45C trade ideas

CRWD Earnings Sniper | $400P Weekly Play

# 🚨 CRWD Earnings Setup (AMC 8/28) 🚨

💥 Bearish Lean | 🎯 \$400 Put | Exp 8/29

📊 **Setup Overview**

* Mixed model signals → leaning bearish

* Institutional volume spike ⚡

* Options flow: Neutral (C/P \~1.0)

* Risk: high (earnings whipsaw potential)

🎯 **Trade Idea**

* Buy \$400 Put (8/29 expiry)

* Entry: \$4.20

* Profit Target: \$12.60 (3x)

* Stop: \$2.10 (50%)

* Confidence: 65%

🕒 **Timing**

* Entry: at open (8/28)

* Exit: by Thursday close

⚠️ **Key Risks**

* Post-earnings IV crush

* Earnings surprise vs. consensus

* Pinning around \$400 strike

---

🔥 Tags for reach:

\#CRWD #EarningsPlay #OptionsTrading #WeeklyOptions #PutOptions #MarketSetup #EarningsTrade #ShortTrade #VolatilityPlay #Cybersecurity #TradingSignals #StocksToWatch

CRWD – Pre-Earnings Game Plan How to read this Metrics Panel (Pro breakdown)

Instrument profile

Cap/Float: Big cap (~$102.2B) with public float ~239.9M shares.

Volume today ~1.73M ⇒ Vol/Float ≈ 0.7% (~0.007×) → thin participation relative to float; limited “squeeze” potential.

Leverage multiplier 0.01× and Explosive Ratio (10-day) ≈ 0 → no recent expansionary bursts; price tends to move in measured steps.

Momentum & Volatility

Momentum signal: Sideways / Low momentum. Tape is balanced; expect mean-reversion/range trades unless momentum improves.

Beta ≈ 0.04 → “Low Volatility” vs the market. Swings are typically muted; position sizing can be a touch larger than a high-beta name (risk governed by stop distance, not beta).

Price change today: +$8.47 (+2.03%) — constructive day but not a regime change by itself.

Price context

Pump % | Price %: +0.72% | +2.03% — confirms the day’s push is price-led, not a high-velocity “pump”.

Prev Close | Now: $417.60 → $426.07.

Target ladder (model)

Est. Target + Cap/Float: C/M/A are projected move sizes from the current price, scaled by capitalization/float:

C (Conservative) ≈ 42.51% → price ≈ $468.6

M (Moderate) ≈ 56.68% → price ≈ $482.8

A (Aggressive) ≈ 85.01% → price ≈ $511.1

Use them as take-profit rungs, not guarantees. In a low-momentum state, probability favors the C rung first.

Risk module

Estimated Stop Loss: $407.50 (about 4.3% below current). This is the invalidating level the model sees for the current setup.

Stop-trail ready: $426.07 (at-market) — if you enter on strength, you can trail once price advances; otherwise keep the static SL while building the position.

Breakout/Momentum/Trend triggers: currently N/A at Lvl 1–3 → there’s no confirmed breakout from the model’s trigger bands yet.

Gap % (Y/R): YoY +0.96% / Rolling +0.72% — benign; not a “gap-and-go” environment.

Bear momentum? YES / Bull momentum? NO — sellers have had the upper hand recently, which is consistent with “sideways/low momentum”. Treat green days as bounces until the trigger flips.

Fundamentals line (for context, not timing)

EPS (TTM) ≈ –0.70, Intrinsic value ≈ –$19.91 (model’s heuristic). These do not drive the intraday signal; they help frame longer-term expectations.

Data status: Float OK — float data is present and used.

Overall signal (dashboard)

“Strong (Bullish)” + “Light Up (Now)” means: today’s session quality is bullish within a broader low-momentum regime.

Translation for execution: favor buy-the-dip in range or breakout only after a trigger prints.

Execution playbook (practical)

1) If trading range/mean-reversion

Entry: pullbacks toward intraday VWAP/short MAs that hold above $417–$420.

Invalidation: $407.5 (panel stop) or last swing-low, whichever is tighter.

Profit taking: stair-step toward C rung ($468s); trail once price accepts above local resistance.

2) If trading trend/breakout

Wait for a model “Breakout Ready / Trend Trigger” to print (or a daily close through your resistance level with expanding volume).

