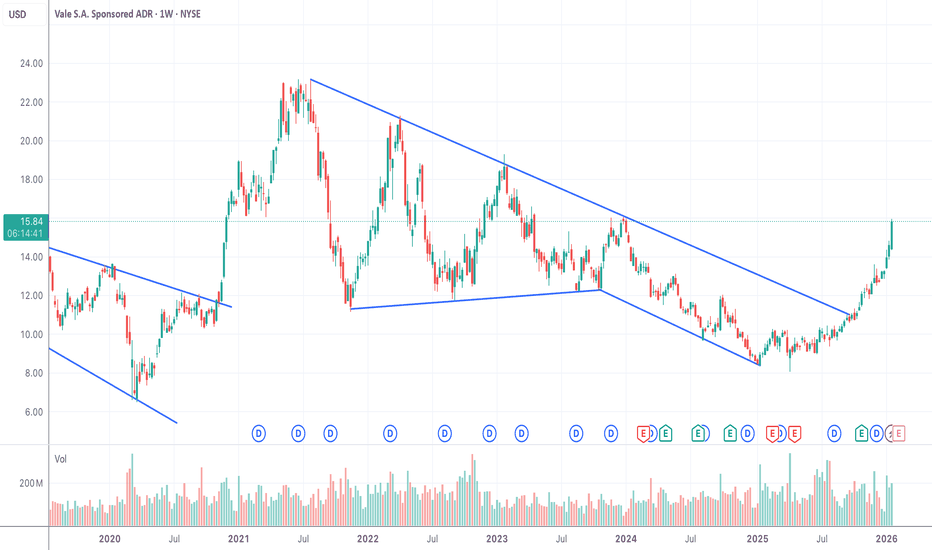

The key is whether it can rise above 17.07 ~ 32.06

Hello, fellow traders.

If you "Follow" me, you'll always get the latest information quickly.

Have a great day.

-------------------------------------

(Vale S.A. Sponsored ADR 1M Chart)

The key is whether the price can break above the Fibonacci level of 0.618 (17.07) on the left and 0.618 (32.06)

Vale S.A. Sponsored ADR

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.27 USD

5.86 B USD

38.21 B USD

4.27 B

About Vale S.A.

Sector

Industry

CEO

Gustavo Duarte Pimenta

Website

Headquarters

Rio de Janeiro

Founded

1942

IPO date

Jan 2, 1970

Identifiers

3

ISIN US91912E1055

Vale SA engages in the production and exportation of iron ore, pellets, manganese, and iron alloys. It operates through the following segments: Iron Solutions, Energy Transition Materials and Others. The Iron Solutions segment includes the production and extraction of iron ore, iron ore pellets, manganese, other ferrous products, and logistic services. The Energy Transition Materials segment involves the production and extraction of nickel and its by-products. Others includes the revenues and cost of other products, services, research and development, investments in joint ventures and associates of other business. The company was founded on June 1, 1942 and is headquartered in Rio de Janeiro, Brazil.

Related stocks

Vale SA - BullishVale S.A. (NYSE: VALE) is a Brazilian multinational and one of the world's largest producers of iron ore, iron ore pellets, and nickel. Headquartered in Rio de Janeiro, the company also produces significant quantities of copper, manganese, and precious metals.

Core Operations & Assets

Vale operates

VALE LT NYSE:VALE

Vale Basics:

Vale excels in extracting, processing, and selling iron ore (including fines and pellets) to global customers, especially steelmakers. Iron ore is the key raw material for steel production, so demand is heavily tied to global infrastructure, construction, and manufacturin

VALENYSE:VALE : Thesis for 2026

1. Strategic Pivot: From Iron Ore Proxy to Base Metals Leader

The most significant development for Vale in 2026 is the transformation of its base metals segment (nickel and copper) from a secondary unit into a primary profit engine.

Nickel Supply Shock: Indonesia, whic

$10 is looking realistic... if Mr. T doesn't mess it up lolWe have a lot of $10 call options on every expiration date for the next few months, meaning this move might take a while to play out. Unsure of exact date if its earnings call or news but $10 seems to be where the focus is.

If tariffs begin or effect Brazil negatively then this stock could plunge o

I am bullish on Vale stock; here’s why Iron ore prices can rise due to tariffs for several reasons:

1. Supply Disruptions – If a major producer or exporter faces tariffs, it may reduce supply in the global market, pushing prices higher.

2. Higher Production Costs – Tariffs on raw materials, equipment, or transportation increase the

Position trade with 50%+ upside potentialTrading near 8-year lows (not considering COVID-19 drop) VALE seems way undervalued both from PE - PS ratio standpoint and also when comparing with its peers. The stock price has reacted three times in $9.75 - $9.80 level. The period of November-December is the starting point of price appreciation s

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.