UNH **UnitedHealth Group (UNH)**:

* Unitedhealth Group Inc is a equity in the USA market.

* The price is 307.42 USD currently with a change of 3.99 USD (0.01%) from the previous close.

* The latest open price was 304.96 USD and the intraday volume is 14930045.

* The intraday high is 310.57 USD and the intraday low is 303.9 USD.

* The latest trade time is Saturday, August 23, 03:57:37 +0400.

---

### Key Highlights:

* **Current Price**: Approximately **\$307.42**, reflecting a **1.34% increase** from the previous close ( , ).

* **Daily Range**: Between **\$303.90** and **\$310.57**, with an opening price around **\$304.96** .

* **Volume**: Around **14.93 million shares**, close to the platform-reported figure ( ).

* **52-Week Range**: From a low of **\$234.60** to a high of **\$630.73** ( ).

* **Analyst Ratings**:

* Consensus: **Buy**

* Average Price Target: **\$397.78**, implying \~29% upside potential ( ).

---

### Recent Developments & Insights:

* **Berkshire Hathaway Boosts Confidence**

Warren Buffett’s Berkshire Hathaway recently acquired **5 million shares** of UNH, sparking a \~14% rally in the stock, signaling confidence in its long-term potential despite recent underperformance ( ).

* **Medicare Advantage Headwinds**

Analysts, including those at Bank of America, caution that changes to the Medicare Advantage rating system and reimbursements may pressure UnitedHealth’s profitability through 2028. A recent **5.06% increase** in reimbursement rates offers some optimism, but potential coding changes remain a significant risk ( ).

* **Mixed Market Context**

On August 22, UNH rose 1.34% to **\$307.42**, compared to Humana (+1.71%) and Elevance Health (+2.24%) ( ). The previous day (Aug 21), UNH climbed 1.17% to **\$303.35**, outperforming Elevance and Chubb, though Humana still led the gains ( ).

---

### Quick Summary Table

| Item | Details |

| --------------------- | -------------------------------- |

| **Current Price** | \~\$307.42 |

| **Intraday Range** | \~\$303.90 – \~\$310.57 |

| **Volume** | \~14.9M shares |

| **52-Week Range** | \$234.60 – \$630.73 |

| **Analyst Sentiment** | Buy, Target: \~\$397.78 |

| **Recent Driver** | Berkshire Hathaway purchase |

| **Risks Ahead** | Medicare Advantage policy shifts |

---

### What Would You Like Next?

Want to dive deeper? I can pull up:

* Upcoming **earnings dates and forecasts**

* **Dividend history** and yield trends

* **Historical performance charts**

* Or compare UNH against its healthcare peers like Humana or Elevance Health

Just let me know where you'd like to go next!

Trade ideas

Safe Long-Term UNH Reversal SetupUnitedHealth Group (UNH) recently experienced a sharp drawdown, hitting a low around $304 after months of selling pressure. However, the price action shows signs of accumulation and stabilization near historic demand zones from 2021–2022.

This setup targets a mean reversion play with a long bias, betting on the recovery of a fundamentally strong, mega-cap healthcare name. UNH is still one of the largest components in the S&P 500 and the dominant player in health insurance + services (via Optum).

UNH ang its sideway trendAfter a severe and large price correction, now it is time for the correction of time and price, and people who suffered in this correction can easily compensate for their losses with asset management and two or three swings.

People like me who started trading stocks and were active in markets that have seen such corrections many times and have been active for more than a decade know very easily and can compensate for the loss, of course you need to know that with the experience we have gained, I will never allow such an event to happen unless it happens with a price gap.

If you are a stock trader and your portfolio is in loss, contact me so that we can compensate for your loss together.

Stay with me and be profitable

Do you have any questions? Ask me in the comments

Don't forget to introduce me to your friends so that we can all profit together?

What do you have in mind that I should analyze for you? Comment for me.