Starter risk: ≤ 0.5–1.0% of account per trade.

Position size (example):

size = (Account × Risk%) / (Entry – Stop)

If $25,000 acct, 1% risk ($250), entry $426, stop $407.5 ⇒ risk $18.5 ⇒ ≈ 13 shares.

3) When to stand down

Momentum remains “sideways/low”; no trigger and price back below VWAP with rising sell volume.

Close < $407.5 (setup invalid).

Major event risk (earnings/guide) with elevated IV if you can’t hedge.

Bottom line

This is a big-cap, low-beta name in a sideways/low-momentum phase that printed a constructive day. Treat long ideas as tactical until a breakout trigger fires. Use $407.5 as your primary risk line, and the C/M/A target ladder (~$469 / $483 / $511) for scaling out once momentum improves.

For educational purposes only; not investment advice.

CRWD – Pre-Earnings Game Plan (Daily)

Quick view

Cap: Big-cap cybersecurity

Trend (1D): Corrective down leg inside a larger up-trend.

Current price: ~$425

Near-term recovery target: $487 (needs confirmation).

Longer-term extension if trend resumes: $575 (weekly swing objective).

Event risk: Upcoming earnings → path can gap.

Key levels

Support: $354–350 (major demand / buyers likely set alerts here).

Trigger to re-long: >$470 close with volume (reclaim of setup zone).

Overhead supply: $502 → $533 (seller bands; “capital defense/critical” on your panel).

Failure line: <$315 (would damage the weekly trend).

Scenarios

1) Bearish (miss or weak guide)

High probability retest $354–350; a deeper spike to $340 possible on panic gaps.

At $425 today, downside to the buy zone is ~20% → poor R/R for new longs here.

2) Base → Recovery (inline/ok print + strong tape)

Need a close back above $470 and VWAP reclaim on intraday matrix.

Then $487 is the first upside checkpoint; above it opens $502 → $533.

Only after that structure holds do weekly targets like $575 come back into play.

How to trade it

Spot/Stock

Preferred plan: Wait for the $354–350 demand zone.

Stagger bids (e.g., $355 / $352 / $350).

Stop 3–5% below the zone (e.g., $339–$342), or use your panel’s Capital Defense line.

First targets: $408 → $470 → $487; then trail for $502–$533.

Avoid chasing at $425 ahead of earnings—R/R skewed, event gap risk.

Options

Pre-earnings IV is elevated → outright calls are dangerous (theta + IV crush).

If you must position:

Bearish/hedge: Defined-risk put spread targeting $360–$350.

Bullish after confirmation: Call spread after a daily close > $470.

Willing to own stock: Post-earnings only, consider cash-secured puts at $350–$355 (accept assignment risk).

Short side

Safer tactically into earnings than naked calls: look to fade rejects near $470 / $500 with tight stops; cover into $354–350.

Execution checklist

Before earnings: No fresh longs at $425. Either wait for $350–354 or the $470 reclaim.

On earnings day:

If gap down into $350–354, watch for capitulation → VWAP reclaim to build a swing long.

If gap up and closes > $470 with volume breadth, can initiate long → $487 / $502–$533.

Risk: Keep per-trade risk ≤1% of account. Define stops before entries.

This is an educational plan, not investment advice. Use your own risk controls and confirm with your system’s signals.

Breaking: CrowdStrike's Bullish Surge Poised for New Highs

Current Price: $420.55

Direction: LONG

Targets:

- T1 = $450.00

- T2 = $480.00

Stop Levels:

- S1 = $410.00

- S2 = $400.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging CrowdStrike's robust business model and upward technical momentum to identify actionable opportunities. Professional traders are focusing on the cybersecurity sector's increasing demand, noting CrowdStrike's ability to capitalize on enterprises’ shift to cloud-first security solutions. Aggregated perspectives also highlight the company's financial strength and market leadership, which reduce long-term risks and position it as a high-probability growth candidate.

**Key Insights:**

CrowdStrike continues to benefit from growing global cybersecurity spending, which is projected to rise steadily over the next decade. The company has established itself as a leader in endpoint security and threat intelligence, commanding a recurring revenue stream through its subscription model. Analysts point to its ability to increase Average Revenue Per User (ARPU) through upselling and cross-selling of additional modules as a key growth driver.

