Market Value: $5,062.71

• Today’s Return: –$1,220.49 (–19.42%)

• Total Return: –$708.54 (–12.28%)

• Average Cost: $25.53

• Shares: 226.01

• Portfolio Diversity: 91.14%

I was hoping for a breakout sooner, but the momentum got clipped by another capital raise. Still, Ryan is active on X, even reposting criticism—which tells me he’s very aware of the pressure, and he’s not backing down. Something is brewing. I trust him. But this time, I’ll remember to take profits on the way up.

I also wouldn’t be surprised if we see more convertible notes in the near future.

Let’s see how this plays out.

Just my opinion—not financial advice.

Time to riseTime to rise, weekly chart buy, expect 30 usd +

GameStop Corp. offers games and entertainment products through its ecommerce properties and stores. It operates through the following geographic segments: United States, Canada, Australia, and Europe. Each segment consists primarily of retail operations, including stores and ecommerce properties focused on games, entertainment products, and technology. GameStop offers new and pre-owned gaming platforms from the major console and PC manufacturers, sells new and pre-owned gaming software for current and certain prior generation consoles, and offers a variety of in-game digital currency, digital downloadable content, and full-game downloads. The firm’s stores and ecommerce sites operate primarily under the names GameStop, EB Games, and Micromania. Its pop culture themed stores also sell collectibles, apparel, gadgets, electronics, toys, and other retail products for technology enthusiasts and general consumers in international markets operating under the Zing Pop Culture brand. The company also publishes Game Informer, a print and digital gaming publication. GameStop was founded by Daniel A. DeMatteo in 1996 and is headquartered in Grapevine, TX.

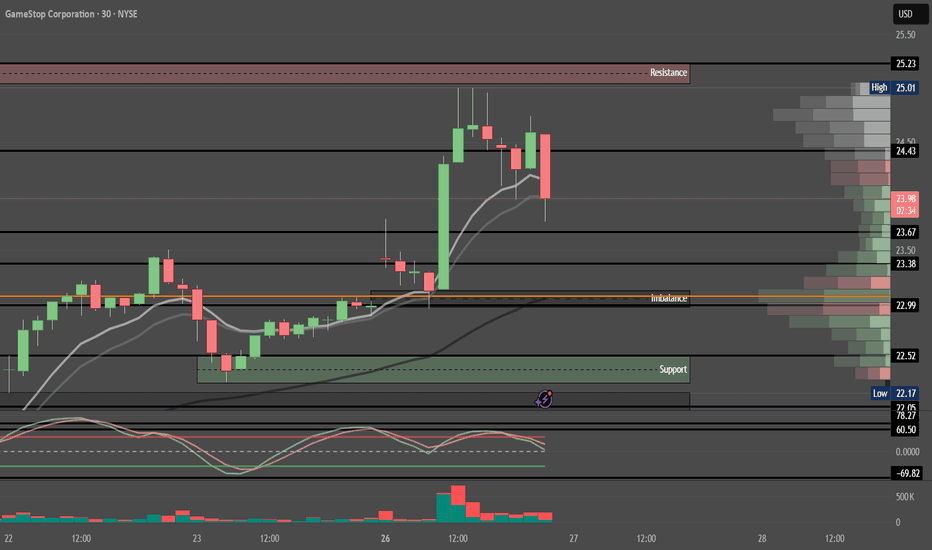

GME News Pop into Supply — Buy the Rumor, Sell the News SetupNYSE:GME 📊 | Buy the Rumor, Sell the News?

🔴 Resistance / Supply

• 24.64 → 25.01

• 25.23 (major sell zone)

🟢 Support / Demand

• 22.99 (imbalance / decision level)

• 22.52 → 22.05

• 21.45 (major support)

Trade the reaction — not the headline 🎯

GME | Will We See Another Meme Rally | LONGGameStop Corp. engages in offering games and entertainment products through its ecommerce properties and stores. The firm's stores and ecommerce sites operate primarily under the names GameStop, EB Games, and Micromania. It operates through the following geographical segments: United States, Canada, Australia, and Europe. The company was founded by Daniel A. DeMatteo in 1996 and is headquartered in Grapevine, TX.

GME, is poised for another jockey play pump anytime soon!GME is one of those stocks which is known for its sudden but short parabolic events -- and they dont come often. An event that only occur every couple of years.