UNH Options Alert – $310 Calls Gearing for Breakout

# 🚨 UNH Options Alert – \$310C (Aug 22) 🚀🔥

📊 **Volume:** 2.5x last wk (institutional flow 💼)

📈 **Options Flow:** C/P 2.67 → bullish momentum 💎

📉 **Weekly RSI:** bearish ⚠️ | 📈 **Daily RSI:** bullish ✅

---

### 🎯 Trade Setup

* 🏦 **Ticker:** UNH

* 🚀 **Direction:** CALL

* 💎 **Strike:** \$310C

* 💵 **Entry:** 0.79 (at open)

* 🎯 **Target:** 1.20

* 🛑 **Stop:** 0.47

* 📅 **Expiry:** Aug 22 (⚡ 2DTE – high gamma)

* 📈 **Confidence:** 65%

⚠️ **Risk:** High gamma volatility + mixed weekly trend → use tight exits.

Buffett Sparks $UNH Biggest Weekly Stock Surge in 16 yearsUnitedHealth Group Inc. (UNH) experienced its most dramatic weekly rally since 2009 following a game-changing investment by Warren Buffett’s Berkshire Hathaway. On August 15, 2025, investor optimism soared as Berkshire disclosed a $1.57 billion, 5 million‑share stake in UnitedHealth—a bold vote of confidence in a company wrestling with regulatory and operational turbulence.

The revelation propelled UNH shares up 11–12% in premarket trading, marking the insurer’s largest single-day gain in over a decade. By week’s end, the surge vaulted UnitedHealth to the top gainer among S&P 500 components, capping its strongest week since 2009.

UnitedHealth’s meteoric rise had broader market implications. Its performance contributed significantly to a momentary record high for the Dow Jones Industrial Average, boosting the index by over 167 points earlier that day, even though it closed just shy of setting a new record.

Market watchers interpreted Buffett’s investment as classic value investing—snapping up a high-quality company that's showing weakness but has underlying strengths.The stock’s valuation, now trading at roughly 15–16 times forward earnings, appears enticing relative to its historical norms.

Rising healthcare and reimbursement costs continue to pressure margins.Broader sector challenges, including scrutiny of pharmacy-benefit managers like Optum Rx—a key part of UnitedHealth’s business—persist. The company is still recovering from internal turmoil, including the tragedy of a company executive’s death in 2024 and leadership changes.

Analysts caution that regulatory reforms in Medicare Advantage rating and coding systems could further delay a turnaround in profitability.

UnitedHealth is projecting a return to earnings growth by 2026, though details remain murky

Following Berkshire’s entry, other major investors—including Appaloosa Management, Lone Pine Capital, and Two Sigma—also added to their positions, reinforcing bullish sentiment despite the risks.

price has completly change trajectories and profit take done =UP1. we start off with a running flow, a smooth procession of

higher highs and lows

2. buyer interest magnified via gap

3. a pullback... or reversal?

my thoughts on what will occur next

* clearly you can see with my linear regression channels,

I am attempting to visualize the increased and diffrence in the

data we have now, this is not just a small jump up,

its en entire new data set

* I have no reason to believe that the current few selling bars

are anything other than a profit take, and another push up

is imminent

* we have had a 69% follow through rate with breakouts of orange

zones, when price closes in the zone,to follow through to the next,

these are great odds for us alongside our idea

* MFI and RSI is oversold, but the past 3 times it was oversold, it was

just a minor blip of a pullback, so i'm not too concerned and in fact,

encouraged due to that, I will enter at the genesis of the next zone and

target the follow through area.

UNH Options Momentum Heating Up – Big Gains in Sight!

# 🚀 UNH Weekly Options Analysis (2025-08-17) – Don’t Miss Out!

### 🔎 Market Overview

UNH shows **strong bullish momentum**: Call/Put ratio at 2.56, rising daily RSI at 71.9, and institutional volume up 1.8x from last week confirm the bullish outlook. Weekly RSI at 37.5 suggests moderate resistance, so caution is advised. Low VIX (\~15) keeps gamma risk low, creating an optimal environment for directional trades.