Technically, the stock is showcasing bullish momentum with a breakout above previous resistance levels. With increasing institutional buying seen in recent trading sessions, traders expect continued upward price momentum. The overall sentiment across investor communities is positive, thanks to CrowdStrike's strong quarterly results and outlook stability, which underline its robust business fundamentals.

**Recent Performance:**

CrowdStrike has demonstrated exceptional resilience in recent weeks, climbing steadily from the $380 mark to its current price of $420.55. This upward trajectory was fueled by stronger-than-expected earnings, which showcased significant year-over-year revenue growth and net profit expansion. The stock has recently solidified a bullish breakout above key moving averages, drawing attention from traders looking for continued follow-through in price action.

**Expert Analysis:**

Analysts highlight that CrowdStrike’s consistent growth trajectory, coupled with its low customer churn rate, demonstrates its competitive moat within the cybersecurity space. Recent technical analysis points to a favorable setup across multiple indicators, including the Relative Strength Index (RSI), which shows the stock is neither overbought nor oversold, presenting further upside potential. Additionally, its robust fundamentals make the stock appealing to long-term institutional investors, adding confidence to short-term bullish trading strategies.

**News Impact:**

Recent reports of escalating cyber threats globally have spotlighted CrowdStrike's central role in mitigating risks for large enterprises. News surrounding heightened government spending on cybersecurity further boosts prospects for CrowdStrike, as it aligns with industry tailwinds. The company’s recent announcement about expanding its AI-driven capabilities has also fueled optimism, showcasing its innovation leadership, which is critical in sustaining competitive differentiation in its market.

**Trading Recommendation:**

Traders should consider a LONG position on CrowdStrike, leveraging its technical breakout and supportive fundamentals to target a sustained rally towards $450 and potentially higher at $480. With favorable sector trends underpinning the cybersecurity industry and robust execution strategies from CrowdStrike, the stock presents a high-probability trade setup for the medium-term. Risk management strategies should ensure stop-loss levels at $410 and $400 for protection.

Do you want to save hours every week? Register for the free weekly update in your language!

CRWD Technical Outlook – Testing Downtrend Resistance📉 CRWD Technical Outlook – Testing Downtrend Resistance

Ticker: CRWD (CrowdStrike Holdings)

Timeframe: 30-minute candles

🔍 Current Setup

CRWD has been in a prolonged downtrend, respecting a well-defined descending resistance line since late July. Each rally attempt has been capped by this trendline, with sellers firmly in control.

Currently, price is trading around 419, sitting just below the descending resistance (~422–424) and under a critical horizontal barrier at 433–434. On the downside, support sits near 407–410.

📊 Breakout Levels

🚀 Upside (Bullish Scenario)

Trigger: Break and close above 424 (trendline resistance), with confirmation above 433–434.

Intermediate Targets:

440–444 → Prior consolidation ceiling.

452–456 → August breakdown zone.

Measured Move Target: ~465 (based on prior swing ranges).

🔻 Downside (Bearish Scenario)

Trigger: Failure at resistance and break below 410.

Intermediate Supports:

407–405 → Current base.

400–398 → Psychological support zone.

Measured Move Target: ~392 (projected from recent consolidation height).

📈 Volume Analysis

Volume remains elevated on sell-offs, confirming strong bearish pressure.

However, the last bounce off 410 came with buyers stepping in modestly, suggesting short-term accumulation.

A decisive breakout above the downtrend line would require a clear volume spike, otherwise sellers are likely to fade rallies.

⚖️ Probability Bias

The dominant trend remains bearish until CRWD clears 424–434.

If bulls reclaim that zone, a reversal toward 452+ becomes possible.

Otherwise, the path of least resistance is lower, with 410 → 400 → 392 as potential downside levels.

✅ Takeaway

CRWD remains locked in a strong downtrend but is testing a key inflection point:

Bullish Break > 424–434: Targets 440 → 452 → 465

Bearish Failure < 410: Targets 405 → 400 → 392

Until then, sellers remain in control, but a trendline breakout could spark a short-covering rally.

EWT perfect 535's all over the chartStarted to accumulate here slowly and getting ready for wave 5 up. Target is $542

For those who don't understand Elliott Wave Theory, follow the 5's for trend and 3's for correction. The pattern repeats all over the chart.