The last big pump was from May 2024 when it tapped its peak at 64.0 levels -- and it did this after waiting 40 months. Thereafter, the meme stock did a hefty trim tapping 78.6 levels. and dropping back to sub 20 zone, a bargain area where most buyers re-converge for another few seasons in prep for a north pressure buildup.

This month, January 2026 -- a basing event has been spotted based on our diagram after 20 months of waiting. An upside pressure is imminent at current levels and its ripe for another jockey play soon for that elusive big move up north.

A seeding opportunity is ideal at current levels for a possible x3 play.

Spotted at 20.0

Target previous peak at 64 - 100.

TAYOR.

Trade mindfully.

GameStop (GME): Insider Buying and Strategic Reset Yesterday, January 20, 2026, CEO Ryan Cohen purchased an additional 500,000 GameStop shares on the open market.

A meaningful insider buying signal, reinforcing management’s confidence in the company’s strategic direction, particularly in a complex and highly volatile market environment.

The recent cost-cutting initiatives, driven in part by the closure of multiple physical stores, should not be viewed purely as defensive actions. Instead, they may reflect a broader strategic reset: a leaner GameStop, less reliant on traditional brick-and-mortar retail and potentially positioning itself for long-term repositioning within the market.

This narrative is further strengthened by the company’s strong cash position, exceeding $10 billion, which introduces optionality and opens the door to potential strategic acquisitions or targeted investments in new business areas.

An additional variable for investors is the presence of outstanding warrants expiring in October 2026, which add leverage to the equity story but also introduce dilution risk and may influence price dynamics and volatility over the medium term.

All of this unfolds against a backdrop of macro and geopolitical uncertainty, with elevated risk aversion across financial markets—conditions that tend to amplify price movements in sentiment-driven stocks such as GME.

While I currently believe the stock may be entering a sideways / consolidation phase, GameStop remains a name with a history of atypical and non-linear price movements. Given the current international and geopolitical environment, GME could once again emerge as one of the market’s unexpected protagonists, especially if new catalysts align with its evolving strategic profile.

This is not a financial advice, please make your own research before make any investment decision.

GME Q2 Earnings Beat + Warrant Dividend: $32 Now the MagnetGameStop’s latest quarterly results came in stronger than expected, reinforcing the turnaround narrative. At the same time, the board announced an unusual “dividend” in the form of warrants, each giving shareholders the right to buy one share at $32 until October 2026 (record date: October 3, 2025).

With this strike price clearly visible, $32 now acts as a magnet for price action in the coming months. Market participants know that above this level the warrants gain real intrinsic value, and below it they are only speculative. It’s reasonable to assume there’s a high probability of the market testing or reaching $32 ahead of the record date.

From a technical perspective, yesterday’s breakout plus strong earnings leaves room for higher targets. According to my chart analysis, the next potential upside levels are descripted by Fibonacci's Trend-based extended figure.

GME AVWAP & recent liquidity injection eventsI have two anchored VWAP signals I check for seeing where individual stocks or etfs are relative to the two most recent liquidity events: COVID QE, and the opening of the "premium window" during the March 2023 regional bank crisis. Strangely I find they both match on GME.

GME: Falling Wedge + Fib area’s + Character loop + Bearish CrabWe're sitting at a juicy confluence right now — the 0.618 fib from the 2024 low-to-high AND the 0.236 from the 2025 high-to-low. When fibs stack, they have my attention.

The Falling Wedge

Classic bullish pattern forming since the end of May: price coiling tighter between converging trendlines.

• First target zone: $28–29 (lines up with the VWAP from the 2020 low)

• Next target: $38 (lines up with the 0.382 Fib and the VWAP from the 2021 high)

Now, will we smash through the 0.236 on the first try? Probably not. GME loves its signature rounding loop before committing to a move, so I wouldn’t be surprised to see some chop here first.

The $20–22 zone has been re-accumulation territory again and again: same support, better structure, and improving fundamentals.

The Bigger Picture: Bearish Crab Harmonic

On the harmonic side, the ABC leg of the big Crab is doing its job as a roadmap. When I flip that same ABC into Fib extensions, the 1.236–1.382 FE band drops right into the larger 1.618 XA D-zone of the Bearish Crab. That whole cluster sits roughly in the $200 area, which is where the full pattern would be expected to exhaust if the Crab completes.

The Roadmap:

Current: $22-23

Wedge breakout: $29-30

Next leg: $38

Extended: $59 → $81 → $122

Harmonic D zone: ~$200

The wedge gives us the catalyst. The harmonic gives us the destination. Let's see how it plays out. NFA. DYOR.