---

### 📊 Key Model Insights

* **Call/Put Ratio:** 2.56 → strong bullish flow

* **Daily RSI:** 71.9 → strong short-term momentum

* **Weekly RSI:** 37.5 → moderate upward trend, watch resistance

* **Volume:** 1.8x previous week → institutional buying confirmed

* **Volatility:** Low VIX → low gamma risk

---

### 📊 Recommended Trade

* **Direction:** CALL (Long)

* **Strike:** \$310.00

* **Expiry:** 2025-08-22

* **Entry Price:** \$5.10 (aim for better at market open)

* **Stop Loss:** \$2.05 (\~60% of premium)

* **Profit Target:** \$7.65 – \$10.20 (50–100% gain)

* **Entry Timing:** Market Open

* **Confidence:** 75%

---

### ⚠️ Key Risks

* Momentum changes → monitor for trend reversal

* Gamma exposure → watch for VIX spikes approaching expiry

* Weekly close → exit by Thursday to avoid gamma decay Friday

---

📊 **TRADE DETAILS JSON**

```json

{

"instrument": "UNH",

"direction": "call",

"strike": 310.00,

"expiry": "2025-08-22",

"confidence": 0.75,

"profit_target": 7.65,

"stop_loss": 2.05,

"size": 1,

"entry_price": 5.10,

"entry_timing": "open",

"signal_publish_time": "2025-08-17 12:11:11 EDT"

}

```

UNH clean breakoutUNH can crawl back to its trading price above $600 within the next 12 months.

After today's load up based on Buffett's news, FOMO will kick in by September for the rally to stabilize. When levels dictate the outcome, the target is obviously correct.

Next stop is $360, then stabilize, followed by $470 and stabilization, then continue to $600 and longer. The presented weekly chart shows the levels and my target. Thank you Buffett & Burry!

UNH - Looking for a short-term bounce NYSE:UNH is looking at a possible bullish mean reversion to the upside after it has broken out of the steep falling wedge and a small V-shaped bottom is in. Stochastic oscillator shows an oversold crossover with bullish divergence. 23-period ROC is showing bullish divergence as well. Prices has also closes above bot the conversion and base line of the ichimoku.

Short-term target is at 320

UNH LevelsJust sharing my UNH chart. Levels have been reactive so far.

Berkshire Hathaway announced their position today so the stock could get a much needed boost through that VPOC overlap area($301-304). If it goes through without issue, $309 -> $312->$320/$322. Let's see if a gap up holds into tomorrow's regular trading hours.

Pissed at the moment because I haven't gotten a chance to enter those 1/15/27 and 12/17/2027 $320 LEAPS yet.

~The Villain

UNITED HEALTH UNH - Two scenarios based on my understanding a sescenario a:

coming back to the 50% or 0.618 retracement then up, then in a typical seasonal bearish period down until beginning of october

scenario b:

First target could be at the descrending trendline then retracement until beginning of october

to the 50% or 0.618

this is of course not a trade call or advide. for educational purpose only...

please comment or chat with me about it!

cheers!

UNH $280 Calls on Fire – Momentum Exploding Today!🚀 UNH Bulls Target \$280 – One-Day Call Sprint

**Sentiment:** 🟢 *Moderate Bullish*

* **Daily RSI:** 55.7 📈

* **Call/Put Ratio:** 2.82 → strong bullish flow

* **Volume:** Weak (0.5× last week) → watch for hesitation

* **VIX:** 15.0 → favorable for directional trades

* **Gamma Risk:** HIGH — expiry in 1 day ⚡

---

### 📊 **Consensus Snapshot**

✅ Multiple models highlight bullish options flow

⚠️ Weak volume & resistance near \$272.19 = caution

💡 High gamma requires tight risk management

---

### 🎯 **Trade Setup**

* **Type:** CALL (Single-leg)

* **Strike:** \$280.00

* **Expiry:** 2025-08-15

* **Entry:** \$0.70

* **Profit Target:** \$0.91 – \$1.40 (+30–100%)