RSI squeezing here on the Weekly, ready for change in momentum to the upside.

Set up is invalidated if it loses the 50 SMA around ~400.

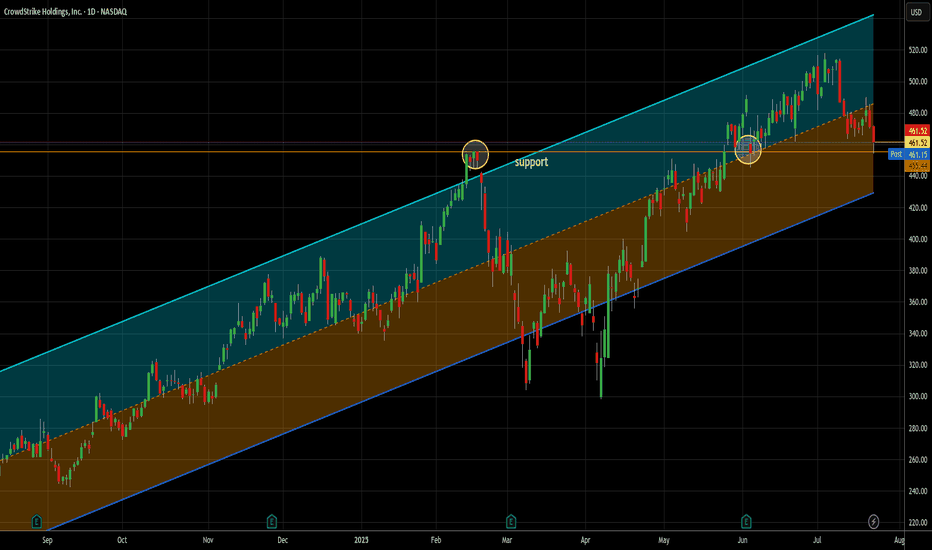

The only way to fight AI is with AI -- long at 461.52I love cybersecurity stocks generally. As our lives become ever more embedded in the electronic world, their necessity increases. As AI driven threats are sure to rise (Sam Altman, founder of OpenAI, spoke to a financial conference this week about the rising threat of AI driven banking fraud), the only way to combat it effectively is with AI. Crowdstrike, along with Palo Alto, are leading the charge in this area and I think will be another great example of AI ultimately being better than humans at the job they need to do here.

Yes, it's a story stock, but you know me - the story is the trading data. So here it is. In the last 12 months, 21 signals. 21 wins, 0 losses. Average trade length = 6.7 days (though that's misleading since all but 4 trades closed in less than that and 20 of 21 were 10 days or less). Average gain was 4.46% - that's an average of .67% per day held. That's almost 16x the long term daily rate of return of SPX and almost 10x the daily return of the Nasdaq 100 in the last year.

Additionally, it bounced off support near today's low and finished stronger. That's always good to see. I will happily add more if my signals suggest it, but of the 21 signals, only once did it produce 2 open lots at once. Nornally, it was one lot paying quickly. 2/3 of the trades closed in less than one week.

As always - this is intended as "edutainment" and my perspective on what I am or would be doing, not a recommendation for you to buy or sell. Act accordingly and invest at your own risk. DYOR and only make investments that make good financial sense for you in your current situation.

Why Is CrowdStrike's Stock Soaring Amidst Cyber Chaos?The digital landscape is increasingly fraught with sophisticated cyber threats, transforming cybersecurity from a mere IT expense into an indispensable business imperative. With global cybercrime costs projected to reach $10.5 trillion annually by 2025, organizations face severe financial penalties, operational disruptions, and reputational damage from data breaches and ransomware attacks. This escalating threat environment has created an urgent and inelastic demand for robust digital defenses, positioning leading cybersecurity firms like CrowdStrike as critical enablers of economic stability and growth.

CrowdStrike's remarkable ascent is directly tied to this surging demand, fueled by pervasive trends such as widespread digital transformation, extensive cloud adoption, and the proliferation of hybrid work models. These shifts have vastly expanded attack surfaces, necessitating comprehensive, cloud-native security solutions that can protect diverse endpoints and cloud workloads. Organizations are increasingly prioritizing cyber resilience, seeking integrated platforms that offer proactive detection and rapid response capabilities. CrowdStrike's Falcon platform, with its AI-native, single-agent architecture, effectively addresses these needs, providing real-time threat intelligence and enabling seamless expansion across various security modules, which drives high customer retention and significant upsell opportunities.

The company's strong financial performance underscores its market leadership and operational efficiency. CrowdStrike consistently reports impressive Annual Recurring Revenue (ARR) growth, healthy non-GAAP operating margins, and robust free cash flow generation, demonstrating a sustainable and profitable business model. This financial strength, combined with its continuous innovation and strategic partnerships, positions CrowdStrike for sustained long-term growth. As enterprises seek to consolidate security vendors and simplify complex operations, CrowdStrike's comprehensive platform is ideally situated to capture a larger share of global cybersecurity spending, solidifying its role as a cornerstone of the digital economy and a compelling investment in a high-stakes environment.

$CRWD: Relative outperformance compared to its peersCybersecurity is one of our favorite themes. This is known to all who have been following this blog space. We have been bullish on the tech sector AMEX:XLK and specifically in the sub sectors within the tech sector. Cybersecurity is one of them. Within Cybersecurity we have some stocks which have outperformed the rest of its peers. One such name is Crowdstrike. NASDAQ:CRWD after suffering a 50% correction last year outage which took its price to 200 $ has recovered the loss and has recovered all the losses and then some. The stock is up almost 140% from its lows.

An outperformer in an outperforming sector. In the chart we also look at the ratio between NASDAQ:CRWD to $HACK. The ATH for the ratio chart was 6. Currently we are @ 5.6 in the ratio chart. The price chart of NASDAQ:CRWD alone looks bullish. If we plot the Fib retracement level just before the 2024 downturn then the next level in the price chart is 520 $. My price target is 520 $ before we can target 700 $ in the medium term.

Verdict : Go Long NASDAQ:CRWD for medium to long term. 520 $ first then 700 $.

CrowdStrike’s Chart Is Showing Caution Signs Ahead of EarningsCloud-based cybersecurity firm CrowdStrike Holdings NASDAQ:CRWD is set to release fiscal first-quarter results after the bell next Tuesday (June 3). Let’s check out the company’s technical and fundamental picture heading into the report.

CrowdStrike’s Fundamental Analysis

I'm not going to lie -- I’ve been long CRWD for a while and the stock has been very, very good to me. However, I see some reasons to be cautious moving forward.

At last check, the Street was looking for the firm to report $0.66 in fiscal-Q1 adjusted earnings per share on $1.11 billion of revenue. That would compare less than favorably to the $0.93 in adjusted EPS that CrowdStrike reported in the same period last year.

On the other hand, $1.11 billion in revenue would represent 20% year-over-year growth for the firm.

However, look at those two figures together and they appear to point to some margin compression. Additionally, 20% y/y sales growth -- while nothing to sneeze at -- would represent sequential deceleration of growth from the quarter just prior.

As a matter of fact, that would mark a fourth consecutive quarter of slower year-over-year growth from the prior 13-week period.

If that's not enough of a concern, all 32 sell-side analysts I can find that cover CrowdStrike have lowered their earnings estimates for the current quarter since it began.

CrowdStrike’s Technical Analysis

I charted CRWD for a different publication a month ago and pointed out what looked at the time like a “double bottom” pattern of bullish reversal.

That set-up worked like a charm, but I’m less confident in what the stock’s chart is showing us now:

True, readers will see still the double-bottom pattern of reversal that I mentioned, marked with two green boxes at left and showing a $392 pivot that stretched from late February into mid-April.

But at CrowdStrike’s recent $474.23 high, the stock was up 28% from that pivot. That’s often close to or even better than what one can expect to get out of a breakout.

And now, we see a so-called “rising-wedge” pattern of bearish reversal developing on the chart’s right side, as denoted with a red box above.

True, CRWD took back its 200-day Simple Moving Average (or “SMA,” marked with a red line above) as it climbed from the stock’s early April lows. The stock also retook also its 50-day SMA (marked with a blue line) and 21-day Exponential Moving Average (or “EMA,” denoted by a green line) during that period.

All of that means the stock should historically see some support on the way down, but we're still talking about a 13% drop before the 50-day line comes into play.

Meanwhile, CrowdStrike’s Relative Strength Index (the gray line at the chart’s top) remains strong, but its daily Moving Average Convergence Divergence indicator (the black and gold lines and blue bars at bottom) is sending mixed signals.