* **Stop Loss:** \$0.42 (≈40%)

* **Confidence:** 65%

* **Entry Timing:** Market open

---

💬 *High-risk, high-momentum expiry play — monitor closely.*

📌 *Not financial advice. DYOR.*

---

**#UNH #OptionsTrading #CallOptions #TradingSignals #DayTrading #StocksToWatch #GammaRisk #OptionsFlow**

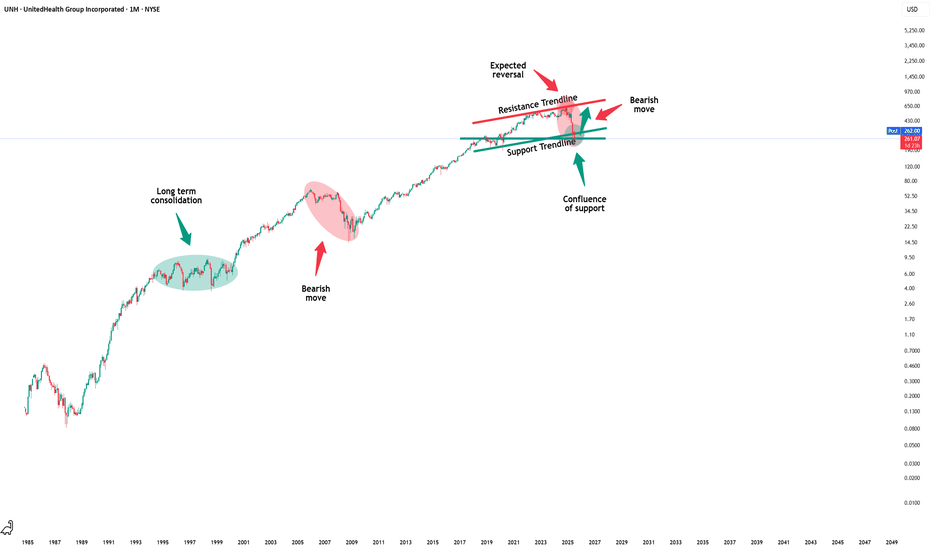

United Health - The perfect time to buy!⛑️United Health ( NYSE:UNH ) finished its massive drop:

🔎Analysis summary:

Over the past couple of months, United Health managed to drop an incredible -60%. This drop however was not unexpected and just the result of a retest of a massive resistance trendline. Considering the confluence of support though, a bullish reversal will emerge quite soon.

📝Levels to watch:

$250

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

$UNH - Going InWe picked up 100 shares of UNH here, it's just too oversold and beat to ignore to at this point.

A 40-50% drop on earnings with speculation on regulatory concerns just seems a bit dramatic. The stock has a conservative dividend growth rate of 14% over the past 5 years. Several analysts still have a Buy rating for the stock with a price target of around $379 (some $400).

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor. I am an amateur investor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies. I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on here, expressed or implied herein, are committed at your own risk, financial or otherwise.

Feel free to give us a follow and shoot us a like for more analysis updates.

UNH Ready to Rip – $265 Calls Set for Liftoff!🚀 **UNH Bulls Take Charge – \$265 Calls in Play!** 🚀

AI models flash **Strong Bullish** this week with a **5.17 Call/Put ratio** and **low VIX (15.9)** – perfect storm for upside momentum. 📈

**Setup:**

🎯 Strike: \$265C (Aug 15)

💵 Entry: \$0.80 | PT: \$1.20–\$1.60

🛑 Stop: \$0.39

⚡ Confidence: 65% – Watch volume!

Generational Buying Opportunity?UnitedHealth Group, a complete sh*t show of a company. The CEO gets murdered, public sentiment towards insurance companies remain at an all time low.

Is this business salvageable? Well, we now have the veteran CEO return to his former job, he was already on the board and understands the company and industry well.

Can the experienced CEO save this sinking ship? Or will all the rats on board sink, drowning investors along with it?