The MACD’s 9-day histogram (the blue bars) has been flipping back and forth in and out of negative territory for almost a month, while the 12-day EMA (the black line) has been wrestling with the 26-day EMA (gold line).

When the gold line is on top of the black line, that can be bearish, especially when the 9-day EMA slips below zero.

For the bulls to win out, it appears necessary for CrowdStrike to hold onto both the rising wedge’s bottom trendline and the stock’s 21-day EMA. And for the bears, those two points would serve as your downside pivots.

Should you take profits here? That's up to you.

But at the very least, the above chart seems to show that CrowdStrike investors should proceed with caution.

(Moomoo Technologies Inc. Markets Commentator Stephen “Sarge” Guilfoyle was long CRWD at the time of writing this column.)

This article discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. Specific security charts used are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. Moomoo and its affiliates make no representation or warranty as to the article's adequacy, completeness, accuracy or timeliness for any particular purpose of the above content. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

TradingView is an independent third party not affiliated with Moomoo Financial Inc., Moomoo Technologies Inc., or its affiliates. Moomoo Financial Inc. and its affiliates do not endorse, represent or warrant the completeness and accuracy of the data and information available on the TradingView platform and are not responsible for any services provided by the third-party platform.

CrowdStrike Poised for AI-Driven Upside Momentum

Targets:

- T1 = $470

- T2 = $489

Stop Levels:

- S1 = $440

- S2 = $412

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in CrowdStrike.

**Key Insights:**

CrowdStrike's strategic integration of AI into its cybersecurity solutions has significantly bolstered its competitive advantage. The ability to harness AI in real-time threat mitigation and enhance operational efficiencies positions CrowdStrike as a leader in the cybersecurity industry. As demand grows for sophisticated enterprise solutions, CrowdStrike is well positioned to capitalize on this trend. Its technology innovations reduce response times to cyberattacks while managing costs effectively, a factor critical for corporate adoption in today’s complex security environment.

The broader adoption of AI technologies across industries further adds to CrowdStrike's growth potential, as enterprises increasingly prioritize intelligent security measures to combat evolving cyber threats. The company’s continuous focus on product development ensures its offerings remain relevant and differentiated in a competitive landscape.

**Recent Performance:**

In recent months, CrowdStrike stock has displayed strong upward momentum fueled by positive earnings reports and increased demand for its AI-driven cybersecurity platform. Trading volume has been consistent, with the stock consolidating near $455 levels before showing signs of bullish continuation as buyers return. Such behavior suggests sustained investor confidence in its long-term growth trajectory, particularly as it aligns with broader technological trends.

**Expert Analysis:**

Market analysts have applauded CrowdStrike's proactive approach to advancing its AI-driven solutions. Many have attributed its market strength to successful integration of cutting-edge AI mechanisms, which not only differentiate it from competitors but also address critical pain points for enterprise customers. As AI adoption accelerates globally, experts foresee robust revenue growth and increasing dominance for CrowdStrike in the cybersecurity domain. Additionally, its ability to maintain partnerships with key industry players strengthens its foothold in this rapidly evolving sector.

**News Impact:**

Recent announcements of CrowdStrike enhancing its AI capabilities and launching new strategic partnerships have underscored the company’s commitment to innovation. Positive sentiment surrounding these developments, coupled with its recognition as a top player in cybersecurity and AI integration, continues to drive investor optimism. With geopolitical uncertainty amplifying cyber risks worldwide, CrowdStrike’s solutions are increasingly viewed as indispensable, creating tailwinds for sustained stock performance.

**Trading Recommendation:**

Based on the above factors, CrowdStrike presents an appealing long opportunity at its current price of $455.59. Targets are set at $470 and $489, with stop loss levels at $440 and $412 to manage risk effectively. Investors seeking exposure to AI-led growth in the cybersecurity domain should consider CrowdStrike for their portfolios. Its proven ability to combine innovation with execution positions it as a prime candidate for strong upside potential.

CRWD – Flat Top Breakout to All-Time HighsCrowdStrike ( NASDAQ:CRWD ) is breaking out of a flat top consolidation, pushing to new all-time highs — a clean momentum setup that’s hard to ignore.

🔹 Price has been compressing just under ATHs with multiple tests of the same level — a classic flat top breakout pattern.

🔹 Today’s breakout candle is strong, with solid volume and follow-through.

🔹 This setup is all about price acceptance at new highs — and the bulls are showing up.

My Trade Plan:

✅ Entry: On breakout through the flat top

⛔️ Stop: Just below today’s low — keep risk tight

🚀 Target: Ride momentum — trail stop as price extends

Why I like this setup:

Clean structure, strong trend, defined risk

ATH breakouts often lead to trend acceleration if supported by volume

panw had their earnings today and gapped down it still has broken loose this is a good sign

CrowdStrike Holdings, Inc. – AI-Native Cybersecurity Powerhouse Company Snapshot:

CrowdStrike NASDAQ:CRWD remains a top-tier cybersecurity leader, redefining endpoint and cloud protection through its AI-powered Falcon platform, securing some of the most critical digital infrastructures in the world.

Key Catalysts:

Falcon Platform – AI-First, Cloud-Native 🧠☁️

Unified security architecture: endpoint, identity, cloud, and data

Leverages real-time analytics, automation, and continuous threat hunting

Widely recognized as a gold standard in modern cybersecurity (GigaOm, Gartner)

Elite Partnerships = Ecosystem Synergy 🤝

Named Google Cloud’s 2025 Security Partner of the Year

Deep collaborations with AWS, Microsoft Azure, and NVIDIA

Embedded in cloud-native DevOps workflows = high stickiness and TAM expansion

AI + Cyber = Next-Gen Growth Tailwind 🚀

Integrating generative AI and autonomous detection to proactively prevent threats

Strategic positioning at the intersection of cloud security and AI operations

Key enabler of Zero Trust architectures for global enterprises

Massive Market Opportunity 🌍

Global cyber budgets rising amid escalating threats

CrowdStrike well-positioned for land-and-expand growth via Falcon modules

Expanding presence in identity protection, XDR, and managed services

Financial Edge:

Consistent 30%+ YoY revenue growth

High gross margins (~77%)

Strong free cash flow generation, underpinning long-term profitability

📈 Investment Outlook

✅ Bullish Above: $370.00–$375.00

🚀 Upside Target: $600.00–$620.00

🎯 Thesis: Platform leverage, elite partnerships, and AI innovation make CrowdStrike a core cybersecurity growth leader for the AI era.

#CrowdStrike #Cybersecurity #AI #CRWD #FalconPlatform #CloudSecurity #NextGenTech

CrowdStrike (CRWD)... Time to disperse ?On a technical basis one victim of a continued market tariff downturn maybe CrowdStrike (CRWD) providing a selling/short opportunity.

Particularly if DJT's tariffs start applying to services.

IMHO two bearish technical formations support this:

1. A Bearish Harmonic Shark formation

2. A Bearish Wolfe Wave

Additionally there is emerging RSI bearish divergence. (bottom panel)

Today the Fed speaks so perhaps this will provide this opportunity.

Optimally the $440 level may provide this selling opportunity.

Also let the overall direction and tone of the market should color your decision.

This is just my opinion. Do your own due diligence.

I will follow up with a short recommendation as warranted.

Good Luck

$CRWD : Exceptional performance. Next stop 500 $. Very few stocks can claim the performance and resiliency of Crowdstrike. NASDAQ:CRWD not only resisted the recent downturn in the volatile markets but also is above it previous multi cycle highs. The stock was @ 400 $ when the major global outage happened, and the stock touched the lows of 200 $ before it had a massive bull run from the lows of 200 $. Before the major ‘Liberation Day’ volatility the stock touched an all time high of 450 $. Since then, the stock has reversed almost all its losses.

This can not be said about many stocks in the market. Even within the Tech sector the subsector Cybersecurity showed a great deal of resilience in the recent market turmoil. In this space we discussed the relative performance of AMEX:HACK vs SMH multiple times. But within the Cybersecurity subsector there are stocks like NASDAQ:CRWD which are trying to reclaim the ATH. Very few stocks in the Tech sector are at or near their ATH. At 430 $ NASDAQ:CRWD is just 5% away its ATH. The RSI is still not in overbought condition which is hovering at 60s. Next stops are 450 $ and then the 1.61 Fib retracement level which magically lies at 500 $.

Verdict : Stay long $CRWD. Next target 500 $.