Nobody knows, that's the truth. And if they do know, no amount of insider buying will save the stock when the selling occurs. It could end up like Enron. I am watching the chart on this very closely. There is a potential huge reward from a return to normality for this business, that is only if you believe.

They will be able to repice their premiums later this year around September/October. Margins should improve over the long turn, this could be one big panic. It remains to be seen. For now we are in a brutal downtrend, any brave dip buyers may be rewarded only in the long term, at buying at any level between here down to $200 DCA.

Not financial advice, do what's best for you.

UnitedHealth: Deeply oversold but worth a closer lookUnitedHealth (UNH) is the largest private healthcare company in America. Eight million Medicare Advantage members. Optum’s network reaches tens of millions more. It has the data, the reach, and the pricing power. At today’s valuation, it’s worth adding to your watchlist. Forward P/E at 11× versus a five-year average of 14×. Price-to-sales at 0.6×. RSI at levels not seen in decades. Oversold. Under-owned.

Mispriced? Potentially. We must make it very clear that there could be more downside. But upside is also worth considering.

The AI angle is real. UNH’s health data trove is unmatched. AI can strip billions in waste, automating claims, flagging fraud, predicting costly illnesses before they happen. This isn’t science fiction. It’s execution. Done right, it builds margins and widens the moat. Few can play at this scale. UNH can.

Healthcare as a sector trades 20-30% cheaper than the S&P 500. Aging demographics and chronic care demand are long-term tailwinds. A re-rating here could be swift and brutal for anyone short.

Now, the problems. Medical costs are spiking. Medicare Advantage margins are squeezed. Guidance was pulled, and that spooked the market. Leadership turnover added uncertainty.

These are real headwinds. But they’re fixable.

Premium hikes are already being set for 2026. Stephen Hemsley, the architect of UNH’s prior growth, is back. He’s cutting, reviewing, and bringing in outside talent.

Price implications? The market is pricing in permanent damage. That’s why you can buy a market leader at a crisis multiple. If margins recover and AI efficiencies kick in, this stock doesn’t just bounce, it re-rates. The gap from 11× to 14× earnings on UNH’s scale is tens of billions in market cap.

The bear pit is noisy. The bull case is quiet. But it’s there, and it’s strong. Stop losses are important to manage more downside risk.

The forecasts provided herein are intended for informational purposes only and should not be construed as guarantees of future performance. This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

UNH – Force Bottom with Bullish Divergence at Support(Weekly Chart) NYSE: UNH remains a fundamentally strong company, even though healthcare is not currently the market’s leading sector. On the weekly chart, price action shows a force bottom (double bottom with take-out stops pattern), flushing stop-losses below the previous low at $248.88.

Last week, price closed back above the $250 support with a bullish candle. Price action and stochastic show a bullish divergence, with stochastic oversold and starting a golden cross. Risk-reward looks very favorable from this level.

UNH a dead stock?After a 63% drop this year from its high, the stock has started seeing rebound.

- UNH's trailing P/E is near 10–11×, while forward P/E is compressed to ~15×

- The RSI had dropped to extreme oversold levels (~20) before rebounding above 39

- Despite current headwinds, UNH raised its dividend by 5%—marking 15 consecutive years of increases. Their current yield (~2.9%) is well above S&P 500 average.

- Q2 operations generated strong cash flow ($7.2B) and delivered a 20.6% return on equity, signaling disciplined capital allocation.

- High upside potential if earnings and sentiment recover.

- according to the quarterly call, New metrics set clearer expectations and reflect internal control.

This is a good stock to get into if you are looking at a 1-2 year horizon.

UNH 4H #UNH

4 hours frame..

Breaking and stability above 252 by closing the stock's targets

259 - 270 - 280

We raise the degrees of caution when the price reaches the levels of 270 - 280

Stop loss per stock Trading closes below 240

In case of closing 4 hours below 240, the stock is looking for a new bottom

Not a recommendation to sell or buy

Trade smartly